ID: PMRREP32440| 197 Pages | 31 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

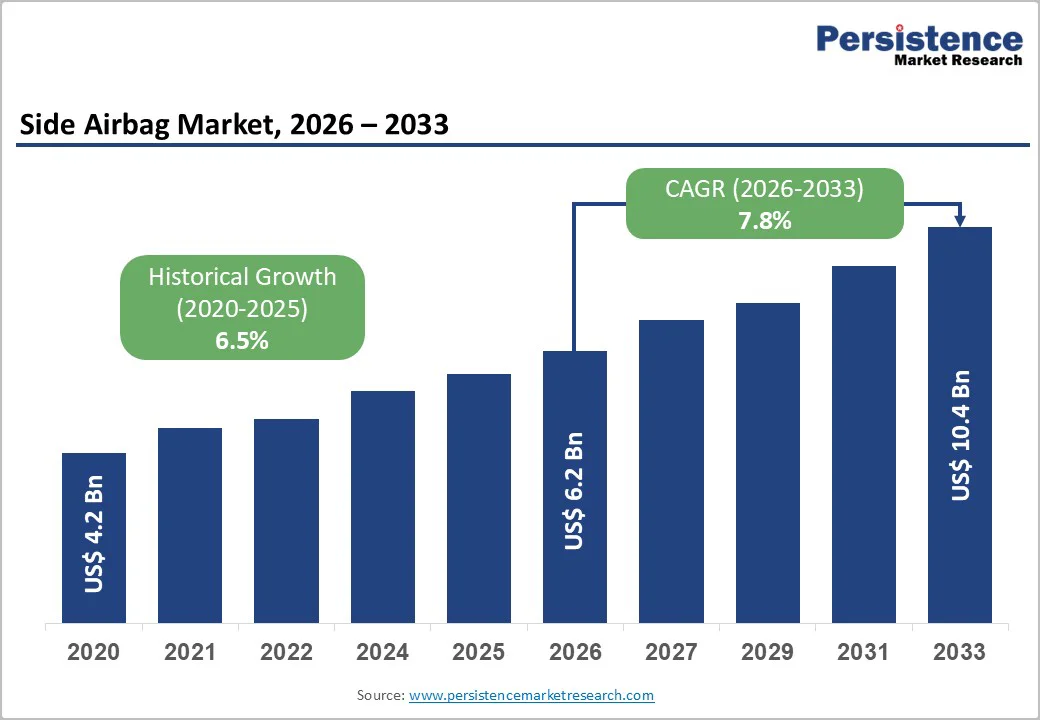

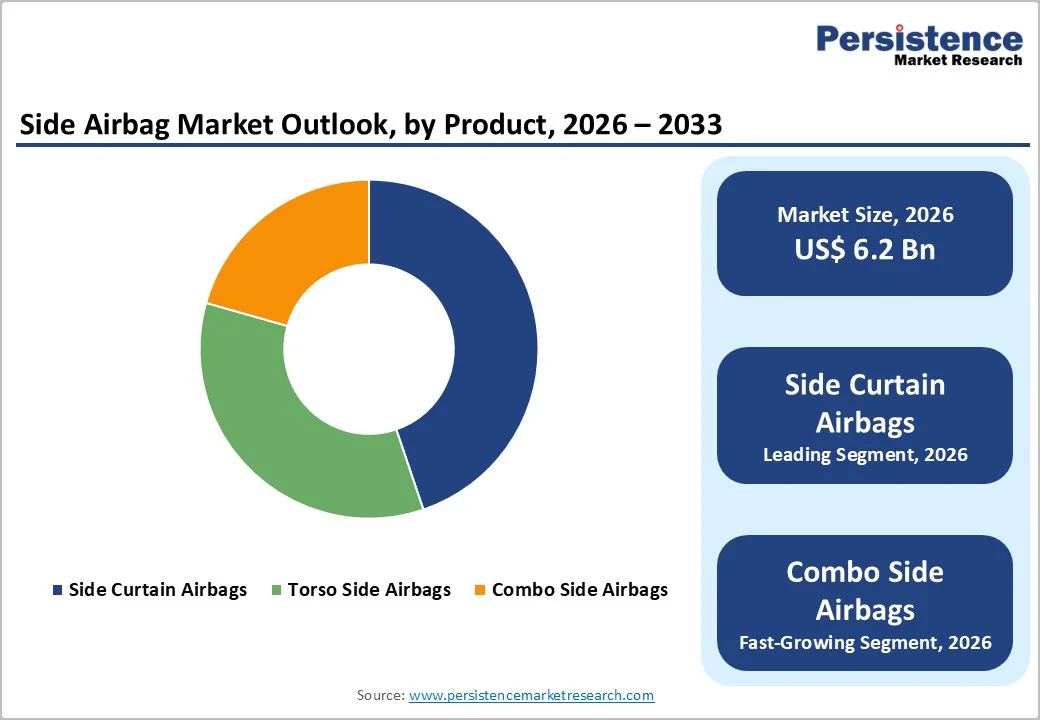

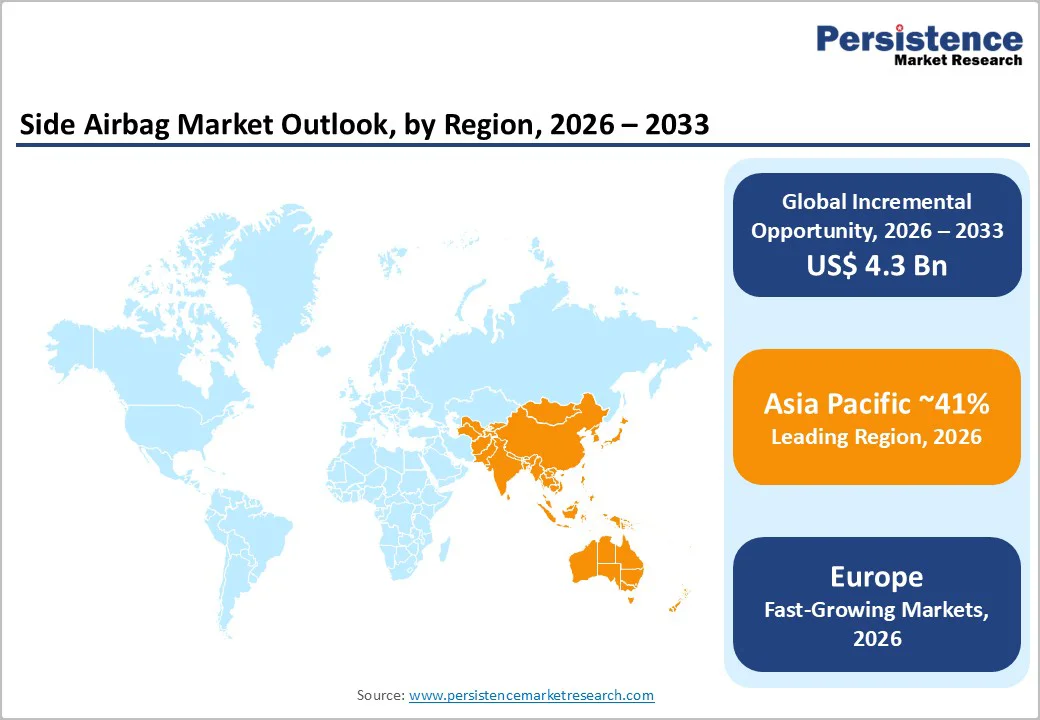

The global Side Airbag Market size is anticipated at US$ 6.1 Billion in 2026 and is projected to reach US$ 10.4 Billion by 2033, growing at a CAGR of 7.8% between 2026 and 2033. Market expansion is driven by side-impact regulations mandating curtain and torso airbags, electric vehicle adoption requiring flat-floor compatible solutions, and intelligent deployment using radar and AI for optimized protection. North America holds 25% share under NHTSA leadership, Europe grows at 7.3% CAGR via Euro NCAP alignment, while Asia Pacific leads with 41% share from manufacturing scale and rising vehicle demand.

| Key Insights | Details |

|---|---|

|

Market Value Forecast (2033F) |

US$ 10.4 billion |

|

Projected Growth CAGR (2026-2033) |

7.8% |

|

Historical Market Growth (2020-2025) |

6.5% |

Market Drivers

Regulatory mandates and safety standards are systematically driving side airbag adoption, with India mandating dual airbags in all passenger cars from October 2022 including two side/torso and two curtain airbags, NHTSA requiring comprehensive side-impact protection in all new US vehicles, Euro NCAP establishing rigorous crash-test protocols with mandatory head and far-side impact protection, and United Nations harmonizing global regulations enabling sustained OEM investment and consumer demand for advanced restraint systems. India dual-airbag mandate implementation. NHTSA side-impact requirements. Euro NCAP crash protocols. UN regulation harmonization. Mandatory airbag integration. Compliance deadline pressure. Global regulatory standardization.

