ID: PMRREP35832| 189 Pages | 6 Nov 2025 | Format: PDF, Excel, PPT* | Packaging

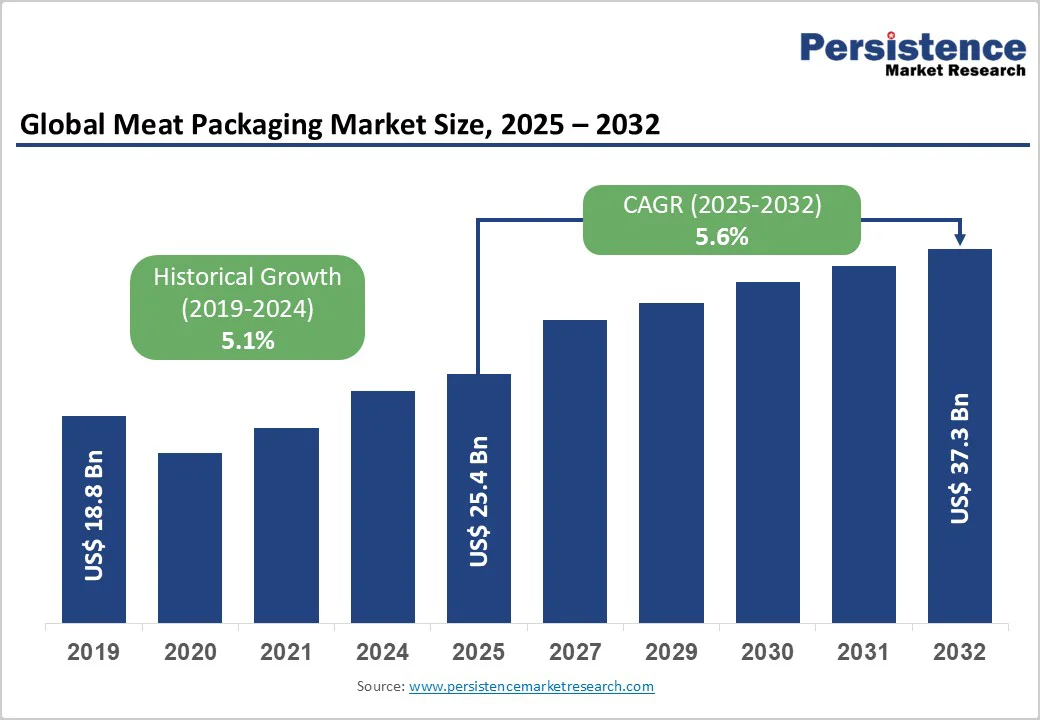

The global meat packaging market size is likely to be valued at US$25.4 billion in 2025, and is projected to reach US$37.3 billion by 2032, growing at a CAGR of 5.6% during the forecast period 2025 - 2032.

The convergence of protein consumption dynamics, technological innovation, and regulatory transformation accelerates the market expansion.

Production growth in the global meat industry directly drives packaging demand by expanding processed meat categories, ready-to-eat offerings, and e-commerce meat delivery channels.

| Key Insights | Details |

|---|---|

| Meat Packaging Market Size (2025E) | US$25.4 Bn |

| Market Value Forecast (2032F) | US$37.3 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.1% |

Global meat production has experienced extraordinary expansion, with total output projected to increase by 46 million metric tons (cwe) by 2034, driven predominantly by Asian markets. Meat production growth is not uniformly distributed geographically. According to OECD-FAO projections, over 55% of the global increase will originate from Asia, with China's post-African Swine Fever (ASF) recovery contributing nearly 10% to global production growth.

This geographic concentration of production growth directly translates to corresponding packaging volume requirements, as industrial-scale meat operations mandate advanced barrier protection and extended shelf-life solutions.

This production surge creates a proportional demand for packaging formats capable of handling diverse meat categories — from fresh to processed and cooked ready-to-eat —each requiring distinct barrier properties and technological specifications.

Growing adoption of MAP technology has accelerated substantially, as it represents a critical driver reshaping packaging requirements across the supply chain. Food processing facilities integrating MAP technology with oxygen levels maintained below 1% and carbon dioxide levels between 25-45% as standard specifications for perishables have demonstrated net waste reductions of up to 30% from unsold packs.

Cold chain infrastructure expansion, particularly in emerging markets across Asia and Latin America, has spiked the deployment of more complex packaging solutions, such as MAP. Moreover, regulatory alignment across trade zones has led to standardization pressures that manufacturers must address through materials science research, chemical substitution, and production process modifications.

