ID: PMRREP29563| 199 Pages | 7 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

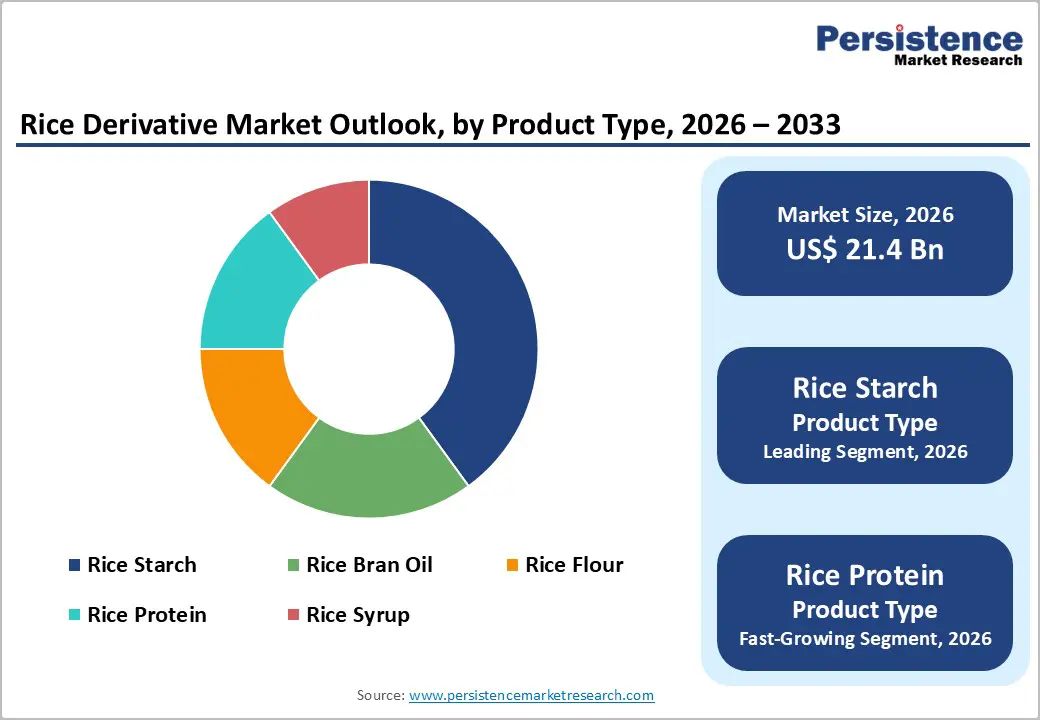

The global rice derivative market size is likely to be valued at US$21.4 billion in 2026, and is expected to reach US$31.9 billion by 2033, growing at a CAGR of 5.9% during the forecast period from 2026 to 2033, driven by the increasing prevalence of clean-label ingredients, rising demand for gluten-free and plant-based products, and advancements in rice starch and protein extraction.

Rising demand for versatile and functional rice derivatives, particularly in the food & beverage and cosmetics & personal care sectors, is driving broader adoption across applications. Innovations in organic and high-purity formulations are further accelerating uptake by providing more sustainable, allergen-free alternatives. The growing awareness of rice derivatives’ role in improving texture and nutritional value in emerging markets continues to be a key factor fueling market growth.

| Key Insights | Details |

|---|---|

|

Rice Derivatives Market Size (2026E) |

US$21.4 Bn |

|

Market Value Forecast (2033F) |

US$31.9 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

5.9% |

|

Historical Market Growth (CAGR 2020 to 2025) |

5.5% |

The growing demand for clean-label ingredients stems from a fundamental change in how consumers assess food, beverage, and personal care products. Today’s consumers are more attentive to ingredient lists and favor formulations that are straightforward, transparent, and easily recognizable. As a result, manufacturers are increasingly eliminating artificial colors, synthetic preservatives, chemical additives, and genetically modified ingredients, replacing them with naturally sourced and minimally processed alternatives.

Health consciousness is a key driver of this shift. Clean-label products are widely perceived as healthier, safer, and associated with fewer long-term health risks. Ingredients derived from plants, fermentation, or traditional processing methods are viewed as more reliable, particularly when labeling clearly communicates sourcing and composition. This perception is further strengthened by rising concerns about food sensitivities, allergies, and dietary preferences such as vegan and gluten-free lifestyles. Regulatory scrutiny and retailer requirements are accelerating adoption, pushing brands to reformulate in line with stricter labeling and transparency standards. Clean-label positioning also enables companies to differentiate their brands, strengthen consumer trust, and support premium pricing strategies.

Limited awareness and low adoption in certain regions continue to act as a major constraint on the rice derivatives market. In many developing and cost-sensitive markets, consumers and end-users are more accustomed to conventional synthetic staples such as wheat flour, maize starch, or palm-based oils. Rice derivatives, including rice protein, rice starch, rice syrup, and rice bran oil, are often viewed as niche or specialty ingredients rather than viable mainstream alternatives, which restricts their market penetration.

Insufficient marketing and a lack of product education further hinder adoption. Small-scale food processors, bakeries, and manufacturers may be unfamiliar with the functional advantages of rice-based ingredients, such as their hypoallergenic nature, neutral taste, and compatibility with gluten-free formulations. As a result, they are less inclined to reformulate existing products or explore new applications using rice derivatives. Distribution limitations also play a role, as inconsistent availability through established supply chains can make sourcing difficult. Higher pricing compared to traditional substitutes may also deter trial and usage, particularly in markets where cost considerations take precedence over health benefits or clean-label appeal.

Advancements in high-functionality and organic rice derivative delivery platforms are reshaping the global ingredients market by tackling two critical challenges, performance limitations and sustainability concerns. High-functionality solutions are designed to deliver enhanced thickening, binding, and emulsification, reducing dependence on synthetic additives and supporting clean-label formulations. Innovations such as modified rice starches, enzyme-treated proteins, cold-water-soluble flours, and hybrid syrups significantly improve functionality while streamlining processing steps, helping brands lower formulation complexity and overall costs.

Progress in organic platforms, including certified organic rice starch, non-GMO rice bran oil, vegan protein isolates, and fully traceable syrups, also aligns with the growing demand for environmentally responsible nutrition. These solutions minimize chemical inputs, reduce allergen risks, and improve bioavailability while offering broad application flexibility without the need for additional additives. Emerging technologies such as bio-fortification, precision milling, and advanced coating systems further optimize texture, stability, and nutritional performance, reinforcing the role of rice derivatives in next-generation functional formulations.

The synthetic segment is anticipated to dominate the market, accounting for approximately 70% of the market share in 2026. Its dominance is driven by cost-effectiveness, large-scale availability, and established supply chains, making it preferred for industrial applications. The synthetic segment provides reliable performance, ensures affordability, and contributes to volume, making it suitable for large-scale food campaigns. Wilmar International Ltd. also exemplifies supply chain dominance in synthetic derivatives. With integration across rice mills and processing facilities, Wilmar secures continuous raw material flow for its synthetic rice bran oil and rice flour products, ensuring affordability and meeting the bulk demand of industrial food campaigns.

The organic segment represents the fastest-growing segment, due to its clean-label appeal and expanding use in premium products. Its pesticide-free profile makes it ideal for targeted wellness, reducing concerns. Continuous innovations in certified sourcing are further strengthening its premium status, driving rapid adoption across North America and Europe, where demand for non-GMO, natural derivatives is accelerating. Axiom Foods, Inc. is a leading U.S. ingredient supplier known for its organic rice protein products such as Oryzatein, which are widely used in clean-label nutrition formulations, including vegan protein powders, functional beverages, and allergy-friendly foods. The company has focused on developing certified organic, non-GMO rice-derived proteins to meet the rising demand in North America and Europe, where consumers increasingly seek natural, pesticide-free ingredients with transparent sourcing and clean-label claims.

Rice starch dominates the market, accounting for roughly 40% of total revenue in 2026, supported by strong demand for thickening agents, large-scale food programs, and the global need for gluten-free binders. Its leadership position is reinforced as brands continue to expand clean-label product portfolios. The increasing uptake of rice protein and wider use of rice bran oil also underscore a growing emphasis on multi-functional, value-added benefits. BENEO GmbH stands out as a leading global supplier of rice starch, recognized for its functional solutions used to thicken, stabilize, and enhance texture in products such as sauces, soups, dairy alternatives, and gluten-free baked goods. The company’s Remypure range of native rice starches is specifically developed to replace chemically modified thickeners while meeting clean-label and gluten-free requirements.

Rice protein represents the fastest-growing segment, driven by strong momentum in plant-based nutrition and its expanding use in dietary supplements. The shift toward high-protein formulations, combined with improved digestibility, is accelerating adoption across applications. Ongoing improvements in isolate purity and the introduction of advanced concentrate blends into consumer trials continue to support market growth. Axiom Foods’ launch of Oryzatein® 2.0, a next-generation rice protein with improved smoothness and broader application potential across food, beverage, and infant nutrition, highlights the industry’s focus on enhanced performance. These advancements are key to expanding rice protein’s role in high-growth areas such as sports nutrition and wellness supplements.

The food & beverage segment is projected to lead the market, accounting for nearly 55% of total revenue in 2026. This dominance reflects its role as the primary platform for texture enhancement and nutritional delivery, supported by large-scale formulation programs and a wide range of products that require functional ingredients. Strong industry integration, experienced formulation teams, and the capacity to manage both high-volume and premium formulations contribute to higher consumption levels. Food and beverage manufacturers are also at the forefront of starch introductions and early-stage protein application trials. For example, Ingredion’s launch of organic native rice starches designed for uses such as frozen ready meals and dressings highlights how ingredient innovation continues to drive growth in this segment.

The cosmetics and personal care segment is expected to be the fastest-growing segment, supported by the natural positioning of rice-derived ingredients and their expanding use in skincare. These ingredients provide gentle, effective moisturizing benefits and are well-suited for hypoallergenic and low-irritation formulations, making them attractive to brands focused on sensitive-skin solutions. Increased consumer engagement, stronger emphasis on beauty and wellness, and broader availability of both everyday and premium rice-based derivatives are accelerating adoption across urban and semi-urban markets. Products such as The Face Shop’s Rice Water Bright cleansers and Rice Ceramide moisturizers demonstrate the effectiveness of rice-derived actives in delivering hydration and mild care. Their success in regions including North America and Asia reflects growing consumer preference for plant-based, clean-label skincare products.

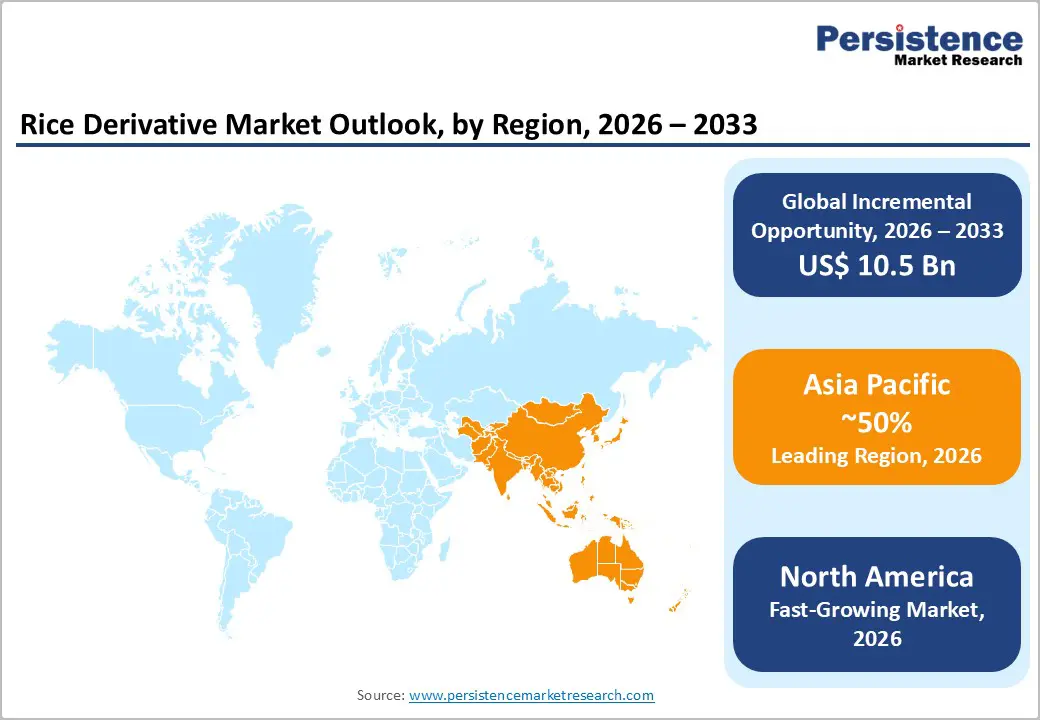

North America is expected to be the fastest-growing regional market, supported by its well-developed food processing infrastructure, strong research and development ecosystem, and high consumer awareness of gluten-free and allergen-friendly products. Advanced processing capabilities in the U.S. and Canada enable large-scale formulation programs and ensure the broad availability of rice derivatives across food and beverage, nutraceutical, and cosmetics applications. Rising demand for organic, convenient, and easy-to-use ingredient formats is further accelerating adoption, as these solutions enhance functionality while reducing the limitations commonly associated with wheat-based alternatives.

Ongoing innovation in rice derivative technologies, such as stable high-protein solutions, improved starch performance, and targeted clean-label enhancements, is drawing substantial investment from both public and private sectors. In parallel, government initiatives and health-focused campaigns promoting allergy management, clean eating, and overall wellness are reinforcing long-term demand. Growing emphasis on specialized rice protein grades and niche applications, particularly in bakery and related segments, is also broadening the scope of rice derivative usage across the region.

Europe’s market growth is underpinned by rising awareness of clean-label advantages, well-developed food systems, and strong government-led sustainability initiatives. Major markets such as Germany, France, and the U.K. benefit from established nutrition and regulatory frameworks that encourage regular use of innovative ingredient solutions, including rice derivatives. These naturally positioned formulations resonate strongly with food manufacturers, health-conscious consumers, and cosmetics users, supporting wider acceptance and consistent adoption.

Continued technological progress in rice derivative development, ranging from enhanced functional performance and application-specific delivery systems to improved organic grades, is further strengthening market prospects. European authorities are increasingly backing research programs and application trials for both mainstream and specialized uses, reinforcing confidence across the value chain. In parallel, growing demand for convenient, allergen-free ingredients aligns with the region’s focus on preventive healthcare and reduced gluten consumption. Public education initiatives and promotional efforts are expanding awareness in urban and rural markets alike, while suppliers continue to invest in advanced processing capabilities and innovative product variants to enhance performance and adoption.

Asia Pacific is expected to dominate, accounting for approximately 50% of the market share, driven by growing production awareness, supportive government initiatives, and expanding application programs across the region. Major economies such as India, China, Japan, and countries in Southeast Asia are actively advancing rice derivative initiatives to improve rice utilization and meet emerging functional and nutritional demands. Rice derivatives are particularly well-suited to these markets due to their local availability, ease of processing, and compatibility with large-scale food programs serving both urban and rural populations.

Advances in processing technologies are enabling the development of stable, efficient, and easy-to-handle rice derivatives that perform reliably under challenging climatic conditions while reducing waste. These improvements are especially important for supplying remote and resource-constrained areas and enhancing overall nutritional reach. Rising demand from the food and beverage, nutraceutical, and cosmetics sectors continues to support market growth. Public–private partnerships, higher agricultural spending, and increased investments in milling research and manufacturing infrastructure are further accelerating expansion. Improved delivery convenience, enhanced functionality, and lower risk of product loss are positioning rice derivatives as a preferred solution across the region.

The global rice derivative market features competition between established agri-processors and emerging specialty suppliers. In North America and Europe, Cargill, Incorporated and ADM lead through strong R&D, distribution networks, and industry ties, bolstered by innovative grades and functional programs. In Asia Pacific, Adani Wilmar Limited advances with localized solutions, enhancing accessibility. High-functionality delivery boosts versatility, cuts alternative risks, and enables mass integrations across regions. Strategic partnerships, collaborations, and acquisitions merge expertise, expand milling, and speed commercialization. Organic formulations solve sustainability issues, aiding penetration in clean-label areas.

The global rice derivative market is projected to reach US$21.4 billion in 2026.

The rising prevalence of clean-label ingredients and demand for gluten-free products are the key drivers.

The rice derivative market is poised to witness a CAGR of 5.9% from 2026 to 2033.

Advancements in high-functionality and organic delivery platforms are the key opportunities.

Cargill Incorporated, ADM, Bunge Global SA, Wilmar International Ltd, and Louis Dreyfus Company are the key players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Nature

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author