ID: PMRREP14953| 187 Pages | 6 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

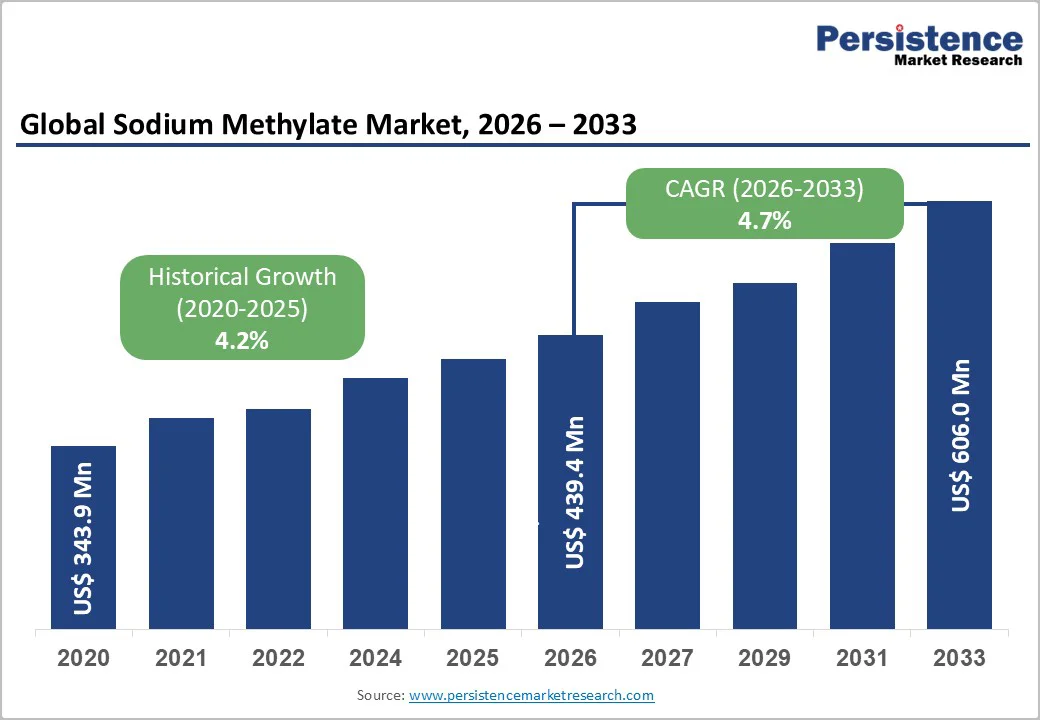

The global sodium methylate market size is likely to be valued at US$439.4 million in 2026 and is estimated to reach US$606.0 million by 2033, growing at a CAGR of 4.7% during the forecast period 2026 - 2033.

Escalating biodiesel production mandates in prominent economies, alongside intensified pharmaceutical synthesis operations and broader deployment of sodium methylate as a catalyst in organic chemical reactions are favoring the market.

Advancements in transesterification methodologies, coupled with stricter environmental regulations that encourage cleaner fuel options, further accelerate consumption across industrial applications. Pharmaceutical manufacturers benefit from the precision delivered by sodium methylate in facilitating active pharmaceutical ingredient (API) synthesis, particularly amid rising global demand for generics from hubs such as India and China.

Forward-looking producers should prioritize scalable, eco-compliant processes to leverage these tailwinds, as evidenced by Europe's focus on sustainable chemical intermediates, positioning sodium methylate as indispensable for long-term compliance and innovation agendas.

| Key Insights | Details |

|---|---|

| Sodium Methylate Market Size (2026E) | US$ 439.4 Mn |

| Market Value Forecast (2033F) | US$ 606.0 Mn |

| Projected Growth (CAGR 2026 to 2033) | 4.7% |

| Historical Market Growth (CAGR 2020 to 2024) | 4.2% |

Regulatory mandates for biodiesel production are driving substantial demand for sodium methylate, a catalyst critical to the transesterification process that converts vegetable oils and animal fats into biodiesel. Producers face increasingly stringent output targets that require catalysts capable of delivering rapid, high-efficiency conversions while maintaining consistent quality metrics across large-scale operations.

Sodium methylate addresses these operational imperatives by enabling reliable conversion performance throughout the production cycle, thereby allowing manufacturers to sustain both throughput levels and product quality standards as blending requirements intensify across major fuel markets.

The shift toward energy diversification has simultaneously elevated procurement priorities around processing inputs that offer stability and cost-effectiveness alongside reliable performance.

Sodium methylate fulfills these evolving requirements through its superior catalytic activity, shortened reaction times relative to alternative catalysts, and seamless compatibility with continuous-flow production systems that modern facilities employ. As refiners and biofuel manufacturers scale operations to meet mandated volumes, procurement strategies increasingly favor catalysts that deliver sustained operational reliability under high-throughput conditions.

Fluctuations in raw material prices introduce significant uncertainty into production planning, since methanol expenses directly shape the overall manufacturing economics for sodium methylate.

Abrupt cost increases erode supplier profit margins, undermine contract reliability, and jeopardize extended pricing agreements with customers in various end-use industries such as biodiesel production. To counter these hindrances, manufacturers must adapt operational tactics, which frequently results in postponed capacity deployment and conservative inventory practices to mitigate financial exposure.

Supply chain interruptions compound these difficulties by hindering the uninterrupted delivery of essential inputs and completed products. Constraints in logistics, including port congestion and localized transport limitations, compromise product availability and adherence to delivery schedules.

Downstream sectors reliant on dependable catalyst availability encounter heightened operational hazards, prompting intricate procurement processes and increased demands on working capital.

Expanding biodiesel demand in developing economies presents substantial opportunities for increased consumption of sodium methylate as a key catalytic reagent in transesterification processes. Countries across Asia, Latin America, and parts of Eastern Europe are implementing stricter domestic fuel-blending mandates, which compel refiners to scale up production capacities.

This trend heightens the necessity for efficient alkaline catalysts that facilitate large-scale, continuous operations while upholding rigorous quality controls. Adjacent investments in greenfield biodiesel plants alongside upgrades to legacy facilities amplify requirements for high-purity inputs, thereby bolstering process reliability and ensuring uniform output yields across expanded infrastructures.

Suppliers of this reagent hold a distinct competitive edge in emerging markets, where buyers prioritize partners that consistently deliver on volume commitments, quality specifications, and safety protocols. Abundant local feedstock resources, coupled with progressive energy diversification initiatives and heightened emphasis on low-emission fuel alternatives, fortify the long-term demand trajectory.

Firms equipped with vertically integrated manufacturing capabilities and localized distribution footprints stand poised to capture greater market share, forging resilient supply partnerships that anchor their leadership in rapidly maturing biodiesel production centers.

The solid form segment is forecasted to capture an estimated 60% of the sodium methylate market revenue share in 2026 due to its exceptional stability, uniform assay concentrations, and adaptability for pharmaceutical and fine-chemical synthesis applications.

Manufacturers favor this variant for enabling precise reaction control, minimizing impurity formation risks, and providing extended shelf life under varied storage conditions. Compatibility with rigorous regulatory standards and quality assurance protocols further solidifies its dominance, channeling demand toward premium sectors that prioritize dependable catalytic efficacy for mission-critical processes.

The liquid form segment is anticipated to undergo accelerated growth from 2026 to 2033 on the back of heightened adoption of sodium methylate in expansive biodiesel plants, where continuous-flow systems demand readily dosable and pumpable catalysts for optimal integration.

Superior handling convenience, diminished preparation durations, and aptitude for high-volume applications simplify operational workflows, fostering broader acceptance within burgeoning biofuel production centers. Escalating capital commitments to transesterification infrastructure further propels this segment's expansion.

