ID: PMRREP35528| 196 Pages | 30 Jul 2025 | Format: PDF, Excel, PPT* | Food and Beverages

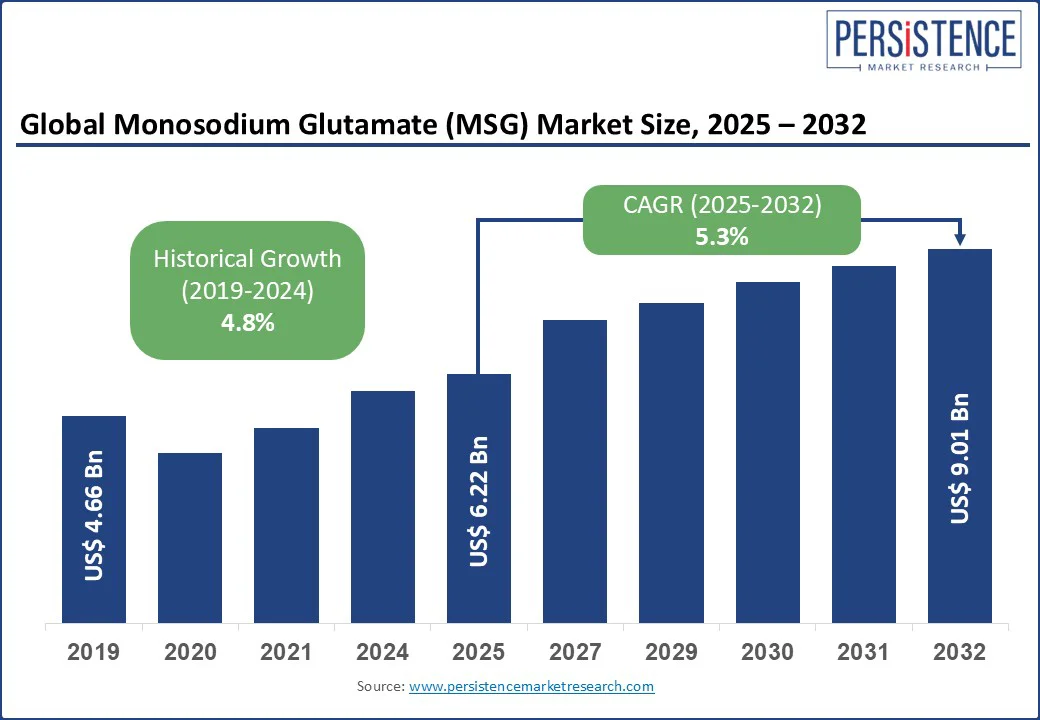

The global monosodium glutamate (MSG) market size is likely to be valued at US$ 6.22 Bn in 2025, and is estimated to reach US$ 9.01 Bn by 2032, growing at a CAGR of 5.3% during the forecast period 2025-2032. The monosodium glutamate (MSG) market growth is driven by a robust demand for processed and convenience foods, expanding urban populations, and a resurging interest in global cuisines that rely heavily on umami-rich profiles. Monosodium glutamate (MSG) is a highly popular, extensively used flavor enhancer prized for its ability to amplify the umami taste in foods without altering their original flavor profiles. It is the sodium salt of glutamic acid, a naturally occurring amino acid found in various foods such as tomatoes, cheese, and mushrooms.

Commercial MSG is typically produced through the fermentation of starch, sugar beets, sugarcane, or molasses. As a result of this method, manufacturers have been able to produce MSG on a large scale in a cost-efficient manner for various food and industrial applications around the globe. In Asia Pacific, the market is aided by deep-rooted culinary use and efficient fermentation-based manufacturing. North America and Europe are witnessing a rekindled interest in MSG, resulting from several scientific studies dispelling the belief surrounding the negative health impacts of the ingredient.

Key Industry Highlights:

|

Global Market Attributes |

Key Insights |

|

Monosodium Glutamate (MSG) Market Size (2025E) |

US$ 6.22 Bn |

|

Market Value Forecast (2032F) |

US$ 9.01 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.8% |

The monosodium glutamate market is riding a sustained wave of consumer demand for convenient, flavorful meal solutions. The accelerated uptake of ready-to-eat noodles, soups, sauces, and meat alternatives in thriving urban clusters is fueling MSG’s insertion in the food ingredients sector. At the same time, changing consumer perceptions about this ingredient are reshaping the market. Decades of skepticism, media coverage, and scientific reviews, including FDA reaffirmations, have helped normalize MSG, backed by studies confirming its safety and flavor benefits while noting it contains only a third of the sodium compared to table salt.

A growing number of food scientists are now attesting to the fact that MSG boosts palatability without raising sodium intake, with an equally rising percentage of brands promoting fermentation-derived MSG as a natural alternative in response to health-conscious diet demands. By adopting this new direction, food companies are also able to leverage the emerging clean-label ingredients trend. As manufacturers innovate with fermentation-based production methods and reduced-sodium powder formats, monosodium glutamate is transitioning from a functional additive to a consumer-trusted ingredient in food supply chains at the global level.

Consumer mistrust surrounding monosodium glutamate is the most significant restraint impeding market expansion, especially in health-conscious and Western markets. A substantial portion of consumers in Western Europe still consciously avoid MSG due to fears of adverse effects such as headaches and allergic reactions, even though authoritative bodies such as the FDA and EFSA confirming MSG’s safety. This stigma, often referred to as “Chinese Restaurant Syndrome,” continues to influence purchasing decisions and put pressure on retailers to offer "no MSG" labeling, shrinking opportunities in mainstream food and seasoning categories.

Simultaneously, regulators are tightening rules around food additives, increasing labeling transparency, and promoting clean-label compliance. Approximately 70% of packaged foods in the European Union (EU) and Australia now require explicit MSG declaration on packaging. Such requirements raise barriers for inclusion of monosodium glutamate in formulations, pushing manufacturers toward natural alternatives such as yeast extract or mushroom concentrate. These shifts not only fragment market share but also limit the potential for MSG to enter emerging product categories such as health-friendly or plant-based foods, creating a structural constraint on its broader adoption.

The rapid surge in plant-based protein products is proving to be a powerful driver for the monosodium glutamate market growth. As meat alternatives strive to replicate umami-rich flavor profiles, fermented or naturally derived MSG offers a clean-label solution that enhances savory depth without relying on artificial additives. Leveraging MSG’s unparalleled ability to amplify meaty and brothy notes, manufacturers can improve taste considerably while keeping ingredient integration short and compliant with clean-label requirements. This paves the way for MSG producers to partner with plant-based startups and formulators seeking premium, fermentation-based ingredients.

Advancements in fermentation technology also make MSG production more efficient and transparent, aligning with consumer demand for minimally processed and traceable ingredients. This dual trend, promising innovations in plant-based proteins coupled with clean-label fermentation, positions naturally produced MSG as a strategic ingredient in the evolving alt-protein landscape. As the sector expands globally, especially in the developed markets of North America and Europe, fermentation-derived monosodium glutamate is slated to become an essential flavor driver, fueling both industry growth and consumer satisfaction.

By form, the monosodium glutamate powder segment is leading, estimated to hold around 61% of the market revenue share in 2025. Its widespread adoption is primarily on account of its efficiency in convenience food and bulk manufacturing. Its superior solubility, consistent mixing in industrial food production, cost-effective packaging, and a long shelf life give it a distinct advantage over other forms of MSG. As a result of these properties, powdered MSG has emerged as the ideal candidate for noodles, soups, snack seasonings, and large-scale food service.

Granular MSG is touted to be the fastest-growing sub-segment, registering a solid 12.6% CAGR through 2032. The texture and gradual dispersion of granular MSG are preferred in meat processing, dressings, and snacks, where controlled flavor release and dust-free handling support premium applications. A unique dimension of this sub-segment is that granules are carving out a niche in higher-end meat, snack, and seasoning products, highlighting an opportunity for formulation companies to target audiences looking for texture control and clean-label appeal.

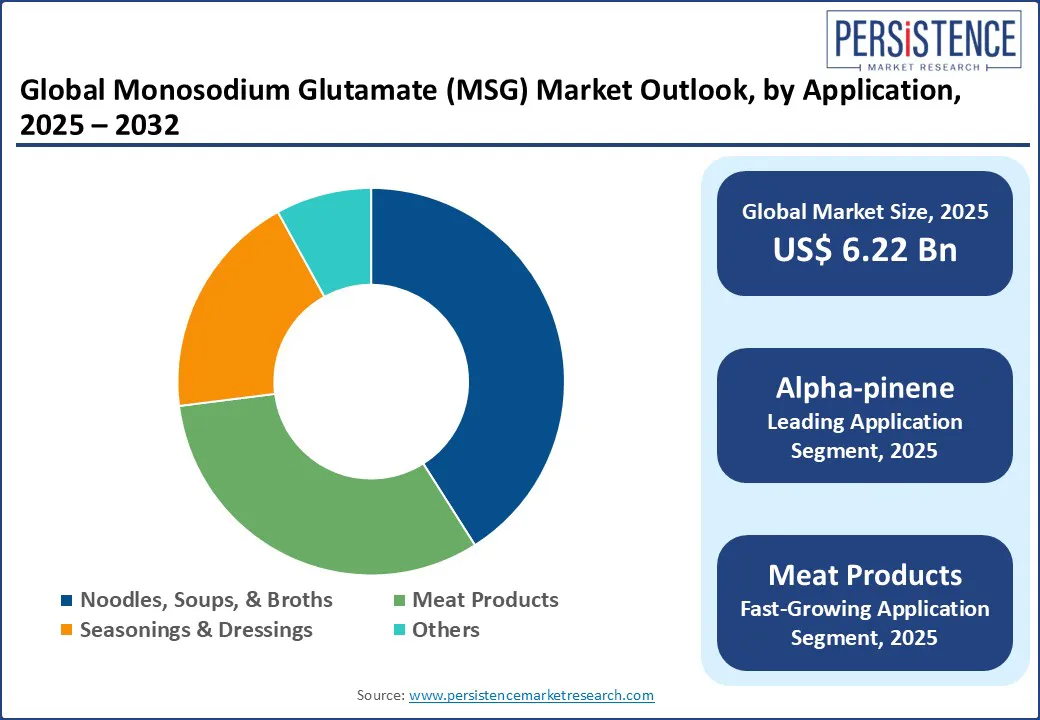

The noodles, soups & broths sub-segment is anticipated to lead the application domain, accounting for 36.5% of the revenue share in 2025. Noodles and soups remain the backbone of the MSG market in terms of volume due to a high consumption in convenience foods in the rapidly urbanizing landscape of several developing economies. The pervasiveness of instant noodle and soup consumption, especially across Asia Pacific, makes monosodium glutamate a staple additive in food preparations, since it ensures that dishes have uniform taste, rich umami flavor profiles, and price predictability for ready-to-cook meals.

On the other hand, the meat products category is estimated to exhibit a 6.7% CAGR through 2032. Earliest-stage plant-based and processed meat alternatives are the main growth drivers for the monosodium glutamate market, with granular MSG being favored in this sub-segment to enhance savory depth and texture control during meat marination or extrusion. Meat products present a high-potential premium niche, especially as clean-label and plant-based meat analog developers seek flavor enhancers that maintain umami without synthetic additives. Manufacturers who are shifting to granular forms of MSG and reformulated umami blends are excellently positioned to capitalize on this upcoming trend.

