ID: PMRREP35868| 184 Pages | 19 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

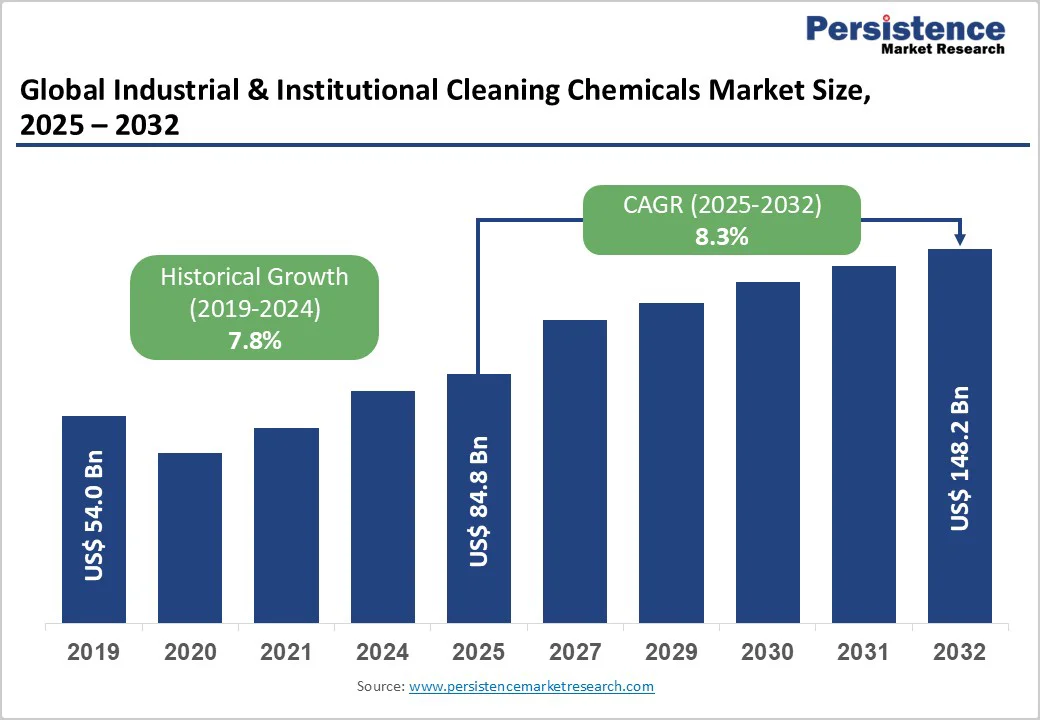

The global industrial & institutional cleaning chemicals market size is likely to value at US$ 84.8 Billion in 2025 and is projected to reach US$ 148.2 Billion, growing at a CAGR of 8.3% between 2025 and 2032.

Market expansion is driven by the rise in hygiene awareness across healthcare, food service, and institutional facilities, coupled with stringent regulatory mandates requiring enhanced sanitation protocols. Robust adoption of eco-friendly formulations and bio-based surfactants are further stimulating the market growth.

| Key Insights | Details |

|---|---|

| Industrial & Institutional Cleaning Chemicals Market Size (2025E) | US$ 84.8 Bn |

| Projected Market Value (2032F) | US$ 148.2 Bn |

| Global Market Growth Rate (CAGR 2025 to 2032) | 8.3% |

| Historical Market Growth Rate (CAGR 2019 to 2024) | 7.8% |

Healthcare institutions worldwide face critical requirements to maintain rigorous infection prevention and control protocols. According to the National Standards of Healthcare Cleanliness 2025 established by NHS in the United Kingdom, facilities must demonstrate comprehensive cleaning standards encompassing both technical cleanliness and efficacy assessments.

The Joint Commission and other regulatory bodies have implemented increasingly stringent infection control standards effective from 2024 onwards, mandating hospitals and medical facilities adopt certified disinfectants capable of eliminating healthcare-associated pathogens including MRSA, VRE, and emerging antibiotic-resistant bacteria.

