ID: PMRREP33151| 191 Pages | 10 Sep 2025 | Format: PDF, Excel, PPT* | Food and Beverages

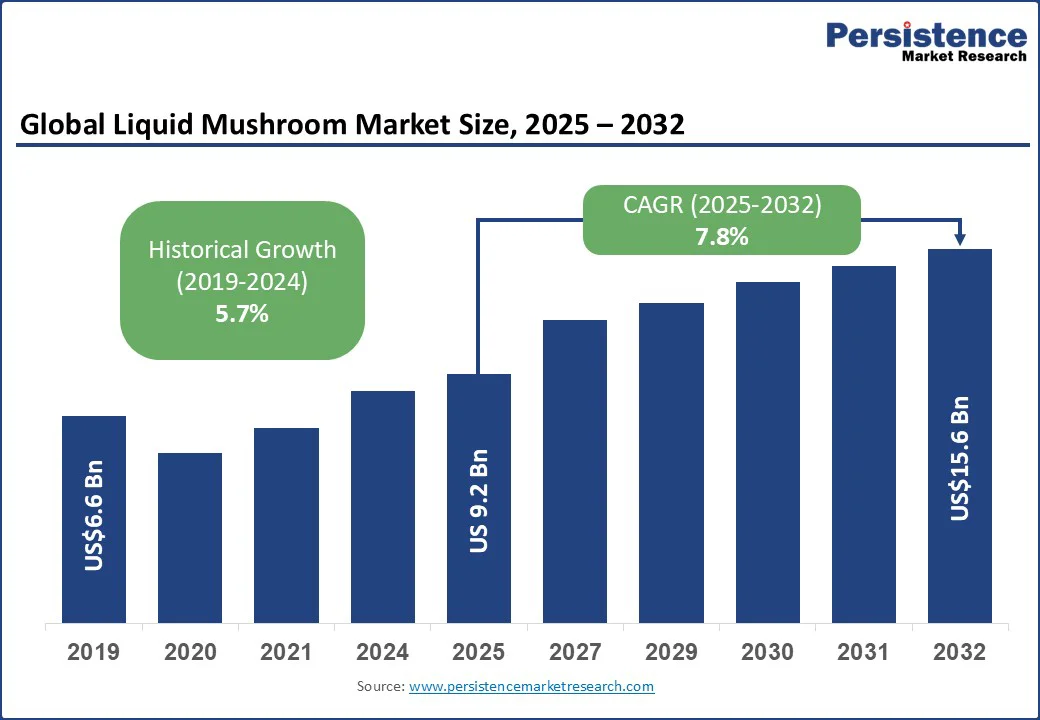

The global liquid mushroom market size is likely to be valued at US$9.2 Bn in 2025 and is estimated to reach US$15.6 Bn in 2032, growing at a CAGR of 7.8% during the forecast period 2025-2032.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Liquid Mushroom Market Size (2025E) |

US$9.2 Bn |

|

Market Value Forecast (2032F) |

US$15.6 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.7% |

The liquid mushroom market growth is being fueled by their ability to fill the gap between traditional herbal medicine and modern health trends. The liquid formulation offers benefits such as immune support, stress reduction, and improved cognitive performance. It appeals to both seasoned wellness enthusiasts and newcomers seeking natural alternatives to conventional supplements.

The surging recognition of liquid mushrooms as multifunctional health boosters is augmenting demand as consumers are seeking all-in-one natural solutions rather than juggling multiple supplements. Immunity, stress management, and cognitive health are usually addressed with separate products. Liquid mushroom blends are now being positioned as a single and convenient alternative.

California-based MUDWTR, for example, markets its liquid mushroom concentrates as a coffee replacement that supports energy, strengthens immunity, and aids mental clarity. This bundling of benefits into one format is appealing to young consumers who prefer a few products with broad functionality. Demand is also being spurred by the rising preference for natural mental health aids at a time when stress and burnout are widespread.