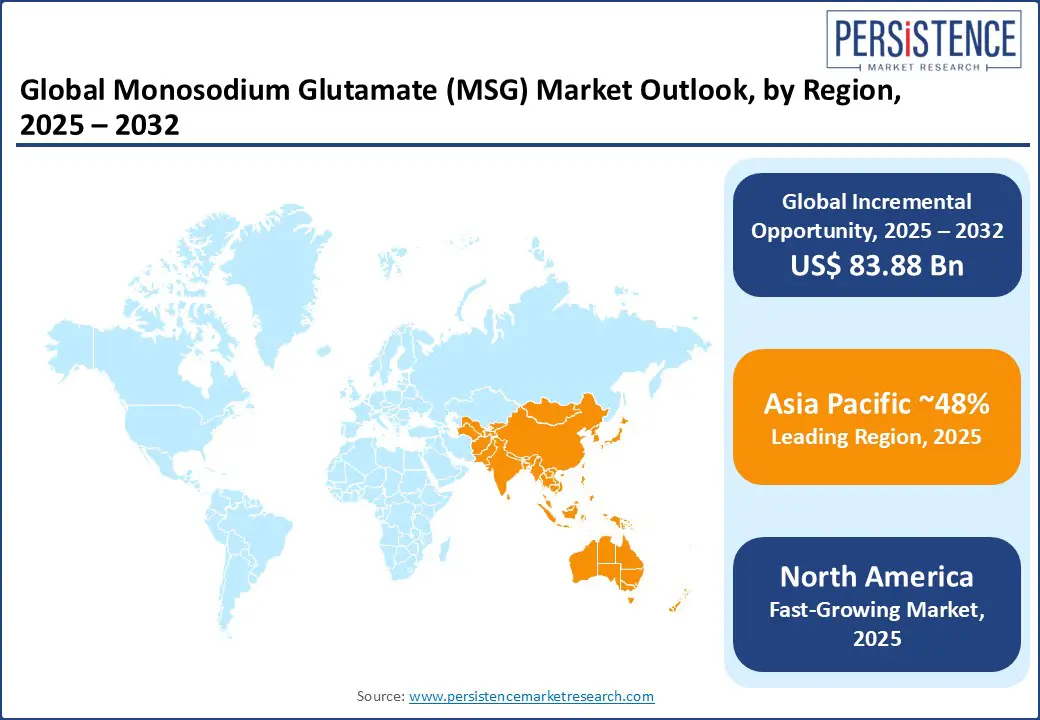

Asia Pacific is likely to hold nearly 48.6% of the monosodium glutamate market share in 2025, occupying a dominant global position. A strong cultural tradition around umami-rich cuisine, combined with strong penetration in instant noodles, sauces, and ready-meals, is the primary reason for the consistent and high-volume adoption of MSG in the region.

Within the region, China leads the market in terms of consumption, bolstered by both domestic adoption and substantial exports. Furthermore, competition in the region revolves around competitive costing structures, anchored in low-cost raw materials and local production scales. This is one of the key factors for Asia Pacific’s enhanced global influence in the MSG space. Apart from China, the burgeoning markets of Southeast Asia and India are also experiencing a steadily increasing demand from fast food, snack, and ethnic cuisine sectors, encouraging producers to launch reduced-sodium and fermentation-friendly MSG variants that align with health-conscious eating.

Owning 27% of the market share in 2025, Europe presents a novel opportunity for the monosodium glutamate market. While consumers in the region have been historically cautious about food additives, a sustained influx of immigrants from South and East Asia over several decades has diversified the regional palate toward ethnic and savory convenience meals, fostering MSG’s role in achieving flavor realism. Consumers, particularly in Germany, the U.K., Italy, and France, are now positively accepting MSG when it is advocated as being clean-label, reduced-sodium, or fermentation-based.

Another key growth driver in Europe is the EU’s strict regulatory system for foods and beverages. Characterized by transparent labeling standards, these regulations have encouraged product innovation and tailored MSG formats that deliver umami depth with clear ingredient disclosures. They have also led European food manufacturers and restaurant chains to incorporate MSG into new product lines targeting health-conscious consumers, despite the stigma it continues to carry.

North America is forecast to command approximately 20% share of the MSG market in 2025, owing to a well-evolved food processing and foodservice ecosystem that has actively embraced convenience and umami-rich flavors. The growth of this regional market is further supported by an increasing consumer openness to savory enhancers, partly due to nutritional transparency mandated by regulatory authorities and clean-label messaging around fermentation-based and reduced-sodium MSG products.

Innovations, including the introduction of powder monosodium glutamate intended for industrial food applications and granular formats for high-end seasonings, are augmenting the market expansion in North America. North America has cemented itself a fertile ground for MSG producers owing to the proliferation of quick-service restaurant chains and growing processed snack markets.

The global monosodium glutamate market features a clear stratified arrangement. Tier-1 leaders, including Ajinomoto, Fufeng Group, Meihua Holdings, COFCO, and Ningxia Eppen Biotech, dominate the market on the back of their extensive fermentation-based manufacturing facilities, economies of scale, and strong R&D in sustainable production methods. These capabilities enable them to offer diverse formats (powder, granules, salted and special MSG) across the food processing and food service sectors. They are also able to strategically leverage their presence across geographies, particularly in Asia Pacific, where cost-efficient supply chains and cultural demand underpin high MSG adoption.

Simultaneously, tier-2 and tier-3 producers, such as Cargill, Vedan International, Gremount, Linghua Group, and COFCO Biochemical, are focusing on specialized formulations such as low-sodium blends, clean-label fermentation products, and niche seasoning formats. Their scaling agility and the ability to adapt to local conditions and tastes allow number of them to serve fast-growing foodservice chains, plant-based product developers, and artisanal seasoning brands.

The monosodium glutamate (MSG) market is projected to reach US$ 9.01 Bn in 2025.

The surging consumption of ready-to-eat noodles, soups, sauces, and meat alternatives in urban centers is driving the monosodium glutamate (MSG) market.

The market is poised to witness a CAGR of 5.3% from 2025 to 2032.

Advancements in fermentation technology to make MSG production more efficient and transparent and a growing consumer demand for minimally processed and traceable ingredients are key market opportunities.

Ajinomoto Co., Inc., Fufeng Group, and Meihua Holdings Group Co., Ltd. are some of the key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Form

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author