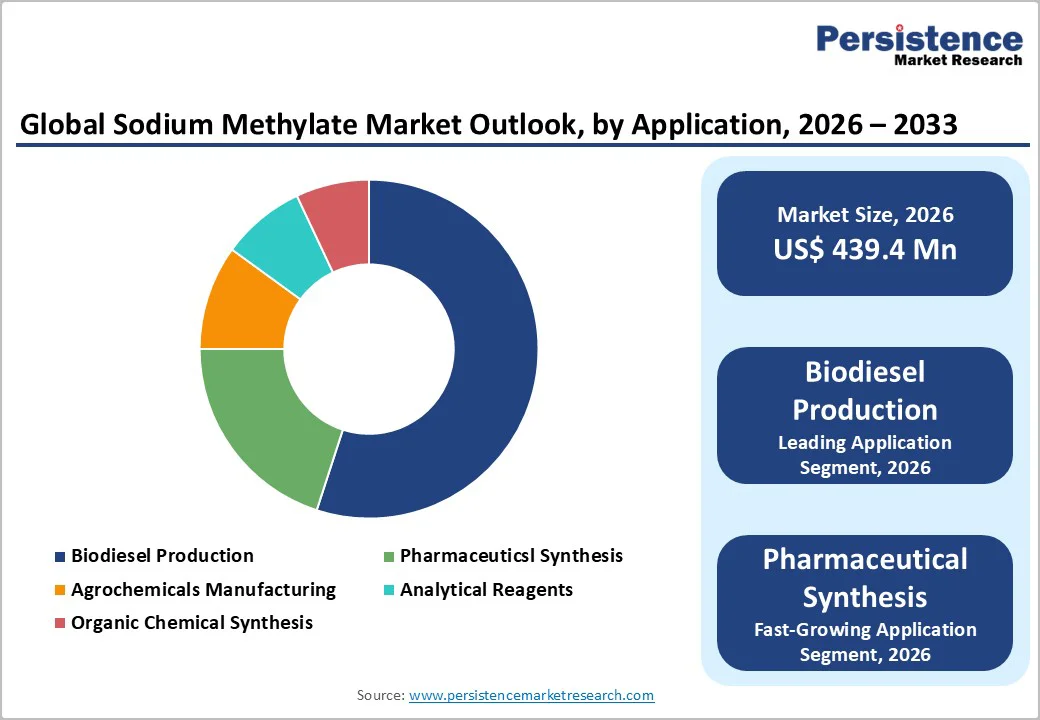

Biodiesel production is set to dominate as the leading application in 2026, commanding approximately 55% of the sodium methylate market revenues, propelled by stringent blending mandates and renewable fuel policies in major economies such as the United States, Brazil, and India.

Large-scale biodiesel facilities prioritize this catalyst for its superior efficiency in transesterification reactions, dependable performance metrics, and seamless support for continuous high-volume operations. These attributes cement its preeminence within industrial biofuel sectors, where regulatory compliance and production scalability define competitive success.

Pharmaceutical synthesis emerges as the fastest-expanding segment, fueled by accelerating global API production and advancements in complex molecule development. Robust demand from key generic drug exporters including India and China intensifies usage in premium synthesis workflows that demand precision and purity.

Surging investments in pharmaceutical manufacturing infrastructure, burgeoning drug formulation pipelines, and reliance on stable chemical intermediates collectively position this application for swift trajectory growth and heightened strategic importance by 2026 and beyond.

The biofuel industry is anticipated to lead the sodium methylate market in 2026, securing an estimated 50% share through worldwide initiatives that promote cleaner energy sources and enforce mandatory blending targets.

Production capacity expansions in emerging economies, coupled with reliable feedstock supplies, sustain steady consumption levels across industrial operations. Energy diversification strategies and robust policy frameworks further entrench its supremacy, establishing biofuels as the foremost end-user for this catalyst in high-volume applications.

The pharmaceutical industry is likely to experience the most rapid expansion as a key end-user, propelled by surging API production and growth in contract manufacturing services.

Escalating healthcare requirements, frequent new drug introductions, and commitments to resilient supply chains heighten reliance on dependable chemical intermediates for synthesis. The integration of sodium methylate into premium processes guarantees accelerated adoption, designating pharmaceutical uses as the principal catalyst for sustained market momentum during the 2026 - 2033 forecast period.

North America is predicted to occupy a prominent position in the sodium methylate market in 2026, bolstered by biodiesel production growth in the United States and expanding renewable energy programs in Canada.

Stricter biofuel blending requirements, particularly through federal and state-level renewable fuel standards, propel demand within expansive production facilities. The pharmaceutical sector in the United States further sustains steady usage for API synthesis and fine chemical manufacturing, ensuring robust industrial demand across diverse applications.

Advancements in catalyst performance and process refinement accelerate integration across biofuel and chemical sectors, enhancing overall efficiency. Well-developed infrastructure, mature supply networks, and access to expert technical resources facilitate seamless procurement and operational deployment. Regulatory incentives, substantial manufacturing capacities, and commitment to sustainable chemical methodologies collectively establish North America as a pivotal driver of worldwide consumption trends.

Europe is likely to maintain a substantial market presence in 2026, underpinned by demanding environmental regulations and widespread adoption of renewable fuel technologies. Nations including Germany, France, and the Netherlands are intensifying biodiesel production to fulfill European Union (EU) emission reduction targets, establishing sustained procurement needs for high-performance catalytic reagents.

The region's robust chemical manufacturing infrastructure, paired with sophisticated pharmaceutical sectors, further amplifies consumption for premium synthesis applications. Policy mechanisms such as tax incentives for biofuel manufacturing and blending requirements guarantee predictable demand patterns throughout the industrial landscape.

Expanding pharmaceutical research and development (R&D) initiatives alongside specialty chemical expansion reinforce consistent consumption across premium applications.

Europe's sophisticated distribution frameworks, technical proficiency, and stringent quality commitments establish it as a principal regional center, with expansion anchored in regulatory obligations, accelerating energy transition agendas, and deepening reliance on advanced chemical intermediates across industrial manufacturing.

These complementary drivers ensure sustained relevance and competitive positioning of Europe and European stakeholders within the sodium methylate market.

