- Executive Summary

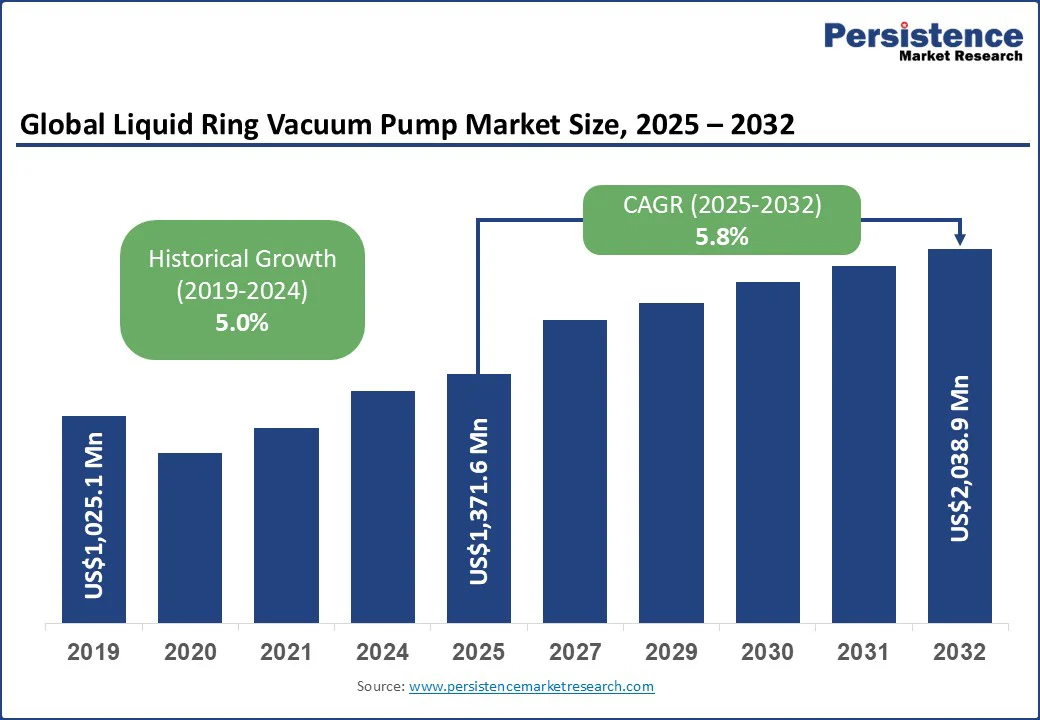

- Global Liquid Ring Vacuum Pump Market Snapshot 2024 and 2032

- Market Opportunity Assessment, 2025-2032, US$ Mn

- Key Market Trends

- Industry Developments and Key Market Events

- Demand Side and Supply Side Analysis

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definitions

- Value Chain Analysis

- Macro-Economic Factors

- Global GDP Outlook

- Global Pump Sales Overview by Region

- Global Chemical & Petrochemical Production Trends

- Global Oil & Gas Exploration and Refining Activity

- Global Water & Wastewater Treatment Investments

- Forecast Factors – Relevance and Impact

- COVID-19 Impact Assessment

- PESTLE Analysis

- Porter's Five Forces Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Technology Landscape

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Price Trend Analysis, 2019 – 2032

- Region-wise Price Analysis

- Price by Segments

- Price Impact Factors

- Global Liquid Ring Vacuum Pump Market Outlook:

- Key Highlights

- Global Liquid Ring Vacuum Pump Market Outlook: Product Type

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Product Type, 2019-2023

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Product Type, 2025-2032

- Single Stage Pump

- Two Stage Pump

- Market Attractiveness Analysis: Product Type

- Global Liquid Ring Vacuum Pump Market Outlook: Material Type

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Material Type, 2019-2023

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Material Type, 2025-2032

- Stainless Steel

- Cast Iron

- Others

- Market Attractiveness Analysis: Material Type

- Global Liquid Ring Vacuum Pump Market Outlook: Flowrates

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Flowrates, 2019-2023

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Flowrates, 2025-2032

- 25 – 600 m³/h

- 600 – 3,000 m³/h

- 3,000 – 10,000 m³/h

- Over 10,000 m³/h

- Market Attractiveness Analysis: Flowrates

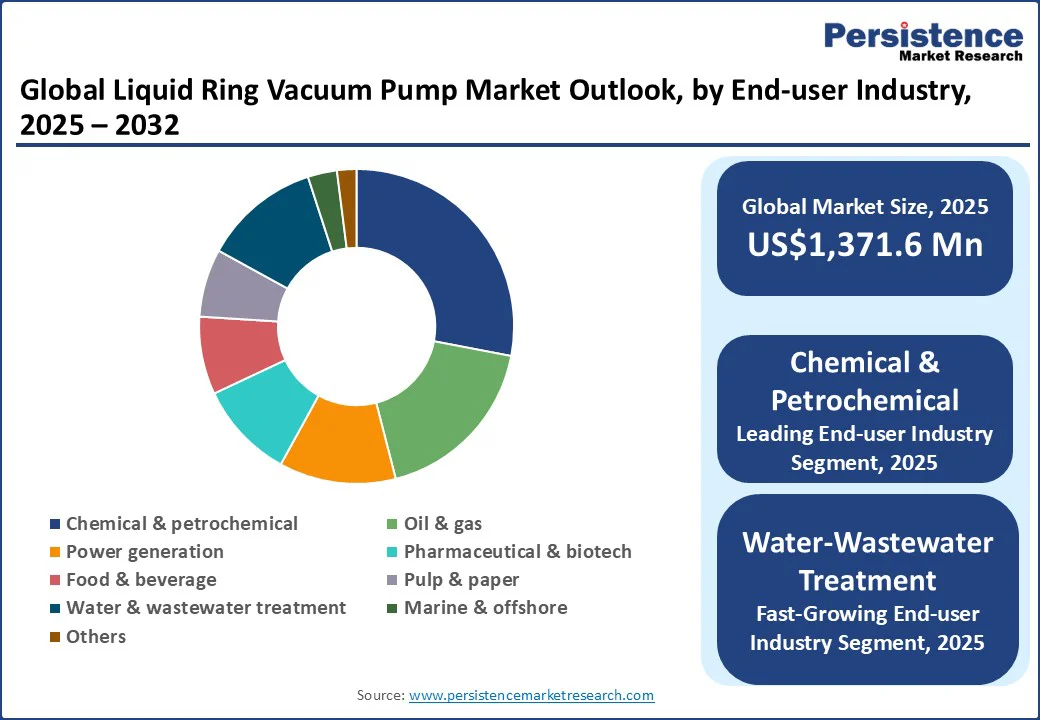

- Global Liquid Ring Vacuum Pump Market Outlook: End-user Industry

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by End-user Industry, 2019-2023

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by End-user Industry, 2025-2032

- Chemical & Petrochemical

- Oil & Gas

- Power Generation

- Pharmaceutical & Biotech

- Food & Beverage

- Pulp & Paper

- Water & Wastewater Treatment

- Marine & Offshore

- Others

- Market Attractiveness Analysis: End-user Industry

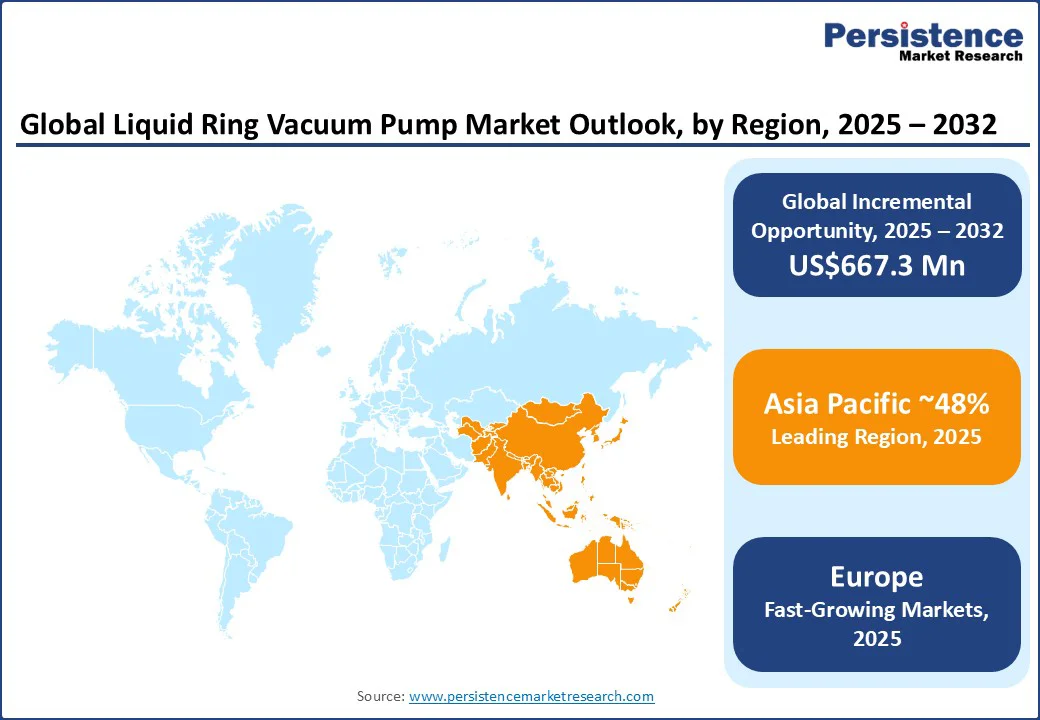

- Global Liquid Ring Vacuum Pump Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Region, 2019-2023

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Region, 2025-2032

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Liquid Ring Vacuum Pump Market Outlook:

- Key Highlights

- Pricing Analysis

- North America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country, 2025-2032

- U.S.

- Canada

- North America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Product Type, 2025-2032

- Single Stage Pump

- Two Stage Pump

- North America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Material Type, 2025-2032

- Stainless Steel

- Cast Iron

- Others

- North America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Flowrates, 2025-2032

- 25 – 600 m³/h

- 600 – 3,000 m³/h

- 3,000 – 10,000 m³/h

- Over 10,000 m³/h

- North America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by End-user Industry, 2025-2032

- Chemical & Petrochemical

- Oil & Gas

- Power Generation

- Pharmaceutical & Biotech

- Food & Beverage

- Pulp & Paper

- Water & Wastewater Treatment

- Marine & Offshore

- Others

- Europe Liquid Ring Vacuum Pump Market Outlook:

- Key Highlights

- Pricing Analysis

- Europe Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country, 2025-2032

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- Rest of Europe

- Europe Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Product Type, 2025-2032

- Single Stage Pump

- Two Stage Pump

- Europe Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Material Type, 2025-2032

- Stainless Steel

- Cast Iron

- Others

- Europe Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Flowrates, 2025-2032

- 25 – 600 m³/h

- 600 – 3,000 m³/h

- 3,000 – 10,000 m³/h

- Over 10,000 m³/h

- Europe Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by End-user Industry, 2025-2032

- Chemical & Petrochemical

- Oil & Gas

- Power Generation

- Pharmaceutical & Biotech

- Food & Beverage

- Pulp & Paper

- Water & Wastewater Treatment

- Marine & Offshore

- Others

- East Asia Liquid Ring Vacuum Pump Market Outlook:

- Key Highlights

- Pricing Analysis

- East Asia Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country, 2025-2032

