ID: PMRREP4707| 210 Pages | 23 Dec 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

The global LTE advanced and 5G market size is valued at US$43.3 billion in 2026 and is projected to reach US$276.0 billion by 2033, growing at a CAGR of 30.3% between 2026 and 2033. This exceptional growth trajectory reflects the accelerating digital transformation across global telecommunications infrastructure and the convergence of mobile connectivity with artificial intelligence-driven applications.

The market's expansion is underpinned by the deployment of 354 commercial 5G networks globally as of March 2025, with 5G connections reaching 2.25 billion worldwide in 2024, representing adoption growth four times faster than 4G at a comparable stage. The proliferation of Internet of Things (IoT) applications, which added 438 million new connections in 2024, bringing the total to 3.6 billion, demonstrates the fundamental shift toward connected ecosystems requiring advanced network infrastructure.

| Key Insights | Details |

|---|---|

|

LTE Advanced and 5G Market Size (2026E) |

US$ 43.3 Bn |

|

Market Value Forecast (2033F) |

US$ 276.0 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

30.3% |

|

Historical Market Growth (CAGR 2020 to 2025) |

19.8% |

The rise in mobile data demand continues to drive the global LTE advanced and 5G market forward at an unprecedented velocity. Global wireless connections have reached 1.5 per person by the end of 2024, up from one connection per person in 2014, fundamentally altering consumption patterns and network utilisation profiles. 5G median download speeds demonstrate 18 times higher performance than 4G, with upload speeds 5 times faster, directly enabling bandwidth-intensive applications such as ultra-high-definition video streaming, real-time interactive gaming, and autonomous vehicle communications.

In North America specifically, 5G coverage has reached 77% of the regional population with 289 million connections by the end of 2024, establishing the benchmark for global adoption curves. This acceleration directly translates into network densification requirements, compelling telecom operators to invest substantially in infrastructure upgrades.

Regulatory environments across developed and emerging economies have catalysed substantial acceleration in LTE Advanced and 5G deployment through systematic spectrum allocation policies and infrastructure investment incentives. The United States Federal Communications Commission (FCC) has aggressively freed additional spectrum for wireless use, including 70 MHz of 600 MHz spectrum repurposed for mobile use and ongoing C-band spectrum (3.7-4.2 GHz) considerations, directly enabling carrier deployment at scale.

The European Union has completed spectrum assignments across 700 MHz low-band and 3.4–3.8 GHz mid-band allocations across all member states except Malta, supporting the EU's Digital Decade 2030 target of 100% outdoor 5G population coverage. China continues demonstrating policy-driven deployment momentum, with China Mobile investing over US$1.8 billion to upgrade 400,000 base stations for 5G-A coverage across 18 Beijing locations, including airports and campuses. These regulatory frameworks create essential conditions for the Global LTE Advanced and 5G Market expansion by establishing legal certainty, reducing deployment friction, and catalysing private-sector infrastructure investment that would otherwise remain constrained by policy ambiguity.

5G network deployment costs range from US$10 billion to US$50 billion per country, depending on geographic scale, population density, existing infrastructure maturity, and regulatory compliance obligations. Individual 5G macrocells require approximately US$200,000 in capital investment, with small cells averaging US$10,000 per installation, creating significant financial barriers for operators in capital-constrained emerging markets. Supply chain disruptions have generated 30% equipment cost increases due to semiconductor shortages, directly impacting deployment timelines and return-on-investment calculations for infrastructure operators.

Telecom carriers have responded by reducing capital expenditure budgets by 15–20% in select markets due to inflation pressures and elevated interest rates, creating temporary delays in network densification critical for LTE Advanced and 5G service commercialisation timelines. This cost structure fundamentally constrains the addressable market opportunity in developing geographies where carrier profitability remains limited.

India's emergence as a significant 5G market demonstrates the untapped opportunity within densely populated emerging geographies. India achieved 301.86 Mbps median 5G download speeds by 2023, ranking 14th worldwide, with nationwide 5G availability surging from 28.1% in Q1 2023 to 52.0% in Q4 2023 through accelerated base station rollout exceeding 400,000 deployments.

Reliance Jio's dominant 68.8% 5G coverage compared to Airtel's 30.4% demonstrates competitive intensity and capital commitment levels that will sustain infrastructure investment momentum. Vodafone Idea (Vi) is set to launch commercial 5G services in March 2025 with planned deployment of 75,000 5G sites over three years, indicating continued infrastructure investment despite the region's relatively recent market entry phase.

The global LTE advanced and 5G market is positioned to capture substantial revenue from this infrastructure buildout phase as equipment vendors, software platform providers, and professional services firms execute deployment projects across the region. India's projected GDP growth and manufacturing sector expansion create secondary demand drivers supporting long-term network utilisation and revenue stability.

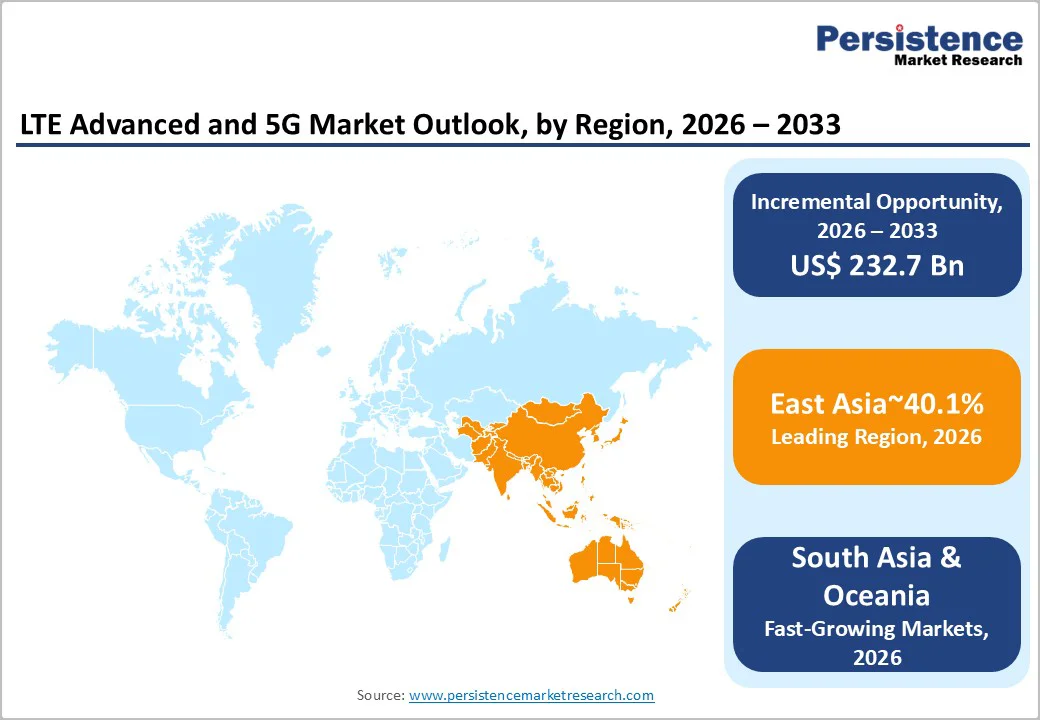

Asia Pacific is anticipated contribution to the global 5G radio access network markets through smart city initiatives and technology adoption acceleration, further validating the opportunity thesis, as capital allocation patterns suggest this region will emerge as the fastest-growing market through 2033.

5G-Advanced (Release-18) commercialization represents a frontier opportunity within the Global LTE Advanced and 5G Market, with 26 telcos across 15 countries currently investing in 5G-A infrastructure and six having achieved commercial launch status, primarily concentrated in Asia Pacific. China Mobile's commercial 5G-A network deployment covering 250 cities and counties, with planned nationwide expansion by the end of 2024 and full commercialisation targeting 2026, establishes a forward-looking commercialisation roadmap. The industry consensus anticipates 75% of 5G base stations will be upgraded to 5G-Advanced by 2030, five years post-estimated commercial launch, signifying sustained infrastructure capital requirements throughout the forecast period.

5G-Advanced enables extended reality (XR) applications, artificial intelligence-driven network optimisation, and enterprise-focused use cases, including autonomous vehicle communications, remote industrial operations, and predictive healthcare applications that create differentiated service revenue opportunities. The integration of AI/ML into network optimisation processes will become essential for telecom operators, creating ancillary market opportunities for software solutions, analytics platforms, and managed service offerings that extend beyond traditional connectivity revenue streams.

Market expansion arising from 5G-A commercialisation will generate multi-wave upgrade cycles supporting the Global LTE Advanced and 5G Market's continued growth trajectory through consumer device upgrades, enterprise private network expansions, and geographic deployment extensions into underserved markets.

Network element components, including radio access networks (RAN), core network infrastructure, and transport network equipment, command the dominant market share at 77.4% in 2026, reflecting the capital-intensive nature of telecommunications infrastructure deployment. This segment encompasses macrocells, small cells, massive MIMO solutions, antenna systems, and backhaul equipment required for comprehensive network coverage and capacity expansion. Major equipment vendors, including Ericsson, Nokia, Huawei, Samsung, and Qualcomm, derive substantial revenue from Network Element sales to global telecom operators executing 5G infrastructure buildout initiatives.

Services represent the fastest-growing component segment within the Global LTE Advanced and 5G Market, encompassing network monitoring, optimisation, managed security services, and value-added telecommunications applications.

Service revenue emerges upon infrastructure completion and enters commercialisation phases, creating structural revenue acceleration opportunities once substantial deployed capital bases are operational. Cloud-based network orchestration platforms, artificial intelligence-driven optimisation software, and cybersecurity solutions constitute primary service growth drivers as operators prioritise network efficiency, reduced operational expenditure (OPEX), and security compliance.

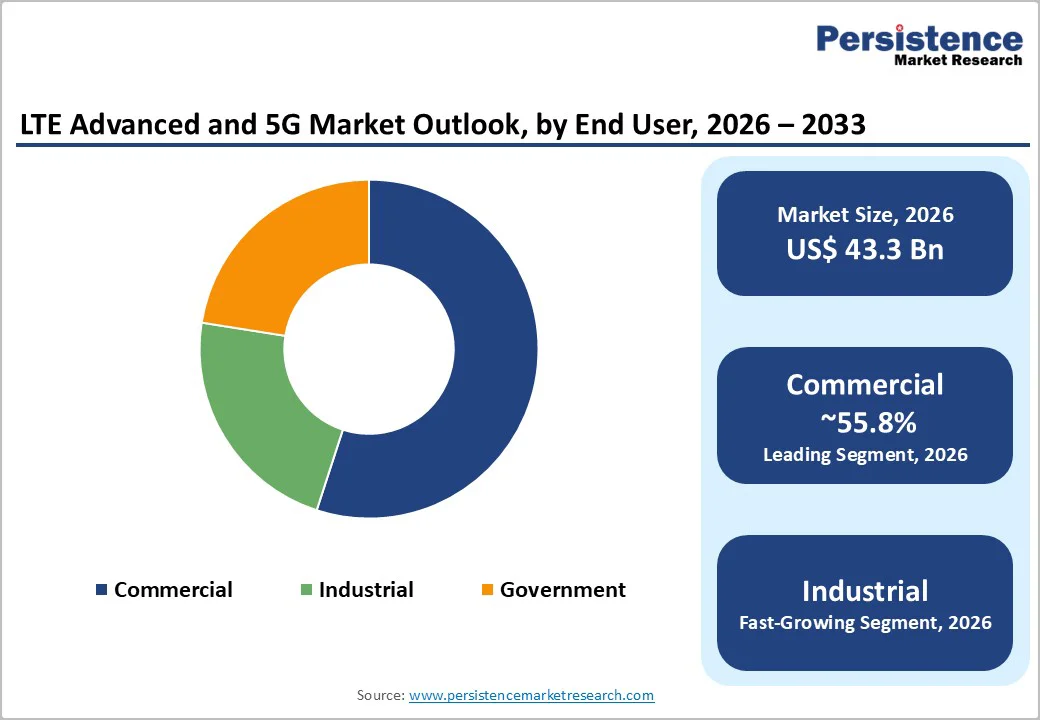

Commercial enterprises represent the market-leading End-user segment at 55.8% market share in 2026, comprising telecommunications service providers, managed service operators, and enterprise End-users implementing private 5G networks within their facilities. This segment demonstrates the highest service quality requirements, the most stringent availability specifications, and the greatest capital allocation toward telecommunications infrastructure and services.

The Commercial segment's dominance reflects the maturity of business telecommunications markets, established procurement processes, and clear return-on-investment justification for capital allocation toward next-generation connectivity infrastructure. Commercial entities prioritise reliable connectivity as a fundamental operational requirement supporting revenue-generating activities across multiple industry verticals.

Industrial End-users represent the fastest-growing segment within the Global LTE Advanced and 5G Market, encompassing manufacturing facilities, mining operations, transportation infrastructure, and utility companies deploying LTE Advanced and 5G technologies for process automation, remote asset management, and predictive maintenance applications. This segment demonstrates the highest growth velocity as industrial automation investments accelerate globally, driven by labour cost pressures, productivity optimisation objectives, and competitive intensity within manufacturing sectors.

North America maintains the position as the leading 5G market globally, representing approximately 22.5% of the Global LTE Advanced and 5G Market, with established network infrastructure supporting early-stage commercialisation initiatives. The region achieved 289 million 5G connections by the end of 2024, representing 67% year-over-year growth from 196 million connections in 2023, with 77% regional population coverage established ahead of other developed markets. 5G Availability in the United States reached 56%, supported by low-band 600 MHz deployments providing broader coverage than higher-frequency alternatives and substantial 5G-capable device penetration, establishing the foundation for accelerated service adoption.

North America's market leadership derives from multiple structural advantages: advanced regulatory frameworks enabling efficient spectrum allocation, mature telecommunications infrastructure supporting rapid 5G overlay deployment, and substantial operator capital investment capacity supporting aggressive network expansion initiatives.

The region achieved parity between 5G and 4G LTE network deployment counts, establishing a unique market milestone of simultaneous legacy technology maintenance and next-generation network buildout. Major carrier consolidation, including T-Mobile's proposed US$4.4 billion acquisition of UScellular assets, demonstrates ongoing infrastructure rationalisation supporting network efficiency and spectrum aggregation optimisation.

North America's market dynamics emphasise commercial services development, private enterprise network deployment, and premium consumer segments supporting higher service pricing and differentiated service capabilities. The region continues attracting substantial private equity investment in fiber infrastructure, with Verizon's US$20 billion Frontier Communications acquisition, AT&T's US$5.75 billion Lumen Mass Markets fiber acquisition, and multiple private equity partnerships supporting broadband access expansion initiatives.

East Asia commands approximately 40.1% of the Global LTE Advanced and 5G Market, representing the fastest-growing regional segment driven by aggressive government policy support, manufacturing sector digitalisation initiatives, and substantial carrier capital deployment across China, South Korea, and Japan.

China Mobile's US$1.8 billion 5G-A infrastructure investment demonstrates a sustained commitment to next-generation network standards ahead of international competitor deployment timelines. Chinese operators' strategic exploration of enterprise and low altitude use cases, including drones, navigation, and smart driving applications establishes a differentiated application ecosystem development supporting premium service monetisation opportunities.

East Asia's market dynamics reflect state-directed digitalization objectives, with government agencies actively supporting telecommunications infrastructure investment through policy mechanisms and targeted capital allocation.

Europe represents approximately 17.2% of the Global LTE Advanced and 5G Market, characterised by fragmented deployment dynamics, regional regulatory variation, and differentiated coverage advancement across member states.

Nordic and Southern European nations, including Sweden and Italy, demonstrate significant 5G availability gains exceeding 40% through 700 MHz band deployments and Dynamic Spectrum Sharing technologies, while Central and Western regions lag substantially behind market leaders. EU mobile users spend 44.5% of their time on 5G networks as of Q2 2025, up from 32.8% annually prior, reflecting progressive network adoption and improving service availability.

Europe's market dynamics emphasise regulatory harmonization, competitive operator protection, and rural coverage obligations supporting equitable geographic service distribution. The completion of pioneer band spectrum assignments across EU member states except Malta represents a major policy milestone, reducing fragmentation and supporting standardised technology deployment across the region. Spain's exceptional achievement of 8% 5G SA market share compared to EU averages of 1.3% demonstrates targeted policy intervention effectiveness through EU recovery fund mechanisms supporting coverage expansion in underserved areas.

The global LTE advanced and 5G market is consolidated, dominated by a few leading telecom equipment providers that hold significant market share and technological expertise. Key players such as Huawei Technologies Co., Ltd., Nokia, Ericsson, Samsung, and ZTE Corporation lead the market with extensive portfolios spanning network infrastructure, software solutions, and advanced 5G deployment capabilities. The market is characterized by high entry barriers due to substantial capital requirements, regulatory complexities, and the need for continuous innovation in radio access networks, core network solutions, and spectrum technologies. Intense competition exists among these incumbents, who differentiate themselves through advanced technology, large-scale deployments, and strategic partnerships with telecom operators globally.

Smaller players and regional vendors exist but have limited influence, making the market largely oligopolistic in nature, with innovation and scale being critical success factors. The ongoing rollout of 5G and LTE Advanced networks continues to reinforce the dominance of these major players while driving investment in next-generation network technologies.

The global LTE advanced and 5G market is projected to be valued at US$ 43.3 Bn in 2026.

The network element segment is expected to account for approximately 77.4% of the global LTE Advanced and 5G Market by Component in 2026.

The LTE advanced and 5G market is expected to witness a CAGR of 30.3% from 2026 to 2033.

Explosive mobile data demand and expanding device connectivity, reinforced by global spectrum allocations and pro-5G policy frameworks, propel the rapid adoption of LTE Advanced and 5G technologies worldwide.

Opportunities in the LTE Advanced and 5G Market arise from rapid 5G rollout in emerging Asia Pacific, commercialization of 5G-Advanced technologies, enterprise digitalisation demand, AI-driven network optimization, and large-scale smart city infrastructure deployments.

The key players in the LTE Advanced and 5G market include Huawei Technologies Co., Ltd., Nokia, Ericsson, Samsung, ZTE Corporation, and Qualcomm Technologies, Inc.

| Report Attribute | Details |

|---|---|

|

Forecast Period |

2026 to 2033 |

|

Historical Data Available for |

2020 to 2025 |

|

Market Analysis |

USD Million for Value |

|

Region Covered |

|

|

Key Companies Covered |

|

|

Report Coverage |

|

By Solution

By Technology

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author