ID: PMRREP4376| 165 Pages | 18 Aug 2025 | Format: PDF, Excel, PPT* | Industrial Automation

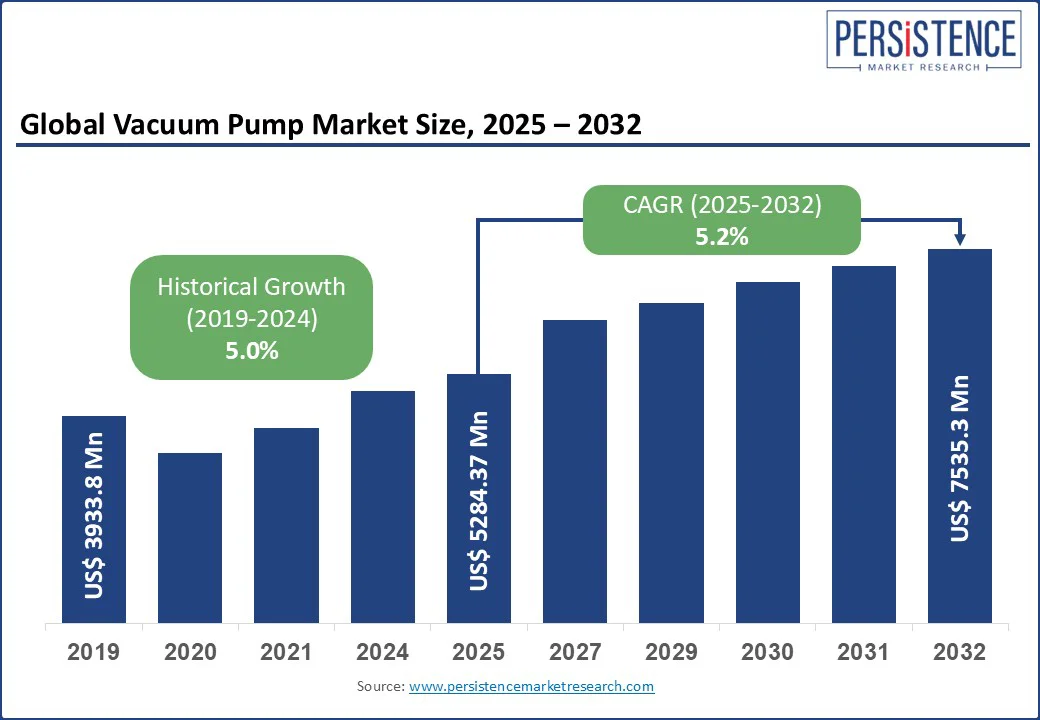

The global Vacuum Pump Market size is likely to be valued at US$5284.37 Mn in 2025 and is estimated to reach US$7535.3 Mn by 2032, growing at a CAGR of 5.2% during the forecast period 2025 - 2032.

The vacuum pump market is driven by increasing demand for diaphragm pumps, scroll pumps, and liquid ring pumps, as well and thin film deposition and energy-efficient vacuum pump solutions. Adoption of energy-efficient and oil-free vacuum pumps in line with EU environmental regulations. There is high demand from Germany, the UK, France, and Italy for industrial automation and laboratory applications.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Vacuum Pump Market Size (2025E) |

US$5284.37 Mn |

|

Market Value Forecast (2032F) |

US$7535.3 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.0% |

The vacuum pump market is driven by several key factors, with a significant focus on the rising demand for vacuum pumps in electronics and semiconductors, particularly for thin film deposition processes. The global semiconductor market grew by 15% in 2025, with vacuum pumps critical for processes such as chemical vapor deposition and etching, which rely on diaphragm pumps, scroll pumps, and high-performance rotary vane vacuum pumps. A 2025 industry report noted that 60% of semiconductor manufacturing facilities use dry vacuum pumps to ensure contamination-free environments, boosting demand for oil-sealed vs dry vacuum pump systems.

Companies such as Intel and TSMC increased vacuum pump adoption by 20% in 2025 to support advanced chip production. The electronics and semiconductors sector’s growth, driven by 5G, IoT, and AI technologies, fuels demand for compact vacuum pump design and multi-stage vacuum pumps, with US$100 Bn invested in semiconductor manufacturing globally in 2025. Additionally, energy-efficient vacuum pump solutions align with sustainability goals, reducing energy consumption by 15%, per a 2025 study, further driving market growth in vacuum pump manufacturing and gas transfer systems.

High initial and maintenance costs pose a significant restraint to the vacuum pump market, impacting vacuum pump maintenance and the adoption of advanced systems. Dry vacuum pumps and multi-stage vacuum pumps, such as scroll pumps and liquid ring pumps, require sophisticated technologies such as pump sealing technology, increasing capital costs by 20-25% compared to traditional pumps, 2025.

Vacuum pump maintenance is costly, with 30% of industrial facilities reporting 10% higher service expenses for high-performance rotary vane vacuum pumps. Small and medium enterprises in emerging markets such as India and Africa face barriers, with 40% opting for cheaper alternatives in 2025, limiting the adoption of energy-efficient vacuum pump solutions.

Additionally, supply chain disruptions for specialized components, with 12% cost increases in 2025, challenge vacuum pump manufacturing, particularly for pressure-lowering pumps and low-pressure pump applications in chemicals and oil & gas.

The growth in energy-efficient vacuum pump solutions presents a significant opportunity for the vacuum pump market, driven by global sustainability trends and regulatory pressures. Energy-efficient vacuum pump solutions reduce power consumption by 15-20%, aligning with regulations such as the EU’s Ecodesign Directive, which mandates 30% energy savings in industrial equipment by 2030.

Dry vacuum pumps, with oil-sealed vs dry vacuum pump systems gaining traction, are ideal for electronics and semiconductors, as well as medical suction equipment, with 20% adoption growth in 2025. Companies such as Atlas Copco and Busch Vacuum Solutions are investing US$ 200 Mn in R&D for compact vacuum pump design and pump sealing technology, enhancing efficiency in HVAC systems and thin film deposition.

Emerging markets, with 1.5 Bn new industrial units projected by 2030, offer opportunities for vacuum extraction pump and multi-stage vacuum pumps in food & beverages and chemicals, positioning energy-efficient vacuum pump solutions as a key growth driver.

Positive Displacement Pumps hold approximately 40% of the market share in 2025 due to their versatility in vacuum extraction pump and low-pressure pump applications across chemicals and oil & gas. Diaphragm pump and liquid ring pump dominate, with 50% adoption in industrial processes in 2025.

Rotary Vane Pumps is driven by high-performance rotary vane vacuum pumps in food & beverages and HVAC systems, with 15% growth in 2025. In HVAC systems, these pumps play a critical role in air conditioning servicing, refrigerant recovery, and system evacuation, ensuring optimal system performance and energy efficiency.

Wet Vacuum Pumps command a 55% market share in 2025, driven by liquid ring pump applications in chemicals and oil & gas, with 60% adoption in heavy industries in 2025. Their ability to operate reliably in harsh environments, manage condensable vapors without performance loss, and provide explosion-proof operation makes them a preferred choice over dry pumps in these settings.

Dry Vacuum Pumps are fueled by oil-sealed vs dry vacuum pump systems in electronics and semiconductors, with 20% growth in thin film deposition applications in 2025. The development is further supported by the increasing complexity of semiconductor designs and the push toward higher wafer yields, where contamination control is critical.

Electronics and Semiconductors hold a 30% market share in 2025, driven by thin film deposition and scroll pump applications, with 25% of semiconductor facilities using dry vacuum pumps in 2025. These processes require ultra-clean and stable vacuum environments to ensure high-quality microchips and electronic components, making vacuum technology indispensable for the industry.

Chemicals are fueled by vacuum extraction pump and pressure-lowering pump applications, with 15% growth in 2025. Vacuum extraction pumps help in removing gases and vapors from reaction vessels and distillation columns, which improves product purity and yield by maintaining optimal pressure conditions.

