ID: PMRREP25609| 240 Pages | 9 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

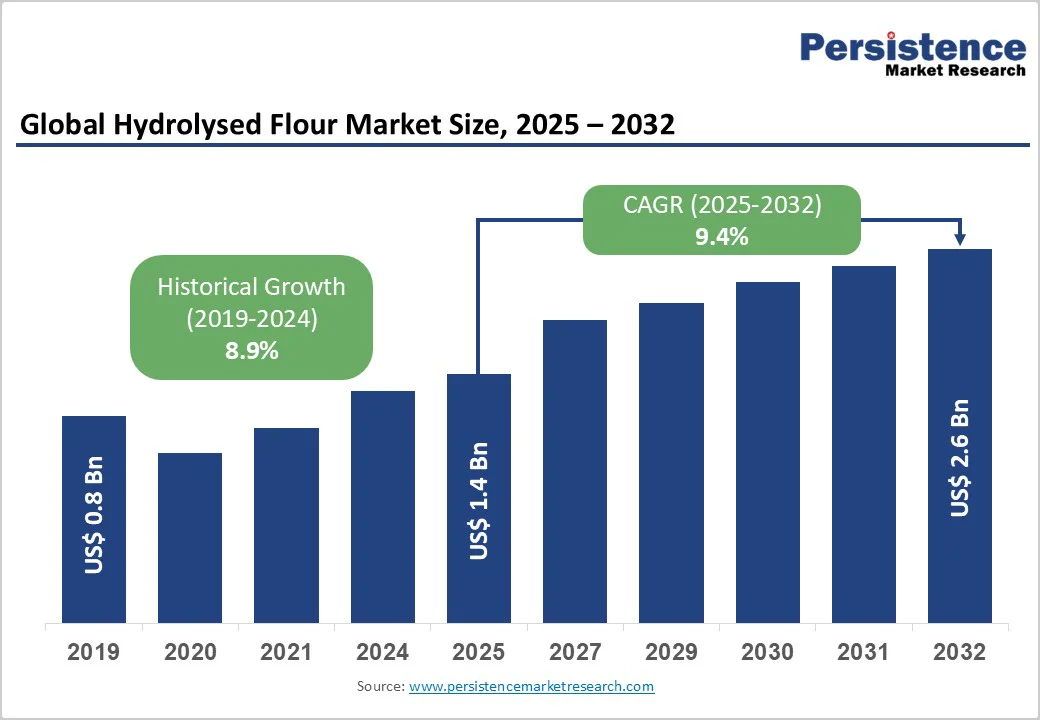

The global hydrolysed flour market size is likely to be valued US$1.4 Billion in 2025, estimated to reach US$2.6 Billion by 2032, growing at a CAGR of 9.4% during the forecast period from 2025 to 2032.

The market is experiencing robust growth driven by the increasing prevalence of gluten intolerance and digestive health concerns, rising demand for clean-label and allergen-free ingredients, and advancements in enzymatic hydrolysis technologies. The need for digestible, hypoallergenic flours in food processing has significantly boosted the adoption of pre-digested flour across various applications, particularly in developed and emerging economies.

The market is further propelled by innovations in plant-based and organic formulations, catering to consumer preferences for sustainable and health-focused products. The growing acceptance of modified flour as a versatile ingredient in gluten-free baking and functional foods, especially for celiac and sensitive consumers, is a key growth factor.

| Global Market Attribute | Key Insights |

|---|---|

|

Hydrolysed Flour Market Size (2025E) |

US$1.4 Bn |

|

Market Value Forecast (2032F) |

US$2.6 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

9.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.9% |

The increasing prevalence of gluten intolerance and the demand for functional, digestible foods are primary drivers of the modified flour market. Gluten-related disorders affect over 1% of the global population, with celiac disease diagnoses growing by 7.5% annually, while the functional food market is expected to reach US$ 300 Bn by 2030. This health crisis fuels demand for allergen-reduced, digestible ingredients. Gluten-reduced flour, processed via enzymatic hydrolysis, reduces gluten content by over 90% and enhances bioavailability, achieving 95% consumer satisfaction in taste tests for gluten-free breads. For instance, products from companies such as Cargill Incorporated have shown 80% improvement in digestibility, reducing gastrointestinal issues by up to 65% in clinical studies. The surge in clean-label trends, coupled with global food tech investments of US$ 20 Bn in 2025, has accelerated adoption. The focus on plant-based diets, supported by WHO dietary guidelines, continues to propel the market forward, particularly in health-conscious regions such as North America and Europe.

High production costs and limited consumer awareness in developing regions restrain the modified flour market growth. Enzymatic hydrolysis requires specialized enzymes and controlled processing, increasing costs by 25-30% compared to conventional flours, with premium variants priced at US$ 6-8 per kg. Scaling production involves capital investments exceeding US$ 15 Mn for modern facilities, alongside complex supply chains for raw materials. Regulatory bodies such as the U.S. FDA and EFSA require rigorous allergen and safety testing, extending approval timelines to 12-18 months. For example, certifications for rice-based flours by Archer Daniels Midland faced delays due to trace gluten concerns, raising costs by 20%. Smaller players struggle against giants such as Buhler A.G., limiting market penetration in regions where traditional flours dominate due to lower awareness of hydrolysed benefits.

Advancements in nutraceutical applications and vegan-friendly formulations present significant growth opportunities for the gluten-reduced flour market. Pea and rice-based variants offer high protein and prebiotic benefits, with 90% efficacy in gut health studies. These align with the nutraceutical market, projected to reach US$ 650 Bn by 2030. For instance, companies such as PGP International are developing organic blends, with trials showing 75% cost reduction in snack formulations. Liquid forms enhance solubility, cutting processing times by 30%, while e-commerce integration boosts consumer access. As global demand for gluten-free and vegan products grows—expected to hit US$ 15 Bn by 2030—these opportunities are set to drive expansion in high-growth regions such as Asia Pacific and Europe.

Wheat digestible flour dominates the market, holding approximately 40% of the share in 2025, driven by its widespread availability, efficient processing infrastructure, and versatility in baking applications. Its ability to deliver traditional textures and flavors makes it popular among gluten-sensitive consumers, supporting its dominance across bakery, confectionery, and functional food segments seeking cleaner label ingredients.

Pea digestible flour is the fastest-growing segment, fueled by the rising popularity of vegan and plant-based diets. Its rich protein profile, hypoallergenic nature, and sustainable sourcing make it a preferred ingredient in meat substitutes, sports nutrition, and nutraceuticals. Growing consumer focus on clean-label and allergen-free products further accelerates its demand in health-oriented markets.

Powdered form leads with over 60% share, due to its long shelf life, easy blending with dry ingredients, and cost efficiency in storage and transportation. Its versatility and stability make it a preferred choice for industrial baking, snacks, and convenience food manufacturing, supporting large-scale production and consistent product quality.

Liquid form is the fastest-growing, driven by its superior solubility, smooth texture, and ability to enhance mouthfeel in beverages and sauces. Its quick dispersion supports formulation efficiency and product consistency, making it ideal for functional drinks, nutritional supplements, and ready-to-eat products in the expanding health and wellness food sector.

Baked Goods dominate with nearly 30% share, fueled by growing demand for gluten-free breads, cakes, and pastries. Their ability to retain texture and flavour appeals to celiac patients and gluten-sensitive consumers. Rising health awareness and the trend toward clean-label, allergen-free bakery products further reinforce baked goods as the dominant application segment in the market.

Snack Foods are the fastest-growing, driven by increasing demand for convenient, healthy options such as protein bars, chips, and extruded snacks. Pre-digested flour enhances their nutritional value, digestibility, and texture, making it ideal for functional and on-the-go products. Rising health-conscious consumption and busy lifestyles are accelerating growth in this segment across global markets.

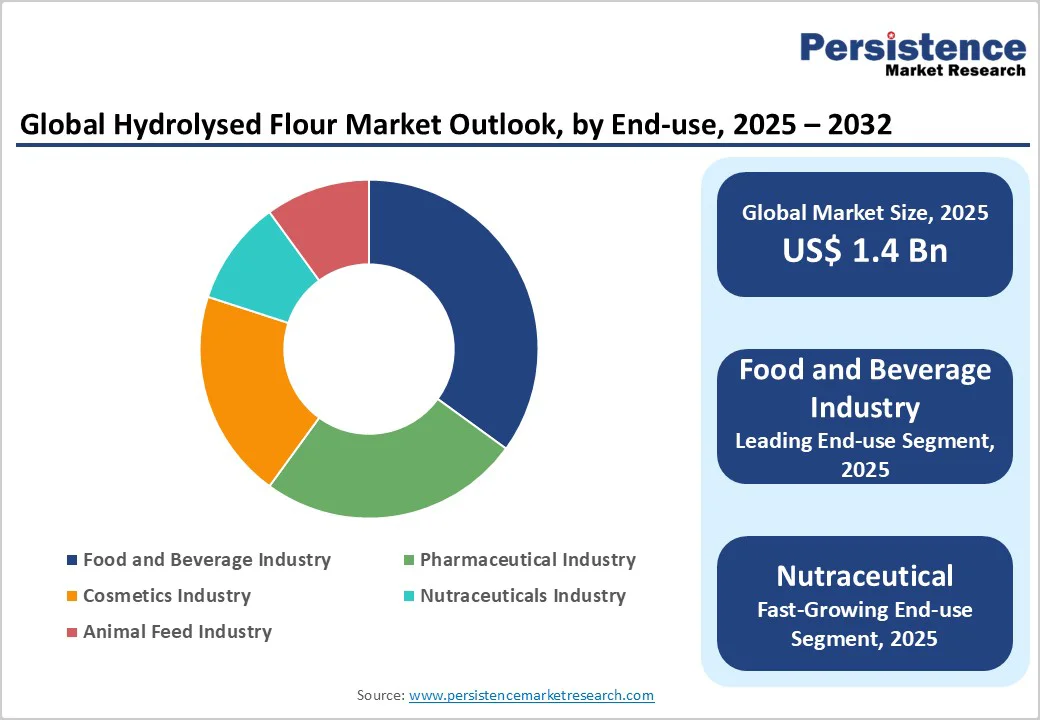

Food and Beverage Industry hold 70% share, utilizing gluten-reduced flour to improve texture, flavour, and nutritional value while reducing allergens. Its versatility supports mass-produced baked goods, snacks, dairy alternatives, and functional foods. Growing consumer demand for allergen-free, protein-enriched, and clean-label products further strengthens its widespread adoption across this sector.

Nutraceuticals Industry is the fastest-growing, propelled using modified flour in digestive health supplements, protein-fortified formulations, and functional nutrition products. Its high digestibility, hypoallergenic nature, and nutritional benefits make it ideal for health-conscious consumers, fueling demand in vitamins, meal replacements, and wellness-focused products, and driving rapid expansion in the sector.

