ID: PMRREP33320| 198 Pages | 18 Aug 2025 | Format: PDF, Excel, PPT* | Food and Beverages

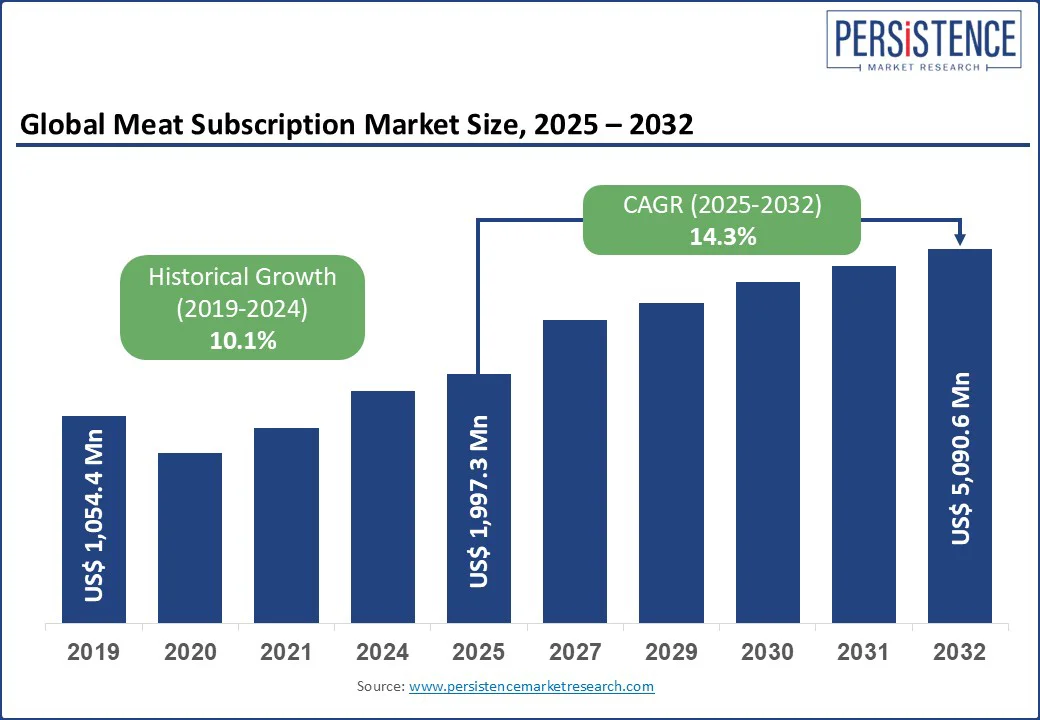

The global meat subscription market size is likely to be valued at US$ 1,997.3 Mn in 2025 and is expected to reach US$ 5,090.6 Mn, growing at a CAGR of 14.3% during the forecast period from 2025 to 2032.

The market is experiencing rapid growth driven by changing consumer preferences for convenience, traceable sourcing, and premium cuts. Subscription services offer customized meat boxes, highlighting sustainability, animal welfare, and freshness, direct from farms, especially among urban and health-conscious consumers.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Global Meat Subscription Market Size (2025E) |

US$ 1,997.3 Mn |

|

Market Value Forecast (2032F) |

US$ 5,090.6 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

10.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

14.3% |

The widespread expansion of e-commerce platforms has been a major growth driver in the meat subscription market. With the convenience of online shopping, consumers are increasingly opting for subscription models that deliver high-quality, customizable meat products directly to their homes.

Post-pandemic, this trend has continued as more consumers appreciate the ease of subscription services. Online platforms also allow meat subscription providers to reach broader geographic areas, extending their customer base. Enhanced digital interfaces and mobile app integrations have further improved customer experience, allowing users to manage subscriptions easily, select delivery frequencies, and customize orders.

As internet penetration grows globally, particularly in emerging markets, the meat subscription market benefits from increased digital engagement and rising consumer preferences for the convenience of e-commerce-driven services, contributing to steady long-term growth.

In 2023, ButcherBox introduced features that let users track their deliveries in real time and get personalized product recommendations based on past purchases, further enhancing the customer experience.

Complying with food safety and hygiene requirements presents a difficulty for meat subscription providers. Businesses operating in numerous locations need help adhering to different areas' regulatory requirements. Ensuring a seamless and sustainable supply chain is essential for the prompt delivery of perishable and fresh products while preserving quality. Last-mile distribution faces challenges, especially in heavily populated urban regions.

Customer satisfaction is contingent upon the capacity to preserve the freshness and quality of meat products throughout delivery and transportation. Establishing an efficient cold chain logistics infrastructure to avert spoilage and contamination poses an additional obstacle to the sales of subscription-based meat.

Meat is widely available in the market, including beef, hog, chicken, lamb, and others. The global population of smartphone users is increasing swiftly, hence, facilitating this technological advancement is aiding the growth of online meal delivery businesses.

The expansion of the meat subscription business in tier-2 and tier-3 cities is propelled by the establishment and accessibility of delivery-only kitchens in regions with limited restaurant or eatery choices. The use of marketing strategies by major industry participants also facilitates the growth of the meat subscription market size. The industry is propelled by incentives offered by producers, like discounts and subscriptions.

Companies providing meat subscriptions provide lower prices for bulk purchases, permit consumers to customize their orders for specific pieces of meat, and allow them to select the frequency of delivery. Factors such as urban population expansion and heightened awareness of premium meat products' health advantages drive customers toward a subscription model for meat consumption.

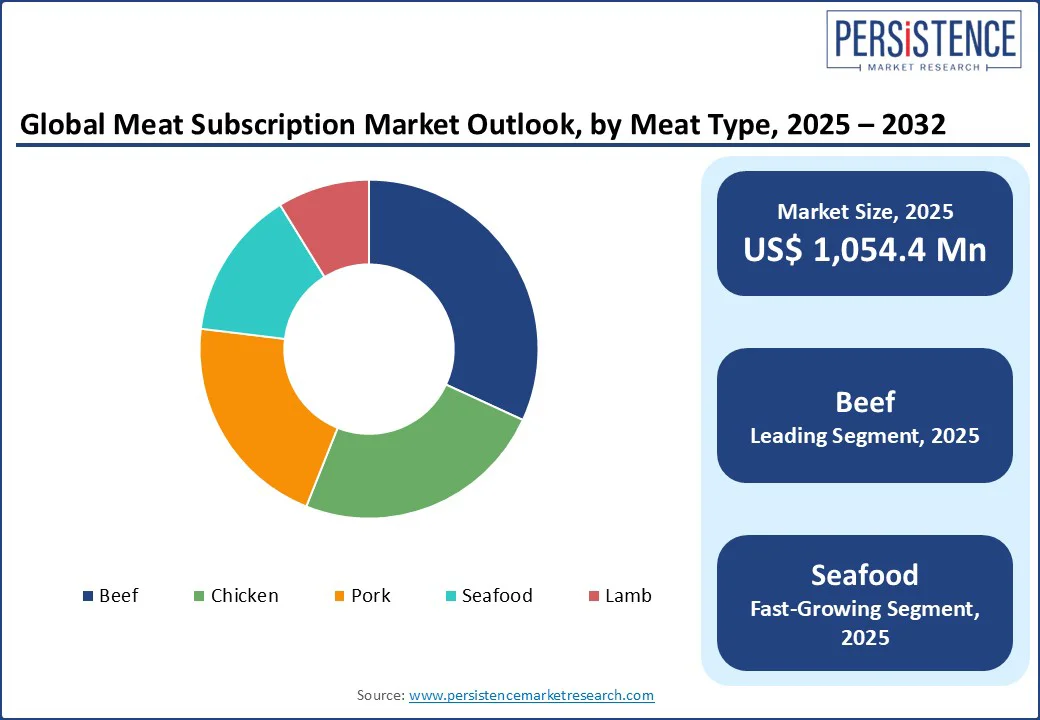

Beef holds approximately 39% of the global meat subscription market in 2025, firmly positioning itself as the top-performing segment. Its dominance stems from its deep-rooted cultural presence in Western diets, especially in the U.S., where grilling, barbecuing, and steakhouse dining traditions remain strong. Consumers perceive beef, particularly premium cuts like grass-fed, organic, and wagyu as high-value, protein-rich options ideal for meal planning and family dinners. Its broad versatility across cuisines also makes it a popular recurring choice in customized subscription boxes.

Meanwhile, subscriptions for chicken are rapidly growing due to its affordability, lean profile, and adaptability in health-conscious meals. Seafood is gaining traction among premium subscribers seeking omega-rich, sustainable proteins. Pork remains steady, especially in European and Asian markets, while lamb caters to niche, gourmet audiences valuing ethnic and festive culinary traditions.

Monthly delivery accounts for about 61% of the global meat subscription market in 2024, mainly because it aligns with typical household consumption and storage routines. Most families prefer to restock their meat supplies every month, which fits average freezer sizes and meal planning habits. This delivery schedule strikes a good balance between freshness, convenience, and budget management. Consumers are increasingly choosing customizable monthly boxes that let them select preferred cuts, proteins, and quantities, boosting overall satisfaction and loyalty. In the U.S., companies like ButcherBox have successfully leveraged this model, providing monthly curated beef, chicken, and seafood boxes tailored to household needs. Although monthly remains the most popular option, quarterly subscriptions are gaining traction among bulk buyers and rural households who favor less frequent shipments, especially for premium cuts, wild game, or specialty items suited for long-term storage.

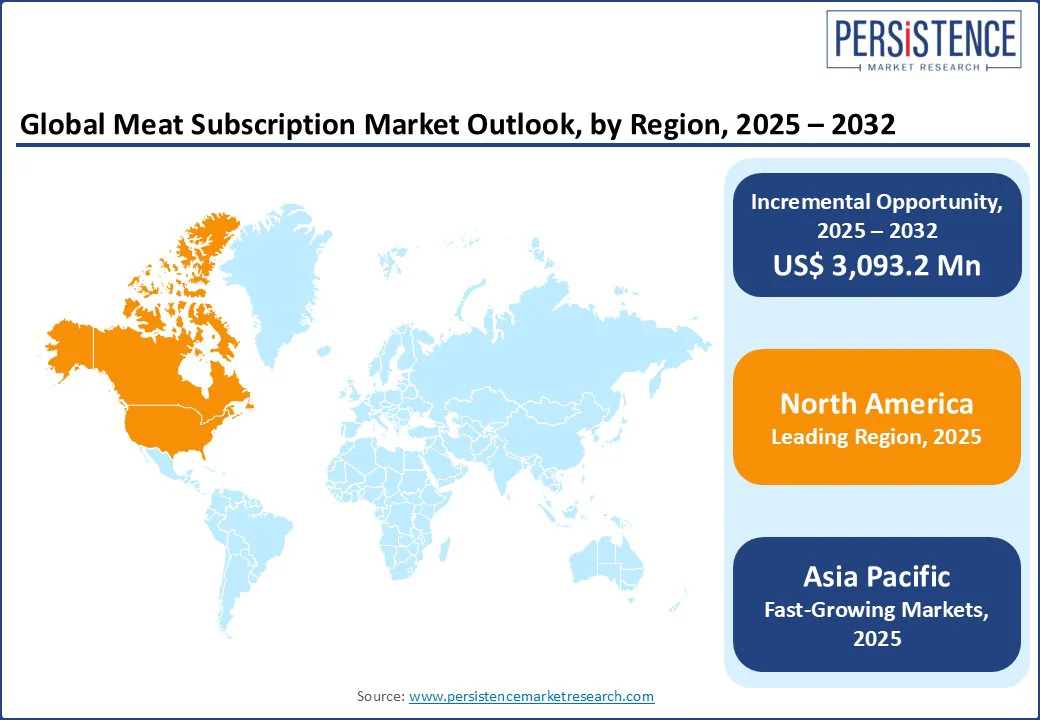

North America holds approximately 38% of the global meat subscription market in 2024, driven by rising demand for high-quality, ethically sourced protein delivered directly to consumers. In the U.S., busy urban lifestyles, growing interest in grass-fed and antibiotic-free meat, and the popularity of meal planning have significantly boosted subscription adoption. Direct-to-consumer brands are expanding offerings to include curated boxes, flexible delivery plans, and value-added content like recipes and nutrition tips. Sustainability and transparency remain key drivers, with consumers increasingly choosing services that support regenerative farming or carbon-neutral practices. Canada is also witnessing a notable rise in subscriptions, particularly among health-conscious millennials and families seeking locally sourced meat. The country’s growing e-commerce infrastructure and emphasis on traceable food origins are fueling rapid expansion. Together, the U.S. and Canada form a mature yet rapidly evolving market for premium meat subscriptions.

Europe meat subscription market is likely to grow at 14.6% of the global meat subscription market in 2024, supported by rising consumer interest in traceable, high-quality protein and sustainable sourcing practices. In the U.K., a strong shift toward ethically sourced meat is driving demand for subscription models that emphasize grass-fed and organic options. Germany and Italy are witnessing increased interest in artisanal and heritage meats, particularly through DTC platforms. According to Eurostat, over 20% of European households purchased food online in 2023, a trend benefiting meat subscription services. In Spain, convenience and health consciousness are reshaping consumer food choices, with many turning to curated meat boxes that offer portion control and transparency. Across Europe, subscription services are responding by offering nitrate-free, hormone-free, and locally sourced meat products with tailored delivery options.

The global meat subscription market is increasingly dynamic, characterized by a mix of legacy players and agile newcomers capitalizing on evolving consumer preferences. Companies are investing in AI-powered logistics, cold-chain optimization, and predictive demand forecasting to enhance delivery accuracy and reduce waste. Emphasis on hygienic, tamper-proof, and sustainable packaging has intensified, particularly in response to heightened consumer awareness around food safety. Players are also prioritizing ethically sourced meat, with transparent farm-to-fork supply chains and partnerships with certified humane, organic, or grass-fed producers. Obtaining certifications such as USDA Organic, Animal Welfare Approved, and Halal/Kosher is becoming standard practice to enhance credibility. Investment activity is rising in automation and inventory management systems to scale operations efficiently. The competitive edge lies in offering traceable, personalized, and responsibly sourced meat delivered with consistent quality and compliance with global food safety standards.

The global meat subscription market is projected to be valued at US$ 1,997.3 Mn in 2025.

E-commerce expansion and consumer shift to online shopping are driving interest in the meat subscription market.

The global meat subscription market is poised to witness a CAGR of 14.3% between 2025 and 2032.

The introduction of cloud kitchens and the extensive availability of meat are the key market opportunities.

Major players in the global meat subscription market include ButcherBox, Crowd Cow, Porter Road Butcher, Moink, Goldbelly, Inc., The Kansas City Steak Company, and others.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Meat Type

By Subscription Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author