ID: PMRREP35639| 192 Pages | 22 Sep 2025 | Format: PDF, Excel, PPT* | Food and Beverages

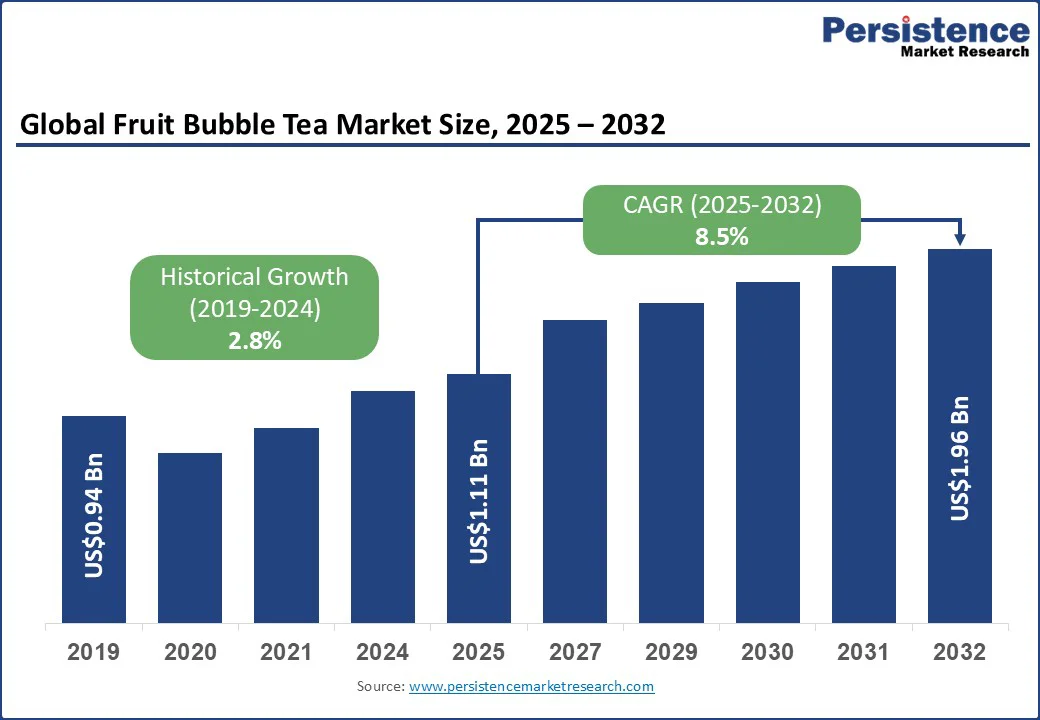

The global fruit bubble tea market size is likely to be valued at US$1.11 Bn in 2025 and is expected to reach US$1.96 Bn by 2032, growing at a CAGR of 8.5% during the forecast period from 2025 to 2032, driven by rising consumer demand for innovative and flavorful beverages. Increasing urbanization, a growing café culture, and the popularity of health-conscious yet indulgent drinks are fueling market expansion.

Key Industry Highlights

| Key Insights | Details |

|---|---|

| Fruit Bubble Tea Market Size (2025E) | US$1.11 Bn |

| Market Value Forecast (2032F) | US$1.96 Bn |

| Projected Growth (CAGR 2025 to 2032) | 8.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 2.8% |

The fruit bubble tea market is expanding as brands introduce exotic, clean-label fruit flavors that go beyond traditional options. Variants made with dragon fruit, lychee, and passion fruit not only enhance the sensory appeal but also align with the growing demand for natural and nutrient-rich beverages.

Consumers are increasingly drawn to products that feature real fruit purees and pieces rather than artificial flavorings, positioning fruit bubble tea as a healthier indulgence. This shift has been reinforced by market studies showing that a large share of bubble tea consumers now prefer authentic fruit-based formulations, making flavor innovation a central growth catalyst for the category.

Another factor shaping market growth is the role of social media in amplifying the appeal of fruit bubble tea. Its vibrant colors, layered textures, and customizable elements such as popping boba or fruit jellies make it highly shareable across Instagram and TikTok, where visual storytelling drives consumer trends.

Younger demographics, in particular, are fueling repeat purchases by seeking beverages that reflect both personal taste preferences and lifestyle choices. An example of this impact can be seen when a leading chain launched dragon fruit and lychee flavors, which generated a notable 30% sales increase in just one quarter, highlighting how viral aesthetics and customization are directly translating into commercial success.

The market faces challenges due to the perishable nature of its core ingredients. Fresh fruit purees, pulps, and toppings require strict cold-chain management and efficient supply coordination to maintain flavor quality and prevent spoilage.

Any disruption in sourcing or delays in transportation can compromise shelf life, create inconsistencies in taste, and result in product wastage. This not only affects profitability but also makes it harder for brands to ensure a consistent consumer experience across outlets.

Another limitation arises from the growing competition of substitute beverages that replicate the flavor appeal without the complexity of preparation. Ready-to-drink fruit teas, sparkling fruit beverages, and infused water products are gaining traction among health-conscious and time-pressed consumers.

These alternatives are often marketed as lighter, cleaner, and more convenient options, drawing away a portion of the audience that might otherwise opt for fruit bubble tea. The increasing preference for such streamlined beverages puts pressure on the market to differentiate itself through innovation and experiential value.

The market is well-positioned to benefit from the rising consumer shift toward functional beverages. Integrating superfoods, probiotics, and adaptogens into fruit-based bubble tea enhances both nutritional value and wellness appeal, creating a stronger connection with health-conscious buyers.

Non-dairy alternatives such as coconut milk and oat milk further expand the addressable audience by appealing to vegan and lactose-intolerant consumers. Combining these elements with exotic fruit flavors allows brands to differentiate their offerings and command premium pricing in an increasingly competitive beverage landscape.

Geographic expansion into underpenetrated regions is also opening new avenues for growth. Markets in Latin America, the Middle East, and Africa are witnessing growing urban populations and rising disposable incomes, yet fruit bubble tea remains a relatively new concept in these areas.

Small-format models such as kiosks on university campuses, pop-up counters at food festivals, and mobile outlets can accelerate entry into these markets with lower upfront investment. These approaches not only build brand visibility among Gen Z and millennial consumers but also create scalable pathways for global players looking to establish an early foothold in high-potential regions.

The fresh fruit bubble tea segment is anticipated to hold the largest share of the market, accounting for an estimated 43% of total sales in 2025. Its dominance is attributed to the strong consumer preference for beverages that emphasize freshness, natural fruit content, and authenticity.

Freshly blended fruit teas are perceived as healthier alternatives compared to artificial syrups, which have become a major differentiator in urban markets where consumers are seeking both indulgence and nutrition in a single product. Chains such as Gong Cha and Sharetea frequently highlight mango, strawberry, and lychee options made with fresh fruit, reinforcing demand for this segment.

The sparkling fruit bubble tea segment is emerging as the fastest-growing. Its rapid adoption is driven by the growing popularity of carbonated functional drinks, particularly among younger demographics looking for novel and Instagram-worthy beverage experiences.

The fusion of fruit teas with sparkling bases caters to the rising appetite for unique textures and refreshing flavor profiles. For example, Taiwanese brands have recently introduced sparkling lychee and passion fruit variants that quickly gained traction across Asia Pacific cafés, underscoring how carbonation and fruit freshness create a premium positioning that resonates globally.

Within the flavor category, tropical flavors such as mango, pineapple, and guava represent the largest segment, contributing nearly 37% of the fruit bubble tea market. Their dominance stems from their wide global familiarity, versatility across both fresh and frozen applications, and strong appeal to consumers seeking exotic yet approachable tastes.

Tropical flavors also blend seamlessly with tapioca pearls and fruit jellies, making them a staple on menus worldwide. Brands often spotlight tropical options in seasonal promotions; for instance, Coco Fresh Tea & Juice regularly features mango and pineapple bubble teas as summer specials, further boosting their market presence.

The exotic flavors segment, which includes lychee, dragon fruit, and kiwi, is the fastest-growing. Growth is fueled by consumer curiosity for adventurous and premium flavor experiences, particularly among millennials and Gen Z. These flavors are also visually distinctive, often resulting in vibrant and colorful beverages that gain high traction on social media platforms.

For example, a leading chain in Singapore introduced a dragon fruit bubble tea line that went viral due to its striking appearance, quickly driving sales and consumer engagement. This emphasis on novelty, aesthetics, and premium positioning makes exotic flavors a critical driver of future growth in the market.

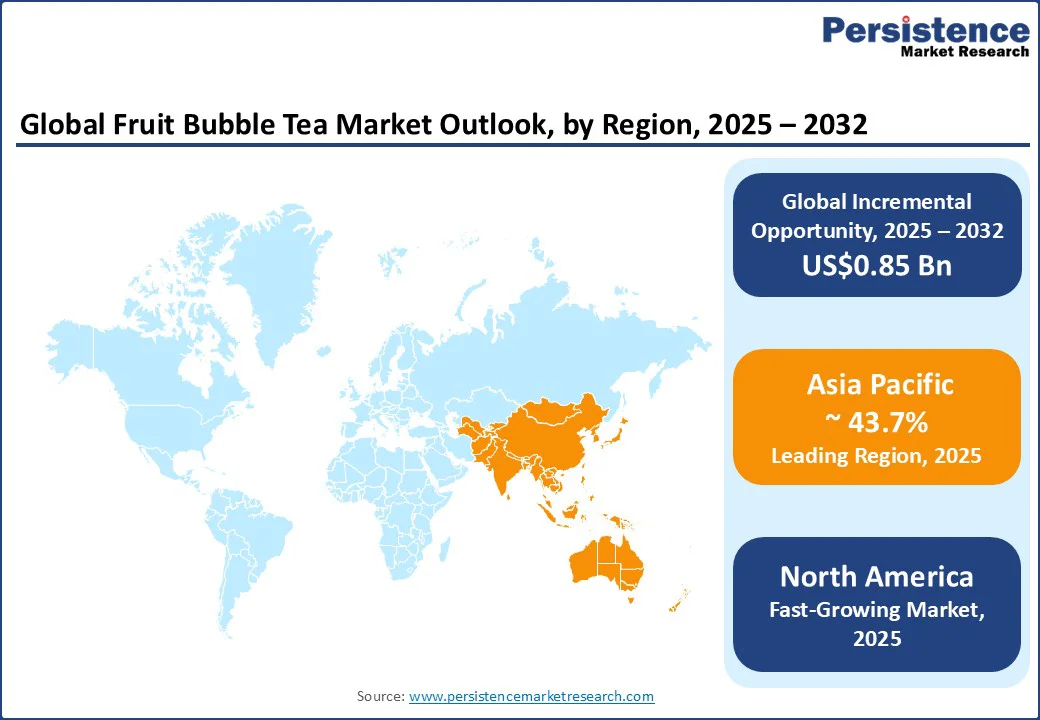

The Asia Pacific region remains the epicenter of the fruit bubble tea market, holding approximately 43.7% of the market share. This leadership is driven by the region's deep-rooted tea culture, rapid urbanization, and a young, trend-conscious consumer base. Taiwan, as the originator of bubble tea, continues to influence global trends with its innovative flavors and preparation techniques, setting the standard for authenticity and quality.

In China, rapid expansion by major players is shaping market dynamics. For example, Heytea introduced fruit-heavy seasonal menus featuring mango, passion fruit, and lychee blends, attracting long queues and viral social media attention. Similarly, Mixue Group continues to grow its footprint, opening hundreds of new outlets each year and experimenting with unique fruit combinations to engage younger consumers.

Vietnam is also witnessing a surge in fruit bubble tea popularity. Local brands such as Royaltea and international chains are launching outlets in urban centers, offering exotic fruit flavors and creative toppings such as popping boba and aloe vera. Pop-up events and collaborations with influencers have helped these brands rapidly gain visibility, highlighting the growing consumer appetite for premium and Instagram-worthy beverages.

North America is the fastest-growing region, as fruit bubble tea is rapidly evolving from a niche beverage into a mainstream lifestyle and social media-driven trend. Originally popularized by traditional Asian tea houses, fruit-based bubble teas have gained significant traction among younger consumers, especially millennials and Gen Z, who are drawn to the drink’s vibrant colors, customizable options, and refreshing flavor profiles.

In the U.S., this growth is largely driven by the expansion of well-known Asian bubble tea brands such as CoCo Fresh Tea & Juice, Gong Cha, and Tiger Sugar. These companies are strategically entering urban markets, particularly in states such as California, Texas, and New York, offering fruit-forward menu items such as mango green tea, lychee yogurt tea, and strawberry jasmine tea.

To appeal to visually-driven consumers, many of these beverages come with add-ons such as rainbow boba, popping pearls, and fruit jellies, creating an engaging and highly shareable experience that performs well on platforms such as TikTok and Instagram.

Mainstream beverage chains have taken notice of the trend and are beginning to integrate fruit bubble tea-inspired offerings into their menus. Starbucks, for example, has tested iced fruit teas with popping pearls, while smaller specialty cafés are developing seasonal drinks that feature tropical fruits such as yuzu, dragon fruit, and passionfruit.

These new beverages often emphasize customization, allowing customers to choose their tea base, sweetness level, and toppings, reinforcing the drink’s appeal as a highly personalized refreshment. The crossover between health and indulgence is also becoming more pronounced, with many cafés introducing smoothie-tea hybrids and plant-based boba drinks that cater to health-conscious consumers.

Europe’s fruit bubble tea market is developing steadily, with consumers drawn to novelty and social media-friendly products. In the U.K., chains such as Madam Hong and Bubbleology are introducing creative fruit blends, such as peach iced tea with popping boba or mixed berry drinks with layered jelly cubes. Seasonal promotions and influencer campaigns have made these drinks highly visible on Instagram and TikTok, helping to expand the category.

Germany has embraced fruit bubble tea through urban café culture, particularly in cities such as Berlin and Munich. Local cafés are experimenting with unusual flavor combinations, such as kiwi-lime and dragon fruit blends, often paired with innovative toppings. Collaborations with lifestyle influencers and pop-up events at shopping districts have helped these brands capture attention and drive foot traffic, creating a strong foothold for the segment in Europe.

Across these regions, growth is being fueled less by numerical scale and more by creative product innovation, influencer-led campaigns, and experiential marketing. Taiwan’s influence as the originator of bubble tea continues to inspire brands worldwide, encouraging experimentation with fruit flavors, toppings, and visually striking presentations that resonate strongly with younger, trend-conscious consumers.

The global fruit bubble tea market is highly competitive, with a mix of established international chains, rapidly expanding regional players, and numerous local specialty cafés. Brands such as Gong Cha, CoCo Fresh Tea & Juice, and Sharetea are expanding aggressively across global markets, while homegrown players in Asia Pacific, such as Heytea and Mixue, continue to set trends through product innovation and large-scale expansion.

In North America and Europe, independent cafés and smaller boutique outlets compete by offering unique fruit blends and premium ingredients to differentiate themselves. The market is also witnessing collaborations with lifestyle influencers, seasonal product launches, and strong use of digital marketing, which further intensifies competition among players seeking to capture the attention of young, social media-driven consumers.

The fruit bubble tea market is estimated to be valued at US$1.11 Bn in 2025.

By 2032, the market is expected to reach approximately US$1.96 Bn.

Key trends include the rising demand for fresh fruit-based bubble tea, the popularity of tropical flavors such as mango and pineapple, the introduction of ready-to-drink (RTD) formats, and the growing influence of social media-driven beverage consumption.

The fresh fruit bubble tea segment leads the market, accounting for nearly 43% of the market share, supported by strong consumer preference for natural, customizable, and visually appealing beverages.

The market is projected to grow at a CAGR of 8.5 % from 2025 to 2032, driven by flavor innovations, café culture expansion, and the rising global influence of Taiwanese bubble tea brands.

Some of the major players include Gong Cha, CoCo Fresh Tea & Juice, Heytea, Mixue Group, and Yi Fang Taiwan Fruit Tea.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Flavor

By Ingredient

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author