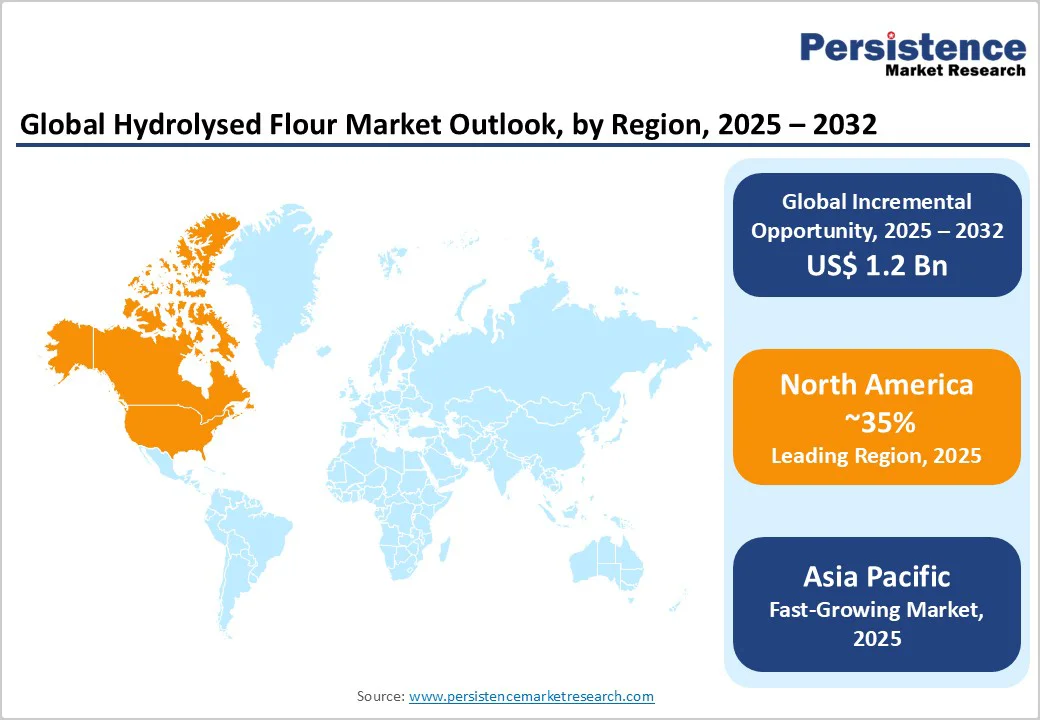

North America accounts for 35% in 2025, driven by the region’s high prevalence of gluten intolerance and celiac disease, which has increased demand for gluten-free and hypoallergenic products. The U.S. and Canada lead in food innovation, with manufacturers focusing on clean-label, organic, and functional foods. Gluten-reduced flour is widely used in baked goods, snacks, beverages, and dairy alternatives, enhancing texture, nutrition, and digestibility, aligning with consumer preferences for healthier, convenient, and allergen-friendly options. Growing awareness of digestive health, protein enrichment, and plant-based diets further supports market growth, with retailers and foodservice companies expanding their product lines to cater to health-conscious consumers.

The U.K., as a key part of Europe, follows similar trends, with rising interest in gluten-free baking driven by NHS health campaigns and supermarket initiatives. Demand for pre-digested flour in breads, pastries, and snacks is increasing, supported by the focus on clean-label, allergen-free, and functional ingredients.

Europe holds about 30% market share, led by Germany and France due to EU regulations promoting clean-label foods and strong bakery sectors adopting digestible flour for gluten-free and functional products. The adoption of pre-digested flour in breads, pastries, snacks, and convenience foods is driven by its ability to improve texture, taste, and nutritional quality, while meeting the rising expectations of health-conscious consumers. Strong regulatory support from the European Union, emphasizing clean-label, natural, and allergen-free ingredients, has further encouraged manufacturers to integrate gluten-reduced flour into product formulations.

Germany leads in innovation, with manufacturers leveraging pre-digested flour for gluten-free breads, high-protein baked goods, and functional snacks targeting digestive health and general wellness. France, known for its artisanal and industrial bakery sectors, is also adopting modified flour to meet consumer preferences for allergen-free and plant-based products without compromising traditional textures and flavors. Across Europe, the focus on sustainability, clean-label formulations, and nutritional enrichment is driving market expansion.

Asia Pacific commands around 20% share and is the fastest-growing region, driven primarily by rapid urbanization, rising disposable incomes, and increasing health awareness among consumers. China and India are key contributors, supported by their expanding processed food industries and growing demand for convenient, nutritious, and affordable food products. Gluten-reduced flour is increasingly used in baked goods, snacks, beverages, and dairy alternatives across the region due to its digestibility, nutritional benefits, and ability to improve texture and shelf life, making it well-suited for mass-produced and packaged foods.

The surge in health-conscious consumers, particularly among urban populations, is encouraging the adoption of gluten-free, protein-enriched, and hypoallergenic products, further fuelling demand for gluten-reduced flour. Additionally, the rise of plant-based diets, functional foods, and nutraceuticals is creating opportunities for manufacturers to innovate and cater to diverse dietary preferences. Governments and regulatory authorities in the region are also promoting food safety, nutritional labelling, and fortification initiatives, which support market growth.

The global hydrolysed flour market is highly competitive, dominated by key players who leverage innovation, strategic partnerships, and specialized product offerings. Leading companies such as PGP International, BELOURTHE S.A., Cargill Incorporated, Archer Daniels Midland, Caremoli Group, and Buhler A.G. focus on R&D to develop allergen-free, gluten-free, and functional formulations that meet the growing demand from health-conscious consumers. They employ enzymatic technology advancements to enhance digestibility, nutritional content, and functional properties, making modified flour suitable for baked goods, snacks, beverages, dairy alternatives, and nutraceuticals.

Beyond innovation, these players secure sustainable, high-quality raw materials to ensure supply stability while supporting clean-label and eco-friendly trends. Certifications like gluten-free, non-GMO, and allergen-free help build consumer trust and expand market reach. Collaborations with food manufacturers, ingredient suppliers, and research institutions further strengthen their positions.

The global gluten-reduced flour market is projected to reach US$1.4 Billion in 2025, driven by demand for gluten-free and digestible ingredients amid rising health awareness.

The market is driven by gluten intolerance affecting over 1% globally and functional food growth to US$ 300 Bn by 2030, necessitating modified flour for allergen-free products.

The market is poised to witness a CAGR of 9.4% from 2025 to 2032, supported by innovations in plant-based flours and nutraceutical applications.

Expansion in nutraceuticals and vegan products offers key opportunities, enabling gluten-reduced flour for digestive health supplements and plant-based snacks.

Key players include PGP International, Cargill Incorporated, Archer Daniels Midland, Buhler A.G., and Caremoli Group, leading through innovation in gluten-free formulations.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Form

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author