Quality and potency concerns are key hurdles for liquid mushroom adoption, as consumers are becoming discerning about what goes into their functional wellness products. Mushrooms are highly sensitive to growing conditions, substrates, and extraction methods. These directly affect the levels of bioactive compounds such as polysaccharides, triterpenes, and beta-glucans. Inconsistencies in these factors often lead to products that vary widely in efficacy, hindering consumer trust.

Small and unregulated brands often advertise benefits such as immunity or cognitive improvement without providing verified lab data. It leads to skepticism among health-conscious buyers. Potency issues are further compounded by the widespread use of mycelium powders rather than fruiting bodies. Brands that rely on mycelium tend to provide cheaper products, but savvy consumers seek fruiting-body extracts to ensure effectiveness.

The rising acceptance of plant-based diets is creating a new opportunity for liquid mushroom brands as modern consumers view mushrooms not just as an alternative protein, but also as a functional superfood. Unlike soy or pea protein, mushrooms carry a reputation for medicinal and adaptogenic properties. These enable liquid mushroom brands to stand out in a crowded plant-based nutrition space. For instance, while oat and almond milk compete in the dairy alternatives market, mushroom-based beverages have gained popularity by promising stress relief, immunity boosts, and cognitive support.

The trend is evident in the U.S. and Europe, where consumers shifting away from dairy are simultaneously looking for beverages with nootropics or adaptogens. In the Asia Pacific, mushroom consumption has always been rooted in traditional medicine. Hence, the shift to plant-based diets is improving the cultural acceptance of mushroom-based drinks. For example, in Japan and South Korea, where flexitarianism is on the rise, mushroom lattes and concentrates are being marketed as a bridge between cultural familiarity and modern health trends.

By nature, the market is bifurcated into organic and conventional. Among these, conventional liquid mushroom extracts are predicted to hold around 63.2% share in 2025, owing to their ability to cater to consumer expectations of simplicity and familiarity. Most wellness users are still at an early stage of experimenting with mushrooms as functional ingredients. Hence, they are shifting toward products that feel straightforward, safe, and rooted in traditional practices. Conventional tinctures, typically alcohol-based dual extracts from fruiting bodies, fit this space perfectly.

Organic liquid mushroom products are gaining traction as they tap into consumer skepticism around agricultural inputs and extraction purity. Shoppers who are already wary of pesticide residues in fruits and vegetables extend that concern to functional food and supplements. Mushrooms, being highly absorbent organisms, are particularly sensitive to contaminants in their growing medium. This makes the certified organic label more than just a marketing buzzword, as it acts as a reassurance of clean sourcing.

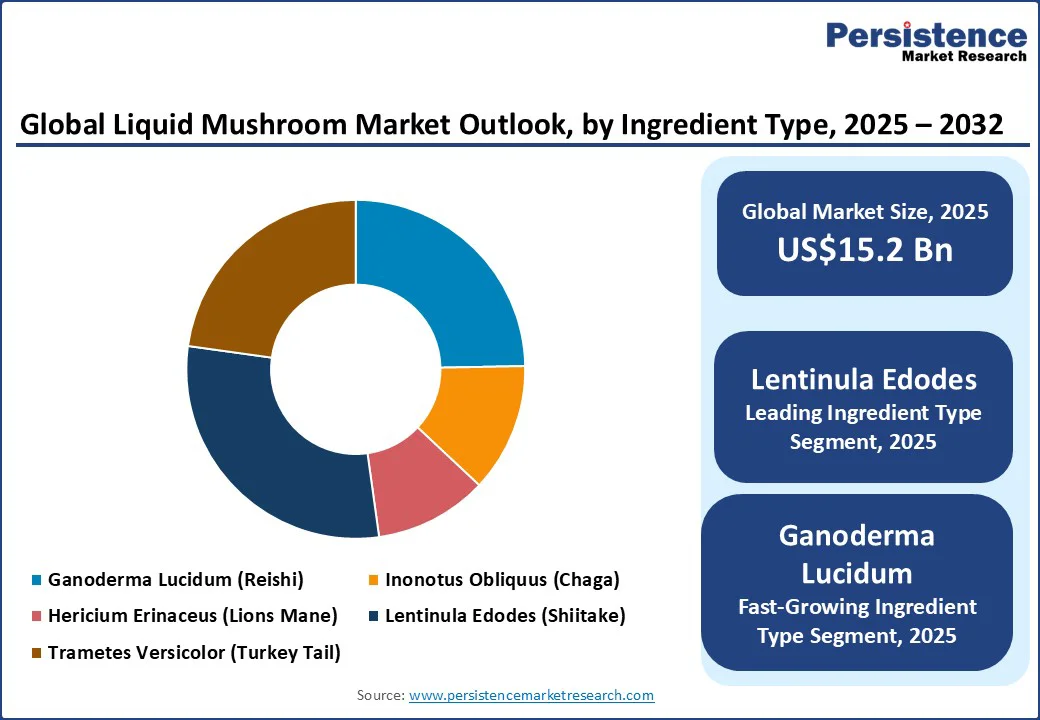

Based on ingredient type, the market is divided into Ganoderma lucidum, Inonotus obliquus, Hericium Erinaceus, Lentinula Edodes, and Trametes Versicolor. Out of these, Lentinula edodes or shiitake mushrooms are expected to account for nearly 29.4% share in 2025, due to their ability to blend culinary familiarity with functional credibility. Shiitake has long been integrated into global cuisines, especially in Asian dishes. This makes it convenient for brands to position shiitake-based liquid extracts as both approachable and beneficial. It helps them avoid the perception of being an obscure or exotic superfood.

Ganoderma lucidum (reishi) is predicted to witness a considerable growth for its deep association with stress management and adaptogenic wellness. It caters to the current consumer shift toward mental health solutions. Reishi is being positioned as a calming mushroom, suitable for relaxation, better sleep, and balance. This feature is proving valuable for companies in North America and Europe, where consumers are turning to natural sleep aids instead of synthetic options.