Electric vehicle adoption is systematically driving specialized side airbag demand, with EV market segment expanding at 11.9% CAGR driven by unique battery packaging and flat-floor cabin architectures requiring customized deployment strategies and reduced thermal loads near high-voltage systems, Autoliv's Bernoulli Airbag Module reducing development costs by 30% through optimized geometry accommodating wide cabin spaces, and center airbags preventing driver-passenger mutual collision during side impacts supporting emerging specialized airbag market within broader EV segment. Battery packaging compatibility. Flat-floor cabin geometry adaptation. Thermal safety considerations. Customized deployment strategies. Reduced heat generation (30% improvement). Center airbag technology. EV-specific platform development.

Market Restraints

Side airbag market expansion is constrained by significant development, testing, and integration costs with specialized EV-compatible airbag systems commanding premium pricing and requiring extensive validation creating affordability barriers particularly in budget vehicle segments and emerging markets limiting mass-market penetration beyond premium segments. Development costs for specialized systems. Testing and validation expenses. EV customization premium. Integration complexity charges. Inflator development investment. Sensor system costs. Price point elevation barriers.

Side airbag market expansion is constrained by complex supply chain requirements involving specialized inflator manufacturing, sensor sourcing, and control electronics creating potential bottlenecks and production delays particularly during rapid demand surges and seasonal variations affecting timely OEM supply and vehicle production schedules. Inflator manufacturing bottlenecks. Sensor component sourcing challenges. Electronic control unit availability. Supply chain coordination complexity. Quality assurance requirements. Global sourcing dependencies. Production delay risks.

Market Opportunities

Emerging market vehicle proliferation and government safety mandates create substantial opportunity, with Asia Pacific commanding 41% market share as China produces over 220 million airbag units annually and India’s mandatory dual-airbag regulation ensures sustained volume growth across passenger, commercial, and electric vehicles. Rising vehicle ownership accelerates baseline demand, while phased mandate implementation improves penetration consistency. Expanding local production facilities reduce import reliance and shorten OEM supply chains. Manufacturing cost advantages support competitive pricing for mass segments. Strong regional OEM concentration enables scale efficiencies. Growing safety awareness elevates consumer acceptance. Regulatory compliance investment further drives technology upgrades and long-term market expansion.

Far-side and center airbag technology development represents a significant emerging opportunity, as Euro NCAP introduces far-side impact testing protocols demanding advanced restraint countermeasures beyond conventional side systems. Center airbags mitigate driver-passenger collision during lateral crashes, creating a high-value niche for specialized occupant protection solutions. Increasing focus on far-side impact protection accelerates R&D investment. Center airbag deployment enhances mutual occupant injury prevention. Compliance with advanced testing protocols becomes a competitive necessity. Premium vehicle segments adopt these technologies first, strengthening premium positioning. The trend enables clear technology differentiation for suppliers delivering integrated sensing, adaptive deployment, and optimized packaging solutions globally worldwide.

Side curtain airbags command 45% of market share, representing dominant product type with roof-mounted deployment protecting occupants' heads during side-impact collisions and rollovers providing comprehensive window coverage and extended occupant protection across diverse vehicle platforms. Roof-mounted deployment. Head protection focus. Window coverage capability. Rollover protection support. Regulatory mandate requirement. Standard equipment positioning. Proven safety record.

Combo side airbags expand as fastest-growing product category at 9.3% CAGR, driven by dual head and torso protection capability reducing serious injury risk and significantly improved coverage compared to single-function airbags supporting emerging consumer preference for comprehensive protection and OEM adoption for premium positioning. Head and torso protection. Comprehensive coverage advantage. Injury reduction effectiveness. Premium positioning support. Regulatory recognition growth. Consumer preference alignment. Advanced technology adoption.

Passenger vehicles command 73% of market share, representing dominant segment reflecting highest production volumes and regulatory compliance requirements across hatchbacks, sedans, SUVs, and premium vehicles supporting broad market adoption and technology standardization. Volume production leadership. Diverse body styles support. SUV popularity growth (elevated rollover risk). Premium vehicle integration. Consumer expectations satisfaction. Market penetration leadership. Revenue generation dominance.

Electric vehicles expand as fastest-growing segment at 11.9% CAGR, driven by rapid EV market expansion with specialized interior architectures and battery considerations requiring customized airbag solutions and innovative deployment strategies supporting high-growth niche with emerging specialized technology opportunities. EV adoption momentum. Flat-floor cabin architectures. Battery integration challenges. Thermal safety requirements. Customized solutions demand. Technology innovation focus. Future vehicle platform emphasis.

Original equipment manufacturer channel commands 87% of market share, representing dominant sales channel with direct factory vehicle integration ensuring quality control, regulatory compliance, and long-term OEM partnerships supporting sustained revenue generation and market leadership. Factory integration standard. Quality assurance priority. Long-term partnerships stability. Volume commitments predictability. Technology collaboration depth. Regulatory alignment assurance. Market revenue dominance.

Aftermarket channel expands at 5.9% CAGR, driven by retrofit demand from existing vehicle owners and fleet operators supporting secondary market development enabling safety enhancement of older vehicles and commercial fleet modernization. Fleet modernization focus. Safety upgrade demand. Retrofit compatibility solutions. Commercial adoption expansion. Cost-effective alternatives. Installer networks development. Complementary market growth.

North America maintains 25% market share, driven by NHTSA regulatory leadership, rigorous safety standards, technology innovation focus, and premium vehicle concentration supporting market development and advanced positioning. NHTSA regulation mandate leadership. Safety standard rigor. Technology innovation ecosystem. Premium market dominance. Consumer safety consciousness. Insurance incentive programs. Advanced feature adoption.

North American market characterized by regulatory compliance emphasis and safety technology leadership with consistent innovation in deployment algorithms and sensor integration. Strong emphasis on side-impact protection and occupant safety. Established supply chains and technical support networks enabling rapid technology deployment. OEM concentration supporting advanced airbag integration and investment in emerging technologies including AI-powered systems.

Europe expands at 7.3% CAGR, driven by Euro NCAP standards, regulatory harmonization, automotive technology leadership, and sustainability emphasis supporting advanced technology adoption and compliance focus. Euro NCAP crash protocols. Regulatory harmonization advancement. Safety standard leadership. Far-side impact protection focus. Sustainability emphasis (recycled materials). Technical expertise depth. Industry advancement momentum.

European market characterized by stringent Euro NCAP crash-test standards and far-side impact protection requirements driving advanced airbag development. Strong emphasis on occupant protection across all seating positions. Established technical expertise supporting reliability and advanced feature integration. Partnership ecosystems enabling innovation particularly in autonomous vehicle safety and intelligent deployment systems.

Asia Pacific commands 41% market share, driven by manufacturing dominance, rapid vehicle production, emerging market expansion, and government safety mandates supporting market growth exceeding global averages. Vehicle production scale dominance (220+ million airbags). China leadership positioning. India mandate implementation. Manufacturing cost advantages. OEM concentration supporting adoption. Government investment support. Regional expansion momentum.

Asia Pacific market characterized by rapid growth with China leading through massive airbag production (220+ million units annually) and average airbag count per vehicle increasing from 2.3 (2020) to 4.8 (2025). India driving sustained growth through mandatory dual-airbag requirements for all new vehicles. Japan and South Korea contributing engineering depth and manufacturing scale for global OEM platforms. Cost-competitive production attracting supply chain development and local supplier expansion.

Market Structure

The side airbag market shows consolidation led by multinational leaders such as Autoliv, ZF Friedrichshafen, and Joyson Safety Systems, driven by integrated portfolios, strong R&D, and long-standing OEM relationships. Specialized players including Toyoda Gosei, Bosch, and Hyundai Mobis enhance geographic reach and technology depth, while regional suppliers and startups address niches through cost competitiveness, innovation, and flexible solutions sustaining competition.

Strategic Developments

Business Strategies

Market leaders pursue differentiation through AI-powered sensor integration, EV-specific architectures, cost optimization, and regulatory compliance leadership ensuring market access. Geographic expansion via emerging-market partnerships, sustainability using recycled materials, and deep OEM collaboration strengthen positioning. Multinationals emphasize comprehensive systems and global OEM ties, while regional specialists leverage local cost advantages, technology partners enable AI integration, and aftermarket suppliers target retrofit-friendly solutions.

The global Side Airbag Market is anticipated at US$ 6.1 Billion in 2026 and is projected to reach US$ 10.4 Billion by 2033.

Market growth is propelled by mandatory global safety regulations, rapid EV adoption requiring new airbag architectures, and AI- and sensor-integrated deployment systems improving accuracy and occupant protection.

The market is projected to expand at a 7.8% CAGR between 2026 and 2033.

Key opportunities lie in Asia-Pacific regulatory-driven volume growth, far-side and center airbag adoption under Euro NCAP protocols, and aftermarket retrofits for aging vehicle fleets growing at ~5.9% CAGR.

The market is led by Autoliv, ZF Friedrichshafen, and Joyson Safety Systems, with strong innovation support from Toyoda Gosei, Bosch, and Hyundai Mobis, particularly in EV-focused, AI-enabled, and cost-optimized airbag technologies.

| Report Attribute | Details |

|---|---|

|

Forecast Period |

2026 – 2033 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Vehicle Type

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author