ID: PMRREP23179| 192 Pages | 28 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

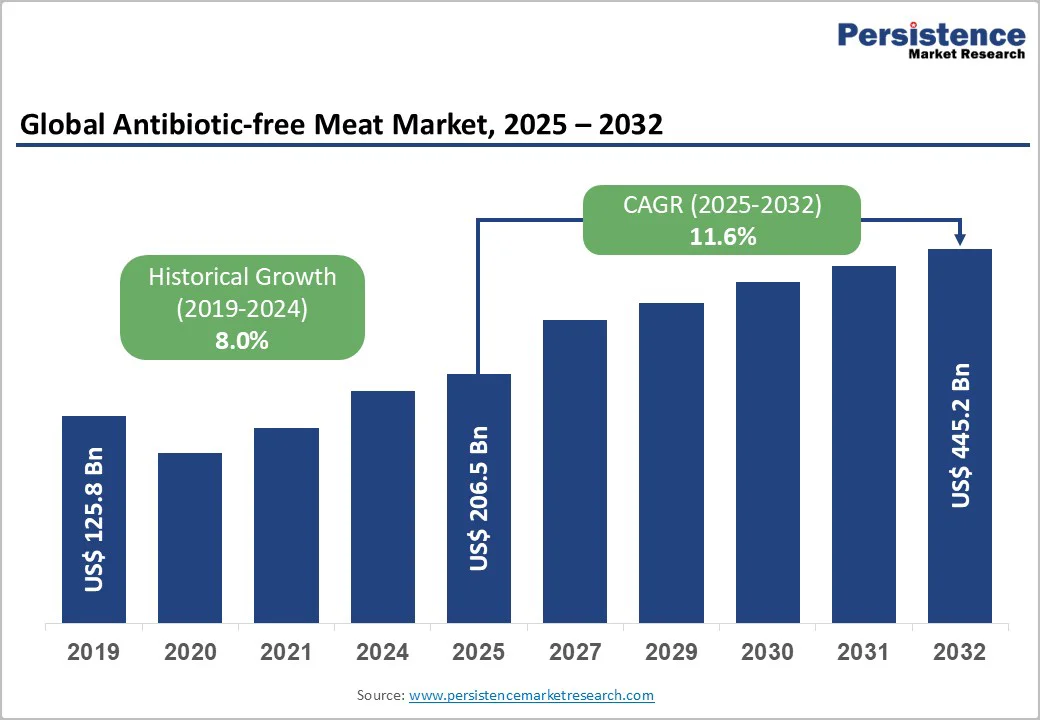

The global antibiotic-free meat market size is likely to grow from US$206.5 billion in 2025 to US$445.2 billion by 2032, at a CAGR of 11.6% over the forecast period. Rise in consumer health awareness, food safety, and sustainable farming practices drives demand for antibiotic-free meat. Moreover, increasing demand for poultry, beef, and pork produced without antibiotics, coupled with stringent regulations in developed regions, is propelling market expansion.

| Key Insights | Details |

|---|---|

|

Antibiotic-free Meat Market Size (2025E) |

US$206.5 Bn |

|

Market Value Forecast (2032F) |

US$445.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

11.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.0% |

Consumers are placing more significance on what's in their food. U.K. consumers prefer clean-label food products, driving demand for antibiotic-free meat across the country and Europe. In markets such as Russia and Poland, there is more room to differentiate a product from competitors through a clean-label approach. Consumers are increasingly on the lookout for nutritional meat products that are free from artificial colors, preservatives, flavors, sweeteners, and other harmful ingredients.

Clean labels can provide a road map to premium and value-added products. From raising animals to products served on the table, consumers prefer transparency in the entire process. Meat production companies are focusing on transparency between consumers and manufacturers by providing all the information about their products, which is driving demand for antibiotic-free meat.

Raising animals without antibiotics significantly increases production costs, posing a major challenge for the antibiotic-free meat market. Farmers must invest more in high-quality feed, enhanced veterinary care, and stringent farm management practices to maintain animal health and prevent disease naturally. Biosecurity measures, such as specialized housing, sanitation, and monitoring systems, add further operational expenses.

Unlike conventionally reared livestock treated with antibiotics, antibiotic-free animals are more susceptible to infections, requiring continuous supervision and preventive measures that increase labor and resource requirements. These higher costs are often passed on to consumers through premium pricing, limiting adoption in price-sensitive markets and creating a financial barrier for smaller producers seeking to enter the antibiotic-free segment.

