ID: PMRREP32853| 192 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

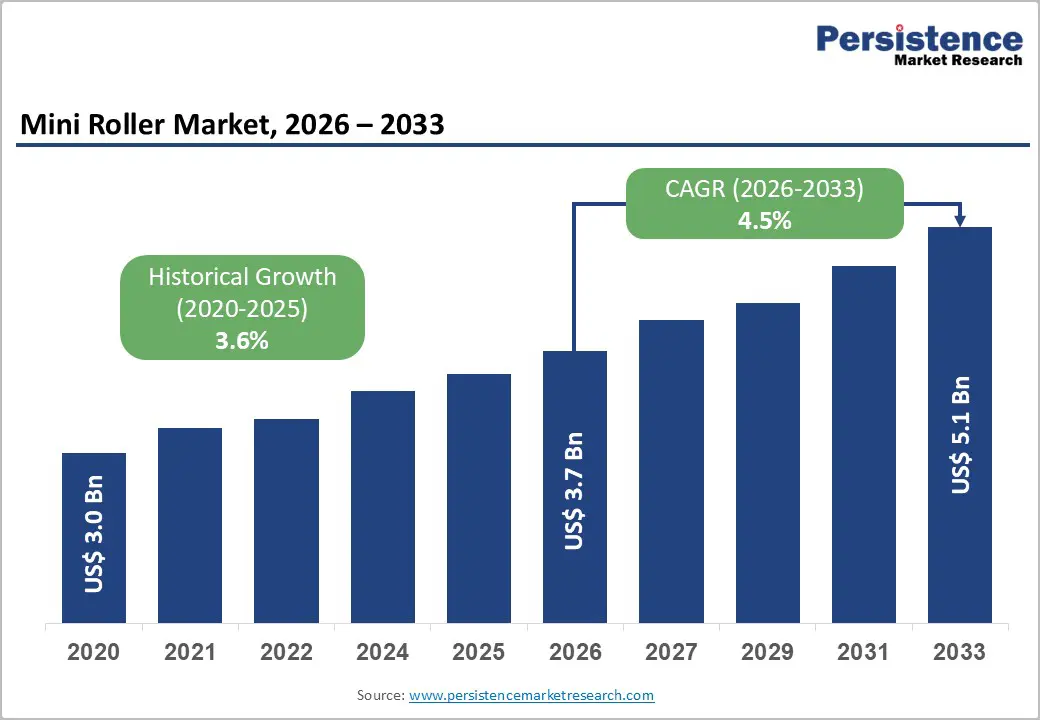

The global Mini Roller Market size is anticipated at US$ 3.7 Billion in 2026 and is projected to reach US$ 5.1 Billion by 2033, growing at a CAGR of 4.51% between 2026 and 2033. Market expansion is driven by rapid urbanization and government infrastructure investment across roads, housing, and metro systems, boosting demand for compact soil and asphalt compaction equipment, accelerating rental adoption delivering 30–40% cost savings for smaller contractors, and technological advances enabling ergonomic design, low vibration, fuel efficiency, smart controls, and compliance. North America holds 28% share, while Europe grows at 4.6%.

| Key Insights | Details |

|---|---|

| Automotive Speed Reducer Market Size (2026E) | US$ 3.7 billion |

| Market Value Forecast (2033F) | US$ 5.1 billion |

| Projected Growth CAGR (2026-2033) | 4.5% |

| Historical Market Growth (2020-2025) | 3.6% |

Expanding Infrastructure and Construction Projects Driving Systematic Compaction Equipment Demand

Expanding infrastructure and construction projects are systematically driving mini roller demand, as global urbanization and government investment in roads, housing, and urban connectivity generate sustained requirements for soil and asphalt compaction. In India, the National Highways Authority delivered 5,614 km of highways in 2025, alongside metro system expansion across 27+ active cities and completion of 28.2 million rural houses. These programs increase soil stabilization needs for foundations, pavement compaction across highways and urban roads, and commercial development activity. Accelerating urban connectivity projects, smart city initiatives, and residential construction continue to reinforce consistent equipment deployment and long-term demand momentum for mini rollers globally.

Rental Model Adoption and Cost Optimization Supporting Market Accessibility

Rental model adoption is systematically driving mini roller market expansion, as contractors and small operators increasingly favor rentals delivering 30–40% cost savings over direct ownership while improving capital efficiency. Rental providers are expanding telematics deployment, enabling real-time tracking, fuel consumption monitoring, predictive maintenance alerts, and optimized fleet utilization. Maintenance responsibility shifting to rental companies enhances operational flexibility and reduces downtime risks. This model improves access for small contractors, regional construction firms, and logistics operators seeking capital-light solutions. Emerging markets are witnessing rapid rental ecosystem development, supported by infrastructure growth, fleet professionalization, and technology-enabled asset management, accelerating adoption of mini rollers across diverse construction and maintenance applications globally.