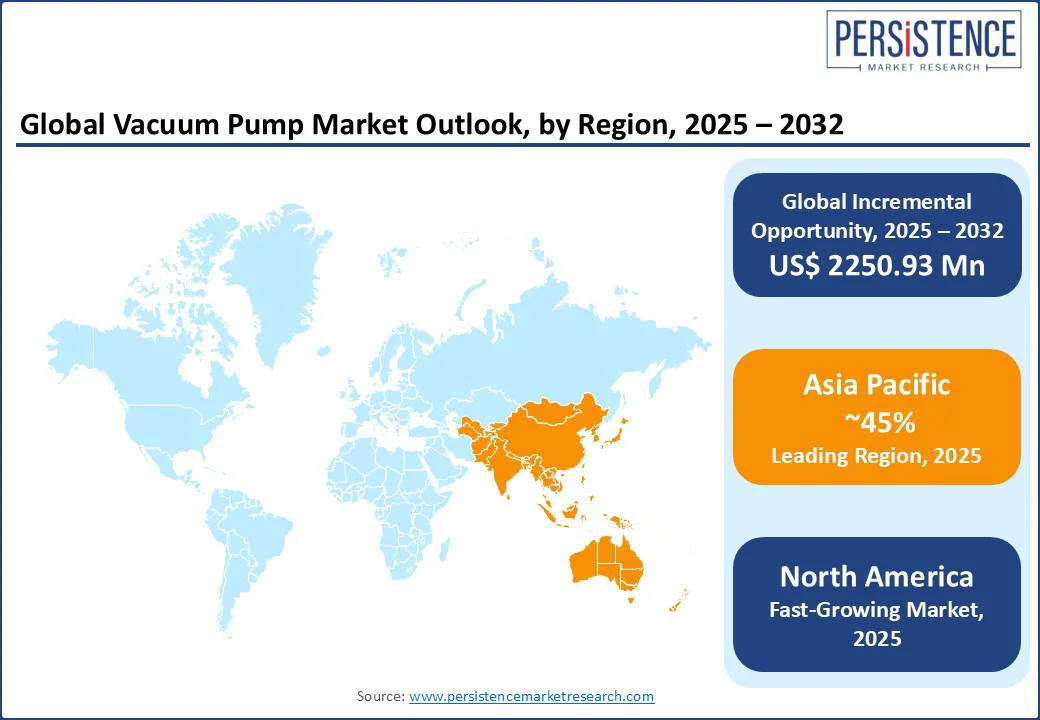

In North America, the vacuum pump market holds a distinct position, commanding a 22% market share in 2025. The U.S. dominates due to its advanced electronics and semiconductor industry and high demand for energy-efficient vacuum pump solutions. The U.S. market grows, driven by thin film deposition and medical suction equipment, with 40% of semiconductor plants using dry vacuum pumps in 2025.

HVAC systems and scroll pump applications grow by 12% annually, supported by compact vacuum pump design. Vacuum pump maintenance services see 15% growth, enhancing system reliability. Atlas Copco and Edwards drive 25% of regional revenue, supported by robust vacuum pump manufacturing and gas transfer systems.

In Europe, the vacuum pump market accounts for a 20% market share, led by Germany, the UK, and France. Germany’s market is driven by chemicals and diaphragm pump applications, with 50% of chemical plants using wet vacuum pumps in 2025. The EU’s Ecodesign Directive boosts energy-efficient vacuum pump solutions, with 20% growth in pump sealing technology. The UK’s focus on food & beverages supports the adoption of liquid ring pumps by Nestlé and Unilever. France’s electronics sector drives 15% growth in scroll pump applications. €150 Mn in EU funding for green technologies in 2025 enhances multi-stage vacuum pumps.

Asia Pacific is the fastest-growing region, holding a 45% market share, led by China, Japan, and India. China has a 40% regional market share, driven by a 25% increase in electronics and semiconductors production in 2025, boosting thin film deposition and dry vacuum pumps. Japan’s market is fueled by medical suction equipment and compact vacuum pump design, with 20% growth in HVAC systems.

India’s market is driven by chemicals and vacuum extraction pump applications, with 90% of new chemical plants using liquid ring pumps in 2025. Energy-efficient vacuum pump solutions and pump sealing technology, supported by US$30 Bn in industrial investments by 2030, drive innovation.

The global vacuum pump market is marked by fierce competition, with vacuum pump manufacturing companies competing on innovation, efficiency, and sustainability. Atlas Copco and Busch Vacuum Solutions dominate in dry vacuum pumps, while Pfeiffer Vacuum leads in high-performance rotary vane vacuum pumps. Oil-sealed vs dry vacuum pump systems, multi-stage vacuum pumps, and energy-efficient vacuum pump solutions add a competitive layer. Strategic partnerships and R&D investments in pump sealing technology are key differentiators.

The vacuum pump market is projected to reach US$ 5284.37 Mn in 2025.

Rising demand in electronics and semiconductors, HVAC systems, and energy-efficient vacuum pump solutions are key drivers.

The vacuum pump market grows at a CAGR of 5.2% from 2025 to 2032, reaching US$ 7535.3 Mn by 2032.

Opportunities include energy-efficient vacuum pump solutions, multi-stage vacuum pumps, and expansion in chemicals and electronics.

Key players include Atlas Copco, Busch Vacuum Solutions, Pfeiffer Vacuum, Ingersoll Rand, Edwards, Becker Pumps, Ebara Corporation, Flowserve Corporation, and ULVAC Inc.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Units |

Value: US$ Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Technology

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author