Raw material prices for polyethylene, polypropylene, aluminium, and paper exhibit significant volatility, creating budgeting challenges for manufacturers. Plastic resin prices fluctuate with crude oil prices and supply disruptions, while aluminium and paper costs respond to commodity market dynamics.

Regulatory compliance complexity across multiple jurisdictions requires manufacturers to maintain distinct packaging formulations for different geographic markets, increasing operational costs and reducing economies of scale. Smaller processing facilities also struggle to achieve compliance within financial constraints, limiting their ability to adopt advanced packaging technologies.

This cost structure advantage benefits tier-1 companies with significant production capacity but disadvantages regional and niche manufacturers.

Vacuum skin packaging offers distinct advantages through product visibility, extended shelf-life through oxygen exclusion, and premium visual positioning that commands retail price premiums. Fresh meat applications benefit particularly from VSP's ability to reduce purge, prevent color oxidation, and maintain product shape while allowing consumer inspection.

In the Asia Pacific, particularly in China, with booming e-commerce channels and expanding cold chain infrastructure, VSP adoption can also accelerate demand for specialised films and tray materials. This technological ecosystem expansion creates supply chain opportunities for material innovators capable of producing high-barrier films designed specifically for vacuum skin attachment.

E-commerce meat delivery represents a nascent but rapidly scaling opportunity requiring specialized packaging. Online delivery requires hermetic, leak-proof packaging with enhanced safety and tamper-evidence features distinct from retail shelf packaging. Companies such as Licious and FreshToHome have captured this emerging demand through quality assurance and convenience positioning.

Packaging innovations include active cooling envelopes, real-time freshness indicators using sensor technology, and sustainable insulation materials that integrate with temperature-controlled delivery networks.

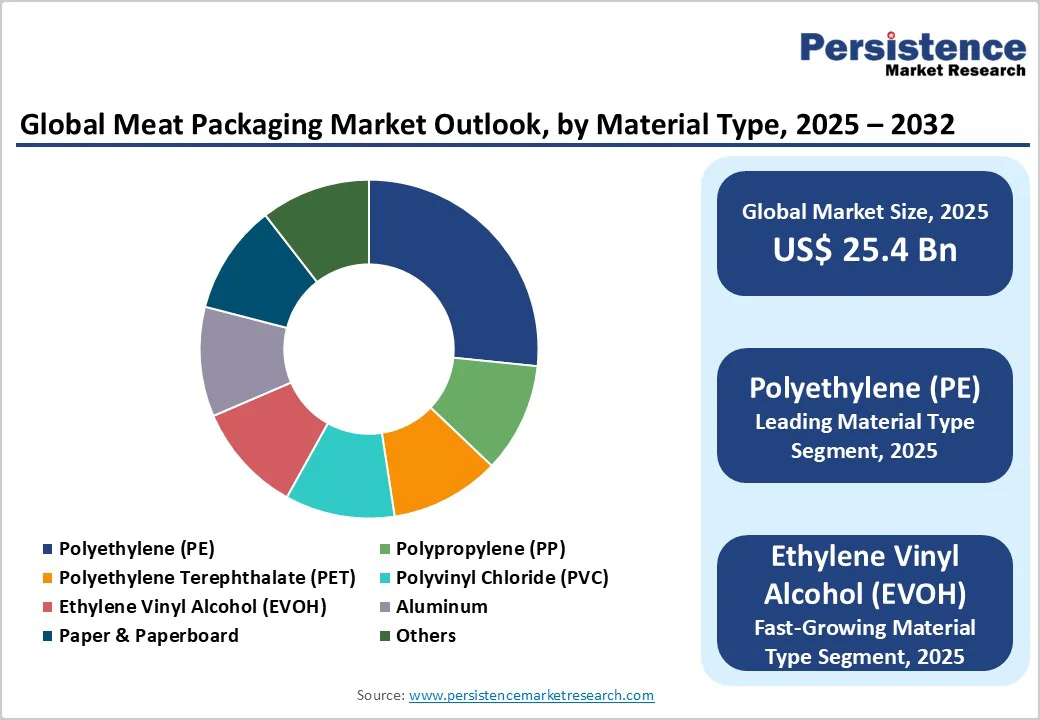

Polyethylene is anticipated to dominate with about 38% of the meat packaging market revenue share in 2025, driven by its optimal balance of oxygen permeability, clarity, mechanical strength, and cost-effectiveness across fresh, frozen, and processed meat applications.

