ID: PMRREP35553| 197 Pages | 7 Aug 2025 | Format: PDF, Excel, PPT* | Packaging

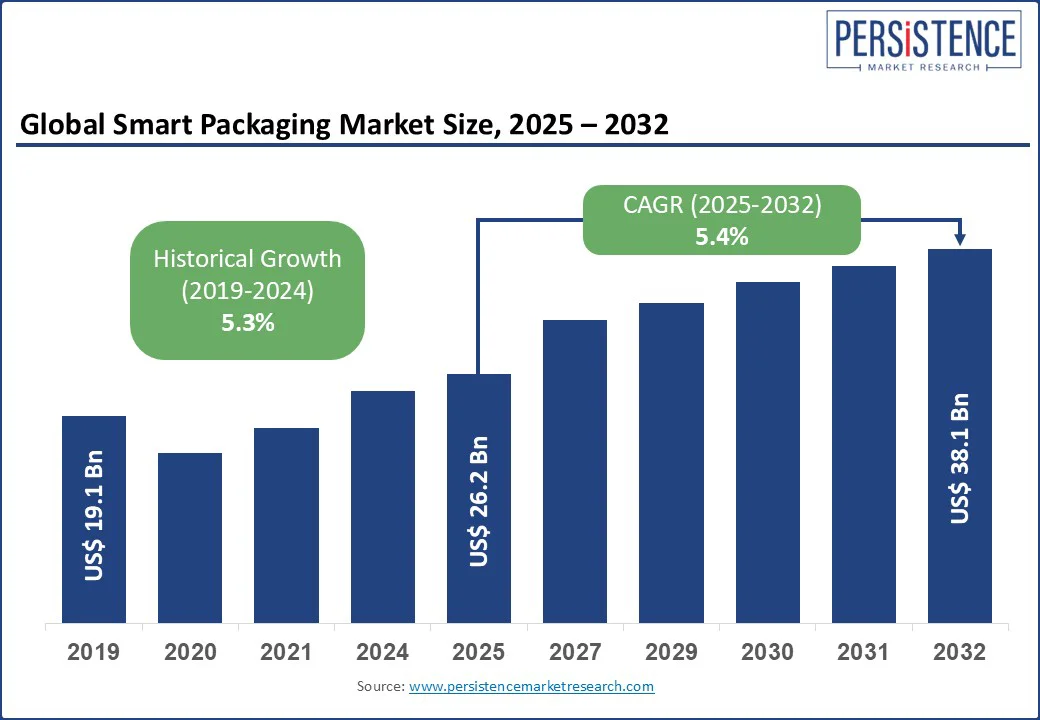

The global smart packaging market size is likely to be valued at US$ 26.2 Bn in 2025 and is estimated to reach US$ 38.1 Bn in 2032, growing at a CAGR of 5.4% during the forecast period 2025-2032. The rising demand for food safety, product authenticity, and supply chain transparency, supported by technological advancements and expanding e-commerce drives growth. Smart packaging is modifying the value creation across the packaging industry by merging material development with embedded intelligence. Compliance tracking has gained huge impetus, as business organizations look for competitive differentiation in sectors such as food, pharmaceuticals, and logistics, packaging that delivers real-time data, spoilage alerts. Businesses that invest early in cost-efficient solutions are better positioned to meet evolving consumer demands and regulatory pressures

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Smart Packaging Market Size (2025E) |

US$ 26.2 Bn |

|

Market Value Forecast (2032F) |

US$ 38.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.3% |

Surging prevalence of foodborne diseases is augmenting the smart packaging market growth as manufacturers seek ways to ensure product safety and restore consumer confidence. According to the World Health Organization (WHO), nearly 600 million individuals fall ill across the globe every year due to contaminated food, with Asia Pacific and Africa at the forefront. It has placed pressure on food companies to adopt packaging that delivers real-time monitoring of freshness, temperature exposure, and microbial activity.

In the U.S., the FDA’s New Era of Smarter Food Safety Blueprint is bolstering this shift by encouraging the use of digital tools. These include smart packaging for better traceability and contamination alerts. Companies are launching temperature-sensitive indicators designed for meat and seafood, which are among the most common sources of foodborne illness. These indicators help identify breaks in the cold chain before pathogens such as Salmonella or Listeria have a chance to multiply.

Data security and privacy concerns are slowing the adoption of smart packaging, specifically in sectors where consumer data or proprietary logistics information is at stake. As packaging becomes more connected, it becomes a potential entry point for data breaches. For example, when QR codes on product packaging are linked to digital loyalty programs or apps, they can expose users to phishing attacks or malware if not properly secured.

