ID: PMRREP30261| 198 Pages | 19 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

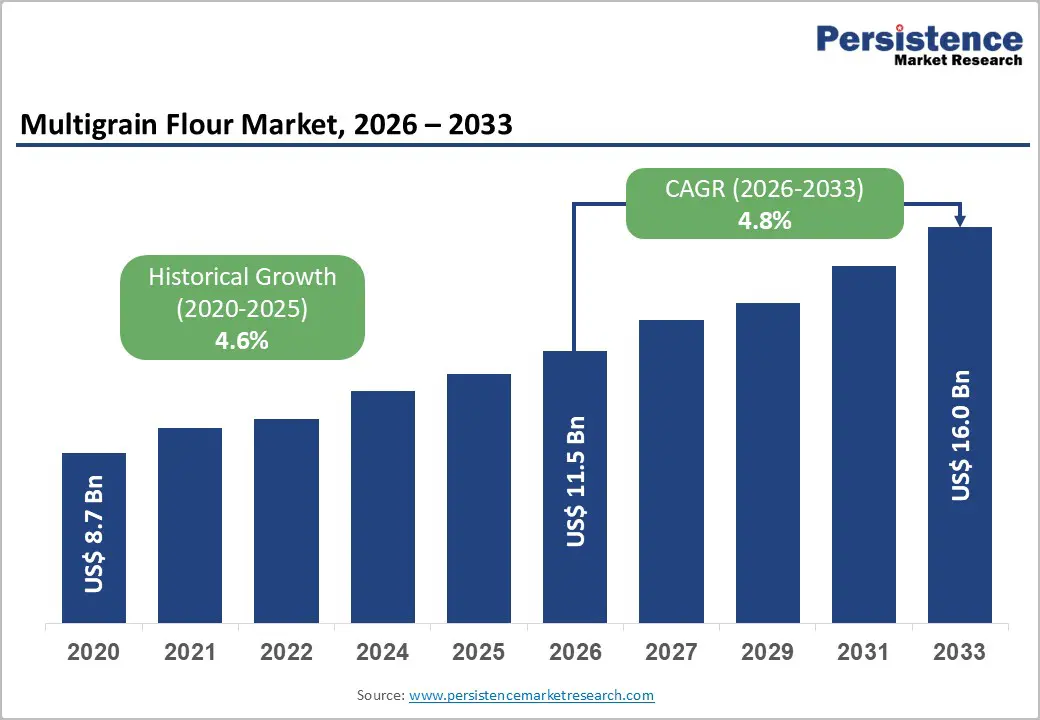

The global multigrain flour market size is likely to be valued at US$11.5 billion in 2026 and is expected to reach US$16.0 billion by 2033, growing at a CAGR of 4.8% during the forecast period from 2026 to 2033, driven by a structural shift in consumer food preferences toward healthier, minimally processed, and nutrient-rich staple foods.

Key growth drivers include rising awareness of whole grains' health benefits, including better digestion, improved glycemic control, and heart health. Consumer surveys show that nearly 75% seek healthier grain alternatives to manage conditions such as diabetes, obesity, and heart disease. Increased use of multigrain flour in bakery items, cereals, snacks, and infant nutrition is also fueling demand.

| Key Insights | Details |

|---|---|

|

Multigrain Flour Market Size (2026E) |

US$11.5 Bn |

|

Market Value Forecast (2033F) |

US$16.0 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

4.8% |

|

Historical Market Growth (CAGR 2020 to 2025) |

4.6% |

Dietary preferences are shifting toward nutrient-dense, functional foods, driven by the rising prevalence of lifestyle-related conditions such as obesity, diabetes, and heart disease. Consumers are increasingly turning to multigrain alternatives over refined flours due to their higher fiber content, complex carbohydrates, and rich vitamin and mineral profiles, supporting better digestion, heart health, and weight management. Multigrain flour, often made from a mix of whole wheat, ragi, oats, bajra, and quinoa, is recognized for its benefits in digestive health, weight management, and sustained energy. Public health campaigns, nutritional labeling, and greater access to health information via digital platforms have further raised awareness.

Multigrain flour is becoming a staple in products such as bread, chapattis, pasta, and breakfast cereals, solidifying its position as a healthier option compared to traditional flours. The growing demand for nutritious, clean-label foods is driving adoption in both developed and emerging markets. Consumers are increasingly drawn to products with minimal processing, natural ingredients, and superior nutritional profiles, attributes that align well with multigrain flour. In response, food manufacturers and bakeries are introducing fortified, organic, and gluten-free multigrain options. This trend is particularly strong among urban populations, health-conscious consumers, and older adults focused on preventive nutrition. The rising demand for healthy foods for children and infants is also expanding the use of multigrain flour in baby food and snacks.

Sourcing, processing, and blending multiple grains for multigrain flours is a complex and costly process. Unlike single-grain flours, multigrain formulations require a diverse range of raw materials, rigorous quality testing, and precise formulation controls to maintain consistent taste and nutritional value. Price fluctuations of grains such as quinoa, oats, and millets, especially when sourced from different regions, further drive up input costs. Specialized milling, segregation, and packaging processes also increase operational expenses, making multigrain flour more expensive to produce. These increased costs are typically passed on to consumers, resulting in premium pricing that can limit adoption, particularly in price-sensitive markets, including developing economies.

Higher prices impact purchase frequency and volume, as many consumers prioritize affordability over nutritional value. While health-conscious consumers may be willing to pay more, mass-market adoption remains limited in regions where food spending is primarily cost-driven. Retailers also struggle with inventory management and slower turnover rates compared to traditional wheat flour. Smaller production facilities face challenges in achieving economies of scale, further restricting cost optimization. These higher production and retail costs present a barrier to widespread adoption, slowing the shift from traditional single-grain flours to multigrain alternatives among the general consumer population.

Consumers are increasingly seeking foods that meet specific dietary and health needs. As awareness of conditions such as diabetes, gluten intolerance, heart disease, and digestive issues rises, there is a growing demand for tailored grain formulations with targeted nutritional benefits. Multigrain flours enriched with high-fiber, plant-based protein, low-glycemic-index ingredients, or gluten-free grains, including oats, millets, and quinoa, are becoming more popular. Food manufacturers are using advances in grain processing and nutritional science to create blends that support weight management, lower cholesterol, and provide sustained energy. These innovations allow brands to stand out in the rapidly growing health and wellness market.

The rising trend of personalized nutrition and preventive healthcare is driving interest in functional and fortified multigrain products. Specialized blends for children, seniors, athletes, and vegans are expanding the use of multigrain flour in categories such as bakery, snacks, and baby foods. Clean-label products, organic certifications, and the inclusion of ancient grains further enhance product appeal. Emerging markets also offer significant growth opportunities, as regulatory bodies are increasingly backing fortified foods to address nutritional deficiencies. Advancements in food processing technologies are improving nutrient retention and flavor, making multigrain products more acceptable to a wider range of consumers.

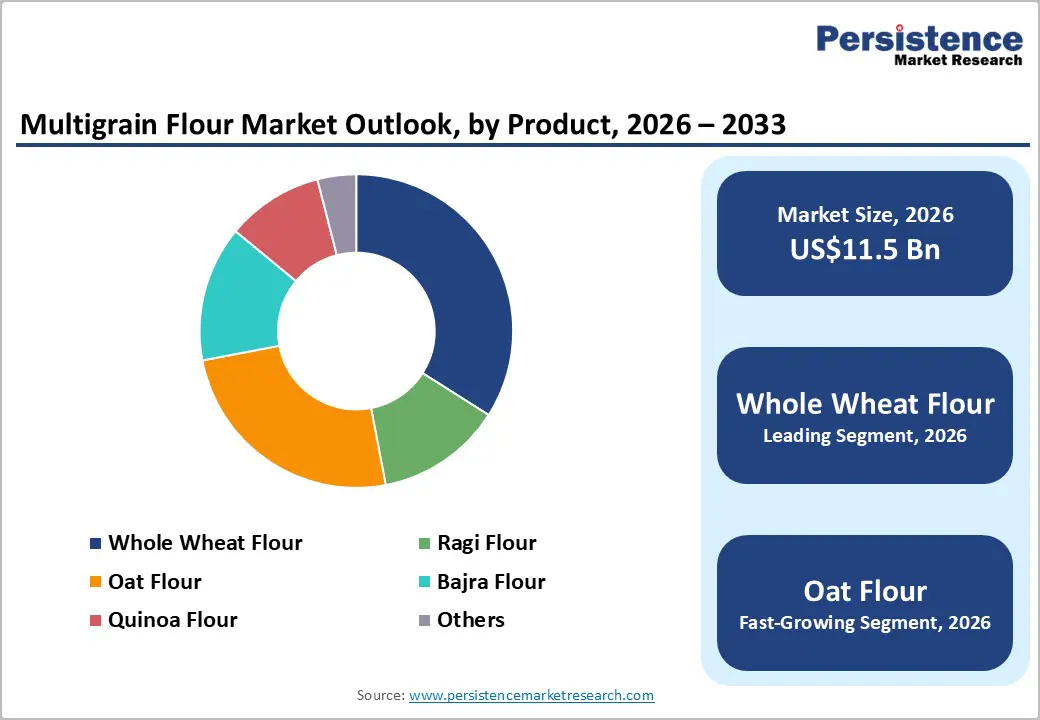

The whole wheat segment is expected to dominate the multigrain flour market, accounting for about 45% of total revenue by 2026. This is due to its established presence in everyday diets and strong consumer trust. Whole wheat flour is a staple ingredient in both household cooking and commercial food production, particularly in items such as bread, flatbreads, and baked goods. Consumers view whole wheat as a balanced choice, offering affordability, familiar taste, and improved nutrition compared to refined flour. Food manufacturers prefer it for its reliable performance in large-scale baking and ease of incorporation into existing recipes. For instance, General Mills actively promotes whole wheat-based products within its health-focused lines, further boosting consumer confidence and expanding market reach.

Oat flour is projected to be the fastest-growing segment by 2026, driven by shifting consumer preferences towards functional and specialty nutrition. As awareness of heart health, digestive wellness, and gluten sensitivities rises, the demand for oat-based products is increasing across various food categories. Oat flour appeals to health-conscious consumers for its potential in cholesterol management, sustained energy release, and compatibility with clean-label diets. Younger, urban consumers, in particular, are drawn to oat flour for its versatility and its reputation as a "supergrain." An example is Quaker, which has successfully extended its brand into oat-based flour and baking products, encouraging wider adoption beyond its traditional breakfast offerings.

Baked goods are expected to lead the market, capturing around 60% of the revenue share by 2026, thanks to their high consumption rates and consistent demand across various regions. Products such as bread, rolls, muffins, cookies, and other baked items are everyday staples, making them ideal for incorporating multigrain flour. Consumers are increasingly opting for bakery goods made with multigrain formulations, as these offer enhanced nutritional benefits without compromising on taste or convenience. Retail and in-store bakeries also play a crucial role by offering fresh multigrain options that appeal to health-conscious consumers. For example, Grupo Bimbo has expanded its range of multigrain and whole-grain bakery products, reinforcing baked goods as the primary driver of multigrain flour demand.

Snacks are projected to be the fastest-growing application by 2026, driven by evolving lifestyles and a rising demand for convenient yet nutritious food options. Urban consumers are shifting away from traditional fried snacks in favor of baked and grain-based alternatives that offer health benefits. Multigrain flour allows manufacturers to position snacks as high-fiber, protein-rich, and functional, appealing especially to millennials and fitness-focused consumers. Manufacturers are also experimenting with various grain blends to improve taste, texture, and nutritional value while ensuring shelf stability. This segment benefits from strong wellness-oriented branding and the growing trend of guilt-free indulgence. For instance, PepsiCo has introduced multigrain-based snack products under its better-for-you snack line, highlighting the expanding role of snacks in broadening the application of multigrain flour.

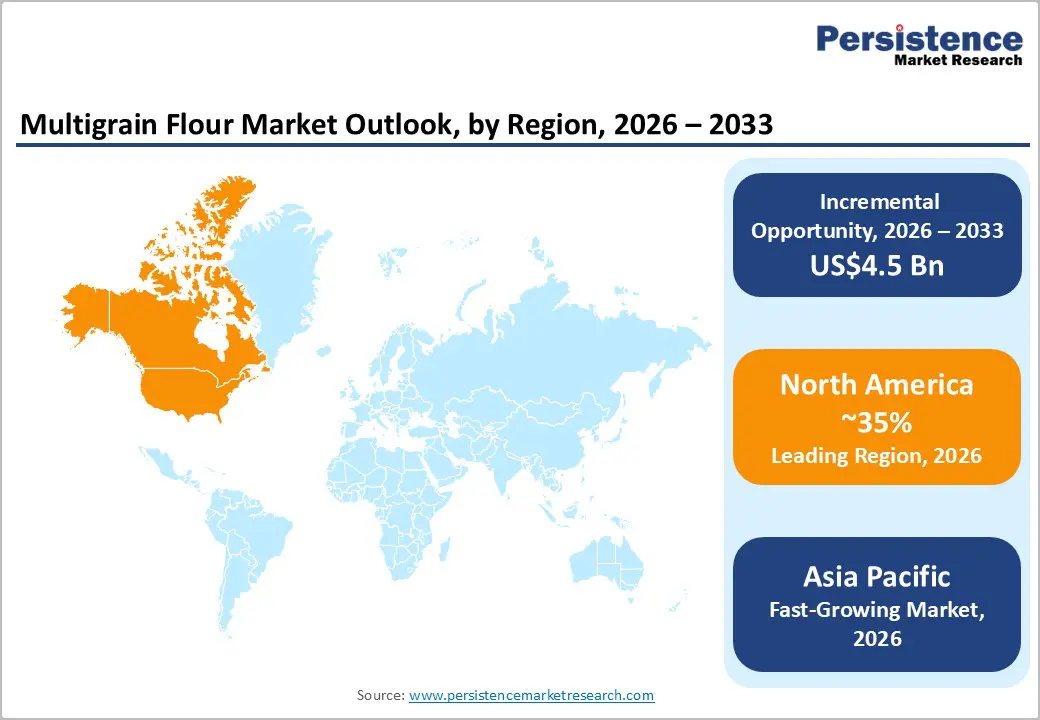

North America is expected to be the leading region, capturing a 35% market share by 2026, driven by a high level of awareness about the benefits of whole grains and the widespread adoption of balanced diets. Consumers are increasingly choosing multigrain flour due to its associations with digestive health, weight management, and heart wellness. Demand is especially strong in the bakery and packaged food sectors, where manufacturers are reformulating products to include multigrain blends. Trends such as clean-label products, transparent nutritional labeling, and a preference for minimally processed foods continue to shape consumer purchasing decisions across both retail and foodservice channels. The growing popularity of home baking and premium artisanal bakery products is helping sustain steady demand in retail markets.

Innovation and product differentiation are key trends shaping the regional market. Food manufacturers are focusing on organic, fortified, and specialty multigrain flours to meet evolving dietary preferences, such as plant-based, high-fiber, and protein-rich diets. Strong regulatory oversight and standardized quality frameworks further build consumer confidence and encourage product innovation. Strategic investments in sustainable milling practices and supply chain optimization are also gaining momentum. For example, Archer Daniels Midland (ADM) is expanding its multigrain and whole-grain flour portfolio in North America, leveraging research and development capabilities to meet the growing demand from industrial bakeries and health-conscious consumers.

Europe is expected to be a key market for multigrain flour by 2026, driven by strong health and wellness trends, as consumers increasingly seek nutritious, clean-label food options. European consumers are highly aware of the benefits of whole grains and preventive nutrition, which boosts demand for multigrain flour in both traditional bakery products and health-focused food categories. Regulatory frameworks and quality standards across the EU further strengthen consumer trust by ensuring transparent labeling and adherence to fortified food guidelines, enhancing market credibility. Countries, including Germany, France, and the Netherlands, are leading this trend, with organic and whole-grain products enjoying strong retail presence and customer loyalty.

Innovation and product diversification are also shaping the regional market, with flour producers exploring functional and specialty grain blends to cater to specific consumer needs. For example, Westmill Foods, a U.K.-based food ingredients company, supplies multigrain and ethnic flour varieties to both retail and foodservice sectors across the U.K. and parts of Europe, showcasing how established companies are adapting to meet growing demand in the health-conscious market. Supermarkets and specialty stores throughout Europe are increasing shelf space for multigrain and ancient-grain flour options to appeal to evolving dietary preferences among urban and health-focused consumers.

The Asia Pacific region is expected to be the fastest-growing market for multigrain flour by 2026, driven by shifting consumer preferences toward healthier, functional foods and by rapid economic and lifestyle changes in major economies. Rising disposable incomes, urbanization, and increased health awareness are driving consumers to shift away from traditional refined flours toward nutrient-dense multigrain alternatives that offer higher fiber, protein, and essential micronutrients. This shift has led to the use of multigrain flour in a wider range of products, extending beyond traditional bakery items to include snacks, ready-to-eat meals, and fortified foods. In response, manufacturers are focusing on clean-label, fortified, and specialty grain blends that cater to regional health and wellness preferences.

Product diversification and strategic expansion by established food companies are key trends shaping the market. Companies are investing in production capabilities and distribution networks to capitalize on the growing demand for functional and multigrain flour products. For example, Nisshin Seifun Group, a leading Japanese food manufacturer, has expanded its flour and premix operations across Asia Pacific, including facilities in China and Thailand, to offer a broader range of grain-based products tailored to local tastes and nutritional needs. The company is also innovating with blends that incorporate ancient grains and high-fiber formulations to meet the rising demand from health-conscious consumers.

The global multigrain flour market is moderately fragmented, with a mix of regional and international players catering to both mass-market and premium segments. Small- and medium-sized local mills, alongside specialty flour producers, compete with large multinational food companies, creating a competitive landscape focused on product differentiation, nutritional quality, and meeting regional taste preferences. Market growth is driven by rising health awareness, a growing demand for functional foods, and an increasing use of multigrain flour in bakery, snack, and infant food applications.

Leading companies in the market, such as Archer Daniels Midland (ADM), COFCO Fulinmen, General Mills, King Arthur Flour, and Nisshin Seifun Group, benefit from strong brand recognition and wide distribution networks. These players compete by driving product innovation, developing specialty multigrain blends, and launching marketing campaigns that highlight the health benefits of their offerings. They also form strategic partnerships with bakeries and food manufacturers. Research and development investments are focused on improving nutrient retention, texture, and flavor, while sustainability and ethical sourcing practices are becoming more important to attract health-conscious and environmentally aware consumers.

The global multigrain flour market is projected to reach US$11.5 billion in 2026.

The multigrain flour market is driven by growing health awareness and a rising consumer demand for nutritious, high-fiber, and functional food products.

The multigrain flour market is expected to grow at a CAGR of 4.8% from 2026 to 2033.

Key market opportunities include product innovation with specialized blends tailored to specific dietary needs, expansion of organic and fortified flour options, growth in ready-to-eat and bakery applications, and increased market penetration in emerging economies driven by rising health awareness.

Shenyang Xiangxue Flour, Heilongjiang Agriculture, COFCO Fulinmen, and Yihai Kerry Arawana Holdings are the leading players.

| Report Attribute | Details |

|---|---|

|

Historical Data |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author