Capital-Intensive Manufacturing and Supply Chain Complexity

Mini roller market expansion is constrained by significant capital investment requirements for manufacturing facilities, quality testing infrastructure, and engineering development combined with complex supply chain requiring specialized component sourcing (hydraulic systems, engines, vibration mechanisms) creating significant market entry barriers particularly for emerging manufacturers limiting competition and pricing flexibility. Manufacturing capital requirements. Quality assurance infrastructure investment. Hydraulic component sourcing challenges. Engine integration complexity. Supply chain coordination costs. Specialized testing facilities. Production scaling limitations.

Market Postponement and Economic Uncertainty Affecting Project Pipelines

Mini roller market expansion is constrained by commercial development postponement trends with 15-20% of planned projects delayed in early 2024 and economic uncertainty affecting infrastructure budgets particularly in developed markets, creating timing volatility in rental equipment demand and irregular project schedules impacting rental utilization and profitability. Project postponement risk (15-20% delay rate). Budget uncertainty in developed markets. Demand timing volatility. Rental utilization rate fluctuations. Economic cycle sensitivity. Infrastructure budget constraints. Financing availability challenges.

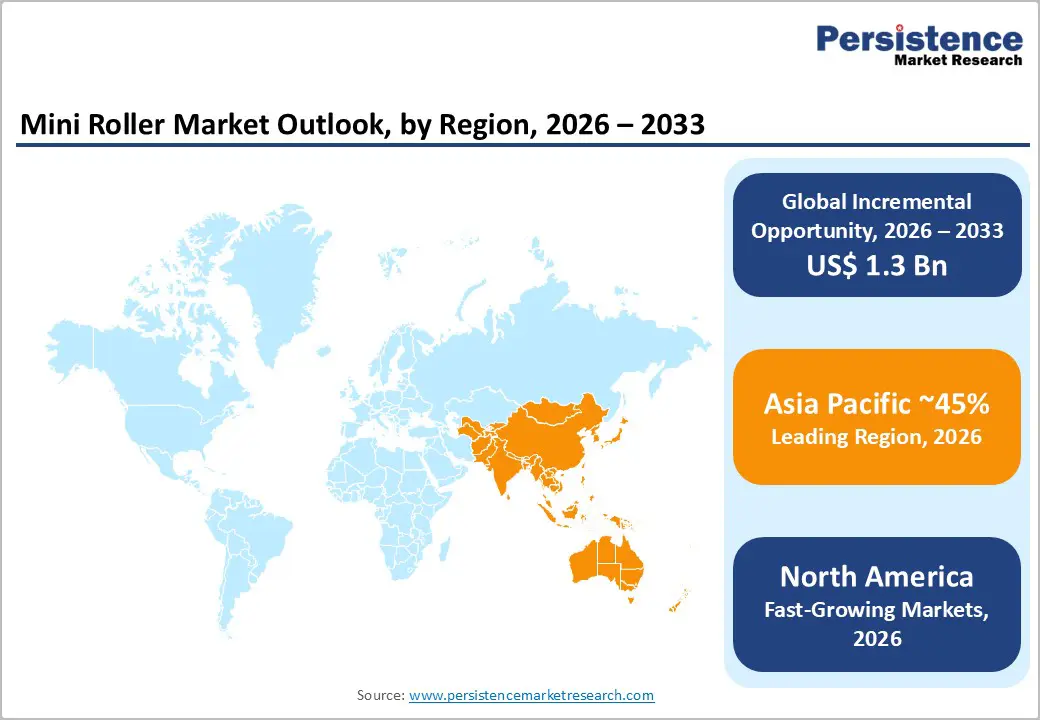

Emerging Market Infrastructure Expansion and Government Investment Programs

Emerging market infrastructure expansion presents a major opportunity, led by India’s rapidly growing construction equipment rental market supported by accelerating road construction and expanding metro systems, including 55 km of the Delhi–Meerut RRTS now operational. Asia Pacific commands 45% global share, underpinned by sustained government investment in highways, urban connectivity, and mass transit. Highway development acceleration, long-term public spending commitments, and rising rental penetration strengthen demand for mini rollers across diverse projects. Additionally, regional manufacturing localization, OEM–rental partnerships, and distribution network expansion enable faster market penetration, cost optimization, and scalable growth across emerging economies and resilient infrastructure execution nationwide globally.

Eco-Friendly Equipment Development and Emission Regulation Compliance

Eco-friendly equipment development represents a strong emerging opportunity, as manufacturers increasingly focus on fuel-efficient, low-emission mini roller designs to comply with stringent global environmental regulations. Growing adoption of electric and hybrid compaction solutions is enabling the formation of a high-value sustainable construction equipment segment. Continuous advances in fuel-efficient engines, electric mini-roller prototypes, and hybrid system integration enhance performance while reducing environmental impact. Additionally, low-vibration technology improves operator safety and comfort. Sustainable positioning allows OEMs to command premium pricing, strengthen competitive differentiation, and align with government procurement policies and green infrastructure initiatives, supporting accelerated growth of the premium mini roller market globally.

Single drum vibratory mini rollers command 55% of market share, representing dominant product type with lightweight design, portability, and versatility enabling diverse soil and asphalt compaction applications supporting broad adoption across construction, landscaping, and maintenance segments with lower cost compared to tandem designs. Lightweight design advantage. High portability capability. Diverse application support. Lower cost positioning. Ease of operation benefit. Small contractor focus. Market dominance positioning.

Double drum vibratory mini rollers expand as fastest-growing product category at 4.2% CAGR, driven by superior compaction performance through dual-drum configuration providing better surface quality and improved efficiency supporting emerging demand from professional contractors and commercial projects requiring advanced compaction capability and time-efficient operations. Dual-drum configuration advantage. Superior compaction performance. Higher efficiency delivery. Professional contractor focus. Commercial project specialization. Quality improvement capability. Premium market segment growth.

Rental ownership model commands 58% of market share, driven by cost savings of 30-40% compared to direct ownership combined with maintenance flexibility and capital efficiency supporting broad adoption among small to medium contractors, regional equipment rental companies, and emerging market operators. Cost savings advantage (30-40%). Capital efficiency benefit. Maintenance flexibility advantage. Equipment obsolescence elimination. Operational tax benefits. SME contractor focus. Rental company expansion.

Direct ownership expands as fastest-growing segment at 3.9% CAGR, driven by growing demand from landscaping companies, property management firms, and utility contractors requiring dedicated equipment supporting emerging specialized application segments enabling long-term reliability and operational control advantages. Landscaping company adoption. Property management firm focus. Utility contractor deployment. Long-term cost advantage. Operational control benefit. Specialized application expansion. Niche market growth.

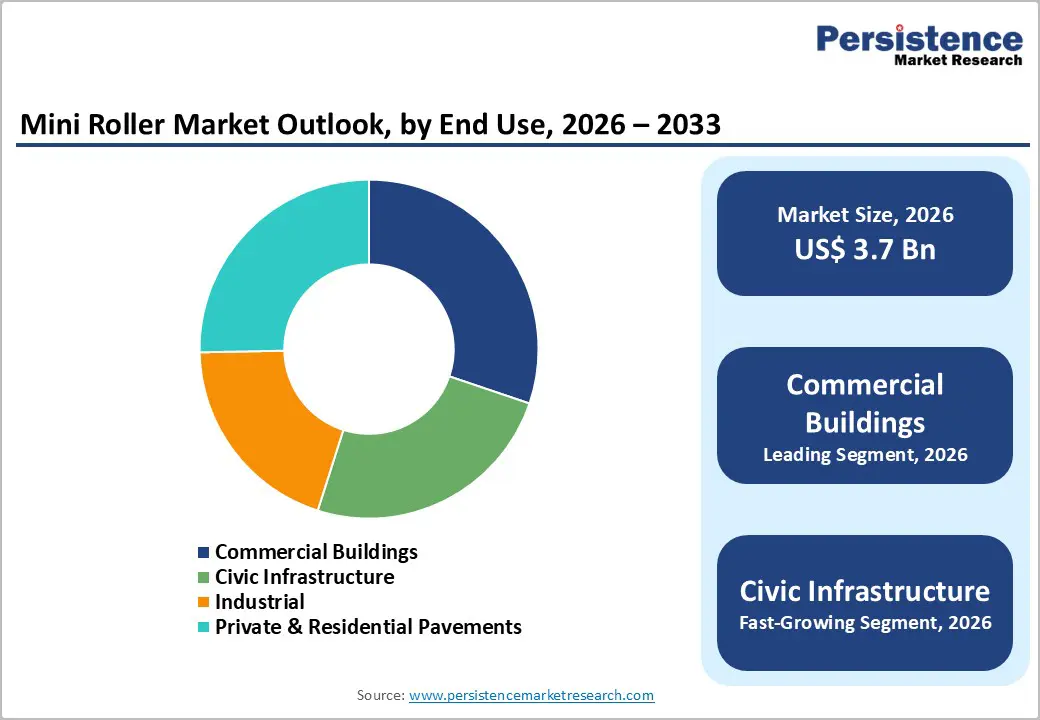

Commercial building applications command 30.2% of market share, driven by large-scale commercial development projects requiring foundation preparation and compaction services across office complexes, shopping centers, and industrial facilities supporting consistent volume demand from commercial construction contractors. Foundation preparation focus. Office complex development. Shopping center construction. Industrial facility compaction. Commercial contractor relationships. Project-driven demand consistency. Market stability anchor.

Civic infrastructure expands as fastest-growing segment at 5.1% CAGR, driven by government-funded road development projects, metro expansions, and public utility installations creating emerging sustained demand for mini roller equipment supporting emerging high-value government contract opportunity. Road development project focus. Metro system expansion work. Public utility infrastructure. Government contract opportunity. Sustained demand momentum. National highway delivery emphasis. Infrastructure investment growth.

North America maintains 28% market share representing established mature market characterized by diversified construction activity, equipment rental ecosystem maturity, advanced technology adoption, and strong regulatory compliance focus supporting premium market positioning and operational maturity. Construction industry diversity. Rental company maturity. Technology adoption leadership. Equipment standardization practice. Regulatory compliance expertise. Supply chain efficiency. OEM partnership ecosystem. North American market characterized by strong preference for rental models supporting small contractor accessibility and capital efficiency optimization. Established rental company networks enabling rapid equipment availability and comprehensive aftermarket support. Emphasis on advanced features including anti-vibration handles and smart controls reducing operator fatigue. Partnership ecosystems enabling rapid technology deployment and innovation particularly in connected equipment and telematics systems. Regional development patterns supporting continued demand for paving and compaction solutions.

Europe expands at 4.6% CAGR, driven by stringent safety standards, high urban density constraints limiting large equipment access, advanced technical expertise in compact solutions, and environmental compliance emphasis supporting premium market positioning and technology differentiation. Safety standard leadership (vibration, noise limits). Urban density constraint adaptation. Technical expertise depth. Environmental compliance focus. Abnormal load transport specialization. Regulatory harmonization advantage. Sustainability emphasis alignment. European market characterized by preference for compact, lightweight vibratory plates due to urban density constraints and bridge load restrictions. Strong emphasis on sustainability driving fuel-efficient and low-emission model adoption. Advanced telematics and smart control systems deployment supporting operational optimization. Technical expertise in custom solutions for specialized applications including pavement maintenance and landscaping. Established supply chain networks enabling efficient regional distribution and comprehensive technical support.

Asia Pacific commands 45% market share driven by rapid urbanization, sustained government infrastructure investment, and expanding rental ecosystems supporting the fastest regional growth momentum. India anchors demand with National Highways Authority delivery of 5,614 km highways in 2025, metro development across 27+ active cities, and Delhi–Meerut RRTS commissioning 55 km of an 82 km corridor. The construction equipment rental market is expanding from USD 4.67 billion to USD 8.98 billion during 2025–2032, improving access for contractors. Rural housing programs and road construction accelerate compaction demand, while emerging rental networks integrate telematics for fleet optimization and predictive maintenance. Cost-competitive manufacturing, regional OEM concentration, and localized supply chains enhance affordability. Strong policy commitment ensures a consistent project pipeline, positioning Asia Pacific as the most dynamic and strategically attractive mini roller market globally for contractors, municipalities, infrastructure developers, rental operators, OEMs, and partners.

Market leaders drive competitiveness through smart controls, telematics integration, rental model optimization for cost leadership, emerging market expansion via partnerships and regional manufacturing, and regulatory compliance leadership. Sustainability positioning, specialization for high-value projects, and strong aftermarket support further differentiate players. Multinationals leverage distribution, regional specialists exploit cost advantages, rental firms enhance fleet optimization, while custom providers address niche application requirements.

The global Mini Roller Market is anticipated at US$ 3.7 Billion in 2026 and is projected to reach US$ 5.1 Billion by 2033.

Market growth is propelled by large-scale infrastructure expansion, 30–40% cost savings through rental models, and technological advancements such as smart controls, telematics, and eco-friendly engines improving operational efficiency.

The market is projected to expand at a 4.5% CAGR between 2026 and 2033.

Key opportunities lie in emerging-market infrastructure programs, low-emission and electric mini roller development, and specialized landscaping and maintenance applications supporting steady direct ownership growth.

The market is led by VOLVO, Wacker Neuson, Dynapac, BOMAG, Hamm, and JCB, with competitive advantage driven by telematics integration, smart controls, and expanding rental service ecosystems.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author