Plant-based hybrid meat products represent a promising innovation in the antibiotic-free meat market, blending high-quality antibiotic-free meat with plant-derived proteins such as peas, soy, or legumes. This fusion caters to the growing population of flexitarians and health-conscious consumers who seek to reduce meat consumption without compromising on taste or nutrition. By combining the natural flavor and protein content of antibiotic-free meat with the sustainability and functional benefits of plant ingredients, these hybrids offer a balanced, environmentally friendly option.

Additionally, they allow manufacturers to position products as premium, nutrient-rich, and ethically sourced, while appealing to markets concerned with animal welfare, antibiotic resistance, and ecological impact. This segment could drive long-term growth through innovation and differentiation.

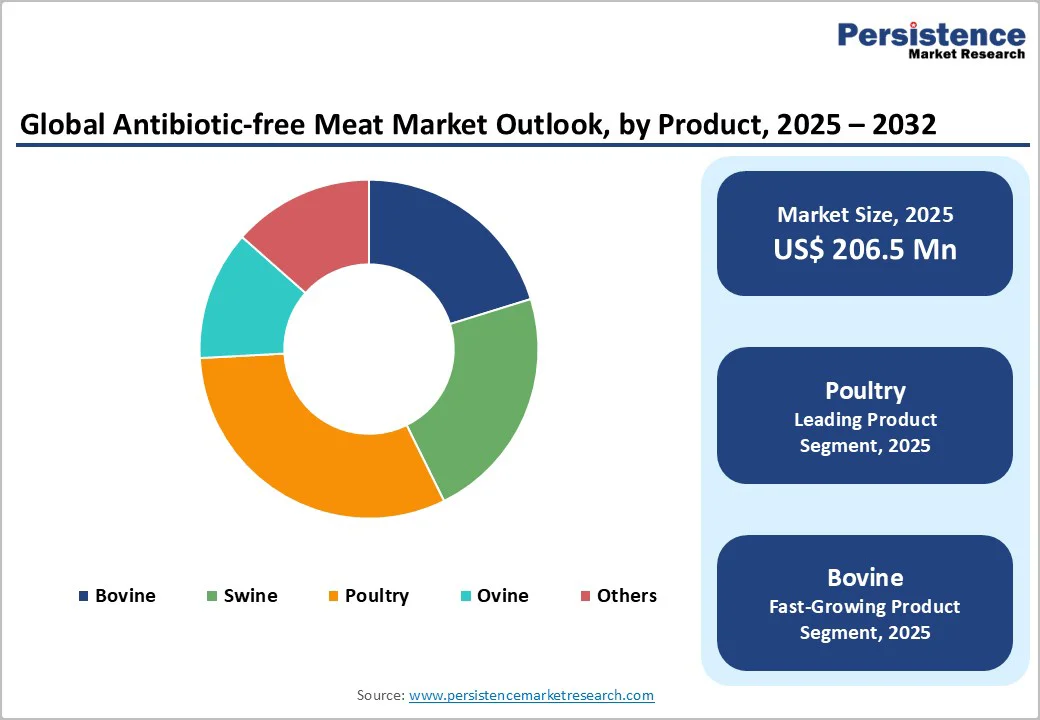

Poultry dominates the antibiotic-free meat market due to a combination of consumer demand, production feasibility, and health perception. Chicken is the most widely consumed meat globally, offering an affordable source of high-quality protein for households across diverse income groups. Its short life cycle and manageable rearing conditions make it easier for farmers to adopt antibiotic-free practices compared to cattle or swine, reducing costs and production risks.

Additionally, consumers increasingly associate poultry with healthier, leaner meat, making antibiotic-free chicken highly desirable among health-conscious buyers. Well-established supply chains, strong presence in retail and online channels, and targeted marketing emphasizing “No Antibiotics Ever” or “Raised Without Antibiotics” labels further reinforce poultry’s leadership, making it the preferred segment in both volume and growth potential.

The household segment leads the antibiotic-free meat market because individual consumers drive the majority of demand for fresh, safe, and high-quality protein. Growing health consciousness and awareness of food safety issues encourage families to prefer antibiotic-free poultry, beef, and pork for daily meals. Retail channels such as supermarkets, hypermarkets, specialty stores, and e-commerce platforms are primarily designed to serve households, offering convenient access to certified antibiotic-free products.

Households are more willing to pay premium prices for meats labeled “No Antibiotics Ever” or “Raised Without Antibiotics,” valuing transparency, nutrition, and ethical sourcing. While foodservice and food processing segments are expanding, household consumption currently dominates both revenue and volume due to its sheer scale, repeat purchase behavior, and strong influence on overall market growth.

