ID: PMRREP35737| 167 Pages | 15 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

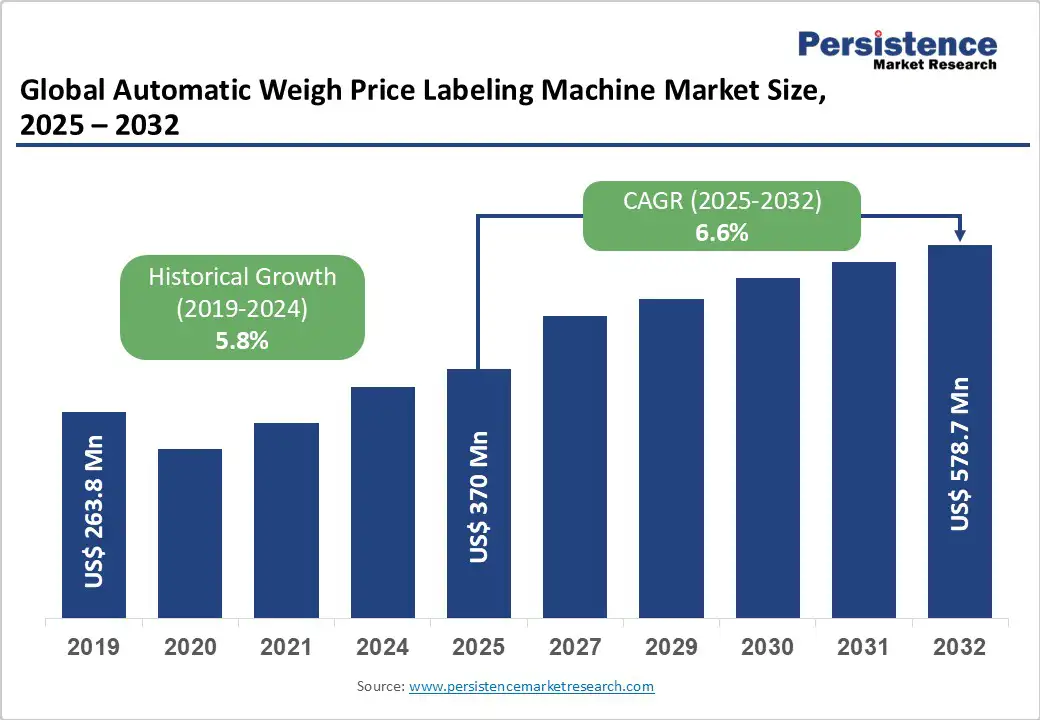

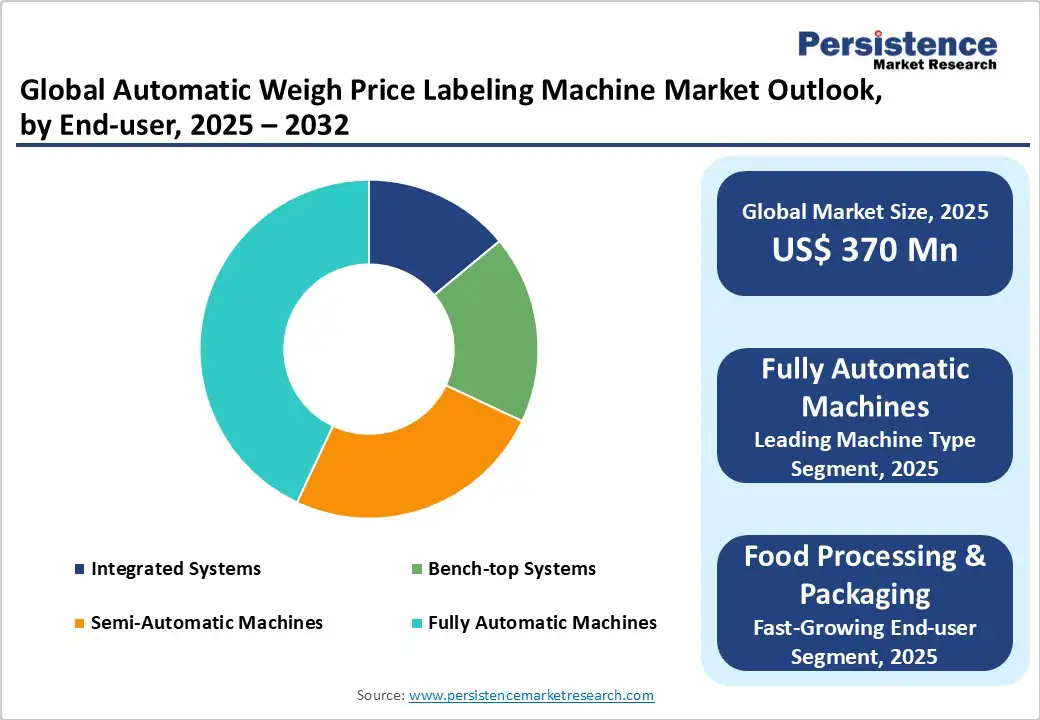

The global automatic weigh price labeling machine market size is expected to be valued at US$370.0 million in 2025. It is projected to reach US$578.7 million by 2032, growing at a CAGR of 6.6% during the forecast period of 2025 -2032.

Rapid advancements in automation technologies, coupled with increasingly stringent food safety regulations globally, are driving manufacturers and end-use industries to adopt integrated weigh-price labeling solutions.

The convergence of Internet of Things (IoT), artificial intelligence (AI), and cloud connectivity enhances operational efficiencies, traceability, and real-time analytics, reinforcing the market’s growth trajectory.

| Key insights | Details |

|---|---|

| Automatic Weigh Price Labeling Machine Market Size (2025E) | US$370.0 Mn |

| Market Value Forecast (2032F) | US$578.7 Mn |

| Projected Growth CAGR (2025 - 2032) | 6.6% |

| Historical Market Growth (2019-2024) | 5.8% |

Automation requirements in retail chains and food processing and packaging sectors are driving the adoption of weigh-price labeling machines. Retailers face mounting pressure to reduce labor costs and minimize human errors at checkout counters. Integrated systems that combine weighing, labeling, and quality inspection reduce manual intervention by up to 30%, improving throughput and accuracy.

Moreover, supermarkets with multi-SKU product assortments benefit from real-time weight verification and dynamic pricing, resulting in a 15% reduction in overcharging and undercharging incidents. In food processing, automated labeling ensures compliance with packaging regulations and streamlines line speeds, with manufacturers reporting a 20% increase in productivity after deploying fully automatic machines.

Agencies such as the US Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have intensified enforcement of labeling and traceability standards. Non-compliance can incur fines exceeding US$100,000 per violation and trigger costly product recalls. Advanced weigh-price labeling machines, featuring AI-guided vision and blockchain-based traceability, enable the automatic capture of weight, price, and timestamp data, ensuring audit readiness.

Early adopters report a 25% reduction in compliance-related downtime and a 30% improvement in traceability accuracy. As global supply chains become more complex, the ability to track products from farm to fork positions weight-price labeling systems as critical compliance tools.

Transitioning from bench-top or semi-automatic machines to fully automatic, IoT-enabled systems demands significant investment. Entry-level fully automatic machines range from US$60,000 to US$100,000, while premium AI-vision assisted models can exceed US$150,000.

Small and medium-sized enterprises (SMEs), particularly in emerging markets, frequently face budgetary constraints that hinder their modernization efforts. This cost barrier limits adoption in price-sensitive segments, where manual or semi-automatic labeling remains prevalent. The payback period for advanced systems can extend beyond 3 years without financing or leasing options, hindering rapid deployment across all industry verticals.

Another challenge is that several existing production facilities and retail outlets operate on legacy POS and ERP platforms lacking standardized interfaces for modern equipment. Approximately 40% of potential adopters cite integration complexity and anticipated downtime as significant hurdles.

