ID: PMRREP15253| 198 Pages | 10 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

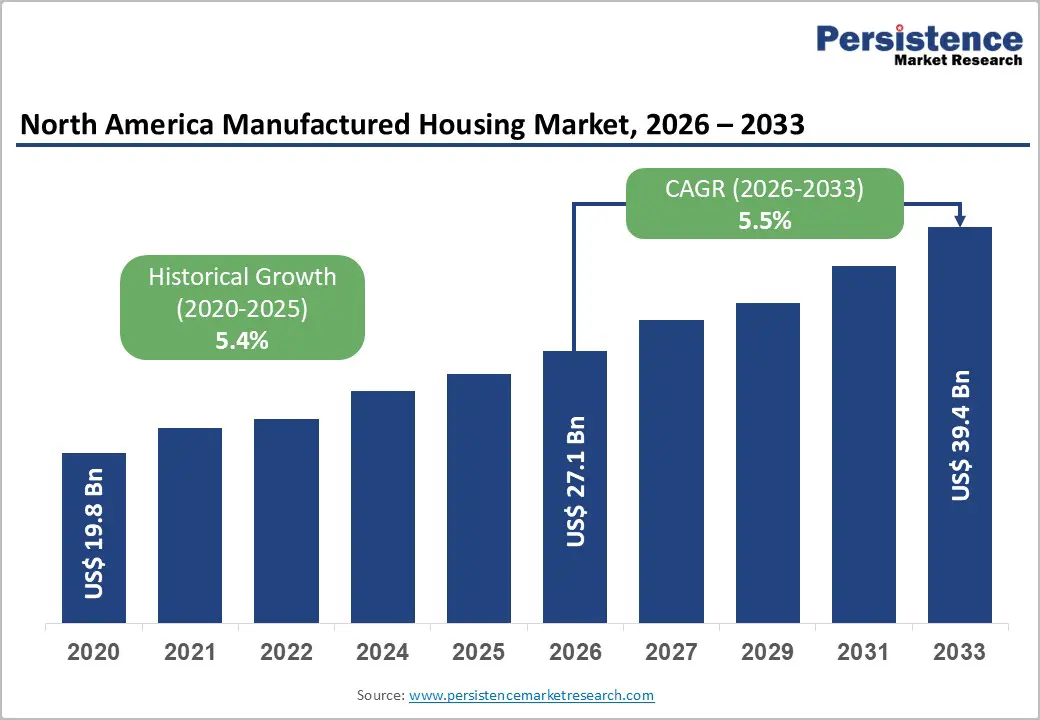

The North America manufactured housing market size is likely to be valued at US$27.1 billion in 2026 and is expected to reach US$39.4 billion by 2033, growing at a CAGR of 5.5% during the forecast period from 2026 to 2033, driven by rising site-built construction costs, increasing affordability challenges, and a focus on energy-efficient, factory-built homes.

Regulatory updates, especially those under the HUD Code, have improved safety, durability, and energy-efficiency standards, helping boost consumer confidence and drive greater adoption. The growing demand for modular and multi-section homes allows for quicker delivery, less construction waste, and consistent quality, positioning manufactured housing as a viable option for both urban infill projects and suburban developments. Manufacturers are also investing more in digital design tools, 3D modeling, and precision-controlled factory processes to increase customization, streamline production timelines, and lower costs.

| Key Insights | Details |

|---|---|

| North America Manufactured Housing Market Size (2026E) | US$27.1 Bn |

| Market Value Forecast (2033F) | US$39.4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.4% |

The rising costs of construction, land, and financing in North America are expanding the affordability gap, driving up demand for manufactured and modular housing. With median site-built home prices soaring in many U.S. markets, manufactured homes, priced 30–50% lower, have become the most affordable option for households burdened by high costs. This shift is further fueled by the affordability crisis, worsened by rising mortgage rates, which have pushed many first-time homebuyers toward more budget-friendly HUD-code and multi-section models that offer similar living space at a much lower price. The growing preference for energy-efficient and net-zero-ready homes is boosting the adoption of manufactured housing, as these units can more easily incorporate solar panels, advanced insulation, and smart home technology compared to traditional homes.

In Mexico, cost-conscious buyers are increasingly opting for prefabricated and modular homes as urbanization reaches 75% and nearshoring accelerates the migration of workers to industrial zones. In both the U.S. and Mexico, rising labor shortages, material inflation, and lengthy construction times are making factory-built homes an increasingly attractive option. These homes offer predictable pricing, faster construction timelines, and better energy efficiency under updated standards, helping homeowners manage utility and maintenance costs. Local government incentives promoting off-site construction methods are also supporting market growth. Developers benefit from reduced on-site risks, quicker project completion, and consistent quality control, while consumers gain access to more affordable and durable housing options.

Financing constraints remain one of the most significant barriers to the broader adoption of manufactured and modular homes across North America. A large share of manufactured homes, especially single-section units, are titled as personal property rather than real estate, making them ineligible for conventional 30-year mortgages. Buyers often rely on chattel loans, which carry higher interest rates and shorter terms, raising monthly payment burdens despite lower home prices. Insurance premiums for manufactured homes can be higher in regions prone to natural disasters, further raising upfront ownership costs. Limited availability of low-cost financing options also slows adoption among first-time buyers and retirees seeking affordable, move-in-ready homes.

In Mexico, financing limitations are similarly a key restraint, even with improvements in Infonavit-backed lending. Many prefabricated units fall outside traditional property classifications, restricting access to long-term credit or subsidized mortgages. Fragmented local manufacturers often lack partnerships with major financial institutions, reducing loan availability and slowing approvals. Cross-border regulatory differences, inconsistent property titling, and limited secondary-market support further discourage private lenders from entering the segment. Rising construction costs, material inflation, and higher interest rates compound the affordability challenge, limiting consumer uptake despite growing interest in modular and factory-built solutions.

The growing emphasis on sustainability, energy efficiency, and personalized living spaces presents a significant growth opportunity for the manufactured and modular housing market. Factory-built construction enables precise engineering, standardized quality control, and optimized material usage, reducing waste while accelerating the integration of energy-efficient features such as high-performance insulation, ENERGY STAR-rated appliances, solar-ready rooftops, and enhanced HVAC systems. These capabilities allow manufacturers to offer customizable floor plans and finishes without the cost overruns typical of site-built homes, aligning well with evolving buyer expectations and stricter building codes.

In both the U.S. and Mexico, demand for energy-efficient and customizable modular units is increasing among urban, suburban, and workforce housing buyers seeking long-term utility savings and flexible living designs. Multi-section and modular homes can incorporate smart thermostats, energy-management systems, water-efficient fixtures, and sustainable materials at scale, improving affordability over the home’s lifecycle. Government incentives for green construction, utility rebates, and updated HUD and regional energy standards further support adoption. Manufacturers are also expanding design catalogs with configurable floor plans, façade options, and interior upgrades, enabling buyers to personalize homes without significantly increasing costs.

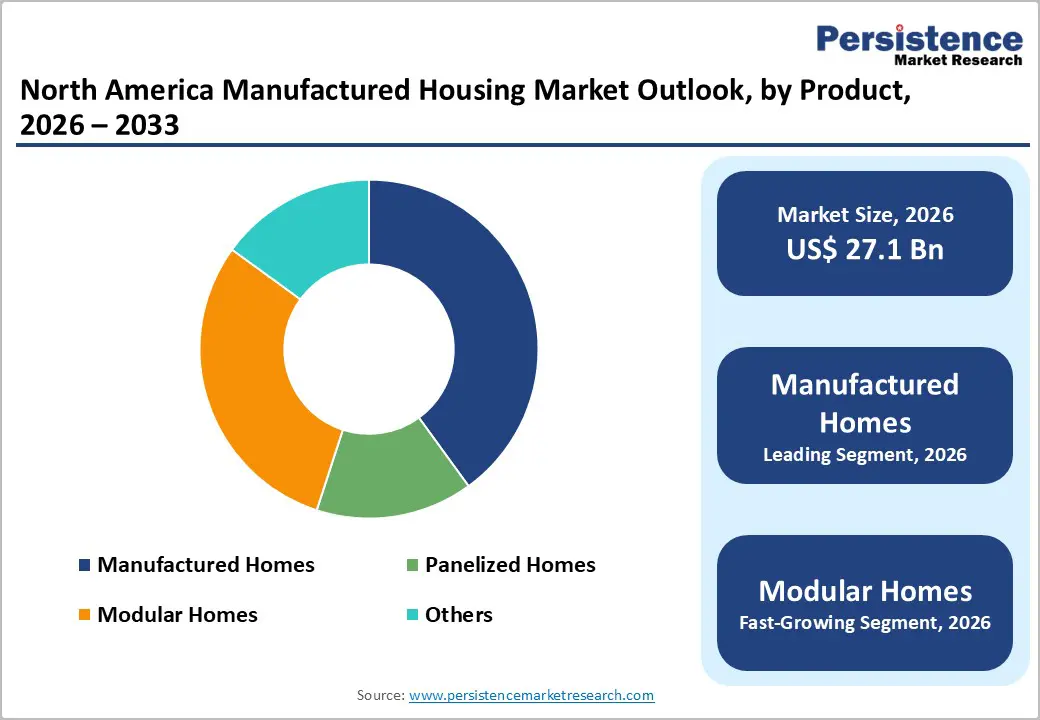

Manufactured homes are projected to lead the North American manufactured housing market, capturing around 50% of total revenue in 2026. Their dominance is driven by HUD compliance, standardized quality, and cost efficiency, making them a preferred choice for rural and suburban buyers. For instance, Clayton Homes leverages high-volume HUD-compliant production to deliver consistent quality across multiple states, while Cavco Industries maintains its leadership by combining factory efficiency with customizable options for first-time homeowners and affordable housing initiatives. High-volume production ensures reliability and quality, positioning manufactured homes as a core revenue driver and a key solution for regional housing affordability challenges.

Modular homes are expected to be the fastest-growing segment, fueled by increasing demand for customization, superior quality control, and sustainable design. Factory-built modules enable flexible layouts, faster construction timelines, and energy-efficient features, appealing to urban buyers seeking modern, eco-friendly housing. For example, Blu Homes offers prefabricated modular units with sustainable materials and smart designs, while Sekisui House North America integrates energy-efficient modules to overcome urban density constraints. By addressing zoning limitations and site restrictions, modular homes represent a high-growth opportunity within the prefabricated housing market.

Multi-section homes are set to dominate the North American manufactured housing market, accounting for approximately 55% of total revenue in 2026. These homes offer spacious living comparable to that of site-built houses, making them especially appealing in suburban and Sun Belt regions, where larger households and available land support larger home sizes. Multi-section units benefit from the efficiency of factory-built construction, which minimizes delays, ensures consistent quality, and reduces long-term maintenance costs. Their eligibility for conventional mortgage financing, when permanently affixed to land, enhances buyer confidence and improves resale value.

Single-section homes are expected to be the fastest-growing segment in 2026, driven by their affordability, compact design, and rapid deployment capabilities. Tailored for first-time buyers, urban infill projects, and areas with limited land, these homes provide an affordable solution to the ongoing housing shortage in many U.S. cities. For example, Champion Home Builders offers single-section units optimized for tight urban lots, while Fleetwood Homes focuses on efficient, compact designs for quick on-site placement. Their smaller footprint facilitates faster installation, enabling manufacturers to scale production and meet the growing demand in urban and semi-urban areas.

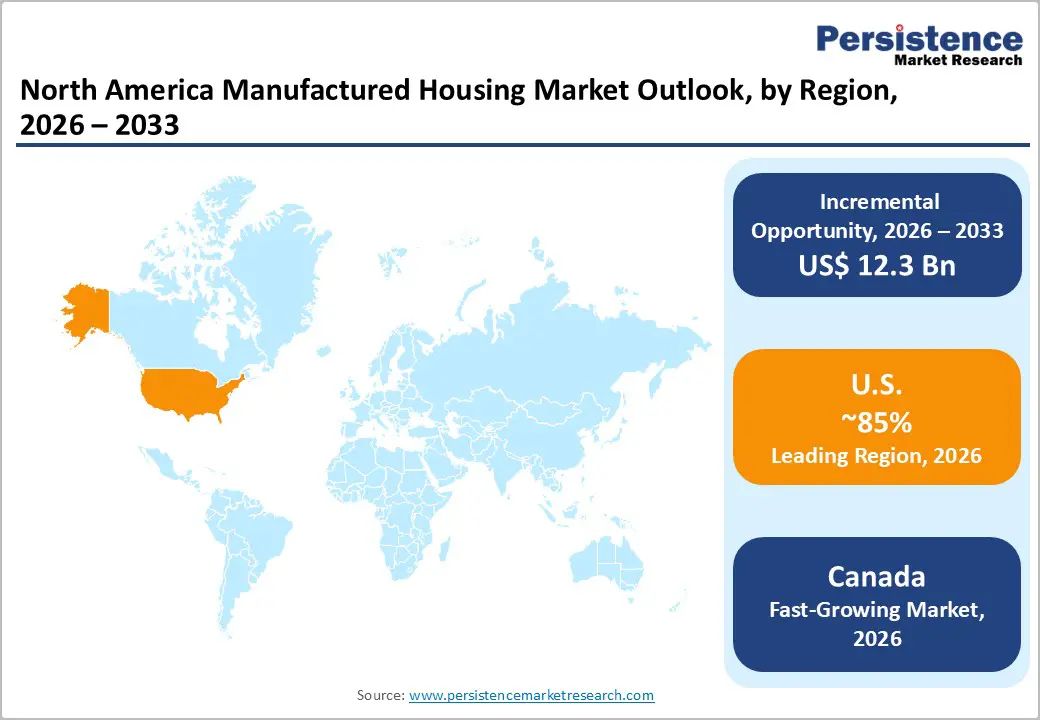

The U.S. is anticipated to remain the dominant region in the global manufactured housing market, capturing 85% of the share in 2026. This dominance is driven by factors such as affordability challenges, growing housing demand, and strong regulatory support, particularly through HUD-code compliance. The continued focus on standardized production, economies of scale, and cost management further bolsters market leadership. For example, Clayton Homes, the largest producer of manufactured homes in the U.S., has expanded its multi-section home offerings across Sun Belt states to cater to families seeking spacious, site-built-like layouts at more affordable prices, boosting demand for larger factory-built homes. While multi-section homes remain the preferred choice for families, single-section homes are gaining popularity for urban infill projects and workforce housing solutions.

Sustainability and customization are emerging as key trends influencing the market. The efficiency of factory-built homes ensures faster construction, consistent quality, and lower long-term maintenance costs, making them an attractive alternative to traditional site-built homes. Rising material costs and labor shortages in conventional construction are further accelerating the shift toward off-site housing, offering more predictable pricing and quicker delivery. Leading manufacturers such as Clayton Homes are responding by integrating energy-efficient designs, smart-home technologies, and customizable floor plans to meet changing consumer demands, all while adhering to HUD-code standards.

The Canada region is expected to be the fastest-growing market, driven by rising real estate prices and an ongoing housing shortage. Factory-built homes are increasingly seen as a viable and more affordable alternative to traditional site-built houses. A key trend fueling this growth is the increasing adoption of modular and multi-section housing, driven by the need for quicker delivery, cost predictability, and sustainability. For instance, Canadian modular construction companies such as NRB Modular Solutions are playing a significant role in residential and mixed-use projects with factory-built structural systems, underscoring the shift toward industrialized construction methods.

The growing demand for energy-efficient homes, including the use of high-performance materials and adherence to evolving building code standards, is further boosting acceptance among homebuyers. Modular construction is also becoming more prominent in multi-family housing and rental developments. The rise of modular units for apartments, townhomes, and social housing, particularly in urban and high-density areas, reflects a broader response to affordability challenges and growing demand for rental units. Provincial housing programs and public-private partnerships are increasingly incorporating modular construction to expedite project timelines and manage costs effectively.

The North America manufactured housing market is characterized by a moderately fragmented structure, with a blend of large national builders, regional manufacturers, and specialized prefab developers serving a broad range of housing needs, from affordable single-section units to multi-section modular homes. Demand is driven by affordability concerns, rising site-built construction costs, and regulatory frameworks such as HUD Code compliance, which ensures consistent quality, safety, and energy efficiency across factory-built homes.

Leading players such as Clayton Homes, Skyline Champion Corporation, Cavco Industries, and Fleetwood Homes dominate the competitive landscape, combining production scale with strong brand recognition and extensive distribution networks across retail, finance, and dealer channels. These companies compete by advancing factory automation, offering digital design and customization options, and expanding their product lines to include energy-efficient and net-zero-ready homes. They form strategic partnerships with lenders to provide better financing options, making homes more accessible to first-time buyers.

The North America manufactured housing market is projected to reach US$39.4 billion in 2026.

Key drivers include rising housing affordability challenges, demand for faster construction, and growing adoption of energy-efficient, factory-built homes across the region.

The North America manufactured housing market is expected to grow at a CAGR of 5.5% from 2026 to 2033.

Key market opportunities in the North America manufactured housing market include the expansion of energy-efficient and net-zero homes, a rise in modular housing adoption for urban infill projects, and a growing demand for affordable housing solutions in rapidly developing regions of the U.S. and Canada.

The key players include Clayton Homes, Skyline Champion Corporation, Cavco Industries, Sekisui House Ltd, BluHomes, Plant Prefab, ICON Technology, and Boxabl.

| Report Attribute | Details |

|---|---|

| Historical Data | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Construction

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author