Low-density polyethylene (LDPE) at gauges between 150 and 200 for frozen meat applications provides thermal durability at -18°C storage temperatures while maintaining flexibility and impact resistance during handling.

The compatibility of PE with modified atmosphere packaging systems and vacuum sealing technologies ensures widespread adoption across retail distribution channels, with particular prevalence in flexible film applications and thermoformed tray substrates.

Ethylene vinyl alcohol (EVOH), designated as the fastest-growing material segment through 2032, exhibits superior barrier properties against oxygen transmission with oxygen transmission rates (OTR) of 0.5-2.0cm³/m²/day compared to polyethylene's 3,000-6,000 cm³/m²/day, making EVOH essential for extended shelf-life applications requiring barrier layer integration within multi-layer film structures.

Moreover, its chemical stability and resistance to moisture-induced barrier degradation provide performance advantages, particularly valuable in vacuum skin packaging configurations and high-barrier coextruded film structures requiring extended preservation windows without aggressive preservative utilization.

Fresh meat is likely to maintain market leadership with 43% share in 2025, encompassing beef, pork, poultry, and lamb commodities distributed through retail channels requiring sustained color retention, oxidative stability, and microbial inhibition.

Fresh meat's dominance reflects fundamental consumer preference for minimally processed products perceived as nutritionally superior, coupled with retail channel proliferation and convenient access across diverse geographical markets.

Cooked/ready-to-eat meat is set to grow the fastest from 2025 to 2032, fueled by rapid urbanization, expansion of dual-income households, and consumer time-scarcity dynamics. The ready-to-eat meat market is witnessing a strong growth trajectory, particularly within e-commerce channels where product traceability and food safety documentation offer competitive differentiation advantages.

This segment requires specialized packaging solutions that address cooked meat’s susceptibility to pathogens such as Listeria monocytogenes and Clostridium botulinum, emphasizing the need for barrier technologies that prevent post-packaging contamination and microbial proliferation.

Modified atmosphere packaging is forecasted to command an estimated 33% market share in 2025, attributable to its effectiveness in inhibiting aerobic microbial species, particularly Pseudomonas, while maintaining red meat colouration through controlled oxygen exposure.

MAP's market prevalence reflects technological maturity, established equipment infrastructure across production facilities, and proven shelf-life extension capabilities, particularly valuable across retail distribution channels where temperature fluctuations and extended storage periods demand robust preservation methodologies.

On the other hand, vacuum skin packaging is likely to emerge as the fastest-growing packaging technology during 2025 - 2032, gaining adoption due to superior visual presentation, extended shelf-life, and operational efficiency advantages.

VSP's market traction reflects consumer preferences for premium positioning, driven by crystal-clear product visibility combined with practical advantages, including greater volume reduction than conventional tray sealing, reduced protective padding requirements, and improved traceability through barcode and QR code integration on rigid substrates.

In North America, the meat packaging industry places prime emphasis on food safety compliance, rapid distribution economics, and consumer convenience. The U.S. meat and poultry industry exports approximately US$30 billion annually, with 25% of pork, 15% of poultry, and 13% of beef directed to export markets.

Domestic retail concentration (grocery chains through regional distribution), coupled with 98% household meat consumption prevalence, creates high-volume, standardised packaging demand. FDA regulations governing meat packaging establish drug residue testing requirements, inspection protocols, and labelling standards for all meat products.

Online meat delivery penetration is also accelerating through DTC platforms such as ButcherBox and Vital Farms, requiring specialized packaging for UPS/FedEx thermal reliability.

