ID: PMRREP32307| 220 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

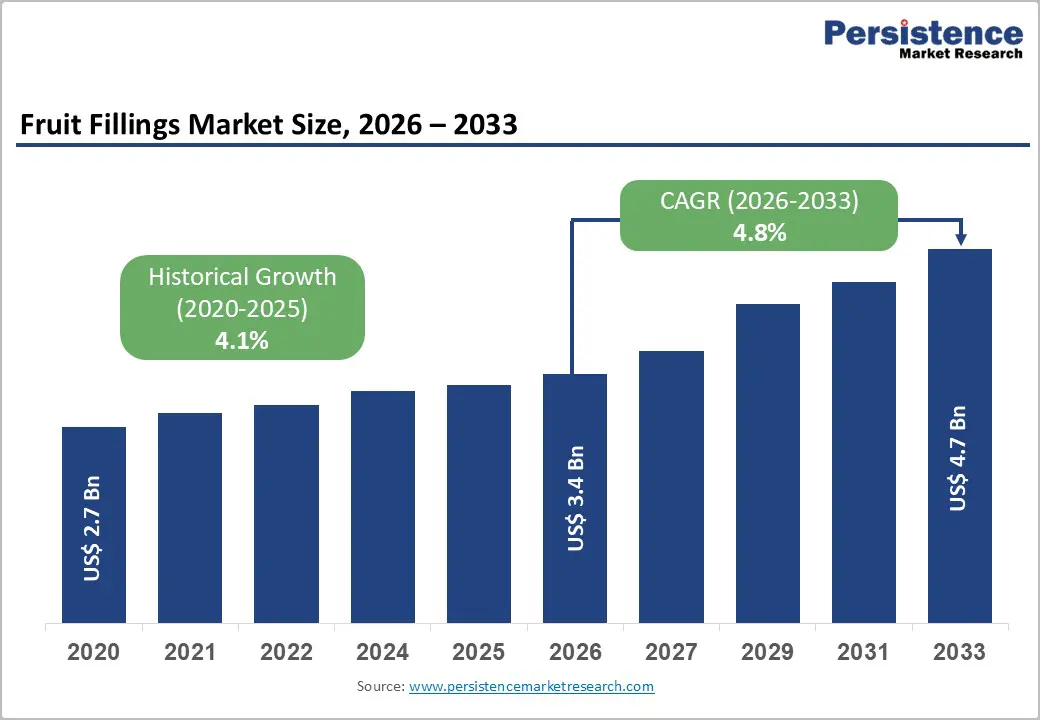

The global Fruit Fillings Market size is expected to be valued at US$ 3.4 billion in 2026 and projected to reach US$ 4.7 billion by 2033, growing at a CAGR of 4.8% between 2026 and 2033.

The global fruit fillings market is evolving from a traditional bakery ingredient space into a dynamic innovation-driven segment shaped by clean-label demands, texture-led beverage applications, and premium fruit sourcing strategies. Regional consumption patterns, product versatility, and formulation science are collectively redefining competitive advantage.

| Key Insights | Details |

|---|---|

| Global Fruit Fillings Market Size (2026E) | US$ 3.4 Bn |

| Market Value Forecast (2033F) | US$ 4.7 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.8% |

Curiosity-driven palates are reshaping fruit fillings as brands experiment with globally inspired flavors that move beyond traditional strawberry or apple. Mango chili, yuzu citrus, dragon fruit, and hibiscus infusions attract adventurous consumers seeking novelty in baked goods and desserts. Clean-label formulations amplify this appeal by replacing artificial colors, flavors, and preservatives with recognizable ingredients, supporting transparency-driven purchasing decisions across retail and foodservice channels worldwide today's increasingly fast-evolving markets.

Manufacturers leverage this driver to differentiate portfolios while maintaining performance under heat, freeze-thaw cycles, and extended shelf life. Natural fruit concentrates, pectin systems, and gentle processing help preserve flavor brightness and texture. Innovation cycles accelerate as clean-label claims unlock premium positioning, encourage private label adoption, and stimulate collaborations between fruit processors and bakery, dairy, and beverage producers serving evolving expectations with responsible ingredient stories globally today at scale.

Consistence begins at the orchard yet often unravels during scaling, where fruit variability, ripeness differences, and seasonal shifts complicate standardization. Brix levels, acidity, and color intensity fluctuate across harvests, creating formulation instability. These variations pressure processors to recalibrate recipes frequently, raising costs, increasing waste, and risking flavor drift that undermines brand reliability for industrial bakery and beverage customers operating at tight margins under contract manufacturing expectations.

Batch-to-batch inconsistency also challenges food safety validation and shelf-life assurance, particularly for clean-label fillings lacking synthetic stabilizers. Minor deviations can trigger customer complaints, reformulation requests, or rejected shipments. Smaller producers feel this restraint acutely due to limited blending infrastructure, constrained quality analytics, and dependence on external fruit suppliers, restricting their ability to scale reliably across regions with consistent sensory outcomes and contractual performance benchmarks intact long-term.

Health-led reformulation is opening profitable white spaces within fruit fillings as sugar reduction becomes a design priority rather than a compromise. Advances in fruit fiber concentration, enzyme processing, and sweetener balancing enable lower-sugar profiles while preserving mouthfeel and flavor release. Functional additions such as prebiotic fibers or antioxidant-rich fruits elevate fillings from indulgent inclusions to value-added components supporting wellness-oriented positioning for modern consumers seeking balance without sacrificing sensory pleasure experiences.

This opportunity favors agile startups and established players willing to invest in formulation science and regulatory clarity. Reduced-sugar fillings unlock access to better-for-you snacks, dairy alternatives, and functional beverages. Early movers can secure premium contracts, private label collaborations, and export growth by aligning nutrition credentials with taste performance and clean ingredient narratives demanded by global brand owners seeking scalable differentiation and compliant innovation pipelines worldwide today aggressively evolving markets.

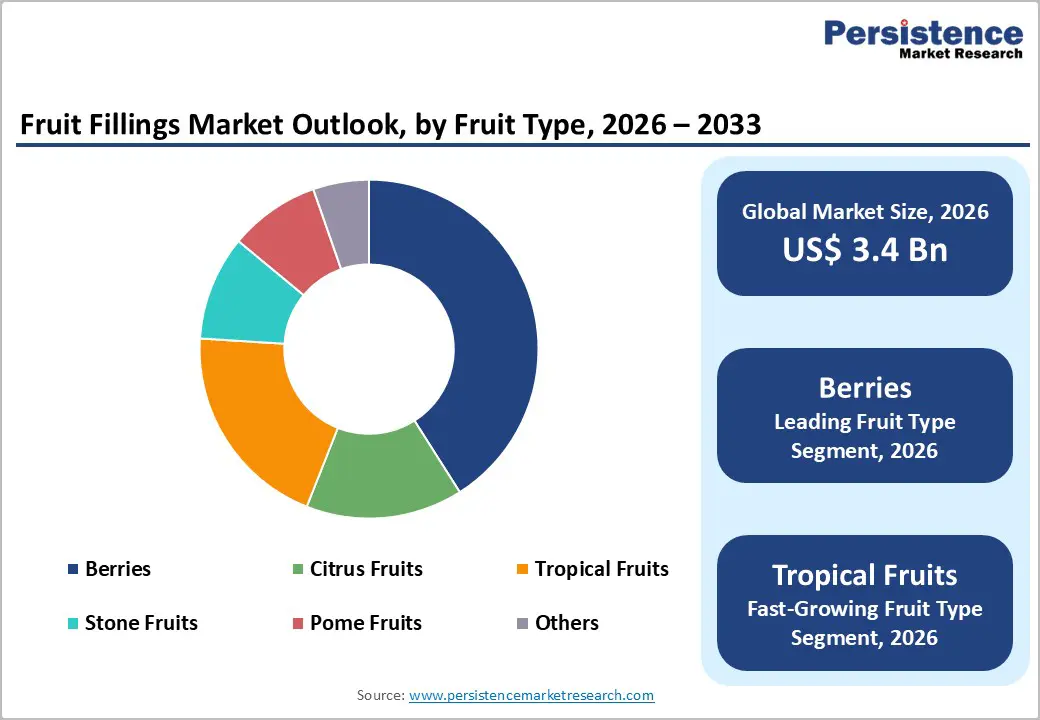

Berries hold approx. 62% market share as of 2025, reflecting their unmatched versatility, color intensity, and consumer familiarity across applications. Strawberry, blueberry, raspberry, and mixed berry fillings deliver balanced sweetness and acidity, performing consistently in bakery, dairy, and beverage systems. Their year-round availability through frozen and processed formats supports reliable sourcing, predictable pricing, and standardized flavor expectations for manufacturers serving global menus efficiently at an industrial scale today, widely adopted.

Beyond functionality, berries benefit from strong health associations linked to antioxidants and natural pigments, reinforcing premium and clean-label positioning. Their visual appeal enhances product merchandising, while familiarity reduces consumer risk during trial. Foodservice and retail brands favor berries for seasonal innovation, limited editions, and cross-category extensions, reinforcing dominance through continuous demand cycles and rapid commercialization timelines across multiple regions with efficient formulation adaptability and stable consumer preferences long-term globally.

Beverages are projected to grow at a CAGR of 6.6% during the forecast period as drink brands seek fruit-forward differentiation with authentic textures. Fruit fillings enable inclusions, swirls, and layered effects in smoothies, yogurt drinks, and fermented beverages. Their compatibility with cold processing and aseptic systems supports innovation in premium, indulgent, and functional beverage formats across retail and foodservice channels globally amid evolving consumption habits and on-the-go demand.

Rising demand for drinkable desserts, protein shakes, and probiotic beverages further accelerate adoption. Fruit fillings deliver flavor stability, visual appeal, and controlled sweetness without clouding liquids. As brands experiment with fruit chunks and layered experiences, beverage manufacturers increasingly partner with filling specialists to co-develop customized textures that enhance mouthfeel while maintaining processing efficiency and shelf-life integrity across scalable production lines serving mass premium portfolios globally today, competitively positioned markets.

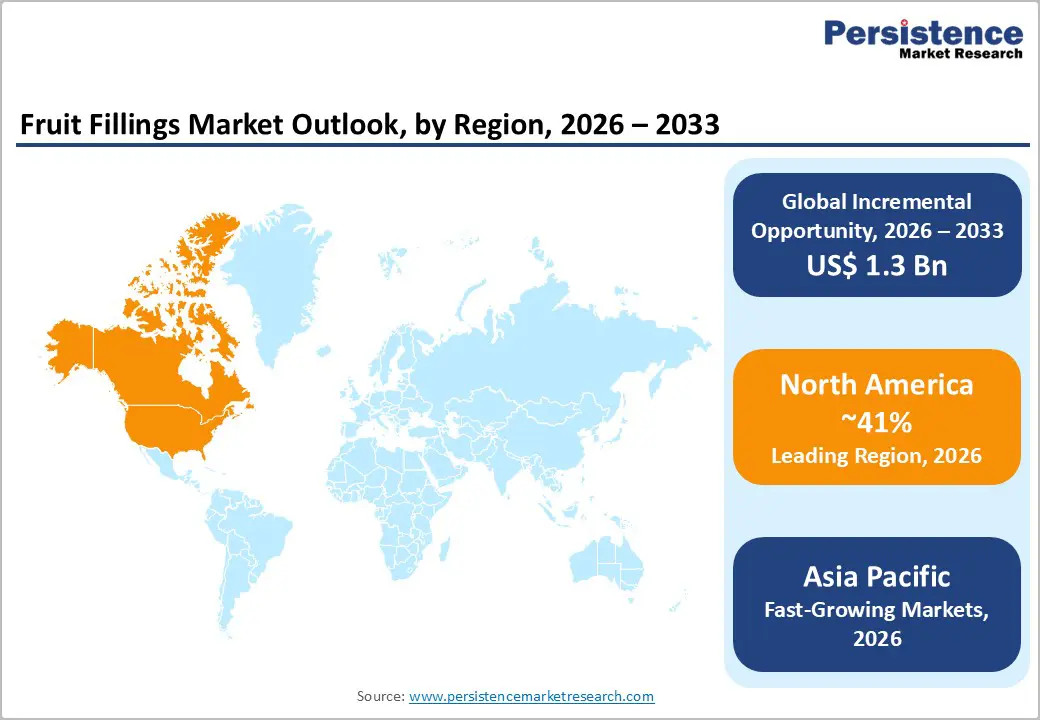

North America holds approximately. 41% market share in the global Fruit Fillings Market, supported by strong bakery, dairy, and beverage manufacturing depth. U.S. brands emphasize clean-label reformulation, reduced sugar, and indulgent textures aligned with premiumization. Innovation centers on berries, tropical blends, and inclusions tailored for frozen desserts, breakfast products, and ready-to-drink beverages across national retail chains with rapid private label expansion and foodservice menu innovation cycles accelerating adoption regionally today.

Canada mirrors these trends while advancing organic certification and sustainability-led sourcing. Manufacturers prioritize traceability, waste reduction, and recyclable packaging to meet retailer standards. Cross-border supply chains encourage harmonized specifications, enabling efficient scaling. Demand for consistent quality, allergen control, and functional positioning continues to shape procurement decisions among North American food and beverage producers seeking resilient suppliers with innovation agility and compliance readiness long-term partnerships nationwide growth objectives aligned closely.

Asia Pacific Fruit Fillings Market is expected to grow at a CAGR of 7.4% driven by rapid urbanization and evolving consumption patterns. India shows rising demand for fruit-based inclusions in dairy desserts and bakery snacks. China focuses on scalable fillings for beverages and frozen products, emphasizing cost efficiency, localized flavors, and high-volume manufacturing capabilities supporting domestic brands and expanding private label penetration across modern retail formats rapidly today.

Japan and South Korea prioritize premium quality, texture precision, and clean ingredient declarations. Japanese producers innovate with refined fruit pieces for confectionery and pastries, while South Korea drives demand through functional beverages and yogurt drinks. Across the region, e-commerce, convenience stores, and foodservice expansion accelerate adoption, encouraging suppliers to tailor sweetness, viscosity, and fruit profiles to diverse cultural preferences efficiently across multi-country distribution networks and pricing tiers competitively.

The market is moderately consolidated, with established ingredient suppliers coexisting alongside regional specialists. Leading companies invest in backward integration to secure fruit sourcing, improve cost control, and stabilize quality. Strategic B2B partnerships with bakeries and beverage brands support customized solutions, while expansion into exotic fruit fillings helps differentiate portfolios in competitive private label and foodservice segments amid evolving regulatory and certification requirements globally today.

Competition increasingly centers on low sugar, non-GMO, organic certifications, and sustainability credentials. Product innovation focuses on cleaner formulations, reduced waste processing, and recyclable packaging. Export opportunities in developing countries attract investment, though compliance with government regulations shapes market entry strategies. Companies balancing innovation speed, quality assurance, and responsible sourcing are best positioned for long-term growth across fragmented demand bases and evolving trade environments worldwide sustainably.

The global Fruit Fillings market is expected to reach around US$ 3.4 billion in 2026.

Product innovation with exotic flavors and clean-label formulations is a key demand driver in the Fruit Fillings market.

North America leads the Fruit Fillings market with about 41% share in 2025.

Innovation in reduced-sugar and functional ingredient formulations is the key opportunity in the market.

Key players include Cargill, Incorporated, T.Hasegawa, Puratos Group, Cornaby's, Dawn Food Products, Inc, Solo Foods, Lucky Leaf, Bakels, AGRANA Beteiligungs-AG, and others

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Fruit Type

By End Use

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author