This regulatory framework directly translates to sustained demand for specialized disinfectants and sanitizers, with the segment projected to grow at 9.0% CAGR through 2032. Healthcare facilities' investment in advanced cleaning chemicals equipped with antimicrobial properties creates a substantial market foundation, supporting consistent revenue generation through institutional procurement cycles.

Commercial establishments, including hospitality, food service, retail, and institutional buildings, are prioritizing cleanliness as a competitive differentiator and health safeguard. The commercial segment is anticipated to expand at an 8.5% CAGR from 2025 to 2032, driven by post-pandemic consciousness regarding workplace sanitation and guest safety.

Major hotel chains, restaurant operators, and office management firms increasingly implement standardized cleaning protocols utilizing professional-grade chemicals, growing demand for concentrated formulations and ready-to-use solutions.

In developed markets such as North America and Europe, facility management standards emphasize compliance with OSHA guidelines regarding workplace cleanliness, slip prevention, and air quality maintenance, necessitating continuous investment in industrial cleaning products across commercial infrastructures.

One of the key restraints limiting the growth of the global Industrial & Institutional (I&I) Cleaning Chemicals market is the increasingly stringent environmental and regulatory compliance landscape.

Governments and environmental agencies worldwide have imposed tighter restrictions on the use of hazardous substances such as phosphates, nonylphenol ethoxylates (NPEs), and volatile organic compounds (VOCs) due to their harmful impact on aquatic ecosystems and air quality.

Compliance with regulations such as the EU’s REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) framework, the U.S. EPA’s Safer Choice Program, and similar guidel//ines in the Asia Pacific significantly increases production and formulation costs for manufacturers.

Companies are required to invest heavily in research, reformulation, and testing to develop eco-friendly alternatives that meet performance standards while maintaining cost competitiveness.

Additionally, the growing shift toward green cleaning and sustainable products creates challenges for smaller manufacturers that lack sufficient R&D capabilities or financial resources to adapt quickly. The continuous need for regulatory updates, certification processes, and labeling compliance also adds to operational complexity, delaying product launches and market entry.

The global shift toward circular economy principles create significant opportunities for manufacturers developing sustainable and bio-based cleaning solutions. Bio-based surfactants derived from renewable resources demonstrate growth at a 5.7% CAGR as businesses prioritize reduced environmental impact.

Companies successfully implementing biomass-balanced surfactants, such as BASF's EcoBalanced portfolio expanded in April 2024 with 20 new biomass-balanced surfactants certified under TÜV Nord REDcert², capture premium market segments while meeting corporate sustainability commitments.

Premium positioning for environmentally compliant products enables margin expansion and brand differentiation, particularly appealing to multinational retail chains and institutional buyers implementing ESG audit requirements. The development of concentrated formulations reducing plastic packaging weight by 80% addresses sustainability concerns while lowering shipping costs, creating dual value propositions for commercial customers.

Rapid urbanization and healthcare infrastructure development across Asia Pacific, Latin America, and Middle East-Africa regions create substantial growth opportunities for cleaning chemicals suppliers.

Rising middle-class populations in countries including India, China, and ASEAN nations drive expansion of hospitality, food processing, and healthcare facilities requiring professional-grade cleaning solutions. Asia Pacific specialty chemicals market demonstrated 49.9% share of global consumption in 2023, with India recognized as the second-largest market for specialty chemicals in the region.

Food safety regulations in emerging markets increasingly align with international standards, mandating adoption of CIP (Clean-In-Place) chemicals and advanced sanitation systems. Asia Pacific CIP chemicals market is projected to reach US$ 6.43 Billion by 2029 at 9.4% CAGR, indicating substantial sectoral growth potential that directly supports cleaning chemicals expansion through interconnected supply chains.

Chlor-Alkali chemicals emerge as the leading raw material category, commanding approximately 45% market share within industrial and institutional cleaning chemicals formulations.

Caustic soda and chlorine derivatives serve as essential alkaline agents and disinfectant precursors across diverse cleaning applications including floor care, disinfection, and industrial degreasing. The chlor-alkali market itself is valued at US$ 74.65 billion in 2025 and projected to reach US$ 100.98 billion by 2032, with soda ash representing a larger position.

Water treatment industries consuming sodium hydroxide for pH adjustment and heavy metal precipitation create sustained downstream demand for chlor-alkali chemicals. Infrastructure development programs globally, particularly in the Asia Pacific and Latin America regions, support expanded chlorine utilization for water sanitation and industrial applications, directly reinforcing cleaning chemicals market fundamentals through integrated supply chain dynamics.

General Purpose Cleaners represent the dominant product type, accounting for approximately 35% market share, driven by universal applicability across commercial buildings, schools, offices, healthcare facilities, and industrial sites.

These formulations effectively handle diverse dirt, grime, and stains on multiple surfaces, making them indispensable for routine maintenance and hygiene protocols. Disinfectants and Sanitizers represent the fastest-growing segment at 6.7% CAGR, propelled by heightened infection prevention focus following global health crises.

Healthcare, food processing, and transit facilities maintain elevated hygiene baselines, creating consistent demand for broad-spectrum disinfectants. Regional manufacturers increasingly introduce quaternary-ammonium-free options leveraging hydrogen peroxide and citric acid, addressing consumer sensitivities while ensuring compliance with local discharge regulations.

Laundry care chemicals and vehicle wash products grow steadily through sensor-driven dosage control technologies and water-reuse systems, conserving utilities and chemical resources simultaneously.

Manufacturing applications dominate end-use segments, accounting for approximately 87% of market composition, driven by sector-specific cleaning requirements in automotive, electronics, food processing, and heavy machinery industries.

Degreasing, precision cleaning, and production area sanitization necessitate specialized, high-performance chemical formulations. Industrial output expansion in emerging economies, coupled with rising automation investments, amplifies demand for eco-friendly, low-VOC alternatives meeting sustainability objectives.

Commercial applications emerge as the fastest-growing segment at 8.5% CAGR, encompassing food service, retail, healthcare, laundry care, and institutional buildings. Stringent cleanliness protocols, escalating health and safety emphasis, and commercial construction expansion worldwide fuel this segment's robust trajectory.

Sustainability trends increasingly influence commercial end-users to adopt environmentally responsible products, driving demand for biodegradable chemicals and green certifications across hospitality, healthcare, and office management sectors.

North America maintains a robust market presence with significant regulatory emphasis on workplace safety and environmental compliance. The Occupational Safety and Health Administration (OSHA) guidelines mandate comprehensive cleaning and maintenance protocols to prevent slip-and-fall incidents and control dust contamination, driving consistent commercial and industrial cleaning chemical adoption.

According to industry analysis, North America contributes substantially to global chlor-alkali consumption at 38.3% share, underpinned by mature industrial infrastructure and strong presence in chemicals, pharmaceuticals, and water treatment sectors.

The United States leads regional innovation through companies such as The Clorox Company, which introduced Clorox Screen+ Sanitizing Wipes in 2025 designed specifically for electronic surfaces in shared spaces, addressing emerging hygiene concerns.

CloroxPro received recognition as the 2024 ISSA Environment & Sustainability Innovation Award for Clorox EcoClean Disinfecting Wipes, reflecting market trend toward EPA Design for Environment (DfE) certified products. Ecolab Inc., in partnership with The Home Depot, launched Ecolab Scientific Clean™ product line in February 2023, targeting laboratory and industrial applications, demonstrating sector-specific product development strategies.

Europe represents a mature market characterized by stringent environmental regulations and pronounced sustainability emphasis, with Germany as the dominant contributor. Germany's industrial base-particularly in manufacturing and chemicals-combined with a highly developed healthcare system, generates substantial demand for premium compliance-aligned cleaning solutions.

German automotive production reached 3.68 million units in 2022, with 11% year-on-year growth, driving industrial cleaning chemicals consumption for manufacturing facilities and finished product care.

The United Kingdom's Government Functional Standard for Property (GovS 004) enforces facility management mandates, including comprehensive cleaning and sanitation requirements, creating regulatory-driven market demand.

European Union commitment to sustainability is reflected in €5.5 Billion annual investments in textile modernization and circular economy initiatives through 2023, supporting demand for environmentally compliant, biodegradable cleaning formulations.

The region's focus on reducing environmental impact promotes the adoption of bio-based surfactants and low-foam, enzyme-based chemicals, positioning Europe as the innovation leader in sustainable cleaning chemistry development.

Asia Pacific emerges as the fastest-growing and highest-demand regional market, driven by rapid industrialization, urbanization, and infrastructure expansion across China, India, Japan, and ASEAN nations.

China dominates regional production and consumption, generating over 136 million metric tons of industrial output annually, while emerging economies including Vietnam and Indonesia rapidly expand manufacturing capabilities. Asia Pacific's specialty chemicals market represented 49.9% of global consumption in 2023, with India recognized as the second-largest specialty chemical market in the region.

India's textile industry, valued at INR 80,000 crores in FY24 with 8.2% annual growth rate, creates sustained demand for specialized cleaning chemicals. Thailand represents significant production capacity through Thai Acrylic Fibre Co. Ltd. (Aditya Birla Group), while supporting regional distribution networks.

Rising middle-class populations and government initiatives promoting manufacturing sector competitiveness drive facility investments and infrastructure development, directly increasing commercial and industrial cleaning chemicals consumption across hospitality, food processing, healthcare, and manufacturing sectors.

The global industrial and institutional cleaning chemicals market demonstrates moderately consolidated characteristics with significant consolidation activity shaping competitive dynamics.

Major multinational corporations, including BASF SE, Henkel AG & Co. KGaA, Clariant, The Clorox Company, and Reckitt Benckiser Group plc, control substantial market shares through integrated production capabilities, extensive distribution networks, and established customer relationships. High barriers to entry resulting from significant R&D investments, regulatory compliance demands, and production scale requirements limit competition to well-capitalized entities.

Market leaders employ differentiated strategies emphasizing innovation in sustainable chemistries, geographic market expansion, and strategic acquisitions. Solenis' 2023 acquisition of Diversey for $4.6 billion demonstrated consolidation momentum, integrating complementary hygiene and sanitation solutions portfolios across 130+ countries.

Competitive dynamics increasingly focus on premium positioning through eco-friendly formulations and specialized product development rather than price-based competition.

The global industrial and institutional cleaning chemicals market was valued at US$ 84.8 billion in 2025 and is projected to reach US$ 148.2 billion by 2032, growing at 8.3% CAGR during the forecast period.

Key demand drivers include stringent healthcare sanitation standards compliance, expanding commercial facilities and facility management services; and technological innovations in sustainable, bio-based chemical formulations meeting environmental compliance requirements.

General Purpose Cleaners currently dominate the market with 35% share due to universal applicability across diverse commercial, healthcare, and industrial surfaces, though Disinfectants and Sanitizers represent the fastest-growing segment at 6.7% CAGR.

North America maintains market leadership with substantial demand from healthcare, manufacturing, and commercial sectors, while Asia Pacific emerges as the fastest-growing region at approximately 9%+ CAGR, driven by urbanization, industrialization, and infrastructure expansion across China, India, and ASEAN nations.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2032 |

| Historical Data Available for | 2019 to 2024 |

| Market Analysis | US$ Billion for Value Tons for Volume |

| Key Regions Covered |

|

| Key Market Segments Covered |

|

| Key Companies Profiled in the Report |

|

| Report Coverage |

|

By Raw Material

By Product Type

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author