ID: PMRREP20260| 195 Pages | 31 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

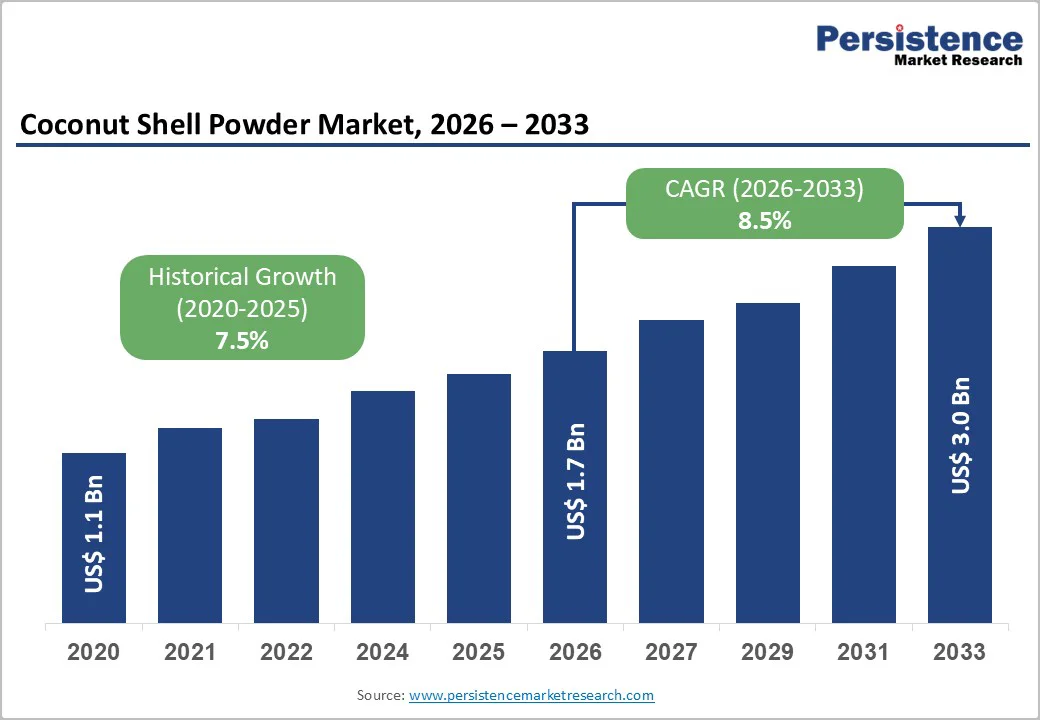

The global coconut shell powder market size is likely to be valued at US$1.7 billion in 2026 and is expected to reach US$3.0 billion by 2033, growing at a CAGR of 8.5% during the forecast period from 2026 to 2033, driven by the rising preference for sustainable, bio-based, and biodegradable materials as substitutes for synthetic fillers, abrasives, and carbon additives across multiple industries. The increasing use of coconut shell powder as a raw material for activated carbon supports strong growth in water and air purification, wastewater treatment, and industrial filtration applications. Expanding adoption in the cosmetics and personal care industry as a natural exfoliant, absorbent, and formulation aid continues to strengthen market traction amid clean-label and eco-friendly product trends.

| Key Insights | Details |

|---|---|

| Coconut Shell Powder Market Size (2026E) | US$1.7 Bn |

| Market Value Forecast (2033F) | US$3.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 8.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 7.5% |

Industries across manufacturing, cosmetics, agriculture, and environmental management are actively shifting away from synthetic fillers, plastic microbeads, and petroleum-based abrasives due to increasing environmental concerns and regulatory pressure. Coconut shell powder, derived from agricultural waste, aligns strongly with circular-economy principles by converting discarded coconut shells into high-value raw materials. Its biodegradable nature, low toxicity, and renewable sourcing make it an attractive alternative for companies seeking to reduce carbon footprints and meet sustainability targets.

Rising corporate ESG commitments and growing consumer preference for natural ingredients, particularly in cosmetics, personal care, and food-related applications. Coconut shell powder plays a critical role in producing activated carbon used in water and air purification, supporting sustainability initiatives focused on clean water and pollution control. The availability of abundant raw materials in coconut-producing regions such as Asia Pacific ensures a stable supply chain, enabling cost-effective production. As sustainability becomes a core purchasing criterion, coconut shell powder continues to gain traction as a versatile, eco-friendly input across multiple end-use industries.

