ID: PMRREP19345| 297 Pages | 14 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

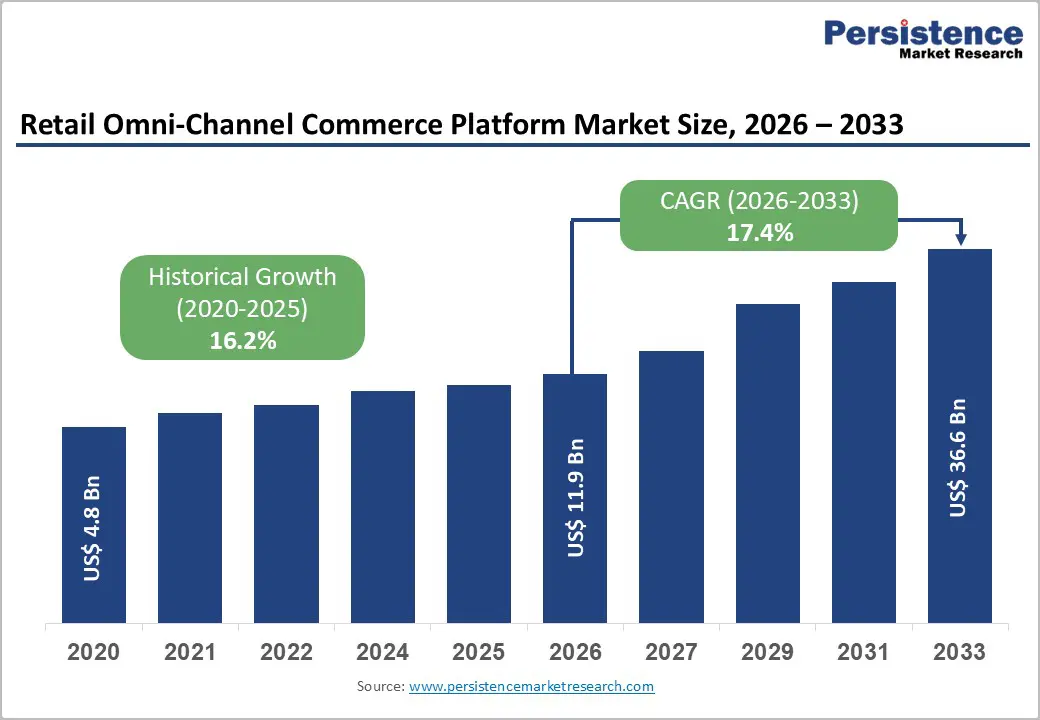

The global retail omni-channel commerce platform market size is expected to be valued at US$ 11.9 billion in 2026 and projected to reach US$ 36.6 billion by 2033, growing at a CAGR of 17.4% between 2026 and 2033.

This strong growth reflects retailers’ increasing focus on delivering seamless shopping experiences across digital and physical channels. Rising e-commerce adoption, cloud deployment, and real-time data integration are driving demand for unified inventory, order management, and customer engagement solutions. Omni-channel platforms enable capabilities such as BOPIS, ship-from-store, and personalized journeys, helping retailers improve operational efficiency, customer satisfaction, and long-term profitability in a highly competitive retail environment.

| Global Market Attributes | Key Insights |

|---|---|

| Retail Omni-Channel Commerce Platform Market Size (2026E) | US$ 11.9 billion |

| Market Value Forecast (2033F) | US$ 36.6 billion |

| Projected Growth CAGR (2026-2033) | 17.4% |

| Historical Market Growth (2020-2025) | 16.2% |

Rising Consumer Demand for Seamless Unified Commerce Experiences

A key growth driver for the retail omni-channel commerce platform market is the rapid shift in consumer behavior toward seamless, channel-less shopping experiences. Customers increasingly expect to browse, purchase, return, and engage with brands across websites, mobile apps, social platforms, and physical stores without friction. Omni-channel shoppers consistently demonstrate higher spending levels and stronger brand loyalty than single-channel customers.

To meet these expectations, retailers are investing in platforms that unify customer identity, inventory, pricing, and order history across all touchpoints. Solutions from providers such as Salesforce Commerce Cloud, Adobe Commerce, and Shopify enable experiences like BOPIS, curbside pickup, and flexible returns. These capabilities improve customer satisfaction, increase basket sizes, and drive higher lifetime value.

Acceleration of Cloud-Based, API-First and Composable Architectures

Another major growth drive is the accelerating adoption of cloud-based and composable commerce architectures, which offer greater scalability, agility, and cost efficiency than traditional on-premise systems. SaaS platforms allow retailers to handle seasonal traffic spikes, launch new channels quickly, and benefit from continuous software upgrades without heavy infrastructure investment.

API-first and microservices-based platforms from vendors such as Shopify, VTEX, Salesforce, and Elastic Path enable retailers to integrate specialized services like AI search, payments, and headless storefronts while maintaining a unified commerce backbone. This architectural flexibility supports rapid innovation, reduces time-to-market, and makes omni-channel platforms more attractive for retailers of all sizes.

High Integration Complexity and Legacy System Dependence

A major restraint for the retail omni-channel commerce platform market is the difficulty of integrating modern platforms with existing legacy systems. Established retailers often operate fragmented ERP, CRM, POS, and warehouse management systems that are heavily customized, making seamless unification challenging. Synchronizing real-time inventory, pricing, and promotions across these systems requires extensive middleware, data harmonization, and custom development.

This complexity drives up implementation timelines and costs, especially for small and mid-sized retailers with limited IT budgets. Consequently, some organizations postpone or scale down omni-channel initiatives, slowing adoption rates and delaying the full realization of digital transformation benefits across their retail operations.

Data Privacy, Security, and Compliance Challenges

Another key restraint is the heightened risk associated with aggregating large volumes of sensitive customer data across omni-channel platforms. Platforms store payment details, behavioral data, geolocation, and identity information, exposing retailers to cyber threats and potential data breaches. Regulatory requirements, including GDPR, CCPA/CPRA, and emerging regional laws in Asia Pacific, impose strict rules for consent, data handling, and cross-border transfers.

Compliance demands investment in encryption, secure architectures, and advanced access controls, increasing overall project costs. Concerns over data governance, privacy, and security can make retailers cautious about implementing deeply integrated omni-channel platforms, modestly tempering the market’s growth trajectory.

Expansion of AI-Driven Personalization and Intelligent Omnichannel Inventory

A major opportunity in the retail omni-channel commerce platform market is the integration of AI and machine learning capabilities. Vendors are increasingly embedding AI-driven tools for personalized product recommendations, dynamic pricing, intelligent search, and conversational commerce. For example, Salesforce Commerce Cloud offers Shopper Copilot actions and omni-channel inventory connectors that optimize stock allocation and fulfillment across multiple locations.

Similarly, Adobe Commerce and Shopify are enhancing automated merchandising and tailored content features. Research indicates that personalized recommendations can boost sales by 10–15% and improve customer engagement. Providers offering integrated, data-driven personalization across all channels are well-positioned to capture new revenue and strengthen long-term retailer relationships.

Growing Adoption Among Medium-Sized and Emerging Market Retailers

Another significant opportunity comes from medium-sized retailers and emerging market players adopting omni-channel strategies. In regions like Asia Pacific, Latin America, and parts of the Middle East & Africa, retail modernization and e-commerce growth are accelerating, fueled by rising smartphone penetration and digital payments.

Cloud-based, modular platforms allow these retailers to implement unified commerce quickly with minimal upfront investment. As governments support digitalization and cashless economies, and as marketplaces and social commerce expand, medium-sized retailers seek scalable solutions to integrate online storefronts, physical stores, and marketplaces. Vendors that offer localized, flexible, and partner-enabled solutions for this segment can capitalize on high growth and relatively low competition.

Within the component segment, Software is the leading category, expected to account for around 68% share of the global retail omni-channel commerce platform market in 2025. Retailers are prioritizing robust commerce engines, customer data platforms, real-time analytics, and unified order management capabilities. Large and mid-sized retailers increasingly invest in cloud-based software to centralize product information, pricing, promotions, and customer experience management, while many implementation and integration services are managed in-house or selectively outsourced.

The fastest-growing component segment is Services, driven by rising demand for system integration, customization, and support. Retailers rely on consulting partners and integrators to connect POS, ERP, CRM, loyalty, and logistics systems. The growth of headless and API-first architectures further boosts the need for services that ensure seamless integration, real-time data consistency, and fully functional omni-channel experiences across digital and physical channels.

Cloud-Based (SaaS) solutions are the dominant deployment model, expected to hold approximately 64% market share in 2025. Cloud platforms are preferred for scalability, predictable operating expenses, and rapid deployment across multiple regions. Built-in resilience, automatic feature upgrades, and reduced on-premise maintenance make SaaS attractive, particularly for large retailers managing multiple stores and digital channels during peak shopping periods such as Black Friday and festive seasons.

The fastest-growing deployment segment is hybrid and API-first cloud architectures, which combine cloud scalability with selective on-premise capabilities. These models enable headless commerce, modular services, and rapid integration of new channels. Retailers adopting hybrid platforms can innovate faster, launch additional touchpoints efficiently, and respond flexibly to evolving customer demands, ensuring seamless unified experiences across both digital and physical stores.

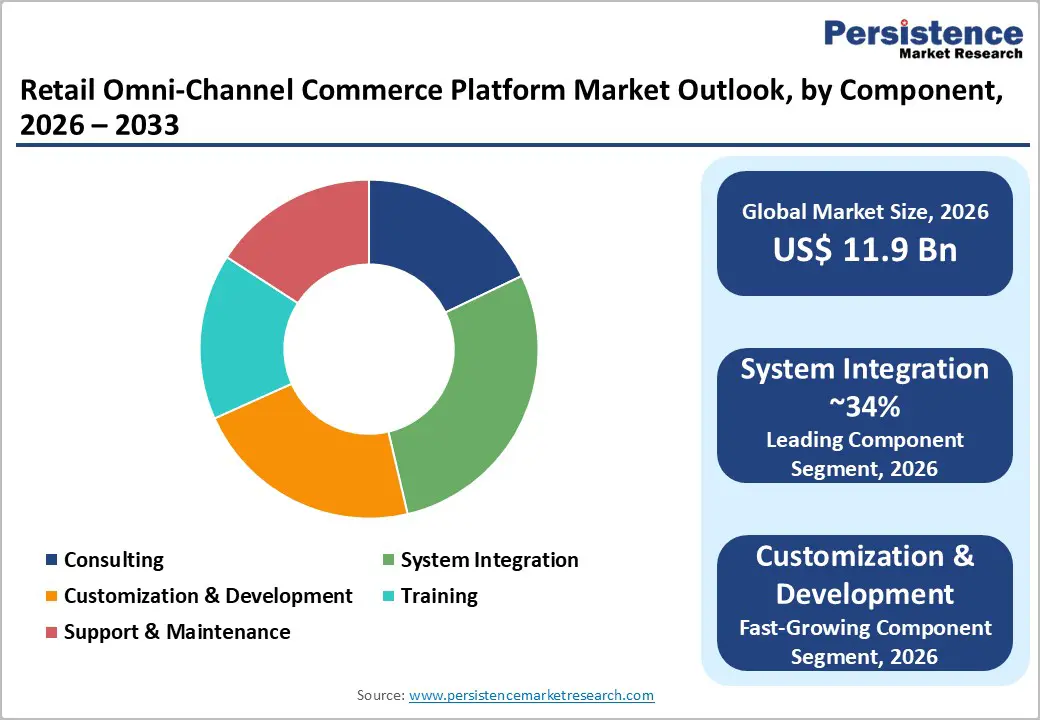

System Integration is the leading service type, projected to hold around 34% share in 2025. Integration services are critical for connecting commerce platforms with ERP, POS, CRM, loyalty programs, and third-party logistics. Providers like IBM, HCL Technologies, Infosys, and Microsoft help retailers maintain consistent inventory, pricing, promotions, and customer data across channels, enabling full utilization of omni-channel capabilities and supporting operational efficiency in complex multi-vendor environments.

The fastest-growing service segment is Customization & Development, fueled by retailers’ needs for tailored solutions. With composable and API-first platforms, vendors can offer personalized storefronts, specialized modules, and advanced analytics. This flexibility allows retailers to implement differentiated customer experiences and adapt rapidly to changing market demands. The segment is expanding as businesses increasingly prioritize agile, future-ready omni-channel solutions that align with evolving retail strategies.

Large Enterprises are the dominant customer segment, expected to account for close to 55% market share in 2025. Large retail chains in FMCG, apparel, consumer electronics, and hospitality require sophisticated omni-channel orchestration due to extensive store networks and multiple digital channels. They have the budgets and organizational readiness to invest in enterprise-grade platforms from SAP, Oracle, Salesforce, and IBM, often supported by global system integrators to ensure seamless implementation.

The fastest-growing enterprise segment is medium-sized retailers, who are increasingly adopting cloud-based and packaged omni-channel solutions. These retailers benefit from quick deployment, scalable pricing, and pre-configured modules that reduce IT complexity. With growing digital maturity, they are leveraging modern omni-channel technologies to compete with larger chains by integrating online storefronts, physical stores, and marketplaces, enhancing customer engagement and operational efficiency.

Among verticals, Apparel and Footwear is the leading segment, accounting for roughly 29% share in 2025. Fashion retailers face high demands for frequent collection updates, style discovery, and immersive experiences. Consumers rely heavily on digital channels for product information, sizing, reviews, and social influence, while still purchasing or returning through physical stores. Capabilities such as endless aisle, unified returns, clienteling, and personalized lookbooks drive investments in omni-channel platforms.

The fastest-growing verticals include FMCG and Consumer Electronics, driven by rising e-commerce penetration and digital payment adoption. Retailers in these sectors are investing in unified commerce to streamline order management, inventory synchronization, and customer engagement across channels. Seamless delivery, flexible returns, and improved visibility across stores and warehouses are key priorities. These verticals offer high growth potential due to rapid modernization, evolving consumer expectations, and opportunities to scale omni-channel solutions efficiently.

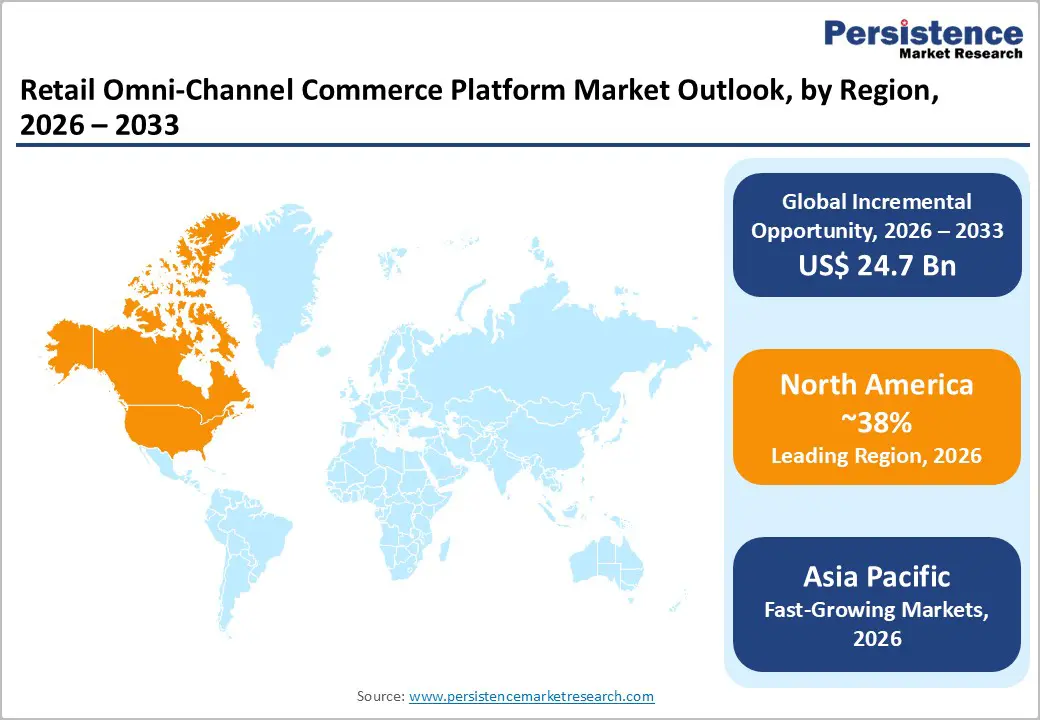

North America is expected to be the leading regional market, accounting for around 38.4% share of the global retail omni-channel commerce platform market in 2025. The U.S. leads omni-channel adoption, with major department stores, big-box chains, and digitally native brands investing heavily in unified platforms to enable BOPIS, same-day delivery, and curbside pickup. Salesforce, Adobe Commerce, Shopify, Microsoft, and IBM dominate deployments, leveraging AI, data cloud, and inventory optimization to enhance customer experiences.