Customized middleware solutions or extensive system upgrades are often required, adding to implementation timelines and costs. In regions where IT infrastructure maturity is low, unreliable network connectivity can further hamper the performance of cloud-connected labeling machines, impacting real-time data exchange and remote monitoring capabilities.

The global e-grocery market is projected to grow at a positive CAGR, driven by consumer preferences for online ordering and home delivery. Weigh-price labeling machines that integrate with e-commerce platforms and warehouse management systems facilitate accurate order fulfillment and dynamic pricing for perishable goods.

Cloud-connected systems enable real-time inventory updates across online and offline channels, reducing stockouts by 25% and improving customer satisfaction. Retailers can leverage these systems to implement personalized promotions and loyalty programs based on purchase history and weight-based discounts.

On the other hand, the meat & poultry processing industry is embracing AI & vision-assisted weigh-price labeling machines to enhance portion control and yield optimization. Trials conducted by leading processors in North America have shown a 10% reduction in yield loss and a 15% decrease in labeling errors through the use of automated defect detection and dynamic label generation. AI algorithms can identify product dimensions, surface irregularities, and spoilage indicators, ensuring only conforming products are labeled.

The fully automatic machines segment is likely to dominate with a 43% share in 2025. Fully automatic solutions provide end-to-end automation, encompassing product feeding, weighing, labeling, and quality inspection, reducing labor costs by 30%, and improving line efficiency by 25%.

Leading vendors offer modular designs that allow easy scalability and maintenance, driving their adoption in large retail chains and food processing plants. Moreover, turnkey integration with upstream conveyors and downstream sorting systems reinforces their market leadership.

High-precision scales are set to lead with a 38% share in 2025. These systems deliver accuracy within ± 0.1 g tolerance, essential for high-value products in pharmaceuticals & nutraceuticals, where regulatory standards demand precise labeling.

The rise of premium retail segments and stringent compliance requirements has heightened demand for high-precision scales. Vendors report that high-precision systems command a 20% price premium over standard scales, yet offer superior ROI through reduced labeling errors and minimized product giveaway.

Cloud-connected/IoT-enabled systems are expected to capture 35% of the market revenue share in 2025. Cloud connectivity enables remote monitoring, predictive maintenance alerts, and over-the-air software updates, resulting in a 20% reduction in on-site service visits.

Real-time data analytics dashboards enable operational managers to track machine performance metrics, such as throughput, downtime, and error rates, across multiple facilities. Early adopters have achieved a 15% improvement in overall equipment effectiveness (OEE) through actionable insights derived from cloud platforms.

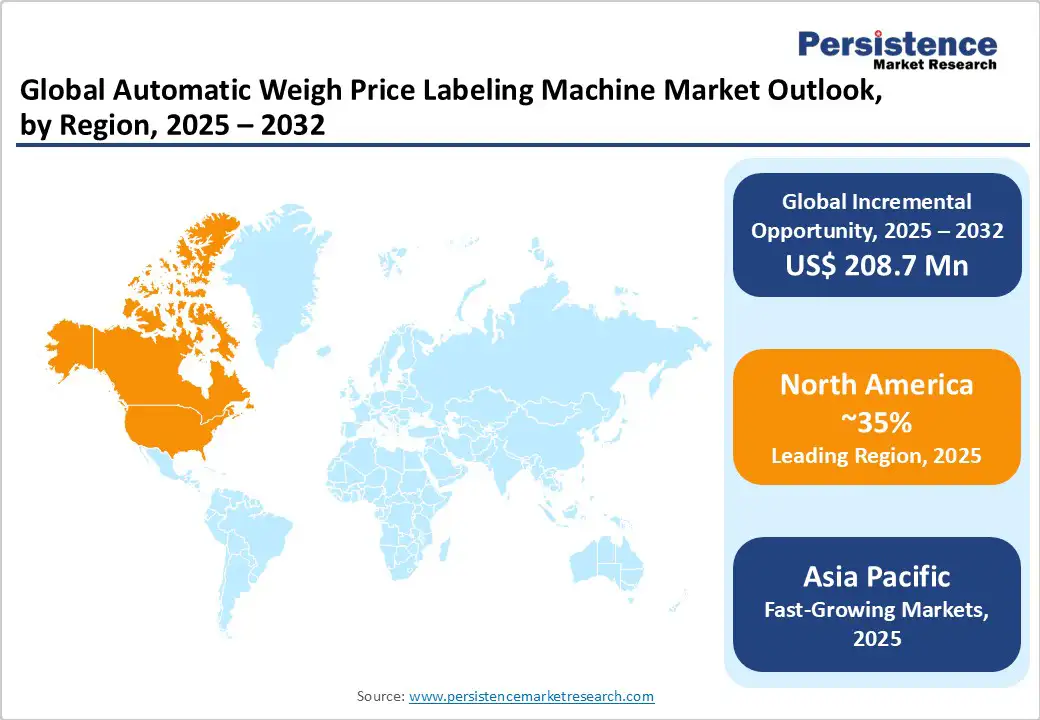

North America leads global adoption, fueled by robust investment in automation across retail chains and food processors. The US FDA’s Enhanced Traceability Rule under the Food Safety Modernization Act has prompted 60% of meat & poultry processors to upgrade to AI-vision assisted weigh-price labeling systems for end-to-end traceability.

Collaborative efforts between machine manufacturers and ERP vendors are enabling turnkey POS-integrated solutions that synchronize pricing and inventory data in real time. Partnerships with cloud service providers offer scalable analytics platforms, helping retailers reduce labeling errors by 18% and optimize promotional strategies based on weight-based pricing data.

Europe is shaped by harmonized EU regulations on food labeling, including the EU Food Information to Consumers Regulation (FIC). Over 50% of major retail chains in Germany, the UK, France, and Spain are piloting blockchain-enabled weigh-price labeling machines to bolster supply chain transparency.

Harmonized certification processes across the EU have simplified equipment approval, enabling vendors such as METTLER TOLEDO and Bizerba to rapidly expand their distribution networks. Subsidies under the EU’s Digital Europe Programme are supporting SMEs in adopting bench-top and semi-automatic systems, while large processors invest in fully automatic and AI-vision assisted solutions to meet escalating demand for precision and speed.

The Asia Pacific is the fastest-growing regional market, driven by China’s large-scale manufacturing and Japan’s incentives for automation. China accounted for 28% of regional installations in 2024, driven by domestic OEMs incorporating low-cost IoT modules to address price-sensitive food processors.

In Japan, government grants covering up to 30% of automation equipment costs are accelerating the deployment of fully automatic and AI-vision systems, particularly in meat & seafood processing. India’s modern retail boom, characterized by the rise of supermarket chains and e-grocery platforms, is fueling demand for ERP/POS-integrated weigh-price labeling machines to ensure pricing consistency across channels.

The global automatic weigh price labeling machine market structure exhibits moderate consolidation, with the top five players, Marel, METTLER TOLEDO, Bizerba, ISHIDA, and ESPERA-WERKE GmbH, collectively holding over 45% share. These companies emphasize R&D in AI-vision technologies, modular automation architectures, and cloud-native platforms.

Emerging business models such as equipment-as-a-service (EaaS) and outcome-based contracts are reducing upfront capital barriers for SMEs. Key differentiators include multi-language user interfaces, rapid deployment and training services, and integrated analytics dashboards. Smaller regional players focus on cost-competitive offerings and service networks to address localized requirements.

The global automatic weigh price labeling market size is estimated reach US$ 370.0 million in 2025.

The market is being driven by a rising demand for automation in retail and food processing, as well as stringent food safety and traceability regulations.

The market is poised to witness a CAGR of 6.6% from 2025 to 2032.

A major growth opportunity lies in the development of AI and vision-assisted systems in meat and poultry processing, which can reduce yield loss and labeling errors.

Key market players include Marel, METTLER TOLEDO, Bizerba, ISHIDA, and ESPERA-WERKE GmbH.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Machine Type

By Weighing Technology

By Degree of Integration

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author