Synthetic fillers, abrasives, and carbon-based materials such as silica, polymer beads, and chemically engineered carbons often offer consistent quality, controlled particle size, and predictable performance at scale. These attributes make them attractive to manufacturers operating in high-volume industrial applications where uniformity and process efficiency are critical. Well-established synthetic supply chains and long-term supplier contracts can limit the immediate substitution of natural materials such as coconut shell powder. Advanced R&D investments by synthetic material producers enhance product performance and durability, reinforcing their preference in technically demanding applications.

Synthetic alternatives frequently benefit from lower short-term costs, easier customization, and broader regulatory acceptance in certain regions. In price-sensitive markets, this cost advantage can outweigh the environmental benefits of bio-based materials, slowing the adoption of coconut shell powder. Some end-users remain cautious about variability in natural raw materials, which can affect performance consistency. Fluctuations in agricultural supply and seasonal availability of coconut shells can further amplify this concern. While demand for eco-friendly solutions is rising, competition from synthetic substitutes continues to restrain market penetration, particularly in applications where performance standardization and cost optimization remain top priorities.

Emerging applications in biofuels and biocomposites present a significant growth opportunity for the coconut shell powder market. Coconut shell powder is increasingly being utilized as a biomass feedstock and carbon-rich additive in biofuel production, supporting renewable energy initiatives and waste-to-energy programs. Its high calorific value and low ash content make it suitable for bio-briquettes, pellets, and co-firing applications, particularly in regions promoting alternative energy sources and reduced fossil fuel dependence. This trend aligns with decarbonization goals and growing investments in sustainable energy infrastructure.

In the bio composites segment, coconut shell powder is gaining traction as a natural filler and reinforcement material in polymer and resin-based composites. Its biodegradability, lightweight nature, and ability to improve mechanical strength make it attractive for applications in automotive components, construction materials, and consumer goods. Rising demand for sustainable materials, coupled with regulatory support for bio-based composites, is encouraging manufacturers to replace synthetic fillers with agricultural waste-derived inputs. Continued innovation and material engineering are expected to expand the role of coconut shell powder in high-value bio-composite applications.

The activated coconut shell powder segment is expected to lead the market, accounting for approximately 70% of total revenue in 2026, driven by its superior adsorption capacity, high porosity, and large surface area, making it highly suitable for water purification, air filtration, wastewater treatment, and industrial gas absorption applications. Municipal water treatment plants, industrial effluent management systems, and household filtration products increasingly rely on coconut-shell-based activated carbon due to its renewable origin and effectiveness. For example, activated coconut shell powder is widely used in drinking water filtration cartridges to remove chlorine, organic contaminants, and odors. Its natural origin also supports sustainability goals, further strengthening its adoption across regulated environmental and industrial applications.

Non-activated coconut shell powder is likely to represent the fastest-growing segment, driven by rising demand in cost-sensitive and natural-input applications. Its growth is supported by increasing use as a filler in industrial materials, a natural exfoliant in cosmetics, and an additive in animal feed. The appeal lies in its minimal processing, lower cost compared to activated variants, and alignment with clean-label and eco-friendly trends. For example, cosmetic manufacturers increasingly incorporate non-activated coconut shell powder in facial scrubs as a biodegradable alternative to plastic microbeads. Growing awareness of sustainable sourcing and agricultural waste utilization further accelerates adoption, particularly in developing markets and small-to-mid-scale industries.

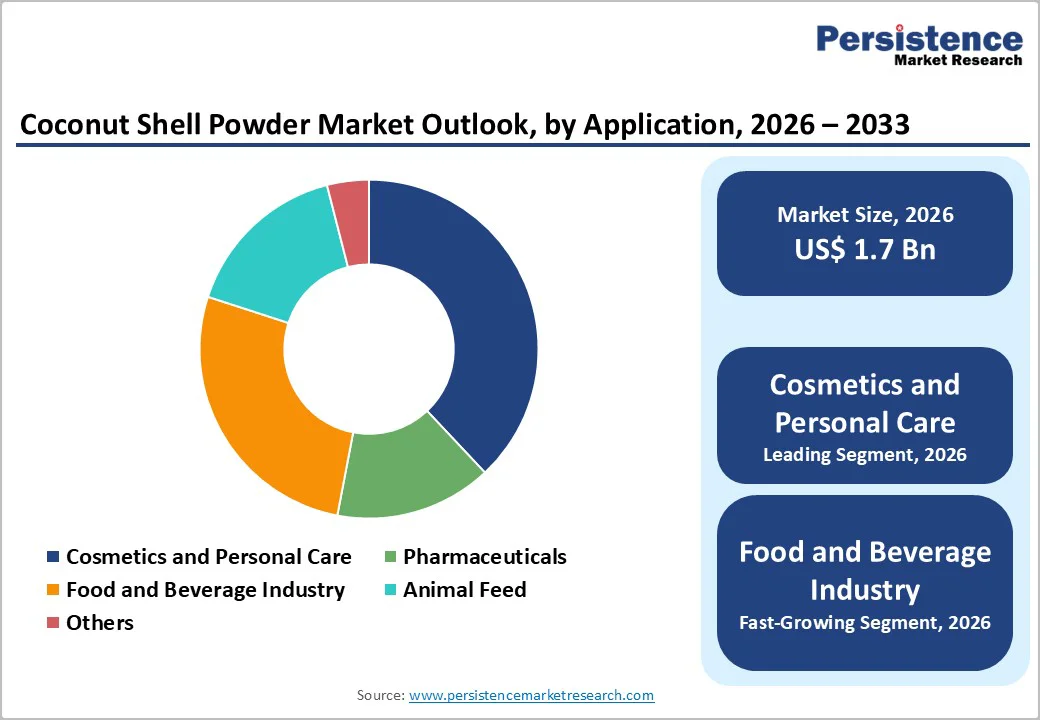

The cosmetics and personal care industry is projected to lead the market, capturing around 30% of the total revenue share in 2026, driven by rising demand for natural, biodegradable, and skin-safe ingredients. Coconut shell powder is widely used as a gentle exfoliant, absorbent, and texture enhancer in products such as facial scrubs, body washes, soaps, and toothpaste. Clean beauty trends, combined with regulatory restrictions on synthetic microbeads, have accelerated the shift toward plant-based alternatives. For example, several natural skincare brands use coconut shell powder in exfoliating formulations to improve skin texture while maintaining environmental compliance. Its organic appeal, low toxicity, and compatibility with natural formulations make it a preferred choice among manufacturers targeting eco-conscious consumers.

The food and beverage industry is likely to be the fastest-growing application in 2026, driven by increasing consumer demand for natural ingredients and functional food additives. Coconut shell powder is gaining attention for its use in filtration processes, food-grade additives, and fiber enrichment applications. Health-conscious dietary trends and clean-label requirements encourage manufacturers to adopt plant-derived inputs over synthetic processing aids. For example, coconut-shell-based filtration media are used in beverage clarification processes to enhance purity and taste. Its role in food processing aligns with sustainability initiatives, supporting adoption. Pharmaceuticals and animal feed segments also show steady growth, benefiting from the powder’s absorbent properties and natural composition.

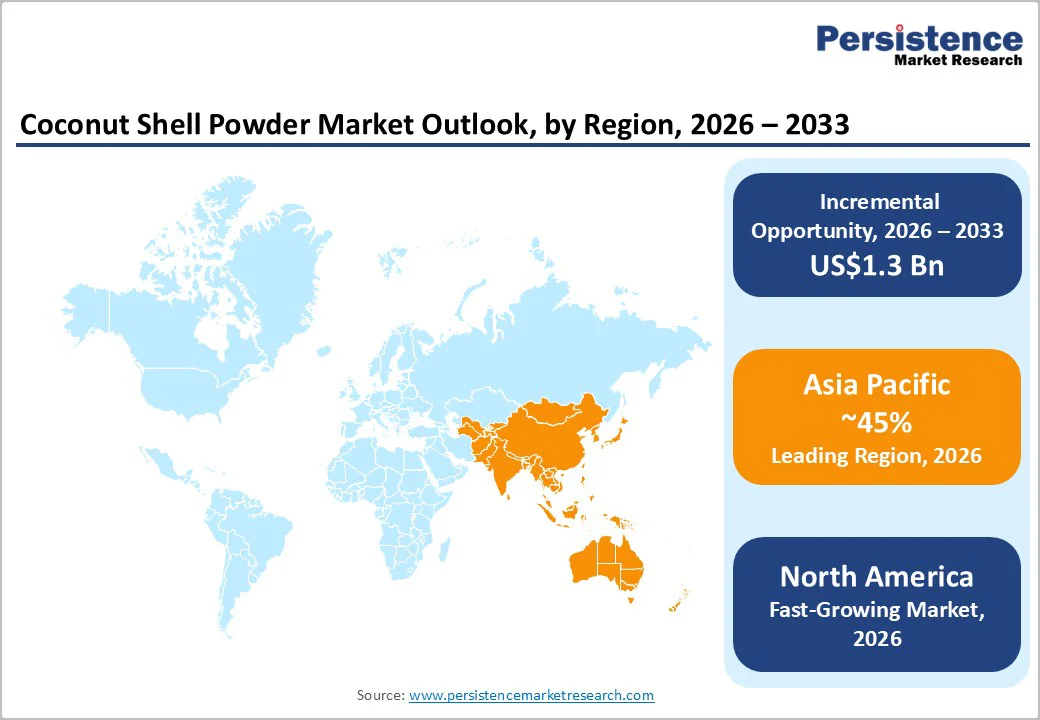

North America is likely to be the fastest-growing region, driven by increasing adoption of coconut shell-derived activated carbon in water and air purification applications as industries pursue more sustainable and eco friendly solutions. This shift is driven by stricter environmental regulations and heightened emphasis on renewable feedstocks among industrial end users. For example, Evoqua Water Technologies has expanded its use of coconut shell-based activated carbon in municipal and industrial water treatment contracts, highlighting a broader industry movement toward natural materials that align with corporate sustainability goals.

The development of value added supply chains and local partnerships that enhance material availability and performance. North American material manufacturers and converters are increasingly collaborating with overseas raw material suppliers and regional processors to ensure quality and continuity of supply. Companies engaged in engineered material solutions are incorporating coconut shell powder into biocomposites and green material offerings to meet customer demand for sustainable innovation. These partnerships and product developments are reinforcing the role of coconut shell powder as a versatile natural input across multiple industrial and consumer applications in North America.

Europe is likely to be a significant market for coconut shell powder in 2026, due to strong sustainability mandates and environmental regulations that favor eco friendly materials over synthetics. The region accounted for a significant portion of consumption, particularly in industrial abrasives, activated carbon production, and cosmetic applications. European manufacturers and end users are increasingly replacing traditional fillers and abrasive materials with coconut shell powder due to its biodegradable nature and lower environmental impact, aligning with EU circular economy goals and strict quality standards that emphasize reduced ecological footprints.

The expansion of diverse applications beyond traditional sectors, such as in sustainable consumer goods and specialty chemical processes. Natural exfoliants featuring coconut shell powder have gained popularity among European skincare brands, reflecting wider consumer preference for clean label and natural ingredients. Coconut shell-derived activated carbon is increasingly used in water and air purification systems, supported by advanced activation technologies that enhance performance and lifespan. These shifts underscore Europe’s focus on sustainable innovation and multi?sector adoption of coconut shell powder as a natural, high?value material.

The Asia Pacific region is anticipated to be the leading region, accounting for a market share of 45% in 2026, driven by growing industrial and consumer demand for sustainable and bio?based materials. Local manufacturers are increasingly supplying high quality powder for activated carbon, abrasives, cosmetic exfoliants, and natural fillers. For example, Shree Balajee Magnesite has expanded its fine mesh coconut shell powder production to serve industrial applications such as activated carbon precursors and water treatment products, reinforcing its position in key Asia Pacific markets where demand for natural raw materials continues to rise.

Asia Pacific is increasingly adopting advanced processing technologies and sustainable sourcing methods, boosting product quality and enabling new applications. Numerous companies are investing in automated grinding and quality control systems to comply with strict standards from the cosmetics, pharmaceutical, and environmental product sectors. These improvements enhance particle consistency and performance while expanding export opportunities to Europe and North America. The region remains a global leader in coconut shell powder production and innovation, driven by both established suppliers and emerging value-added manufacturers.

The global coconut shell powder market exhibits a moderately fragmented structure, driven by the presence of numerous regional and local manufacturers alongside several established international players competing for share through product quality, sustainability focus, and expanding distribution networks. Companies operate across Asia Pacific, North America, and Europe, leveraging abundant raw material availability, cost efficiencies, and strategic partnerships to meet demand from diversified end?user sectors such as activated carbon production, cosmetics, and industrial applications.

With key leaders including Viet Delta, Shree Balajee Magnesite, Premium, SREE AGRO PRODUCTS, and Sudar Bio Fuels, the competitive landscape spans both established coconut shell powder producers and emerging players focusing on specialty grades and niche applications. These players compete through product innovation, mesh size customization, quality certifications, sustainable sourcing commitments, and expanded distribution channels, often forming partnerships or exploring mergers to enhance capacity and geographic reach. The focus on R&D to enhance particle uniformity, expand applications, such as high-performance activated carbon and biocomposites, and align with eco-friendly trends highlights the intense and evolving competition driving the market.

The global coconut shell powder market is projected to reach US$1.7 billion in 2026.

The key drivers include the rising demand for sustainable, eco-friendly, and natural materials across industrial, cosmetic, and purification applications.

The coconut shell powder market is expected to grow at a CAGR of 8.5% from 2026 to 2033.

The key opportunities include growing applications of coconut shell powder in biofuels, biocomposites, activated carbon production, cosmetics, and sustainable industrial materials.

Viet Delta, Shree Balajee Magnesite, Premium, SREE AGRO PRODUCTS, and Sudar Bio Fuels are the leading players.

| Report Attribute | Details |

|---|---|

| Historical Data | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author