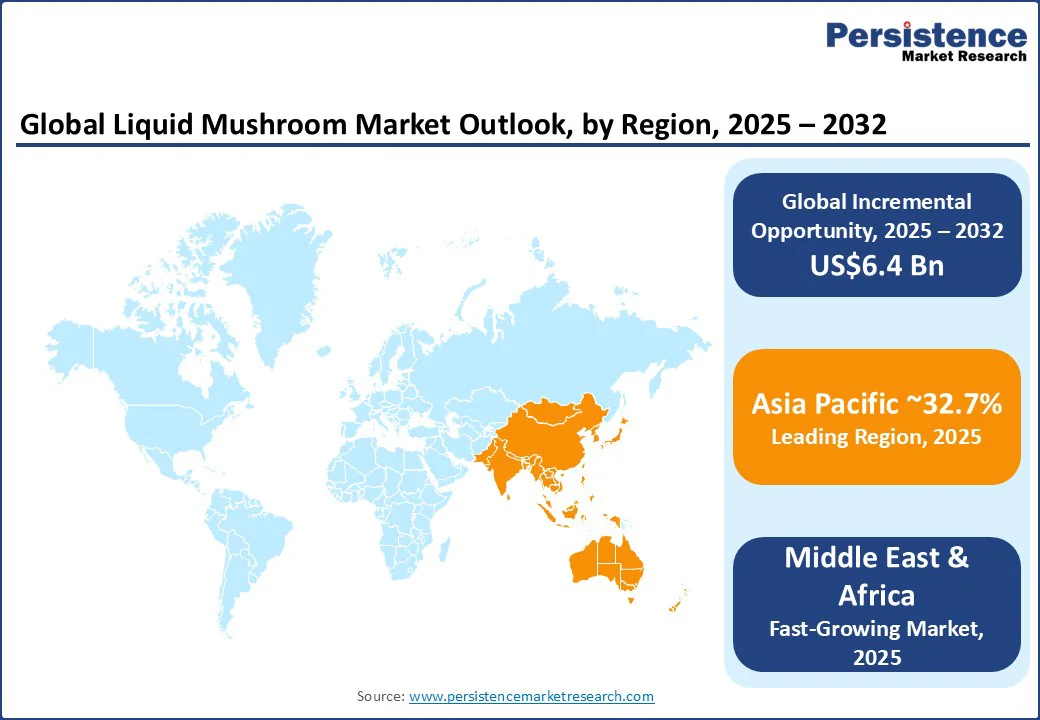

Asia Pacific is speculated to account for approximately 32.7% of the market share in 2025, spurred by a confluence of traditional practices and modern wellness trends. China, Japan, and South Korea have a rich history of utilizing mushrooms such as reishi, shiitake, and lion's mane in both culinary and medicinal contexts. This cultural foundation has smoothly integrated with contemporary health movements. It has resulted in a booming market for liquid mushroom extracts in dietary supplements, functional beverages, and nutraceuticals.

In Japan, the consumption of functional mushrooms has deep historical roots, and this tradition is being revitalized in the modern wellness landscape. The demand for functional mushroom products is skyrocketing as consumers seek natural health solutions. This resurgence is supported by both ancient dietary practices and contemporary health trends. Liquid medicinal mushroom products are being incorporated into daily routines across Asia Pacific as they provide a practical means to access the health benefits of mushrooms.

The Middle East & Africa is exhibiting a gradual but notable emergence of liquid mushroom products, as part of the broader functional mushroom market. In the UAE, there is a surging interest in functional food, including liquid mushroom products. It is attributed to a shift toward healthy lifestyles and increased awareness of natural health remedies. The country’s well-established wellness industry contributes to the adoption of such products. Similarly, Saudi Arabia is experiencing a rise in the acceptance of functional mushrooms, with reishi and shiitake being the most popular varieties.

In South Africa, the organic mushroom market is expanding, with a focus on products such as liquid mushrooms. The country's rising health-conscious population is pushing demand for these products. Local producers are beginning to cultivate mushrooms for both domestic consumption and export, indicating a positive outlook for the market. Egypt is experiencing a gradual increase in the consumption of functional mushrooms, including liquid extracts. This growth is being driven by a blend of traditional usage and modern health trends.

The market is steadily expanding in North America based on the increasing consumer interest in functional wellness products. Companies across the U.S. and Canada are leading this growth with diverse, high-quality tinctures and extracts made from medicinal mushrooms such as Reishi, Lion’s Mane, Chaga, and Shiitake. North Spore, for instance, delivers dual-extraction organic tinctures that emphasize potency and bioavailability. It also provides transparent sourcing and detailed product information for consumers seeking natural wellness options.

Vesper Mushrooms focuses on high-concentration extracts such as their Gray Matter blend. It combines multiple mushroom species to improve cognitive support. The company’s formulation uses a 2:1 fruiting body to alcohol ratio, showcasing a commitment to delivering potent products. Similarly, Forage Hyperfoods in Canada emphasizes sustainably sourced and wild-harvested mushrooms from Québec’s boreal forests. It delivers tinctures from reishi, chaga, turkey tail, and cultivated lion’s mane, appealing to eco-conscious consumers.

The global liquid mushroom market has become a battleground between established functional food brands, artisanal tincture makers, and mainstream beverage firms. Key companies have been instrumental in building category awareness by introducing mushroom-based drinks into everyday formats such as coffee, cacao, and even Nespresso-compatible pods. This strategy positions the product not as a niche supplement but as part of a daily habit, giving brands a powerful retail visibility and partnerships with grocery chains. A few companies emphasize hyper-local sourcing, wild-harvesting, and on-farm extraction to differentiate themselves.

The liquid mushroom market is projected to reach US$9.2 Bn in 2025.

Rising consumer demand for natural immunity boosters and the emergence of new stress-relief solutions are the key market drivers.

The liquid mushroom market is poised to witness a CAGR of 7.8% from 2025 to 2032.

Expansion into plant-based formulations and collaborations with wellness brands are the key market opportunities.

Tyroler Glückspilze, Natura Mushrooms, and Catskill Fungi are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Nature

By Ingredient Type

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author