ID: PMRREP32324| 246 Pages | 30 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

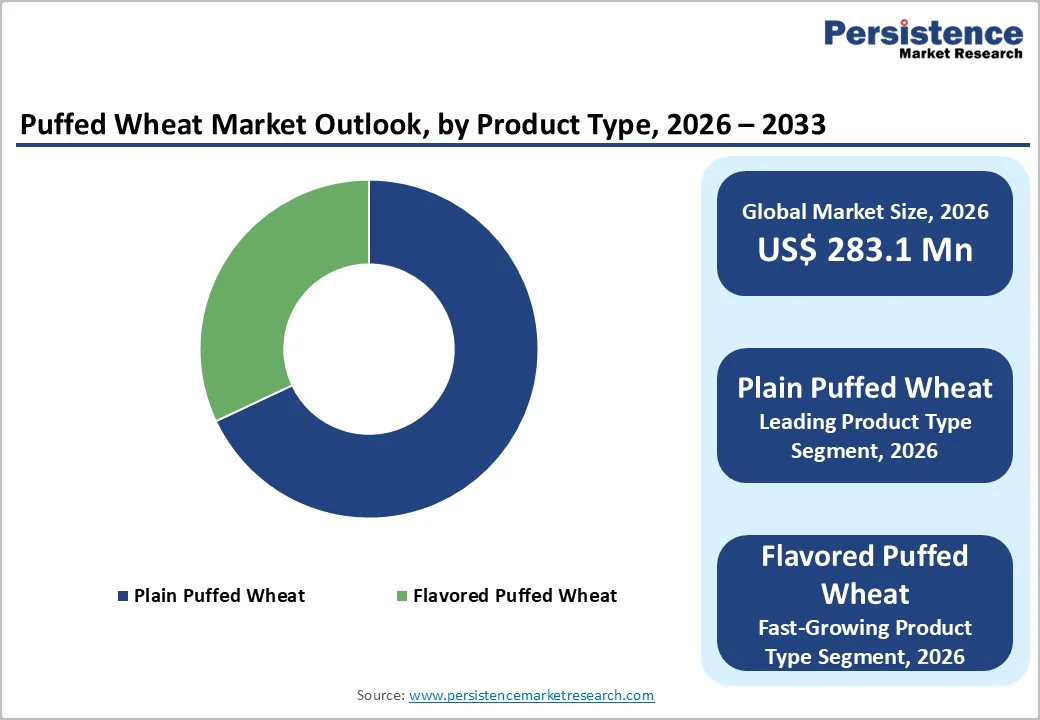

The global puffed wheat market size is expected to be valued at US$ 283.1 million in 2026 and projected to reach US$ 434.2 million by 2033, growing at a CAGR of 6.3% between 2026 and 2033.

A traditionally simple grain is being redefined by health-driven consumption, premium snacking, and formulation innovation. The global puffed wheat market is evolving from a breakfast staple into a versatile ingredient and snack platform across regions.

| Key Insights | Details |

|---|---|

| Global Puffed Wheat Market Size (2026E) | US$ 283.1 Mn |

| Market Value Forecast (2033F) | US$ 434.2 Mn |

| Projected Growth (CAGR 2026 to 2033) | 6.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.4% |

Morning eating habits are undergoing a quiet reset, favoring simplicity, balance, and perceived wholesomeness. Puffed wheat fits directly into this shift, offering a light, whole-grain base that aligns with reduced sugar, low-fat, and portion-controlled breakfast choices. Its compatibility with clean formulations makes it attractive for cereals, granola blends, and snack clusters positioned around everyday wellness.

Snacking behavior reinforces this momentum. Consumers increasingly seek lighter textures and familiar grains between meals, especially products positioned as baked, minimally processed, and fiber-supportive. Puffed wheat enables manufacturers to deliver crunch without heaviness, supporting guilt-free snacking claims. As health awareness extends beyond breakfast into all-day consumption, puffed wheat benefits from being nutritionally acceptable, versatile, and easy to integrate across formats.

Competitive pressure is intensifying as alternative grains crowd shelf space traditionally occupied by wheat-based products. Quinoa, millet, sorghum, and rice are increasingly promoted for perceived digestibility, novelty, or regional relevance, drawing attention away from conventional puffed wheat formats. This diversification challenge puffed wheat’s historical dominance in the cereals and snacks sector.

Shifting dietary narratives further complicate positioning. Gluten-sensitivity concerns, whether medically driven or lifestyle-based, encourage some consumers to avoid wheat entirely. Brands responding to these preferences often reformulate with non-wheat grains, limiting the inclusion of puffed wheat. As product developers chase differentiation and premium cues, puffed wheat must compete harder on functionality, cost efficiency, and familiarity to retain relevance in an increasingly grain-diverse marketplace.

Flavor innovation is transforming puffed wheat from a basic ingredient into a value-added snack platform. Seasoned, sweetened, or coated puffed wheat formats allow brands to target indulgence-seeking consumers without abandoning lighter positioning. This opens the door to premium pricing through artisanal flavors, natural seasonings, and region-inspired taste profiles.

Startups and emerging brands are especially well-positioned to capitalize on this shift. Small-batch production, bold flavor storytelling, and visually distinctive packaging help flavored puffed wheat snacks stand out online and in specialty retail. Pairing flavor with claims such as baked texture, whole-grain content, or reduced oil strengthens appeal. As snacking becomes experiential, flavored puffed wheat offers scalable premiumization without complex processing requirements.

Plain Puffed Wheat holds approx. 68% market share as of 2025, reflecting its role as a foundational ingredient across multiple food categories. Its neutral taste, long shelf life, and consistent structure make it indispensable for breakfast cereals, baking mixes, and industrial formulations where predictability matters. Manufacturers favor plain variants for their flexibility and cost efficiency.

Flavored puffed wheat represents a smaller yet dynamic segment, gaining traction in snacks and ready-to-eat formats. These products rely on coatings and seasoning rather than structural changes, keeping processing manageable. While flavors drive engagement, plain puffed wheat remains the volume anchor, supporting scale, private-label adoption, and widespread use across both consumer and foodservice applications.

Baking Ingredients are projected to grow at a CAGR of 7.8% during the forecast period in the global puffed wheat market, driven by innovation in texture-focused formulations. Bakers increasingly use puffed wheat to add crunch, volume, and visual appeal to breads, bars, cookies, and confectionery inclusions without increasing density.

Home baking trends and premium artisanal products further support this trajectory. Puffed wheat offers functional advantages, including moisture balance and structural contrast, especially in multigrain and better-for-you recipes. Industrial bakers also value its ease of handling and formulation stability. As baked goods evolve toward differentiated textures and cleaner ingredient decks, puffed wheat is emerging as a preferred structural enhancer rather than a secondary filler.

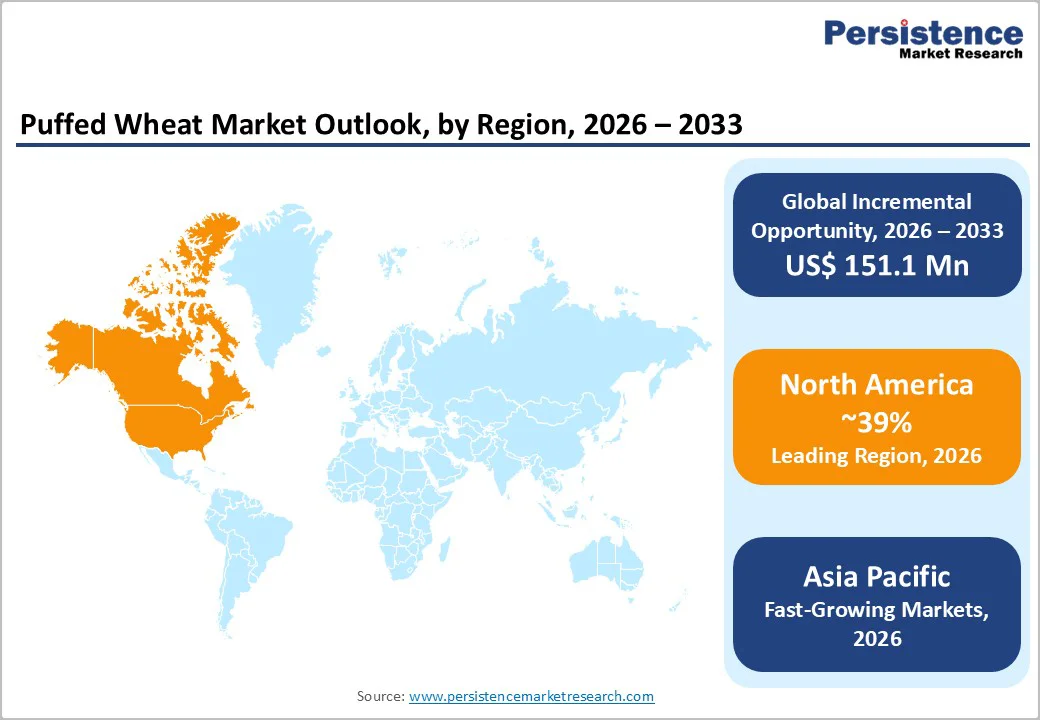

North America holds approximately 39% market share in the global puffed wheat Market, supported by entrenched breakfast cereal consumption and strong snacking culture. In the United States, manufacturers are reformulating cereals and snack mixes with simpler ingredient lists, reinforcing puffed wheat’s relevance as a recognizable grain base.

Canada complements demand with supply strength and innovation in grain processing. Canadian producers emphasize consistency, traceability, and sustainability, supporting domestic use and exports. Across both markets, puffed wheat is increasingly featured in private-label cereals, bakery inclusions, and better-for-you snacks. E-commerce and club retail formats are accelerating volume movement, keeping North America at the center of both consumption and formulation trends.

Asia Pacific puffed wheat market is expected to grow at a CAGR of 8.1%, driven by urbanization and evolving eating habits. In India, puffed wheat benefits from cultural familiarity, as it is used in traditional snacks and modern breakfast blends, positioned around affordability and convenience.

China is adopting puffed wheat within hybrid cereal snacks and bakery fillings, often paired with sweetness or texture contrast. Japan favors precision, using puffed wheat in portion-controlled snacks and confectionery applications where lightness matters. South Korea emphasizes visual appeal and crunch in snack innovation, integrating puffed wheat into coated and seasoned formats. Across the region, localization, flavor adaptation, and price sensitivity shape adoption patterns, supporting steady expansion.

The global puffed wheat market is moderately fragmented, with established grain processors operating alongside regional specialists. Leading companies focus on improving crop yield stability, securing certifications, and investing in consistent quality to meet food and bakery standards. Product innovation centers on texture control, size uniformity, and application-specific customization.

Sustainability messaging and consumer education are becoming competitive levers, particularly around whole-grain benefits and responsible sourcing. Online retail growth encourages smaller brands to enter niche snack and baking segments, intensifying competition. At the same time, regulatory compliance requirements for food safety and labeling reinforce entry barriers. Expansion strategies increasingly balance capacity growth with operational efficiency rather than aggressive price competition.

The global Puffed Wheat market is expected to reach around US$ 283.1 million in 2026.

Rising Demand for Health-Conscious Breakfast and Snacking Trends is the key driver in the Puffed Wheat market.

North America leads the Puffed Wheat market with about 39% share in 2025.

Premiumization through Flavored Puffed Wheat Snack is key opportunity.

Key players include Kellogg Company, Post Consumer Brands, General Mills, Inc., Associated British Foods plc, Wise Foods, Inc and others

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Mn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By End Use

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author