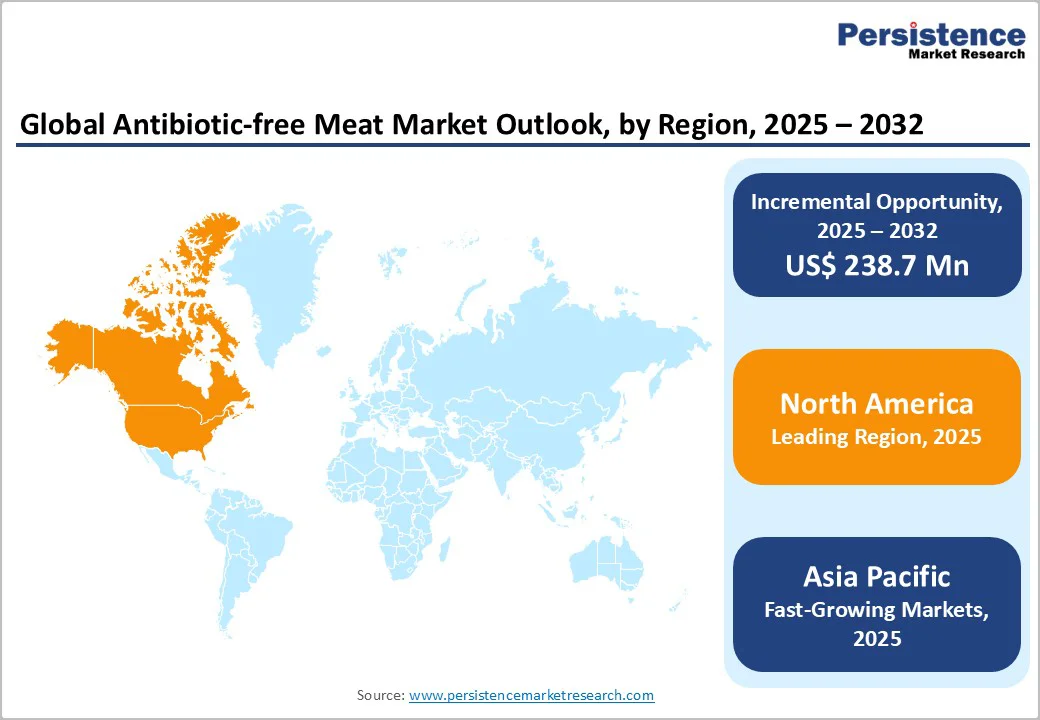

North America, particularly the U.S., leads the global antibiotic-free meat market, driven by strong consumer demand for healthier, safe, and ethically sourced proteins. American consumers increasingly prioritize labels such as “No Antibiotics Ever” and “Raised Without Antibiotics,” associating them with nutrition, animal welfare, and food safety. Major poultry, beef, and pork producers have invested heavily in certified antibiotic-free supply chains, supported by stringent FDA and USDA regulations restricting routine antibiotic use in livestock. Retailers, from supermarkets to online platforms, actively promote premium antibiotic-free meat lines, while foodservice chains incorporate these offerings into menus to meet consumer expectations. The trend toward transparency, traceability, and sustainable farming practices continues to reinforce North America’s position as the leading regional market.

The Asia-Pacific region is emerging as a high-growth market for antibiotic-free meat, driven by rising disposable incomes, urbanization, and shifting consumer preferences toward healthier and safer protein sources. Countries such as China, Japan, South Korea, and Australia are witnessing increasing demand for poultry, pork, and beef produced without antibiotics, fueled by awareness of food safety, antibiotic resistance, and nutrition. The rapid expansion of modern retail chains, e-commerce platforms, and cold-chain infrastructure is improving the accessibility of premium antibiotic-free products. Additionally, governments are gradually implementing stricter regulations on antibiotic use in livestock, supporting market growth. As consumers increasingly value transparency, traceability, and ethical farming practices, the Asia Pacific is poised to become a key growth engine for the global antibiotic-free meat market.

The global antibiotic-free meat market is highly competitive, dominated by both large integrated producers and specialized regional players. Leading companies invest in certified supply chains, traceability systems, and premium product lines to meet growing consumer demand for safe, ethical, and high-quality meat. Key strategies include brand differentiation, partnerships with retailers and foodservice chains, and expansion into e-commerce channels. Companies also focus on innovation, offering value-added, ready-to-cook, or hybrid meat products.

The global antibiotic free meat market is projected to be valued at US$206.5 Bn in 2025.

Increasing consumer concern over antibiotic residues, drug resistance, and foodborne diseases boosts demand for antibiotic-free meat.

The global antibiotic free meat market is poised to witness a CAGR of 11.6% between 2025 and 2032.

Combining antibiotic-free meat with plant proteins to attract flexitarian consumers.

Tyson Foods, Inc., Foster Farms, Hormel Foods Corp, Perdue Farms Inc., and others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn, Volume if Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Flavor

By Form

By End-user

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author