Retailers in North America benefit from advanced payment infrastructure, high e-commerce penetration, and a dense technology ecosystem. Regulatory frameworks such as CCPA/CPRA drive investments in secure, compliant architectures. Retailers are early adopters of social commerce, conversational commerce, and unified loyalty programs. Omni-channel platforms help improve operational efficiency, optimize store footprints, and maximize customer lifetime value, reinforcing the region’s leading position in the global market.

Europe represents a mature and evolving market, driven by adoption in Germany, the U.K., France, and Spain. Retailers operate in multi-lingual, multi-currency environments, requiring platforms that balance localization with centralized governance. GDPR and EU digital regulations emphasize data privacy, consent management, and security, favoring vendors with strong compliance credentials. The region is witnessing robust adoption of click-and-collect, ship-from-store, and cross-border e-commerce.

Fashion, specialty retail, and grocery sectors are upgrading digital stacks and experimenting with headless commerce and progressive web apps for flexibility. Unified platforms help retailers create consistent experiences across brick-and-mortar, marketplaces, and owned digital channels. The market is projected to grow at a CAGR of 17.7%, reflecting steady expansion as retailers modernize operations, improve customer engagement, and enhance omni-channel capabilities across multiple countries.

Asia Pacific is projected to be the fastest-growing region, accounting for approximately 34.8% share of the global market in 2025. Large, digitally savvy populations, expanding middle classes, and rapid e-commerce and mobile payment adoption drive growth in countries such as China, Japan, India, and ASEAN economies. Super-app ecosystems, social commerce, and livestream shopping in China push retailers to integrate marketplaces, mini-programs, and physical stores seamlessly.

Rising smartphone penetration, digital payments, and government support in India and Southeast Asia accelerate unified commerce adoption among fashion, electronics, and grocery retailers. Investments in cloud infrastructure, local data centers, and collaboration between regional and global vendors make SaaS omni-channel platforms more accessible. Retailers are experimenting with online-to-offline journeys, QR-based interactions, and integrated loyalty programs, making omni-channel solutions central to growth strategies across both developed and emerging Asia Pacific markets.

The retail omni-channel commerce platform market is moderately concentrated, featuring a mix of global technology leaders and specialized commerce vendors. Competition is centered on platform breadth, cloud scalability, AI-driven capabilities, and industry-specific solutions. Companies leverage strong partner and integrator ecosystems to support implementation, integration, and ongoing digital transformation initiatives, helping retailers unify customer experiences across physical and digital channels.

Emerging vendors are differentiating through modern architectures, rapid deployment models, and marketplace enablement, offering flexibility and scalability for retailers. Strategic partnerships, acquisitions, and continuous product innovation are key factors shaping the competitive dynamics and future growth of the market.

Key Market Developments

The global retail omni-channel commerce platform market is expected to reach US$ 11.9 billion in 2026, reflecting strong adoption across leading retail verticals and regions.

Market growth is driven by rising consumer expectations for seamless cross-channel experiences, increased e-commerce penetration, unified inventory and order management, cloud-based (SaaS) adoption.

North America leads with 38.4% share, supported by advanced digital infrastructure, innovation ecosystems, and early adoption of cloud-native, AI-enabled omni-channel platforms by large retail chains.

Vendors can leverage AI-driven personalization, intelligent inventory, and composable commerce to target medium-sized and emerging market retailers, unlocking higher customer lifetime value and new revenue streams.

Prominent players include Salesforce, Inc., Oracle Corporation, SAP SE, Adobe Inc. (Magento), Shopify Inc., and BigCommerce Holdings, Inc.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Component

Deployment Model

Service Type

Enterprise Size

Vertical

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author