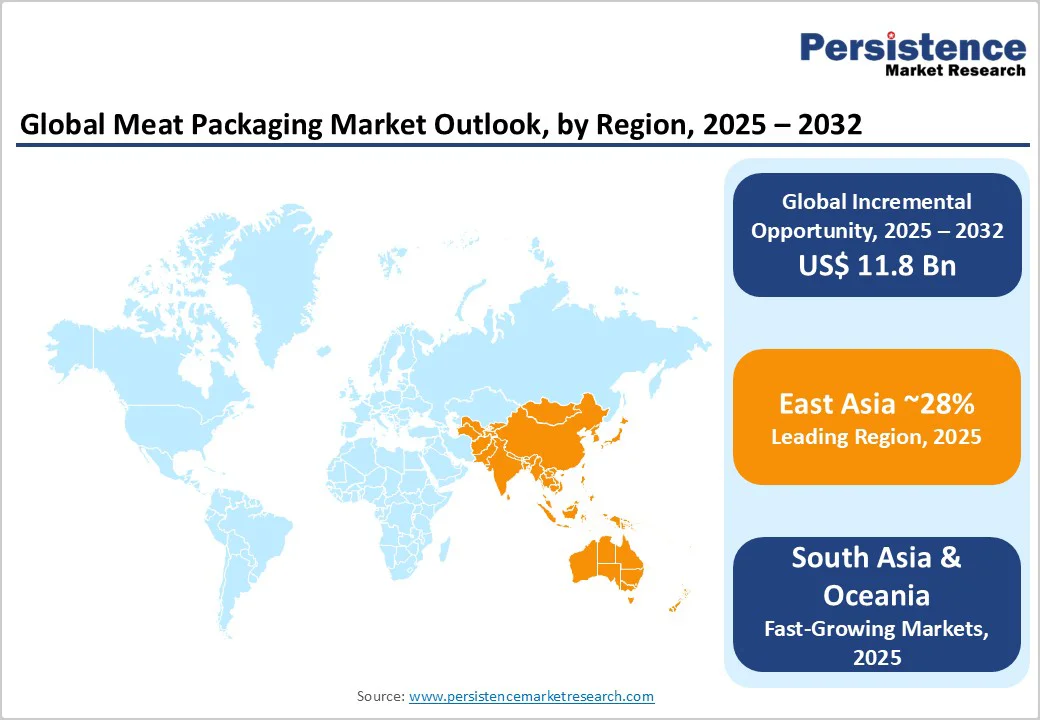

Asia Pacific dominates the meat packaging share on the back of China's production scale and export-driven meat industry. China commands more than a third of the red meat consumption share in Asia Pacific, with domestic production supplemented by significant imports from Australia, Brazil, and Uruguay.

Import dependency for premium beef creates packaging requirements for extended shelf-life (vacuum skin and high-barrier MAP formats) and export-compliant traceability labelling. Modernizing cold chain infrastructure across eastern and southern coastal regions further supports the adoption of advanced packaging technology.

Export markets demand specialised formats including lacquered tinplate containers, multilayer vacuum pouches, and antimicrobial films complying with destination market regulations. E-commerce penetration in tier-1 cities, Shanghai, Beijing, and Shenzhen, creates dual packaging demand: ultra-fresh formats for online rapid delivery and extended shelf-life formats for cold chain logistics.

The European meat packaging market reflects mature characteristics with a focus on sustainability compliance and regulatory harmonisation. The regulatory environment governed by the EU PPWR (effective 2025) mandates 100% recyclability by 2030, compelling manufacturers to transition from established multilayer films to mono-material solutions (mono-PE, mono-PP) and paper-based alternatives.

Constantia Flexibles' product innovations —EcoPeelCover, EcoAluTainer, and EcoTwistPaper — reflect this transition. Government food safety standards across member states establish specifications for packaging materials.

Furthermore, packaging innovations are focused on circular-economy principles, including material reduction, aluminum thickness reduction enabled by novel lid designs, compostable alternatives for defined segments, and digital recycling enablement through labeling standardization.

The global meat packaging market structure is characterized as consolidated, with a few dominant players holding significant market share. Amcor plc, Sealed Air Corporation, Berry Global Group Inc., Mondi plc, and Crown Holdings Inc. are the top key players in this sector. These companies lead the market due to their extensive global presence, advanced technological capabilities, and comprehensive product portfolios.

Their strong distribution networks and continuous innovation in packaging solutions have solidified their positions in the industry. The market's consolidation is further evidenced by Amcor's acquisition of Berry Global in an US$ 8.43 billion all-stock deal in April 2025, aimed at creating a packaging powerhouse with combined revenues of US$ 24 billion.

The global meat packaging market is projected to be valued at US$ 25.4 billion in 2025.

The accelerated rise in global meat consumption, technological advancements in packaging solutions, and evolving regulatory standards favoring sustainability and food safety are driving the market.

The market is poised to witness a CAGR of 5.6% from 2025 to 2032.

Key market opportunities include the expansion of e-commerce and online meat delivery channels, the adoption of innovative skin vacuum packaging for premium positioning, and the development of sustainable, recyclable packaging materials aligned with stricter environmental mandates.

Some of the leading market players are Amcor plc, Sealed Air Corporation, Berry Global Group Inc., Mondi plc, and Crown Holdings Inc.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2032 |

| Historical Data Available for | 2019 to 2024 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Key Companies Covered |

|

| Report Coverage |

|

By Material Type

By Packaging Technology

By Meat Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author