Consumer hesitation is increasing, specifically in Europe, where GDPR regulations impose strict controls on data collection and storage. Several retailers have delayed or limited the rollout of smart packaging features such as personalized offers or usage tracking due to fears of non-compliance. From the corporate side, supply chain visibility features in smart packaging can inadvertently expose sensitive business information.

The emergence of nanomaterials, antimicrobial films, and compostable packaging is creating new avenues for smart packaging companies. Nanomaterials such as zinc oxide nanoparticles and silver-based nanocoatings are used to create active surfaces that inhibit bacterial growth without altering food taste or texture. Antimicrobial films are gaining traction in the pharmaceutical and healthcare sectors. These are used in high-risk medical products such as wound dressings and inhalers, where sterility is essential.

Compostable packaging, once limited to basic biodegradable plastics, is now entering the smart packaging segment through bio-based indicators and sensor-embedded cellulose films. A few companies have developed fully compostable containers with embedded freshness sensors for premium food applications. This type of hybrid solution is expected to be attractive to brands facing pressure to meet ESG targets and smart functionality requirements.

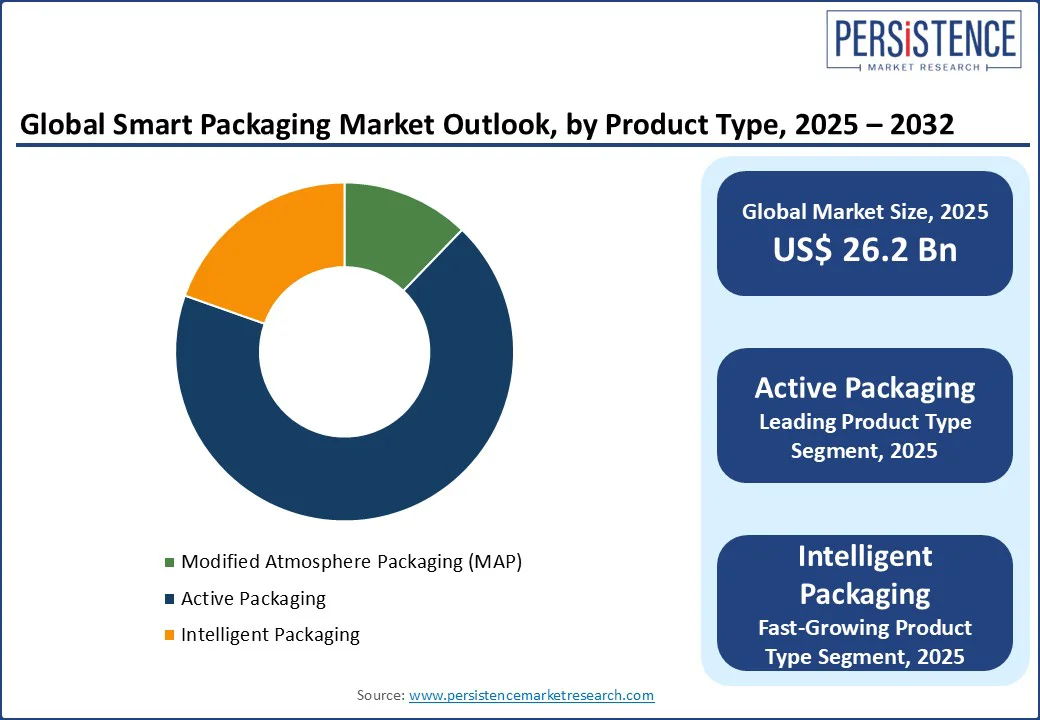

By product type, the market is divided into modified atmosphere packaging, active packaging, and intelligent packaging. Among these, active packaging is poised to hold around 68.2% of the smart packaging market share in 2025 as it directly interacts with the product to extend shelf life and improve safety, making it ideal for perishables. It has gained immense popularity due to its effectiveness in moisture and gas control, specifically for meat, dairy, and seafood. Recent developments have also extended its functionality beyond food. Antimicrobial films, which release natural or synthetic agents, are now widely used in medical packaging to reduce contamination risks.

Intelligent packaging is witnessing considerable growth due to its ability to provide real-time data, which is becoming essential across healthcare, food logistics, and high-value consumer goods segments. Increasing demand for product traceability and anti-counterfeit measures is a key factor behind this surge. In addition, the rise of direct-to-consumer supply chains has played a key role in pushing the segment. In cold-chain logistics, for example, various firms have adopted Bluetooth-enabled smart packaging solutions that transmit live data on temperature and humidity.

By application, the segmentation comprises food and beverages, personal care and cosmetics, pharmaceuticals, electronics, e-commerce, and others. Out of these, food and beverages are anticipated to account for nearly 46.8% share in 2025 due to the sector’s urgent requirement for freshness tracking, shelf-life extension, and contamination prevention. Food products have narrow safety margins and short shelf lives, making features such as time-temperature indicators and oxygen scavengers highly valuable. For instance, Walmart Canada is using smart pallet labels with temperature sensors to assess real-time conditions for meat and dairy transportation.

Pharmaceuticals are emerging as a key application, due to the rising concerns over counterfeiting, strict regulatory demands, and the requirement for better patient adherence. According to the WHO findings, around 10% of medical products available in the low and middle-income countries are either sub-standard or of the lowest quality. Therefore, the significance of adoption smart packaging technologies, including serialization, RFID/NFC-enabled labels, and tamper-evident seals can be a game-changer in these regions.

In 2025, North America is estimated to account for approximately 43.7% of the market share, due to rising demand from the food, beverage, and healthcare sectors. The U.S. smart packaging market is predicted to see a surge in investment in connected packaging technologies. Companies such as 3M, Insignia Technologies, and Avery Dennison are dominating with intelligent solutions that enable freshness tracking, authentication, and real-time supply chain monitoring. The focus has shifted from basic RFID tags to novel features, including time-temperature indicators and oxygen scavengers, specifically in meat and dairy packaging.

With a sharp rise in direct-to-consumer grocery and meal kit services, players are investing in packaging that protects perishable goods and also communicates with consumers. The U.S. Food and Drug Administration (FDA) has encouraged the use of tamper-evident and track-and-trace smart packaging for pharmaceuticals under the Drug Supply Chain Security Act. It is further compelling companies to adopt embedded technologies that go beyond QR codes. In Canada, companies such as Ripple Farms are working on biodegradable smart tags that monitor freshness and compost naturally.

Smart packaging in Europe is developing under the rising pressures of regulatory compliance and sustainability. The European Union’s Circular Economy Action Plan and Green Deal have augmented the move toward eco-friendly and intelligent packaging solutions. Hence, companies are integrating biodegradable smart sensors and paper-based NFC tags to reduce electronic waste. Finland-based Stora Enso has developed renewable fiber-based RFID tags that are gaining traction among retailers for tracking goods without adding plastic or heavy metals.

The food industry is a key adopter, mainly in Western Europe. Supermarkets, including Sainsbury’s and Tesco in the U.K., are experimenting with color-changing freshness indicators for packaged meat and seafood. They are helping customers identify spoilage without opening the pack. In Germany, Wipak introduced smart films that monitor gas levels inside food packaging, allowing better shelf-life prediction. The rise of reusable packaging solutions in Berlin and Amsterdam has also spurred the use of smart QR codes and blockchain-based tracking.

In Asia Pacific, the market has an unbalanced structure, with ongoing adoption in technologically innovative countries and cautious entry in developing markets. Japan and South Korea lead the region in both innovation and deployment. In Japan, several companies have collaborated to launch transparent barrier films with integrated freshness sensors, designed for ready-to-eat meals and bento boxes. South Korea-based cosmetics giants have also embedded NFC-enabled smart labels into skincare packaging to deliver usage tracking and product authentication through their mobile apps, addressing concerns about counterfeits.

China is pursuing a unique approach by linking smart packaging to its massive e-commerce and logistics infrastructure. Platforms, including JD.com and Alibaba, have started using RFID and QR-enabled smart boxes for cold-chain delivery of vaccines and perishable groceries. While the market potential is high in India, adoption is still niche, primarily confined to urban areas and premium products. On the other hand, Singapore is emerging as a testbed for high-tech packaging.

The global smart packaging market is characterized by strategic collaborations between packaging giants, electronics manufacturers, and tech start-ups. Leading companies are partnering with sensor technology firms to develop packaging that enables real-time tracking, freshness indicators, and product authentication. A key trend is the integration of NFC and RFID technologies. The competition is not just about who can embed more tech, but who can achieve commercial viability by balancing functionality, cost, and recyclability. As sustainability mandates become more stringent worldwide, companies that deliver biodegradable smart materials or easy-to-recycle smart components are gaining a competitive advantage.

The smart packaging market is projected to reach US$ 26.2 Bn in 2025.

Rising prevalence of foodborne illnesses and consumer demand for transparency are the key market drivers.

The smart packaging market is poised to witness a CAGR of 5.4% from 2025 to 2032.

Growth in RFID-enabled reusable packaging solutions and deployment of edge computing at the packaging level are the key market opportunities.

Sealed Air Corporation, Amcor PLC, and Multisorb Technologies are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Packaging Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author