ID: PMRREP33214| 240 Pages | 24 Dec 2025 | Format: PDF, Excel, PPT* | Industrial Automation

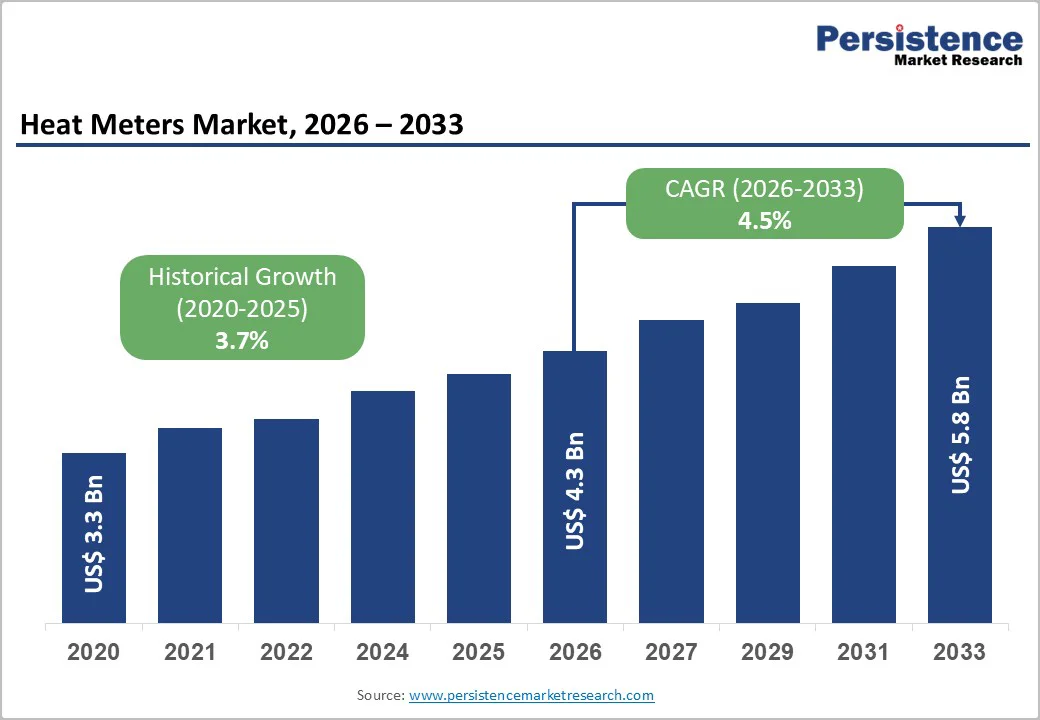

The global heat meters market size is valued at US$ 4.3 billion in 2026 and is projected to reach US$ 5.8 billion by 2033, growing at a CAGR of 4.5% between 2026 and 2033. Growth is supported by rising demand for energy-efficient heating, tightening metering and billing regulations, and the expansion of district heating and cooling networks in Europe, Asia, and select North American urban centres. Adoption of static (ultrasonic) meters and wireless connectivity is accelerating within a market still dominated by mechanical and wired installations.

| Key Insights | Details |

|---|---|

|

Heat Meters Market Size (2026E) |

US$ 4.3 Bn |

|

Market Value Forecast (2033F) |

US$ 5.8 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

4.5% |

|

Historical Market Growth (CAGR 2020 to 2024) |

3.7% |

Regulatory Pressure on Energy Efficiency, Metering, and Billing Transparency

The EU Energy Efficiency Directive (EED), recast in 2023, raises binding energy efficiency targets and introduces stricter rules on metering and billing of thermal energy. Member States must ensure more frequent and transparent information on heating and cooling consumption particularly in multi-apartment buildings—which directly boosts demand for accurate heat meters and sub-metering systems. The Directive also promotes local heating and cooling plans in municipalities with more than 45,000 inhabitants and mandates more efficient district heating and cooling supply by 2050. Similar trends in national regulations and building codes in Europe and other regions are driving mandatory or incentivized installation of heat meters, making regulatory compliance a key structural growth driver.

District heating accounts for a significant portion of space and water heating demand in many European, Asian, and some North American cities, and is central to decarbonization strategies. The revised EED requires progressive integration of renewable and waste heat into district systems and limits support for fossil-based heat after 2030. These shifts increase the need for precise measurement of thermal energy flows at the building and sub-building levels to manage efficiency, allocate costs, and validate the performance of new heat sources. Market research points to a multi-billion-dollar expansion of district heating capacity through 2030, with heat meters as mandatory components in new and upgraded networks. This structural linkage between district heating investments and metering demand provides a resilient growth base.

Retrofitting existing buildings-particularly older multi-apartment or mixed-use buildings-with individual heat meters and modern communication infrastructure can be capital-intensive and technically complex. Costs include device hardware, installation, hydraulic modifications, communication modules, and integration with billing systems. In markets without strong regulatory enforcement or incentives, building owners may defer investments, slowing adoption rates in the retrofit segment. Legacy building infrastructure and mixed heating configurations can also limit the feasibility of installing meters at the apartment level, constraining market penetration in some residential stock despite regulatory aspirations.

As heat meters become connected devices, data security, privacy, and interoperability concerns intensify. Utilities and regulators require secure data transmission, GDPR-compliant handling of consumption data in Europe, and adherence to open or standardized communication protocols. Fragmentation across communication technologies (wired M-Bus vs wireless RF/LoRa/NB-IoT) and proprietary backend solutions can create vendor lock-in and integration complexity. Utilities may be cautious about large-scale wireless deployments until cybersecurity and interoperability standards are mature and proven, which can delay or phase the rollout of advanced heat metering solutions.

Research shows static (ultrasonic) and smart meters gaining share due to higher accuracy, reliability, and lower maintenance, while the wired segment currently dominates but wireless grows faster. As utilities and ESCOs roll out smart metering programs, there is an opportunity to upgrade large installed bases of mechanical and wired meters to static, wireless, and remotely readable devices. Given that static meters already command more than 70% share in some recent segment analyses and are expected to reach USD 4.4 Bn by 2034, the global market for next-generation smart heat meters and associated communication modules and software could reach several billion dollars in incremental revenue over the next decade.

Heat meters generate granular consumption data that can serve as the foundation for energy performance contracting, tenant billing services, predictive maintenance, and optimization offerings. Vendors and ESCOs can monetize heat meter data through software subscriptions, analytics services, and integrated energy management platforms. With the global heat meter market expected to reach around US$ 5 Bn by early-2030s, even modest penetration of value-added digital services can create significant ancillary revenue pools. This opportunity is strongest in commercial and industrial segments where energy savings and transparency requirements are highest.

Mechanical heat meters currently dominate the market with around 74.3% share, driven by their low cost, proven reliability, and long-standing use in residential and small commercial buildings. Using turbine or multi-jet flow sensors, they remain preferred in regions where budget constraints, water quality issues, or installation practices limit the adoption of advanced technologies. Their cost-effectiveness continues to support widespread use despite lower long-term accuracy.

Static heat meters, especially ultrasonic models, are expanding rapidly due to superior accuracy, no moving parts, reduced maintenance, and strong long-term performance. They are increasingly chosen for district heating networks and smart metering programs. With projected revenues of USD 4.4 billion by 2034, static meters are expected to become the fastest-growing segment, capturing most new installations and replacement demand as utilities shift toward digital, remotely readable solutions.

Wired heat meters hold the largest market share at approximately 68.2%, supported by their reliability, security, and suitability for permanent installations. Commonly using M-Bus and similar protocols, wired systems integrate seamlessly with existing building management systems and remain the preferred choice for large buildings, industrial facilities, and district heating substations where established infrastructure justifies cabling. Their long-standing use makes them the backbone of many legacy metering networks.

Wireless heat meters represent the fastest-growing connectivity segment, driven by demand for flexible, low-cost deployment and reduced manual reading requirements. Using technologies such as RF, wireless M-Bus, Zigbee, NB-IoT, and LoRaWAN, they enable remote monitoring, frequent billing, and leak detection. Wireless solutions are especially attractive for retrofits, multi-apartment buildings, campuses, and smart city projects, and are increasingly favored in new metering tenders.

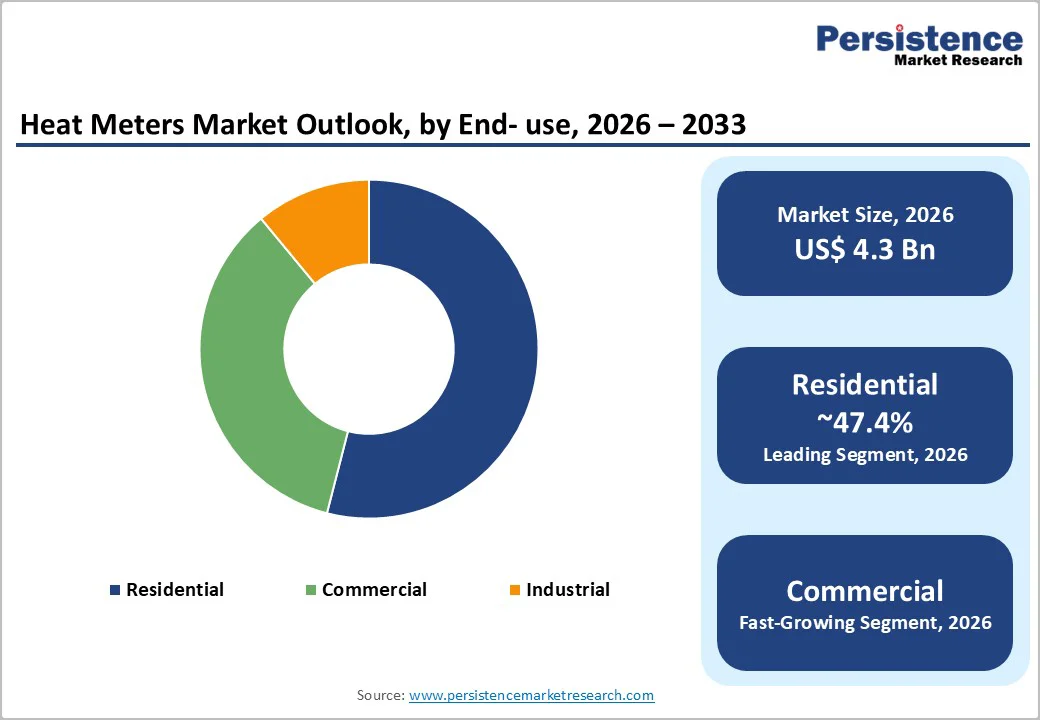

The residential sector accounts for nearly 47.4% of global heat meter demand, driven by widespread use in multi-apartment buildings, district heating networks, and individual dwellings connected to shared heating systems. EU mandates requiring consumption-based billing and individual metering in centrally heated buildings have accelerated adoption, especially across Central and Northern Europe. Growing consumer demand for transparent billing and energy-saving incentives further strengthens residential uptake.

The commercial sector is the fastest-growing end-user segment, supported by rising deployment in offices, hospitals, retail complexes, campuses, and mixed-use facilities with large heating and cooling loads. Strong ESG requirements, green building certifications, and corporate decarbonisation goals are driving investment in smart, connected heat meters with advanced analytics, increasing both meter value and long-term service revenues.

North America currently represents a smaller share of the global heat meter market than Europe. Still, it offers steady growth, particularly in urban district heating, campus utilities, and high-performance commercial buildings. District energy systems drive the U.S. market in colder regions, campus and healthcare heating networks, and a growing interest in building decarbonisation and ESG reporting. While heat meters are less ubiquitous in residential buildings than in Europe, adoption is increasing in multi-family housing and high-efficiency developments.

Key growth drivers include state and city-level climate policies, building energy codes, and decarbonisation initiatives by universities, hospitals, and corporate campuses. District energy operators are investing in modern metering, controls, and analytics to optimize efficiency and integrate renewable and waste heat sources.

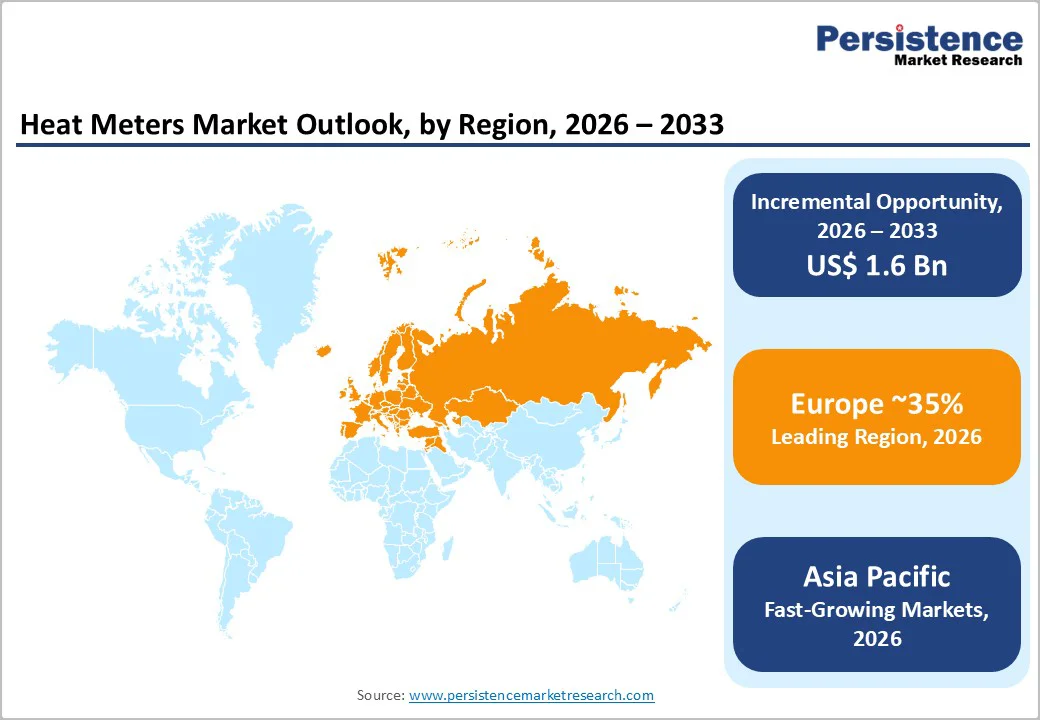

Europe is the largest and most mature heat meter market globally, underpinned by extensive district heating infrastructure, strong regulatory frameworks, and high household penetration of metered heating systems. The region accounts for a substantial portion of global revenues and is expected to maintain a mid-single-digit CAGR through 2030–2033 as retrofits, regulatory tightening, and technology upgrades continue.

The regulatory environment is shaped by the EU Energy Efficiency Directive 2023/1791, which sets binding energy savings targets and demands clearer metering and billing rules for thermal energy, particularly in multi-apartment buildings. This creates a predictable and supportive framework for heat meter suppliers. The market is relatively consolidated around European meter manufacturers, including Kamstrup, Danfoss, Zenner, Diehl, Apator, BMETERS, Sycous, Itron, Siemens, and others, many of which have long-standing relationships with utilities and housing companies.

Asia Pacific is an emerging and fast-growing region for heat meters, driven by district heating in northern China, expanding urban district cooling, and rising energy efficiency priorities in Japan, South Korea, and parts of India and ASEAN. While the region’s current share of global revenues is smaller than Europe’s, growth rates are expected to be higher, supported by urbanisation, industrialization, and policy efforts to reduce local air pollution and energy intensity.

China has the largest district heating network outside Europe, and modernizing these systems through more granular metering, balancing, and control is a key policy objective to improve efficiency and billing fairness. As China pursues building energy efficiency and heating reform, the demand for both mechanical and static heat meters, and especially systems with remote reading, is expected to grow. Japan and South Korea use heat metering in district energy, commercial facilities, and industrial processes, with advanced building technologies supporting the adoption of smart meters.

The heat meter market is moderately concentrated, with a group of well-established European and global players accounting for a significant share of global revenues. Key companies include Kamstrup, Danfoss, Zenner, Itron, Diehl, Apator, BMETERS, Landis+Gyr, Siemens, Sontex, Sycous, Ista, Brunata, Techem, GWF MessSysteme, Axioma Metering, Sensus (Xylem), and others, as noted across multiple market reports. While regional and local manufacturers serve specific markets, the need for accuracy, regulatory compliance, and reliable communication encourages purchasing from recognized brands. Competition centers on technology (static vs. mechanical), connectivity (wired vs. wireless), integration with IT systems, service offerings, and pricing.

The Heat Meters market is estimated to be valued at US$ 4.3 Bn in 2026.

The key demand driver for the Heat Meters market is the global push toward energy efficiency and consumption-based billing across residential, commercial, and district heating networks.

In 2026, the Europe region will dominate the market with an exceeding 35% revenue share in the global Heat Meters market.

Among the End-user, Residential holds the highest preference, capturing beyond 47.4% of the market revenue share in 2026, surpassing other End-user type.

The key players in Heat Meters are BMETERS, Diehl, Kamstrup, and Siemens

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Bn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product type

By Connectivity

By End - user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author