- Executive Summary

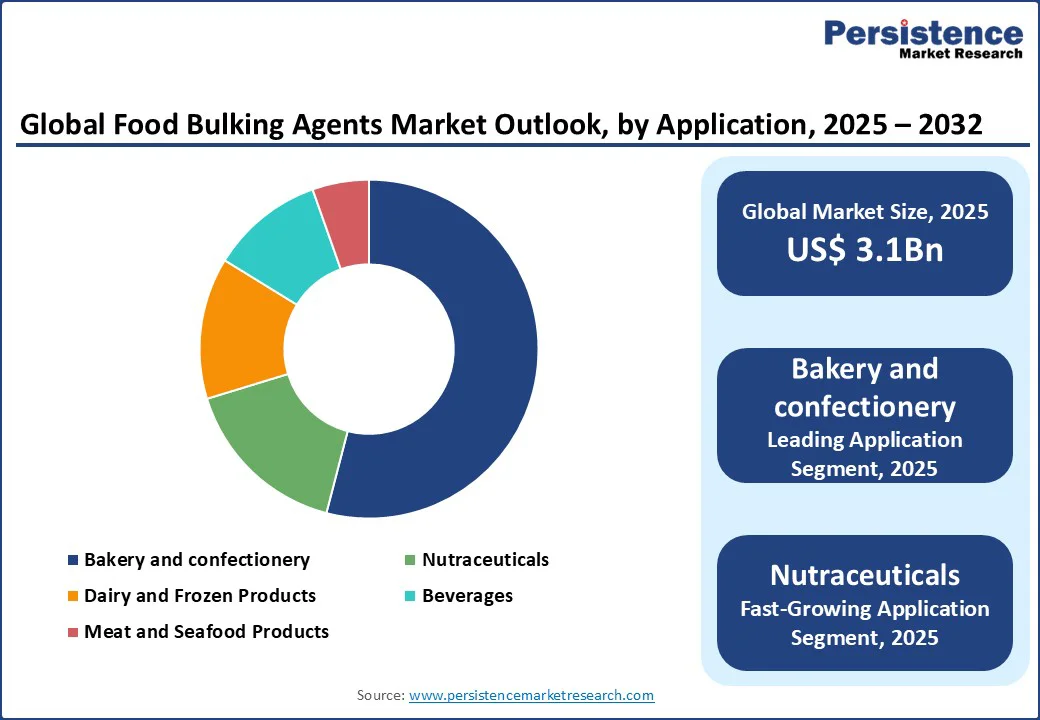

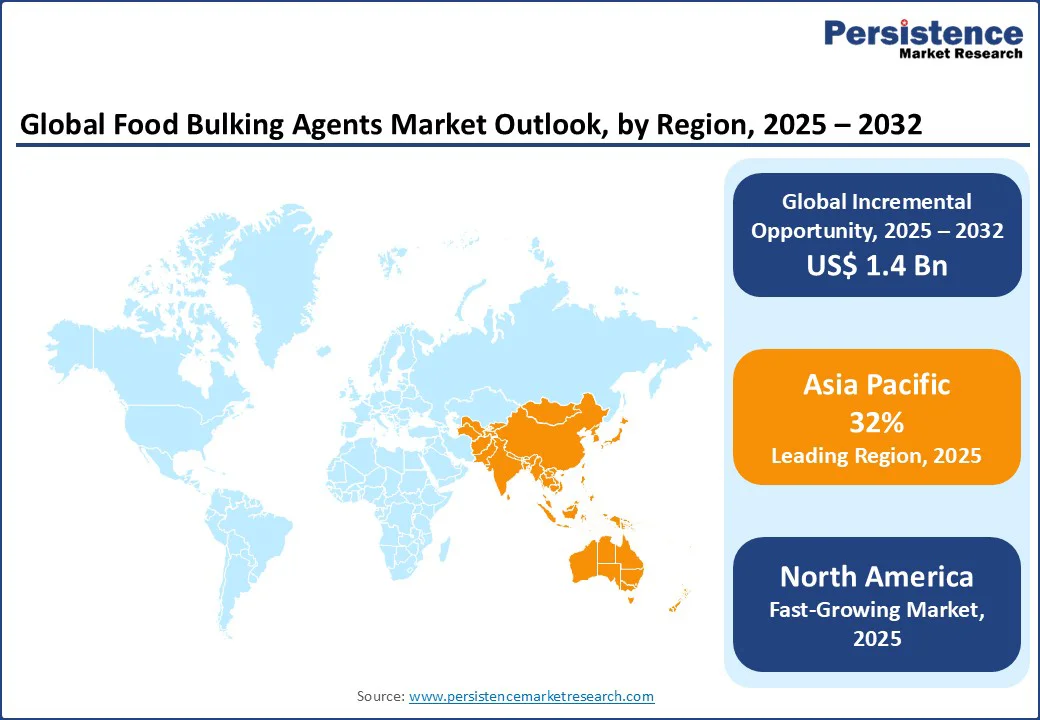

- Global Food Bulking Agents Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 - 2032, US$ Bn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Value Chain Analysis

- Key Market Players

- Regulatory Landscape

- PESTLE Analysis

- Porter’s Five Force Analysis

- Consumer Behavior Analysis

- Price Trend Analysis, 2019 - 2032

- Key Factors Impacting Product Prices

- Pricing Analysis, By Product Type

- Regional Prices and Product Preferences

- Global Food Bulking Agents Market Outlook

- Market Size (US$ Bn) Analysis and Forecast

- Historical Market Size (US$ Bn) Analysis, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, 2025-2032

- Global Food Bulking Agents Market Outlook: Product Type

- Historical Market Size (US$ Bn) Analysis, By Product Type, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025-2032

- Antioxidants

- Forms and Enhancers

- Anticaking Agents

- Acids

- Emulsifiers

- Humectants

- Stabilizers

- Others

- Market Attractiveness Analysis: Product Type

- Global Food Bulking Agents Market Outlook: Form

- Historical Market Size (US$ Bn) Analysis, By Form, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Form, 2025-2032

- Powder

- Granules

- Liquid

- Others

- Market Attractiveness Analysis: Form

- Global Food Bulking Agents Market Outlook: Application

- Historical Market Size (US$ Bn) Analysis, By Application, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Bakery and Confectionery

- Dairy and Frozen Products

- Beverages

- Meat and Seafood Products

- Snacks, Nutraceuticals

- Animal Feed

- Others

- Market Attractiveness Analysis: Application

- Market Size (US$ Bn) Analysis and Forecast

- Global Food Bulking Agents Market Outlook: Region

- Historical Market Size (US$ Bn) Analysis, By Region, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Region, 2025-2032

- North America

- Latin America

- Europe

- East Asia

- South Asia and Oceania

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Food Bulking Agents Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product Type

- By Form

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- U.S.

- Canada

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025-2032

- Antioxidants

- Forms and Enhancers

- Anticaking Agents

- Acids

- Emulsifiers

- Humectants

- Stabilizers

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Form, 2025-2032

- Powder

- Granules

- Liquid

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Bakery and Confectionery

- Dairy and Frozen Products

- Beverages

- Meat and Seafood Products

- Snacks

- Nutraceuticals

- Animal Feed

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- Europe Food Bulking Agents Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product Type

- By Form

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Rest of Europe

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025-2032

- Antioxidants

- Forms and Enhancers

- Anticaking Agents

- Acids, Emulsifiers

- Humectants

- Stabilizers

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Form, 2025-2032

- Powder

- Granules

- Liquid

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Bakery and Confectionery

- Dairy and Frozen Products

- Beverages

- Meat and Seafood Products

- Snacks

- Nutraceuticals

- Animal Feed

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- East Asia Food Bulking Agents Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product Type

- By Form

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- China

- Japan

- South Korea

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025-2032

- Antioxidants

- Forms and Enhancers, Anticaking Agents, Acids, Emulsifiers, Humectants, Stabilizers, Others

- Market Size (US$ Bn) Analysis and Forecast, By Form, 2025-2032

- Powder

- Granules, Liquid, Others

- Fruit Form

- Mint

- Coffee

- Chocolate

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Bakery and Confectionery

- Dairy and Frozen Products

- Beverages

- Meat and Seafood Products

- Snacks, Nutraceuticals, Animal Feed

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- South Asia & Oceania Food Bulking Agents Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product Type

- By Form

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- India

- Indonesia

- Thailand

- Singapore

- ANZ

- Rest of South Asia & Oceania

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025-2032

- Antioxidants

- Forms and Enhancers

- Anticaking Agents

- Acids

- Emulsifiers

- Humectants

- Stabilizers

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Form, 2025-2032

- Powder

- Granules

- Liquid

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Bakery and Confectionery

- Dairy and Frozen Products

- Beverages

- Meat and Seafood Products

- Snacks

- Nutraceuticals

- Animal Feed

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- Latin America Food Bulking Agents Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product Type

- By Form

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- Brazil

- Mexico

- Rest of Latin America

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025-2032

- Antioxidants

- Forms and Enhancers

- Anticaking Agents

- Acids

- Emulsifiers

- Humectants

- Stabilizers

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Form, 2025-2032

- Powder

- Granules

- Liquid

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Bakery and Confectionery

- Dairy and Frozen Products

- Beverages

- Meat and Seafood Products

- Snacks

- Nutraceuticals

- Animal Feed

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- Middle East & Africa Food Bulking Agents Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product Type

- By Form

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- GCC Countries

- Egypt

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025-2032

- Antioxidants

- Forms and Enhancers

- Anticaking Agents

- Acids

- Emulsifiers

- Humectants

- Stabilizers

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Form, 2025-2032

- Powder

- Granules

- Liquid

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Bakery and Confectionery

- Dairy and Frozen Products

- Beverages

- Meat and Seafood Products

- Snacks

- Nutraceuticals

- Animal Feed

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- BEHN MEYER

- Overview

- Segments and Product Type

- Key Financials

- Market Developments

- Market Strategy

- Ingredion Incorporated

- Cargill

- DuPont Nutrition & Biosciences

- Symrise

- CP Kelco

- VW-Ingredients

- Archer Daniels Midland Company (ADM)

- Roquette

- Kerry Group

- BASF

- Others

- BEHN MEYER

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment