ID: PMRREP35977| 200 Pages | 26 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

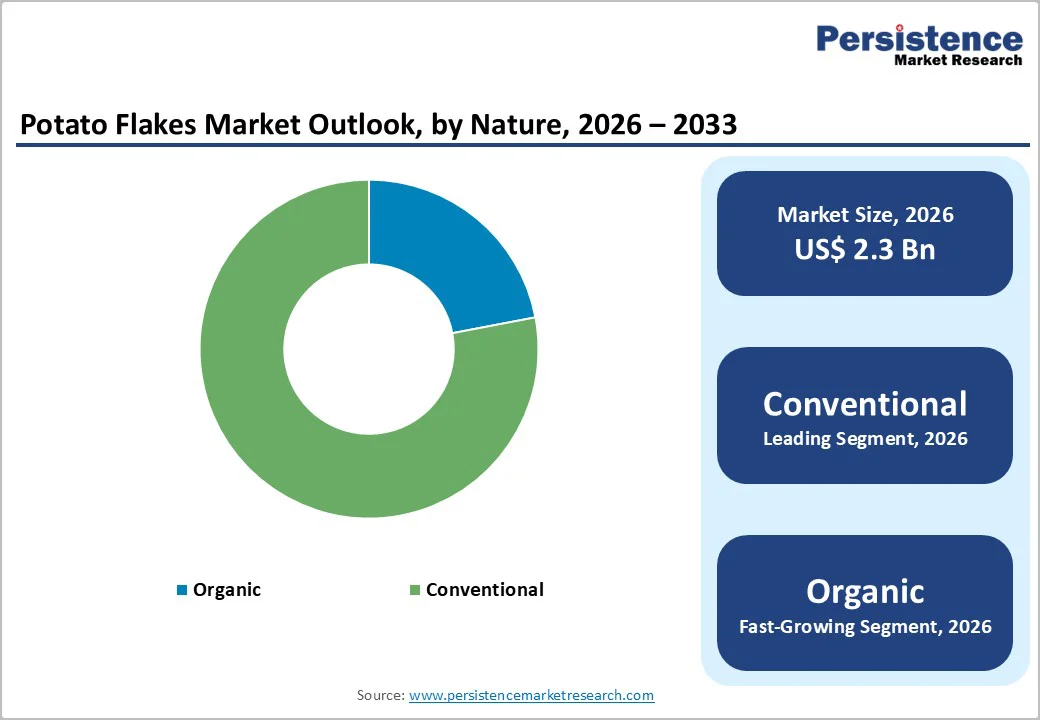

The global potato flakes market is estimated to grow from US$ 2.3 billion in 2026 to US$ 3.5 billion by 2033. The market is projected to record a CAGR of 6.1% during the forecast period from 2026 to 2033.

A steady surge in convenience-driven eating and advanced dehydration technologies is reshaping the global Potato Flakes ecosystem. From frozen snacks to QSR menus, the category is becoming a quiet powerhouse in modern food processing.

| Global Market Attributes | Key Insights |

|---|---|

| Global Potato Flakes Market Size (2026E) | US$ 2.3 Bn |

| Market Value Forecast (2033F) | US$ 3.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.2% |

Convenience is becoming a defining factor in modern kitchens, and potato flakes are perfectly positioned to meet this demand. With busy schedules and shrinking meal preparation time, consumers are increasingly seeking ingredients that simplify cooking while maintaining taste and nutritional value. Potato flakes allow households to whip up mashed potatoes, soups, and baked goods in minutes, reducing reliance on raw potatoes and minimizing prep work. Their versatility makes them appealing for a wide range of culinary applications, from traditional comfort foods to innovative recipes, catering to the desire for speed without sacrificing quality.

Foodservice operators are also leaning on potato flakes to streamline menu offerings. Quick-rehydration properties and consistent texture allow restaurants, cafeterias, and catering services to serve uniform, high-quality dishes efficiently. This efficiency translates into reduced labor costs, faster service, and enhanced customer satisfaction, reinforcing the adoption of potato flakes as a convenient, time-saving ingredient across both commercial and home kitchens.

Climate volatility is tightening its grip on global potato production, making raw material pricing increasingly unpredictable. Irregular rainfall, shifting temperature patterns, and more frequent droughts disrupt potato yields and quality, creating unstable supply conditions for processors. These inconsistencies push procurement costs upward and force manufacturers to navigate a volatile cost environment. When potato harvests fluctuate, producers face higher risks of sourcing gaps, directly influencing production planning and pricing strategies for potato flakes.

Processing companies also encounter additional challenges in maintaining consistent quality standards when raw material characteristics vary. Variability in starch content, moisture levels, and tuber size affects processing efficiency and final product uniformity. As climate pressures intensify, manufacturers must invest in stronger sourcing networks and improved agronomic practices to stabilize costs and protect operational reliability.

A surge in frozen meals and modern snacking habits is creating fresh openings for companies developing fortified and specialty potato flakes. Brands supplying frozen snacks, ready-to-cook appetizers, and meal kits are increasingly searching for cleaner textures, nutritional enhancements, and consistent binding properties. This shift encourages producers to explore value-added flakes enriched with proteins, fibers, spices, and micronutrients that align with evolving consumer expectations in convenience foods. Such innovations help manufacturers secure stronger positions in B2B supply chains serving global snack and frozen food giants.

Startups gain room to differentiate by offering allergen-friendly, gluten-free, and functional formulations tailored for premium snack launches. The rising demand for healthier indulgence allows younger companies to collaborate with frozen food brands, co-develop unique blends, and capture attention in an industry seeking fresh ideas and versatile ingredient solutions.

B2B holds approx. 73% market share as of 2025, driven by the heavy reliance of frozen food manufacturers, snack processors, and quick-service restaurant chains on consistent, large-volume supplies of potato flakes. Industrial buyers prioritize stable texture, predictable functionality, and tight specification control, making B2B procurement the backbone of the market. This dominance strengthens as producers invest in automated blending, fortified variants, and tailored moisture profiles suited for mass production lines across global food processing clusters.

The B2C space remains active through hypermarkets/supermarkets, convenience stores, specialty stores, and online retail, though volumes are smaller. Retail interest is rising as consumers explore mashed potato mixes, culinary bases, and instant meal kits. Growth here favors brands offering clean-label, flavor-enhanced, and chef-style formulations designed for home kitchens.

Organic potato flakes are projected to grow at a CAGR of 8.3% during the forecast period, and this momentum reflects a decisive consumer shift toward ingredients perceived as clean and responsibly grown. Interest in pesticide-free, minimally processed pantry staples is climbing as households, foodservice operators, and packaged food brands streamline labels and strengthen sustainability narratives. This is pulling organic potato flakes into mainstream formulations ranging from instant mixes to premium culinary bases.

Their rising adoption is further supported by expanding organic acreage, improved certifcation systems, and stronger retailer emphasis on traceable sourcing. Food processors are exploring organic variants to differentiate new product lines and appeal to buyers seeking healthier comfort foods. This steady alignment between supply upgrades and evolving consumer preferences is setting the stage for sustained organic category expansion.