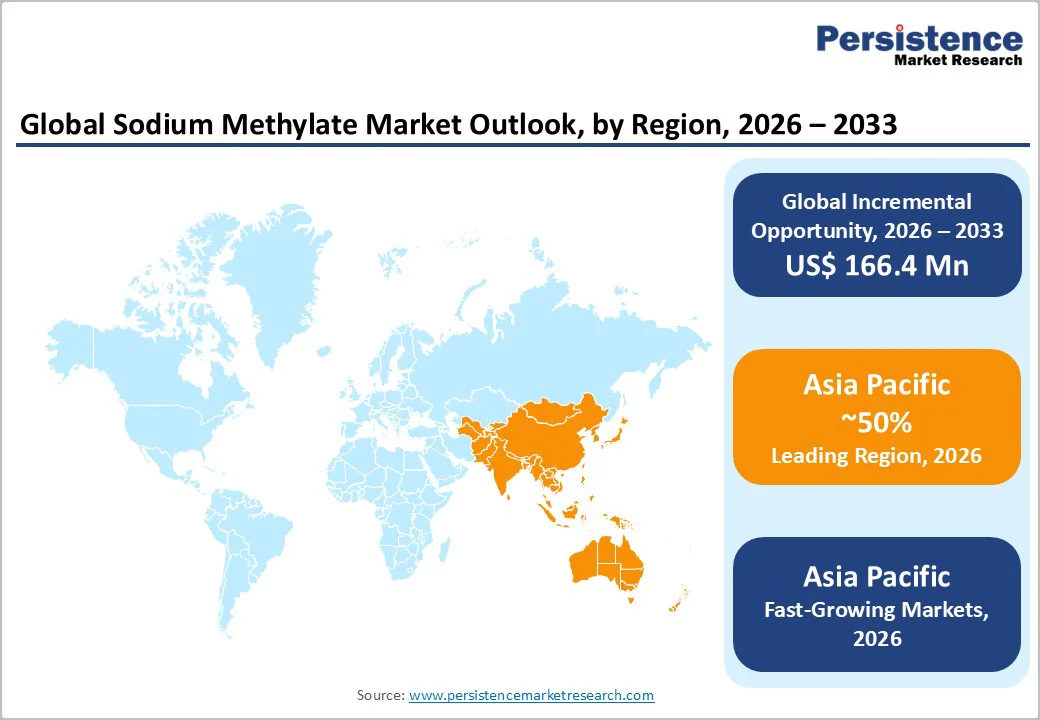

Asia Pacific is projected to dominate in 2026, capturing approximately 50% of the sodium methylate market share. Its dominance is underpinned by large-scale biodiesel production in countries such as China and India, where government mandates for renewable fuel blending are actively implemented.

The presence of cost-competitive chemical manufacturing hubs allows regional producers to secure bulk procurement contracts with biodiesel plants and pharmaceutical manufacturers. High domestic consumption combined with strategic export capabilities strengthens the position of Asia Pacific, while well-established industrial supply chains ensure consistent availability, minimizing operational disruptions and supporting high-volume, large-scale applications across multiple industries.

Asia Pacific is also expected to be the fastest-growing regional market during the 2026 - 2033 forecast period due to the convergence of expanding pharmaceutical synthesis operations, agrochemical production, and biofuel demand. Rising investments in advanced transesterification and chemical synthesis facilities enhance process efficiency, increasing the adoption of sodium methylate.

Coupled with robust infrastructure for logistics, proximity to raw material suppliers, and a skilled technical workforce, the region benefits from accelerated deployment, rapid market penetration, and a favorable cost-to-performance balance, reinforcing its dual status as both dominant and fastest-growing between 2026 and 2033.

The global sodium methylate market displays a moderately consolidated structure, where leading firms such as BASF, Evonik Industries, DowDuPont, and DuPont each command roughly 10% market share.

These organizations capitalize on substantial production capacities, cutting-edge technological expertise, and extensive distribution infrastructures to preserve their competitive standing. Their operational scale guarantees uninterrupted supply to demanding industrial sectors, including biodiesel manufacturing and pharmaceutical synthesis, both of which necessitate catalysts of superior quality and unwavering reliability.

Regional producers, especially those concentrated in Asia, complement this landscape by emphasizing economical manufacturing processes, proximate supply chains, and dedicated technical assistance tailored to local needs. Such strategies enable them to serve fast-developing industrial clusters effectively.

The broader market evolution hinges on continuous innovation, enhanced process efficiencies, and adaptive responses to escalating requirements from biofuel and pharmaceutical domains, fostering an equilibrium between multinational authority and localized flexibility.

The global sodium methylate market is projected to reach US$ 439.4 million in 2026.

Increasing renewable fuel mandates, growth in pharmaceutical and fine chemical industries, technological advancements in catalyst efficiency, and expansion of industrial chemical production are driving the market.

The market is poised to witness a CAGR of 4.7% from 2026 to 2033.

Key market opportunities include expanding biodiesel production, growing pharmaceutical synthesis, rising demand in emerging regions, and investments in sustainable and efficient catalyst technologies.

Some of the key market players include BASF, Evonik Industries, DuPont, Arkema, Mitsui Chemicals, and LyondellBasell.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author