- China

- Japan

- South Korea

- East Asia Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Product Type, 2025-2032

- Single Stage Pump

- Two Stage Pump

- East Asia Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Material Type, 2025-2032

- Stainless Steel

- Cast Iron

- Others

- East Asia Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Flowrates, 2025-2032

- 25 – 600 m³/h

- 600 – 3,000 m³/h

- 3,000 – 10,000 m³/h

- Over 10,000 m³/h

- East Asia Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by End-user Industry, 2025-2032

- Chemical & Petrochemical

- Oil & Gas

- Power Generation

- Pharmaceutical & Biotech

- Food & Beverage

- Pulp & Paper

- Water & Wastewater Treatment

- Marine & Offshore

- Others

- South Asia & Oceania Liquid Ring Vacuum Pump Market Outlook:

- Key Highlights

- Pricing Analysis

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country, 2025-2032

- India

- Southeast Asia

- ANZ

- Rest of SAO

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Product Type, 2025-2032

- Single Stage Pump

- Two Stage Pump

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Material Type, 2025-2032

- Stainless Steel

- Cast Iron

- Others

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Flowrates, 2025-2032

- 25 – 600 m³/h

- 600 – 3,000 m³/h

- 3,000 – 10,000 m³/h

- Over 10,000 m³/h

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by End-user Industry, 2025-2032

- Chemical & Petrochemical

- Oil & Gas

- Power Generation

- Pharmaceutical & Biotech

- Food & Beverage

- Pulp & Paper

- Water & Wastewater Treatment

- Marine & Offshore

- Others

- Latin America Liquid Ring Vacuum Pump Market Outlook:

- Key Highlights

- Pricing Analysis

- Latin America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country, 2025-2032

- Brazil

- Mexico

- Rest of LATAM

- Latin America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Product Type, 2025-2032

- Single Stage Pump

- Two Stage Pump

- Latin America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Material Type, 2025-2032

- Stainless Steel

- Cast Iron

- Others

- Latin America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Flowrates, 2025-2032

- 25 – 600 m³/h

- 600 – 3,000 m³/h

- 3,000 – 10,000 m³/h

- Over 10,000 m³/h

- Latin America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by End-user Industry, 2025-2032

- Chemical & Petrochemical

- Oil & Gas

- Power Generation

- Pharmaceutical & Biotech

- Food & Beverage

- Pulp & Paper

- Water & Wastewater Treatment

- Marine & Offshore

- Others

- Middle East & Africa Liquid Ring Vacuum Pump Market Outlook:

- Key Highlights

- Pricing Analysis

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country, 2025-2032

- GCC Countries

- South Africa

- Northern Africa

- Rest of MEA

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Product Type, 2025-2032

- Single Stage Pump

- Two Stage Pump

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Material Type, 2025-2032

- Stainless Steel

- Cast Iron

- Others

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Flowrates, 2025-2032

- 25 – 600 m³/h

- 600 – 3,000 m³/h

- 3,000 – 10,000 m³/h

- Over 10,000 m³/h

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by End-user Industry, 2025-2032

- Chemical & Petrochemical

- Oil & Gas

- Power Generation

- Pharmaceutical & Biotech

- Food & Beverage

- Pulp & Paper

- Water & Wastewater Treatment

- Marine & Offshore

- Others

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles

- Busch Vacuum Solutions

- Company Overview

- Product Portfolio/Offerings

- Key Financials

- SWOT Analysis

- Company Strategy and Key Developments

- Atlas Copco

- Gardner Denver

- DEKKER Vacuum Technologies

- Elmo Rietschle

- Pfeiffer Vacuum

- Edwards Vacuum

- Graham Manufacturing

- Vacuubrand

- Vacuum Research Corporation

- Kinney Vacuum

- Tuthill Vacuum & Blower Systems

- Metallurgical High Vacuum Corporation

- ACI Medical

- Binaca Pumps

- Busch Vacuum Solutions

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment