ID: PMRREP30519| 187 Pages | 8 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

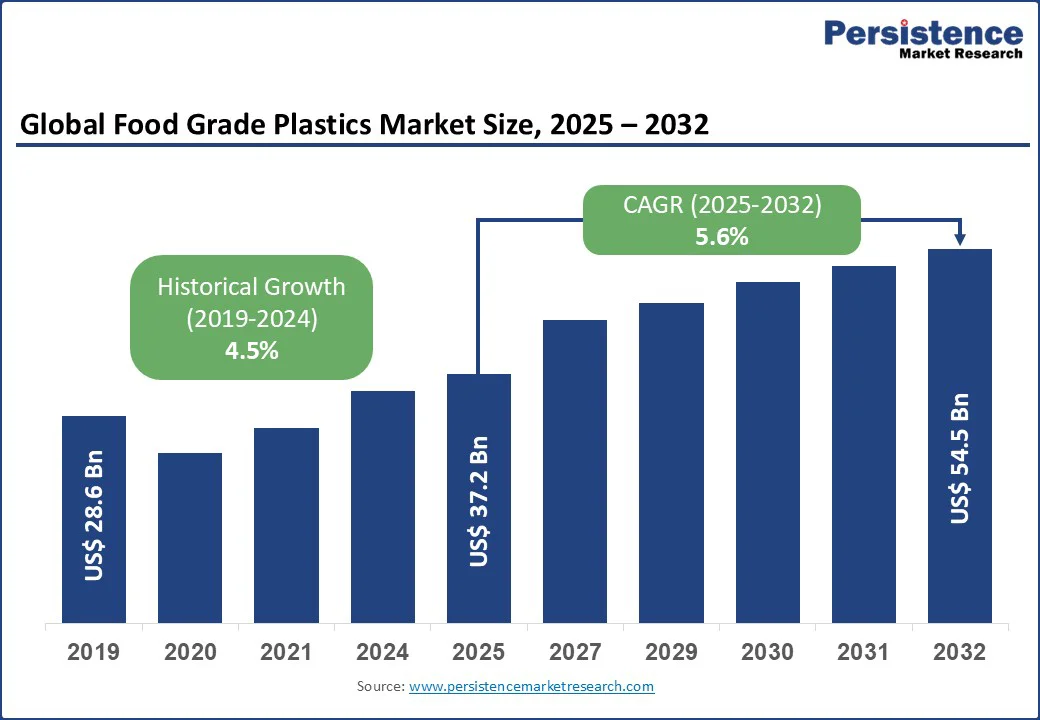

The global food-grade plastics market size is likely to be valued at US$37.2 Bn in 2025 and is expected to reach US$54.5 Bn by 2032, registering a CAGR of 5.6% during the forecast period from 2025 to 2032.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

|---|---|

| Food Grade Plastics Market Size (2025E) | US$37.2 Bn |

| Market Value Forecast (2032F) | US$54.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.5% |

The food-grade plastics industry is witnessing consistent growth fueled by heightened consumer awareness of food safety and hygiene, coupled with strict regulatory standards. Expanding packaged food consumption, urbanization, and lifestyle changes are further boosting demand. Additionally, innovation in recyclable and biodegradable plastics creates opportunities for sustainable packaging solutions globally.

The global surge in awareness of food safety and contamination prevention is a primary driver of the food grade plastics market. According to the World Health Organization, foodborne illnesses account for over 600 million cases annually, with contamination being a leading cause.

The rising prevalence of these conditions, particularly among urban populations, drives demand for plastics with excellent barrier properties and non-toxicity. In North America, a significant share of consumers relies on packaged foods, necessitating advanced molding and extrusion technologies to meet demand.

Technological advancements in plastic compounding and recycling are propelling market growth. Modern systems, such as BASF’s high-performance polymers, offer improved recyclability and reduced leaching, enhancing consumer satisfaction.

A recent study found that food-grade plastic packaging extends shelf life by up to thirty percent compared to alternatives, boosting consumer confidence. The integration of sustainable practices and bio-based alternatives, such as plant-derived resins, supports adoption in ready-to-eat foods and beverages.

Government health initiatives and increased funding for food safety programs further drive market expansion. In India, national schemes such as the Food Safety and Standards Authority of India (FSSAI) have expanded access to certified plastic packaging, increasing demand for food-grade materials. In North America, favorable regulatory policies, such as the FDA’s approval of plastic safety claims, incentivize manufacturers to invest in high-quality resins, fueling market growth.

Sustainability concerns in plastic sourcing continue to hinder widespread adoption, particularly in environmentally conscious markets such as North America. Food-grade plastics are often derived from petroleum-based sources, raising concerns about plastic waste and pollution.

The high cost of sustainable alternatives, such as recycled or bio-based plastics certified by organizations such as the FDA, adds to production expenses, with advanced compounding systems requiring significant upfront investment.

Additionally, ongoing costs for quality testing and compliance with environmental regulations, such as the U.S. EPA’s guidelines, increase the total cost of ownership. For manufacturers in resource-limited regions, such as parts of Latin America and Southeast Asia, these financial burdens limit scalability, restricting access to premium food-grade plastic products.

The need for skilled personnel to operate advanced molding and extrusion systems also poses a challenge. Producing high-quality plastics requires expertise in injection molding and quality control, and an industry survey reported a shortage of trained technicians in Asia Pacific processing facilities. This skills gap, combined with high training costs, restricts the adoption of advanced technologies in developing regions, slowing market growth.

The development of sustainable and alternative plastic sources presents significant growth opportunities, particularly by enabling environmentally friendly production for eco-conscious consumers. Bio-based plastics, such as those produced by Solvay and Evonik, offer a greener alternative to traditional resins, reducing reliance on fossil fuels.

These innovations address sustainability concerns and appeal to the growing eco-friendly demographics, particularly in North America and Europe. For instance, Westlake Plastics’ recycled HDPE is gaining traction in food containers, exemplifying the shift toward sustainable solutions.

The rise of premium e-commerce food delivery formulations offers another growth avenue. Food grade plastics, with their lightweight and durable properties, are increasingly used in packaging to ensure product integrity during transit. A recent market study found that e-commerce food sales grew significantly worldwide, driving demand for high-quality plastics in formulations. Companies such as Ensinger Inc. are capitalizing on this trend by offering tailored plastic grades for food delivery manufacturers.

The growing adoption of digital supply chain platforms and blockchain for traceability also enhances market potential. Companies such as Saint-Gobain Performance Plastics are integrating IoT-based systems, ensuring sustainable sourcing and regulatory compliance. This trend supports market expansion by addressing consumer concerns about ethical production and improving supply chain efficiency.

The global food grade plastics market is segmented into high-density polyethylene, low-density polyethylene, polyethylene terephthalate, polyvinyl chloride, polypropylene, polystyrene, and others. Polypropylene dominates, holding approximately 38.6% share in 2025, due to its abundant availability and high durability. Resins such as polypropylene and polyethylene are widely used for their excellent barrier properties, making them a cost-effective choice for large-scale production.

Polyethylene terephthalate is the fastest-growing segment, driven by increasing demand for premium plastics in beverage bottles and functional packaging. Its high clarity and recyclability, particularly in North America and Europe, boost its adoption in high-value markets.

By recyclability, the food grade plastics market is divided into recyclable and non-recyclable. Recyclable leads are expected to have a 40% share in 2025, driven by their high usage in sustainable packaging for foods such as dairy and snacks. Recyclable plastics are critical for reducing environmental impact, with over 70% of global food grade plastic production shifting toward this category.

Recyclable materials are also the fastest-growing segment, driven by rising regulations and increasing demand for eco-friendly alternatives. The increasing use of recyclable plastics in packaging to support circular economy goals, particularly in North America and Europe, drives demand for specialized formulations.

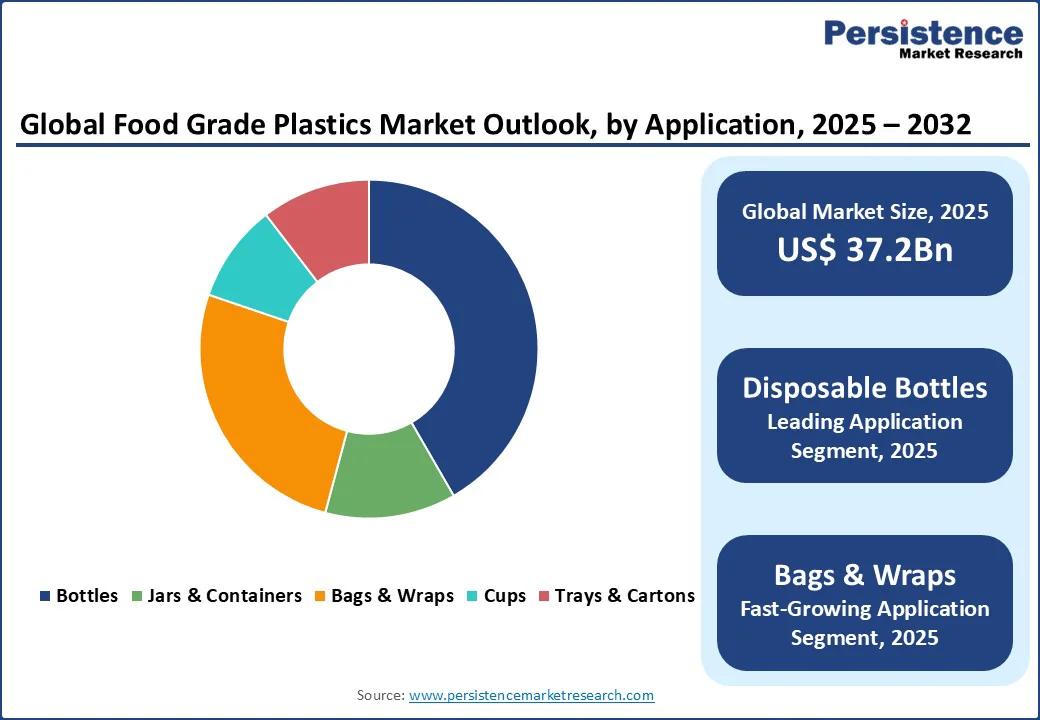

By application type, the market is divided into bottles, jars & containers, bags & wraps, cups, lids & caps, trays & cartons, and others. Bottles lead with a 40% share in 2025, driven by their high usage in beverage and condiment storage globally. These are critical for maintaining freshness and safety in bottled products, with over 70% of global production consumed by this sector.

Bags & wraps are the fastest-growing segment, fueled by rising convenience food consumption and demand for flexible packaging. The increasing use of bags and wraps in e-commerce and retail to support hygiene and portability, particularly in North America and Europe, drives demand for specialized formulations.

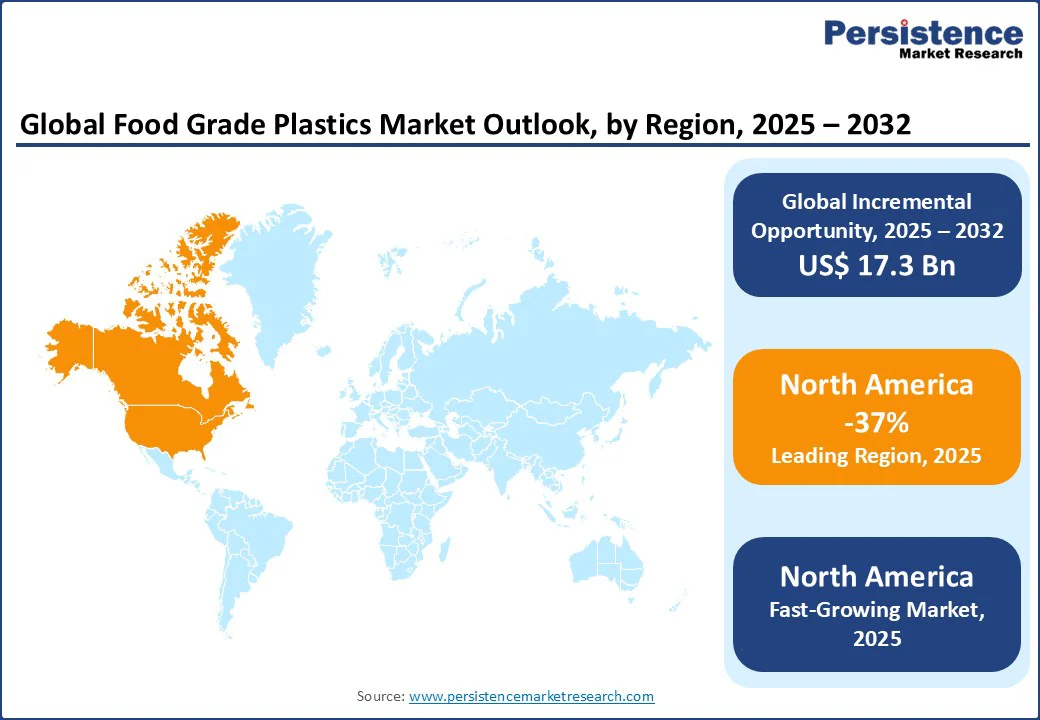

North America is the leading region in the industry, holding a 37% market share in 2025, driven by the U.S., Canada, and Mexico, which have robust regulatory support and high consumption of packaged products. The U.S. dominates within North America, supported by strong sales from leading brands such as Westlake Plastics and Professional Plastics. The FDA’s stringent regulations on food safety foster innovation and compliance, encouraging the adoption of recyclable plastics and bio-based alternatives across major markets.

In the U.S., market growth is driven by the rising preference for flexible and sustainable plastic packaging in functional foods and beverages. Products such as Victrex’s high-performance polymers are gaining popularity for their durability and safety.

Consumer preferences are shifting toward traceable and eco-friendly products, with companies such as Solvay incorporating FDA-certified sourcing to enhance credibility. Additionally, the rise of e-commerce food delivery and stringent FDA regulations further incentivize manufacturers to invest in advanced compounding technologies, supporting market growth.

In Europe, the food grade plastics market is significant, led by Germany, France, and the U.K., driven by high consumer awareness of food safety benefits and a robust packaging industry. Germany is a key contributor, with companies such as Evonik and BASF offering innovative, recyclable solutions. The EU’s strict regulations, such as the Plastics Strategy, encourage the adoption of sustainable and high-quality plastics.

In the U.K., demand for high-clarity plastics is rising, fueled by increasing consumption of ready-to-eat foods. France is witnessing growth in e-commerce applications, with companies such as Saint-Gobain Performance Plastics providing specialized grades for food delivery packaging. Regulatory support for sustainable production practices across Europe further enhances market prospects.

Asia Pacific remains the fastest-growing region for the industry, with China, India, and Japan emerging as key contributors. In India, heightened health awareness and supportive government food safety programs, such as FSSAI initiatives, are fueling demand for affordable plastic packaging, with companies such as MITSUBISHI leading the supply of cost-effective, recyclable materials.

China’s growth is underpinned by extensive food processing expansion, where brands such as Ensinger Inc. provide high-quality plastics for container applications. Japan is carving a niche in premium-grade plastics for snack packaging, with Solvay gaining prominence. Rising healthcare investments and digital procurement platforms further bolster regional market expansion.

The global food grade plastics market is intensely competitive, driven by the pursuit of innovation, sustainability, and cost efficiency. Companies are increasingly focusing on recycled and bio-based plastics to align with stringent environmental and food safety standards.

Strategic collaborations, acquisitions, and regulatory certifications strengthen market positioning, while investments in advanced compounding and extrusion technologies enhance product performance. Differentiation is achieved through eco-friendly innovations, compliance with global regulations, and competitive pricing strategies targeting diverse end-use sectors.

The Food Grade Plastics market is projected to reach US$37.2 Bn in 2025.

Rising health awareness, food packaging expansion, and government food safety initiatives are the key market drivers.

The Food Grade Plastics market is poised to witness a CAGR of 5.6% from 2025 to 2032.

Innovation in sustainable sourcing and e-commerce applications creates market opportunities.

Ensinger Inc., Solvay, and BASF are among the key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

| Customization and Pricing |

|

By Resin Type

By Recyclability

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author