ID: PMRREP35742| 197 Pages | 16 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

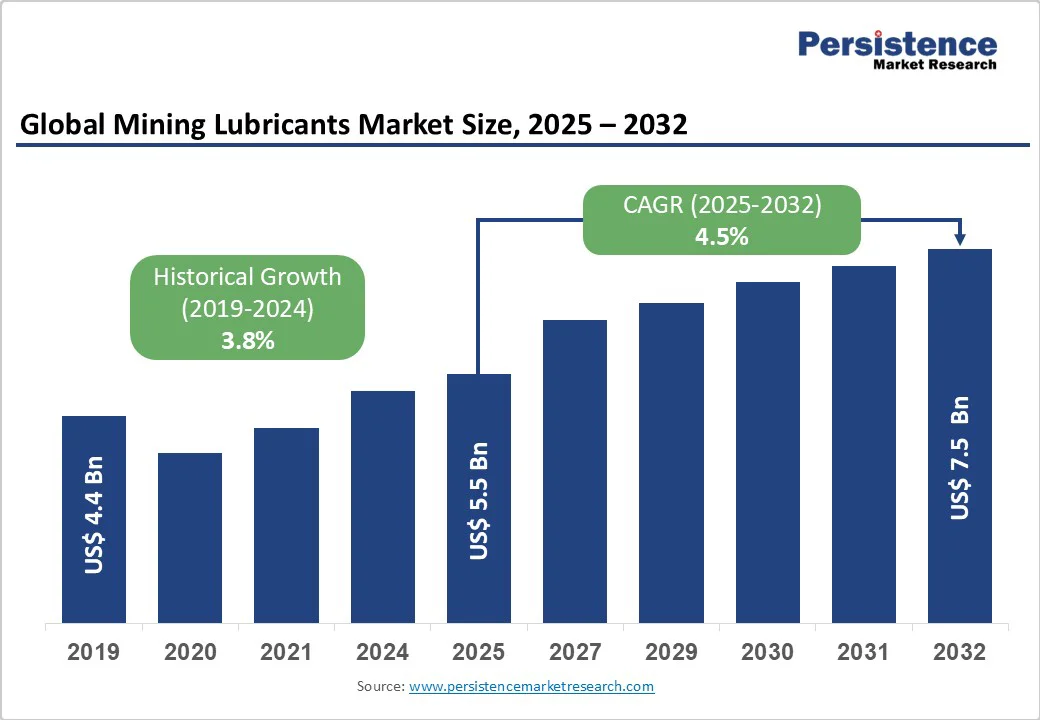

The global mining lubricants market size is likely to be valued at US$ 5.5 Billion in 2025 and is projected to reach US$ 7.5 Billion by 2032, growing at a CAGR of 4.5% between 2025 and 2032.

The market expansion is driven by intensified mining activities across emerging economies, technological advancement in equipment automation, and regulatory mandates for high-performance lubricants.

Growing mineral demand from construction, electronics, and renewable energy sectors necessitates advanced lubrication solutions that enhance equipment efficiency while reducing operational downtime.

| Key Insights | Details |

|---|---|

| Mining Lubricants Market Size (2025E) | US$ 5.5 Bn |

| Market Value Forecast (2032F) | US$ 7.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.8% |

The adoption of automated mining equipment has emerged as a primary driver transforming lubrication requirements across global mining operations. Modern mining facilities increasingly deploy autonomous haul trucks, robotic drilling systems, and AI-powered excavation equipment that operate continuously under extreme conditions.

These sophisticated machines require specialized lubricants capable of withstanding prolonged operational cycles, temperature fluctuations, and heavy mechanical stress. IoT-enabled lubrication systems provide continuous condition assessment, optimizing lubricant utilization and extending equipment life cycles while minimizing manual intervention and safety risks in hazardous mining environments.

Governments worldwide are implementing comprehensive critical mineral strategies to secure supply chains and reduce dependency on concentrated production sources. The United States, European Union, Australia, and Canada have established strategic frameworks promoting domestic mining expansion through tax incentives, streamlined licensing, and exploration funding.

Global rare earth production has doubled from 135,000 tonnes in 2015 to 380,000 tonnes in 2023, with new discoveries in Wyoming, Sweden, and Canada driving geographic diversification.

Mining companies are expanding into deeper and more challenging environments, including underground operations and offshore extraction, necessitating advanced lubricants with enhanced thermal stability and extreme pressure protection. These strategic initiatives directly correlate with increased lubricant demand as operations scale up to meet national security requirements and economic development objectives.

Stringent environmental regulations are reshaping lubricant specifications and driving innovation toward biodegradable and low-toxicity formulations. The Environmental Protection Agency's Vessel Incidental Discharge Act and European Union's Ecolabel certification require mining operations to adopt environmentally responsible lubrication practices.

Mining companies face increasing accountability for soil and water contamination, with traditional asphalt-based lubricants containing heavy metals like lead, zinc, and cadmium presenting significant environmental risks.

Canadian and American regulators actively encourage biodegradable lubricant adoption through policies targeting reduced environmental footprints, while investor pressure and public opinion further accelerate sustainable practice implementation. This regulatory framework creates substantial market opportunities for synthetic and bio-based lubricants that meet performance requirements while achieving environmental compliance objectives.

Fluctuating crude oil prices directly impact synthetic lubricant production costs, as many formulations rely on petrochemical-derived base stocks and additives. The mining lubricants industry faces ongoing supply chain disruptions affecting the availability of specialized additives, base oils, and packaging materials.

Geopolitical tensions and trade restrictions further complicate raw material procurement, particularly for high-performance additives sourced from limited global suppliers. Manufacturing lead times have extended significantly, with some specialty lubricant components experiencing 12-16 week delivery delays.

These supply chain challenges force mining companies to maintain larger inventory buffers, increasing working capital requirements and storage costs while potentially compromising lubricant quality through extended storage periods.

The convergence of IoT technology, artificial intelligence, and condition monitoring systems presents substantial opportunities for intelligent lubrication management across mining operations.

Smart lubrication platforms capable of real-time monitoring, automated replenishment, and predictive analytics are transforming maintenance strategies from calendar-based schedules to performance-driven protocols.

Mining companies implementing digital transformation initiatives report 15-20% reductions in lubricant consumption and 25-30% decreases in equipment downtime through optimized lubrication practices. These systems enable precise lubricant selection based on actual operating conditions, environmental factors, and equipment performance data, significantly improving both operational efficiency and cost management.

Advanced sensor technologies integrated with automatic lubrication systems provide continuous equipment health monitoring, enabling proactive maintenance interventions before critical failures occur. This technological evolution creates new revenue streams for lubricant manufacturers through service-based business models, where value is delivered through uptime optimization rather than product volume sales.

Rapid industrialization across Asia-Pacific, Latin America, and African markets is driving unprecedented mining investment and infrastructure development. India's mining GDP reached US$ 9.95 billion in FY25, with steel production exceeding 112 million tonnes and aluminum output reaching 42 lakh tons.

China's mineral production comprises 26.9% of global output, while India contributes 7%, reflecting the region's dominant role in resource extraction. Government initiatives including Production-Linked Incentive schemes have attracted US$ 3.55 billion in mining-related investments, creating substantial demand for high-performance lubricants.

Infrastructure projects across emerging economies require extensive mineral extraction for construction materials, metals, and energy production. The projected US$ 1 trillion annual construction output in India by 2030 and sub-Saharan Africa's infrastructure expansion programs represent significant market opportunities for mining lubricant suppliers.

These developments coincide with technology transfer initiatives that introduce advanced mining equipment requiring sophisticated lubrication solutions, further expanding market potential in previously underserved regions.

Synthetic oils command the leading position in the mining lubricants market with 48% market share in 2025, driven by superior performance characteristics under extreme operating conditions. These formulations demonstrate exceptional thermal stability, extended drain intervals, and enhanced oxidation resistance compared to conventional mineral oils. Mining operations benefit from synthetic lubricants' ability to maintain viscosity consistency across wide temperature ranges, reducing equipment wear and maintenance frequency.

Bio-based lubricants represent the fastest-growing segment within the base oil category, driven by environmental regulations and sustainability initiatives across global mining operations. These formulations offer biodegradability rates exceeding 90% within 28 days, significantly reducing soil and water contamination risks compared to traditional petroleum-based products.

Mining companies increasingly adopt bio-based solutions in environmentally sensitive areas, including operations near water bodies, protected ecosystems, and residential communities. The segment benefits from regulatory support through policies encouraging sustainable lubrication practices and carbon emission reduction targets.

Engine oils maintain the leading position with 25% market share in 2025, reflecting their critical role across diverse mining equipment platforms. These lubricants serve heavy-duty diesel engines powering excavators, haul trucks, bulldozers, and drilling rigs operating in harsh mining environments.

The segment benefits from continuous equipment expansion as mining operations scale up production capacity and deploy larger, more powerful machinery. Modern mining engines require advanced oil formulations capable of extended drain intervals, superior deposit control, and enhanced fuel economy to optimize operational costs.

Gear oils and greases collectively represent 22% market share in 2025 and constitute the fastest-growing product segment, driven by increasing complexity in mining equipment transmissions and drive systems. Modern mining machinery incorporates sophisticated gear systems requiring specialized lubrication for optimal power transmission, component protection, and operational efficiency. These products serve critical applications including final drives, planetary gears, and high-load transmission systems operating under extreme torque and pressure conditions.

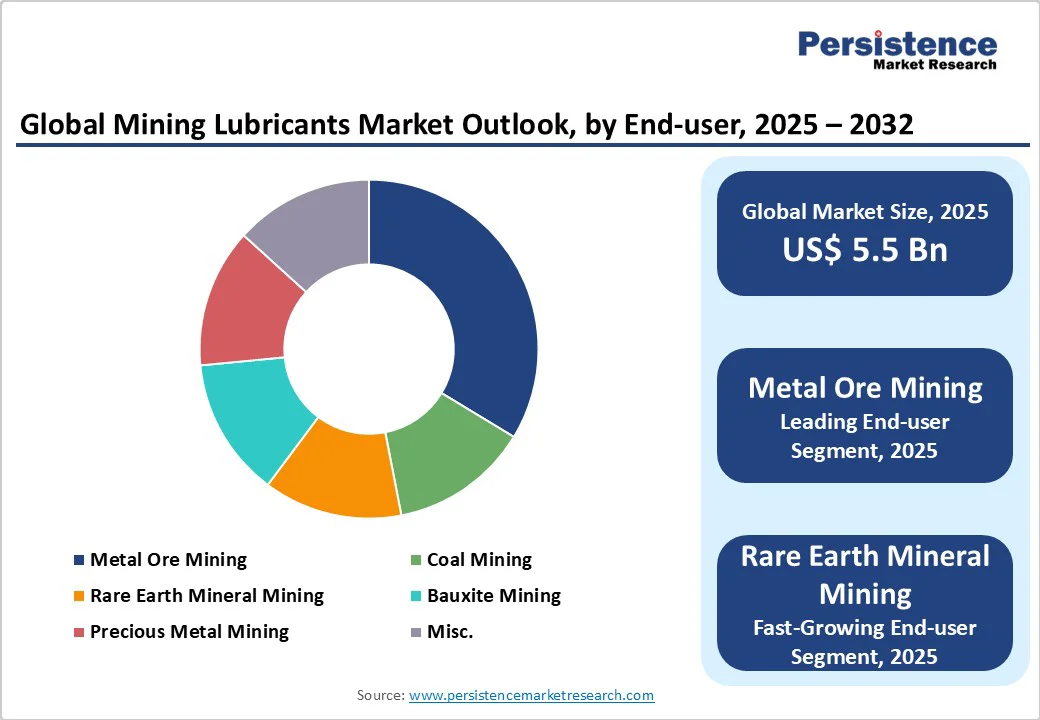

Metal ore mining holds the dominant position with 45% market share in 2025, reflecting the sector's substantial equipment requirements and operational scale. This segment encompasses iron ore, copper, aluminum, and other base metal extraction operations that form the foundation of global industrial production.

The segment's leadership position corresponds with massive infrastructure investments, construction activity, and manufacturing expansion across emerging economies requiring extensive metal inputs.

Mining companies in this sector operate some of the world's largest mobile equipment, including haul trucks with payload capacities exceeding 400 tonnes, necessitating substantial lubricant volumes for optimal performance.

Metal ore operations demonstrate consistent demand patterns driven by urbanization, infrastructure development, and industrial growth across Asia-Pacific markets.

China's steel production reaching 1.56 billion tonnes and India's expanding aluminum output to 42 lakh tons underscore the sector's scale and lubrication requirements. These operations require specialized lubricants capable of protecting equipment operating in abrasive environments with high dust levels, extreme temperatures, and heavy mechanical loads characteristic of metal ore extraction processes.

Surface mining techniques command 70% market share in 2025, reflecting the method's economic advantages and equipment efficiency in suitable geological conditions. This approach enables deployment of massive equipment including draglines, rope shovels, and ultra-class haul trucks that require substantial lubricant volumes for optimal performance.

Surface operations benefit from accessibility for maintenance activities, enabling implementation of advanced lubrication systems and condition monitoring technologies that optimize equipment reliability and operational efficiency.

Underground mining holds 30% market share in 2025 and represents the fastest-growing mining technique segment, driven by resource depletion at surface levels and advancement in underground mining technologies. The growth of underground mining reflects increasing depth of mineral extraction as easily accessible surface deposits become depleted, necessitating sophisticated equipment and lubrication solutions capable of reliable operation in challenging subsurface environments.

These operations require specialized maintenance procedures and lubricant formulations that minimize environmental impact while ensuring equipment protection and operational safety in confined underground spaces.

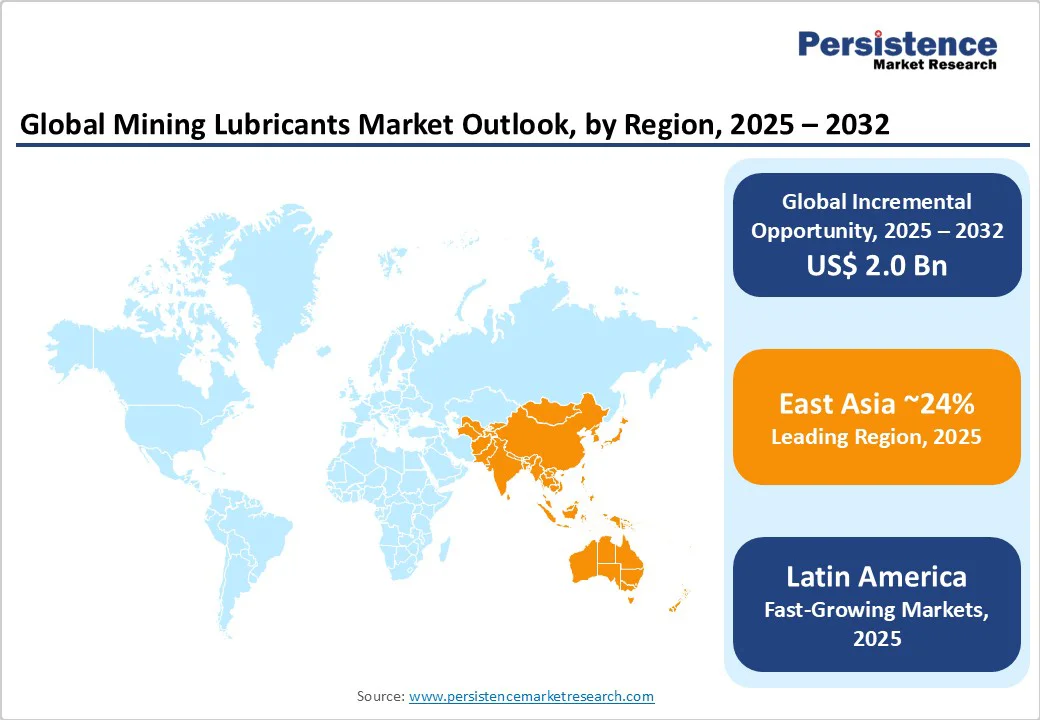

East Asia dominates the global mining lubricants market with 24% market share, driven by China's position as the world's largest mineral producer, accounting for 26.9% of global mining output.

The region's leadership reflects massive industrial infrastructure, continuous urbanization, and sustained demand for construction materials, metals, and energy resources. China's steel production reached 1.56 billion tonnes in 2023, while mineral production has increased 139.9% since 2000, demonstrating the scale of operations requiring extensive lubrication solutions.

The regulatory environment in East Asia increasingly emphasizes environmental compliance and operational efficiency. China has implemented comprehensive mining safety regulations and environmental protection standards that drive demand for high-performance lubricants capable of reducing equipment downtime and environmental impact.

Government initiatives promoting sustainable mining practices and technological modernization create opportunities for advanced lubrication solutions including synthetic and bio-based formulations.

North America holds 22% of the global mining lubricants market, driven by technological innovation, automation adoption, and stringent environmental regulations. The region leads in autonomous mining systems, IoT-enabled equipment monitoring, and predictive maintenance, optimizing lubrication efficiency. The U.S. mining sector, valued at USD 106 billion in 2024, and Canada’s oil sands, producing 1.9 million barrels daily, highlight substantial lubricant demand.

Regulatory frameworks, enforced by the Environmental Protection Agency (EPA) and Transport Canada, mandate environmentally safe lubricant practices, encouraging biodegradable formulations and advanced containment systems. Government initiatives supporting critical mineral security and supply chain diversification further drive mining and lubricant growth.

Key strategic developments include Shell & Whitmore Reliability Solutions, targeting U.S. mining and rail sectors with integrated lubrication services. Investments focus on sustainability, automation, and operational efficiency, positioning North America as a leading market for advanced and environmentally compliant mining lubricants.

South Asia & Oceania holds 18% market share, with Australia and India driving regional growth through substantial mineral reserves and expanding extraction activities.

Australia's mining sector doubled capital expenditures to enhance iron ore and coal capacity, while India's mining GDP reached US$ 9.95 billion in FY25 with steel production exceeding 112 million tonnes.

The region benefits from abundant mineral resources including iron ore in the Pilbara region, coal deposits across Queensland and New South Wales, and diverse metal ores supporting global supply chains.

Regulatory frameworks in this region emphasize environmental sustainability and worker safety. Australia has implemented stringent environmental protection standards for mining operations, particularly in sensitive ecological areas, driving demand for biodegradable lubricants and advanced containment systems.

India's government has introduced Production-Linked Incentive schemes attracting US$ 3.55 billion in mining investments while promoting sustainable extraction practices through policy incentives and regulatory compliance requirements.

The global mining lubricants market exhibits a moderately consolidated structure with oligopolistic characteristics, where the top 6-8 players collectively hold approximately 55-60% market share while numerous smaller regional and specialty players compete in niche segments.

ExxonMobil Corporation, Shell plc, TotalEnergies SE, Chevron Corporation, BP plc (Castrol), and FUCHS Petrolub SE dominate through integrated supply chains, advanced R&D capabilities, and comprehensive technical services. These leading companies leverage vertical integration from base-oil refining to finished lubricant blending, enabling cost advantages and quality control while maintaining extensive global distribution networks and mining-specific product portfolios.

The market demonstrates barriers to entry through significant capital requirements, regulatory compliance costs, and established OEM partnerships, creating competitive moats for incumbent players. Technology differentiation serves as the primary competitive battleground, with leaders investing in IoT-enabled condition monitoring, biodegradable formulations, and predictive maintenance platforms to capture premium segments.

Despite oligopolistic tendencies among major players, the market maintains moderate fragmentation due to regional specialists, application-focused manufacturers, and emerging sustainable lubricant companies serving specific mining sectors and geographical markets.

The global Mining Lubricants market is projected to be valued at US$ 5.5 Bn in 2025.

The Metal Ore Mining segment is expected to hold around 45% market share in 2025, driven by extensive infrastructure development and rising industrial demand in emerging economies.

The market is poised to witness a CAGR of 4.5% from 2025 to 2032.

The Mining Lubricants market growth is driven by technological advancements in mining equipment automation, critical mineral security initiatives, and stringent environmental regulations.

Key market opportunities include digital transformation with predictive maintenance integration, expanding mining activities in emerging markets, and increasing adoption of sustainable, bio-based lubricants.

The top key market players in the global Mining Lubricants market include ExxonMobil Corporation, Shell plc, TotalEnergies SE, Chevron Corporation, and BP p.l.c.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2032 |

| Historical Data Available for | 2019 to 2024 |

| Market Analysis | USD Million for Value |

| Region Covered |

|

| Key Companies Covered |

|

| Report Coverage |

|

By Base Oil

By Power Type

By End-user

By Mining Technique

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author