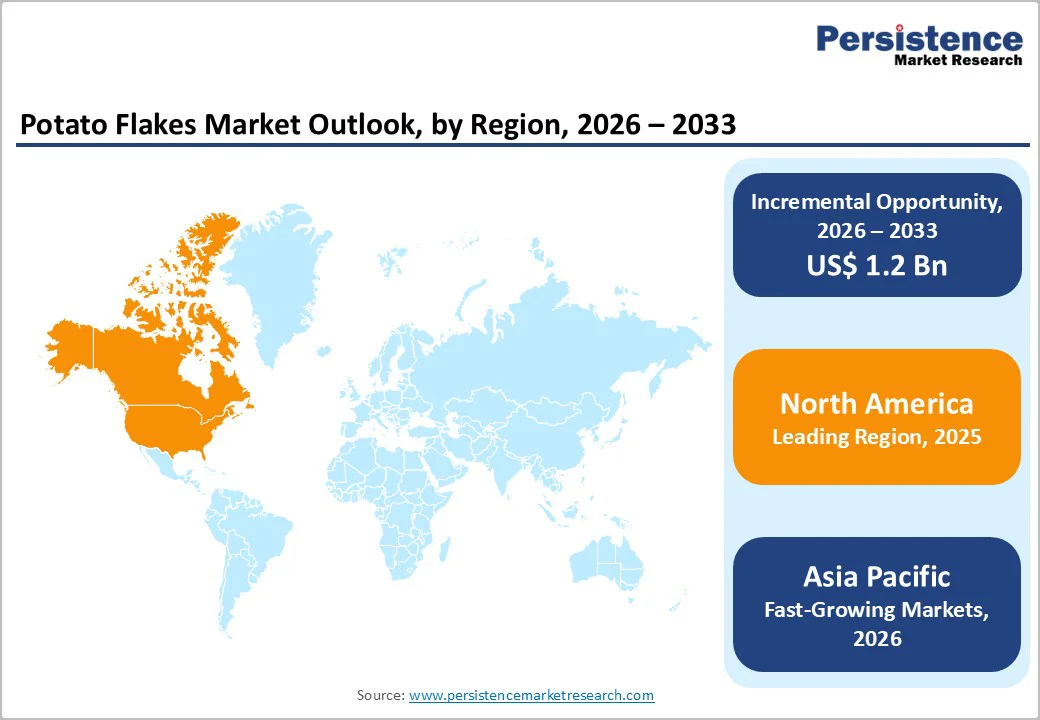

North America holds approximately 37% market share in the global Potato Flakes Market, and this influence is shaped by a strong processing ecosystem anchored in the U.S. and Canada. The region benefits from large-scale potato cultivation supported by USDA-backed production programs and provincial agricultural frameworks in Canada, which sustain consistent raw material availability. Manufacturers are aligning with rising demand from frozen snacks, quick-service restaurants, and dry-blend meal kits, while U.S. brands push for cleaner labels and shorter ingredient decks in instant formulations.

Canada’s expanding interest in shelf-stable potato ingredients is driving more collaborations between processors and local growers, supported by government initiatives encouraging crop quality improvements. Foodservice chains across North America are increasing adoption of potato flakes for standardized texture, while growing cold-chain stress is prompting food companies to explore dehydrated formats as a stability-focused alternative.

Asia Pacific Potato Flakes Market is expected to grow at a CAGR of 7.4%, driven by rapid shifts in consumer behavior and an expanding processed food ecosystem across China, India, Japan, and South Korea. China’s snack manufacturers are integrating premium-grade flakes into extruded and baked formats to enhance consistency, while India’s rising instant-meal culture is fueling demand from namkeen producers, ready-mix brands, and QSR chains seeking scalable thickening and binding solutions. Japan continues to favor high-purity, additive-free potato ingredients aligned with its stringent quality norms.

South Korea’s boom in convenience-store meals is prompting higher use of potato flakes in mashed bases, dumpling fillings, and ready-to-cook kits. Regional producers are ramping up capacity through contract farming and technology upgrades to stabilize supply. Growing interest in dehydrated, low-moisture ingredients supports adoption across urban markets where shelf life and storage efficiency matter.

The market reflects a moderately consolidated nature, shaped by established processors scaling capacity and newer entrants pushing specialized formulations. Leading companies are upgrading drum-drying precision, enzymatic pre-treatment steps, and moisture-control systems to deliver cleaner textures for industrial users. Startups are leaning into clean-label potato flakes, exploring low-acrylamide processes and plant-based meal applications to capture health-driven consumers. B2B remains the strategic core, with major suppliers partnering with snack manufacturers, frozen-food brands, and QSR chains to co-develop consistent, multifunctional flakes. R&D efforts target improved rehydration, fortified variants, and blends tailored for high-speed production lines. Online retail is expanding visibility for small producers, while cross-border collaborations strengthen supply assurance for the global food processing industry.

The global Potato Flakes market is projected to be valued at US$ 2.3 Bn in 2026.

Increasing consumer demand for fast, hassle-free cooking options is driving the global Potato Flakes market.

The global Potato Flakes market is poised to witness a CAGR of 6.1% between 2026 and 2033.

Expanding frozen and snack food categories are opening clear room for fortified and specialty potato flake formulations, creating a strong growth window for industry players.

Major players in the global Potato Flakes market include The Emsland Group, Royal Avebe, KMC, Lamb Weston, Idaho Pacific Holdings, Bob’s Red Mill Natural Foods, McCain Foods, and others.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Nature

By End Use

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author