ID: PMRREP33593| 220 Pages | 30 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

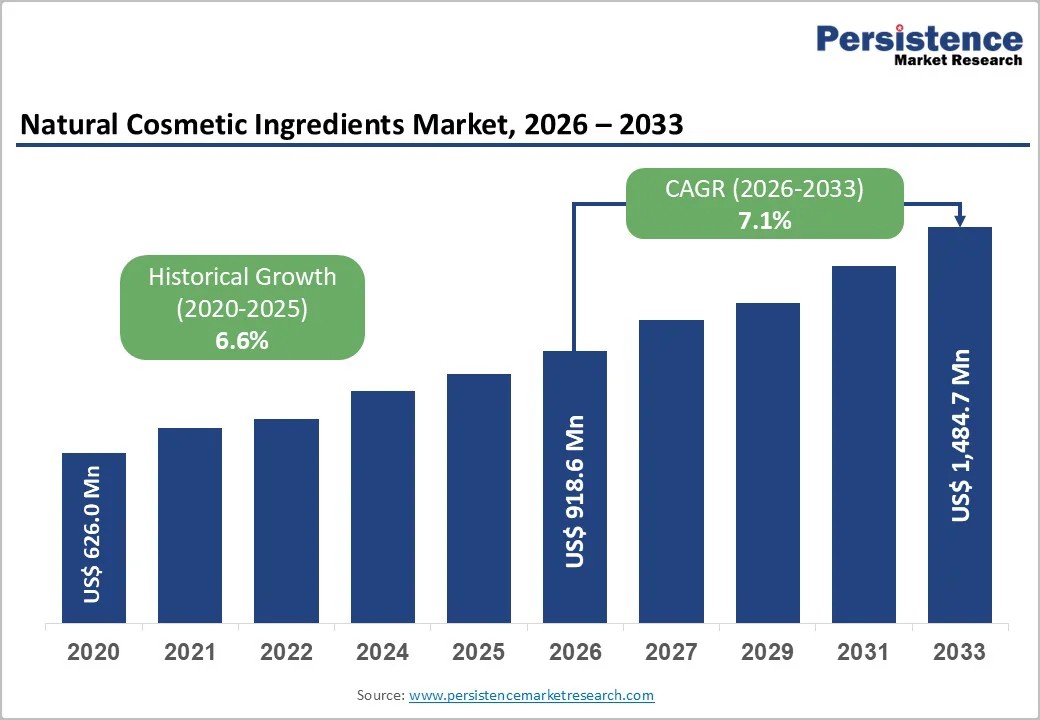

The global natural cosmetic ingredients market size is supposed to be valued at US$918.6 Mn in 2026 and is projected to reach US$1,485.7 Mn by 2033, growing at a CAGR of 7.1% between 2026 and 2033.

The natural cosmetic ingredients industry is driven by increasing consumer demand for chemical-free and sustainable beauty products. As awareness of the harmful effects of synthetic chemicals grows, over 40% of shoppers are actively seeking natural and organic alternatives. This trend is reinforced by stringent regulatory frameworks, particularly in Europe, with EC Regulation 1223/2009, which mandates higher safety and transparency standards.

| Key Insights | Details |

|---|---|

| Natural Cosmetic Ingredients Market Size (2026E) | US$918.6 Mn |

| Market Value Forecast (2033F) | US$1,485.7 Mn |

| Projected Growth CAGR (2026 - 2033) | 7.1% |

| Historical Market Growth (2020 - 2025) | 6.6% |

Consumer consciousness regarding the adverse effects of synthetic chemicals has intensified dramatically, with half of Americans considering toxic chemicals in personal care products a serious health threat. This concern rises to more than 80% among women under fifty. Consumer shift toward natural ingredients decisively propels the natural cosmetic ingredients market, with most favoring organic skincare over synthetic options. This preference stems from health concerns about chemicals, amplified by social media and labels that emphasize transparency.

Manufacturers are responding by reformulating products to exclude harmful ingredients such as parabens, sulfates, and synthetic preservatives, thereby positioning natural cosmetic ingredients as essential components in addressing this evolving consumer demand. Sustainability claims further enhance appeal, aligning with wellness trends and driving acceptance of premium pricing.

Regulatory frameworks across major markets are increasingly mandating higher safety and transparency standards, thereby accelerating the adoption of natural cosmetic ingredients. The European Union's Regulation (EC) 1223/2009 establishes rigorous requirements, including over 1,700 prohibited substances and 372 restricted substances, forcing manufacturers to transition to safer natural alternatives. In North America, the FDA's Modernization of Cosmetics Regulation Act (MoCRA) of 2022 strengthened oversight mechanisms, while state-level initiatives in California and New York have banned toxic ingredients, further driving the demand for natural preservatives and emollients.

Recent amendments, such as Commission Regulation (EU) 2023/1545, introduced additional restrictions on fragrance allergens, adding more than 60 new restricted substances. These regulatory pressures create a competitive advantage for manufacturers investing in natural ingredient innovation, as compliance becomes intertwined with market differentiation and consumer trust.

Natural cosmetic ingredients face challenges such as fluctuating raw material costs and inconsistent supply due to agricultural dependencies and seasonal variations. Plant-based emollients, essential oils, and botanical extracts are particularly affected by climate conditions and geopolitical issues in Southeast Asia, Africa, and Latin America.

Unlike synthetic alternatives with stable production costs, natural ingredients require long cultivation periods and complex extraction processes, leading to variability in quality and pricing. Compliance with the EU Deforestation Regulation increases costs for suppliers, especially small-scale producers lacking proper documentation. Additionally, price premiums for certified organic materials limit adoption among cost-sensitive manufacturers, putting them at a disadvantage relative to cheaper synthetic substitutes.

Natural ingredients pose unique formulation challenges, as finding one-to-one replacements for conventional synthetic polymers and preservatives is often difficult. Although natural biopolymers are sustainable and can act as rheology modifiers, they require specialized expertise and reformulation to match the stability and shelf-life of synthetic options. Botanical preservatives also struggle with efficacy, especially in water-based formulations that are prone to microbial contamination. Ingredient adulteration in the supply chains for natural raw materials can compromise product consistency and safety, necessitating strict quality control and third-party verification.

Furthermore, plant-derived ingredients may contain allergens or toxic compounds, requiring thorough safety testing to meet regulatory standards. These challenges limit formulation flexibility and extend development timelines, discouraging some manufacturers from fully embracing natural ingredients despite increasing market demand.

Advanced biotechnology and fermentation-based ingredient development offer significant opportunities in the natural cosmetic ingredients market. Companies like Evonik Industries AG have introduced innovative solutions, such as Vecollage® Fortify L, a vegan collagen polypeptide, and renewable glycolipid biosurfactants, to target premium segments and meet sustainability demands. Similarly, Croda International PLC has launched Zenakine, a neuroactive ingredient addressing stress-related skin issues, expanding therapeutic options in cosmetics.

These advancements not only align with the specialty chemicals market's growth but also cater to rising consumer interest in effective, science-backed natural products. By investing in these technologies, companies can achieve premium pricing and differentiate themselves in the thriving professional and luxury beauty segments.

The Asia-Pacific region presents substantial growth potential driven by expanding middle-class populations, rising disposable incomes, and cultural affinity for botanical ingredients in beauty rituals. Traditional use of natural remedies such as neem, ginseng, tea tree oil, and turmeric in India, China, Japan, South Korea, and Southeast Asian nations provides a strong foundation for the adoption of natural cosmetic ingredients.

China and other emerging markets demonstrate robust demand for plant-based ingredients, leveraging strong e-commerce infrastructure and favorable demographics. The region's abundant availability of naturally sourced ingredients, including herbs, botanicals, and plant extracts, positions Asia-Pacific as both a significant consumption hub and production center. International brands are establishing manufacturing facilities across the region to capitalize on lower production costs, skilled labor availability, and proximity to rapidly expanding consumer markets, thereby creating substantial opportunities for natural cosmetic ingredient suppliers.

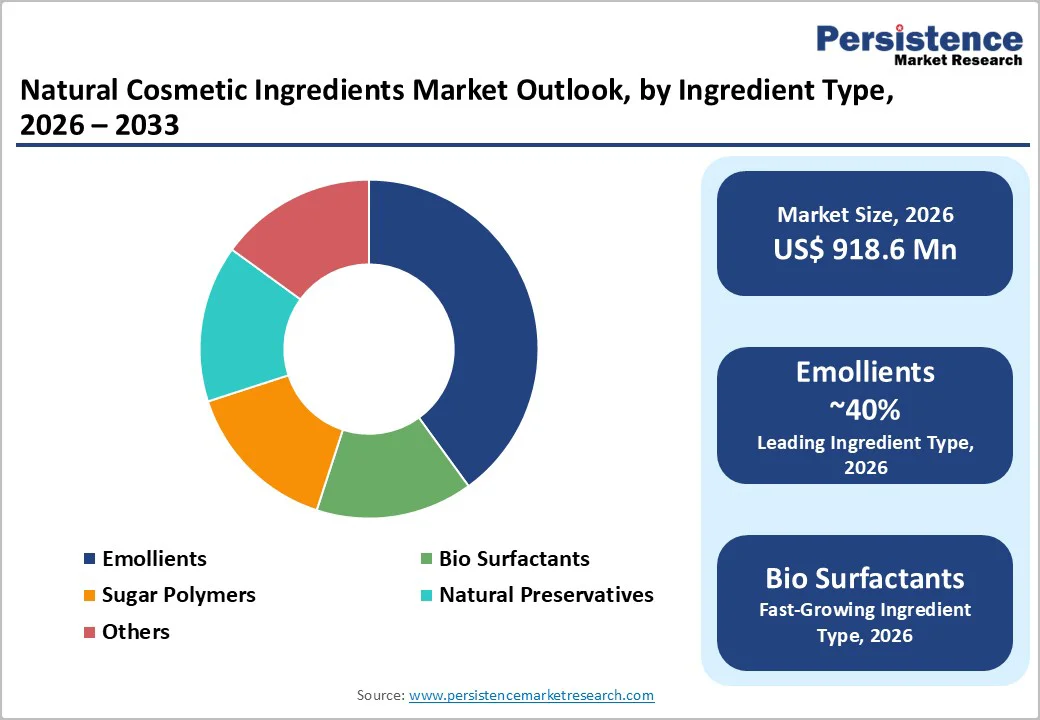

Emollients lead the ingredient type category with approximately 40% share. Natural plant-based emollients, including aloe vera, squalane, jojoba oil, and shea butter, have replaced synthetic alternatives in premium skincare formulations to meet consumer demand for recognizable, sustainably sourced ingredients.

BASF expanded its natural-based portfolio in April 2025 with Lamesoft® OP Plus, a wax-based opacifier dispersion demonstrating biodegradability while maintaining performance standards. The Behenyl Alcohol Market, a key fatty alcohol emollient derived from natural sources, supports this segment's growth through applications in lotions, creams, and hair conditioners, where it provides emulsification and texture enhancement.

Skin Care dominates the application category, capturing around 45% share, driven by consumers' intensive focus on facial care routines that emphasize clean formulations and visible anti-aging results. Botanical extracts, natural preservatives, and plant-derived emollients are concentrated in this segment due to direct skin contact, requiring hypoallergenic properties and safety-tested ingredients that meet stringent dermatological standards. Clariant launched CycloRetin in 2024, a natural retinol alternative based on natural peptides extracted from sustainable sources, addressing growing interest in effective yet gentle ingredients for healthy aging support.

Bio surfactants are gaining attention in the personal care chemicals ingredients Market as Evonik develops glycolipid-based alternatives that meet functionality requirements while delivering sustainability value propositions. The application diversity enables manufacturers to optimize ingredient selection based on performance requirements, regulatory constraints, and price positioning across mass-market and prestige channels.

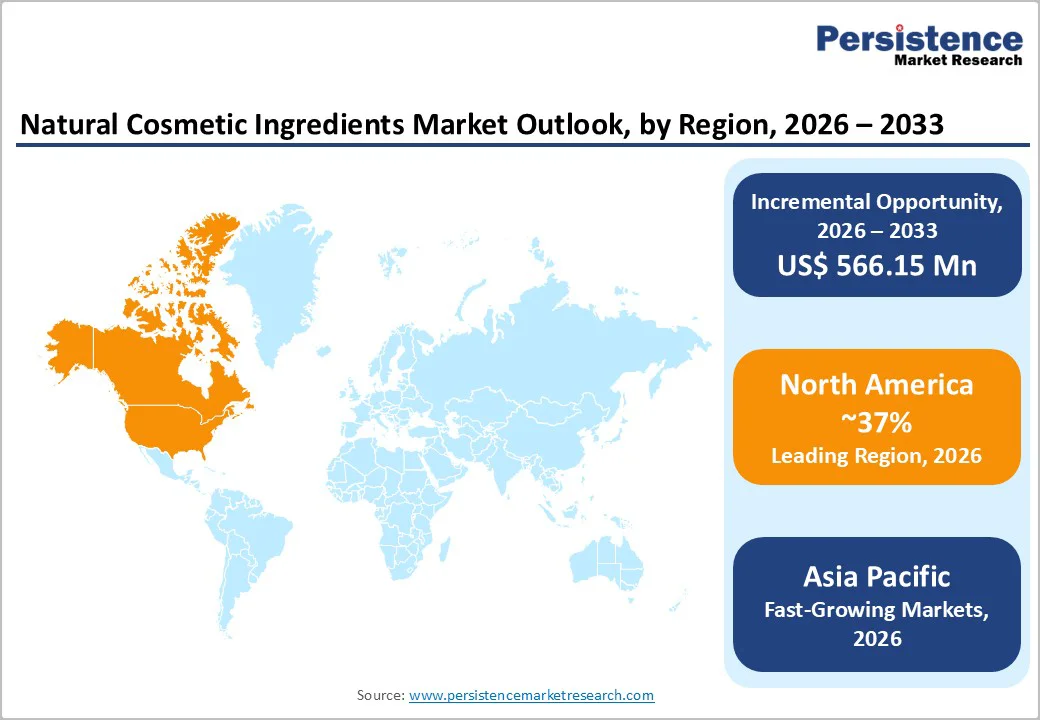

North America drives growth through the U.S. innovation ecosystem, where clean beauty thrives on R&D in biotech. The U.S. maintains market leadership through robust consumer demand for transparency, clean labeling, and scientifically validated natural ingredients supported by sophisticated retail infrastructure and digital commerce platforms. The region's market leadership reflects an advanced regulatory infrastructure, with the FDA and USDA enforcing stringent safety standards and organic certification requirements.

Industry self-regulation through organizations, including the Personal Care Products Council, establishes voluntary standards exceeding minimum legal requirements, fostering an innovation ecosystem focused on biotechnology-derived actives and next-generation preservation systems. Major brands, including Kiehl's, Burt's Bees, and Dr. Bronner's, have established strong market positions by pioneering clean beauty concepts and transparent ingredient disclosure, influencing broader industry standards.

Europe has the most stringent regulatory environment globally, with the EU Cosmetic Regulation (EC) No 1223/2009 and ongoing amendments restricting synthetic chemicals while promoting natural alternatives. Germany, France, and the United Kingdom lead adoption of natural cosmetics through established organic certification schemes, including COSMOS, Ecocert, and Natrue, which set voluntary standards exceeding regulatory minimums.

Recent regulatory updates introduced in 2024 by Commission Regulation (EU) 2024/996 have imposed new restrictions on several cosmetic ingredients, reinforcing the compliance-driven transition to natural preservation and formulation systems. Maximum concentration limits for fragrance allergens, implemented in 2023, affect over 60 natural oils and are expected to impact markets by 2028, requiring full reformulation efforts.

Asia-Pacific emerges as the fastest-growing regional market for natural cosmetic ingredients. China, India, and Japan drive accelerating demand for natural cosmetic ingredients through expanding urban middle-class populations increasingly conscious of synthetic chemical risks and environmental sustainability. Traditional beauty practices that incorporate botanical ingredients such as ginseng, green tea, turmeric, and rice water provide a cultural foundation for the adoption of natural cosmetics. E-commerce platforms, including Tmall, JD.com, and regional marketplaces, enable direct consumer access to international brands that emphasize natural formulations, while social media influencers on WeChat and Douyin educate audiences about the benefits of clean beauty.

The global natural cosmetic ingredients market demonstrates moderate consolidation with multinational chemical companies controlling significant market share alongside specialized botanical extract suppliers and emerging biotechnology firms. Leading players, including BASF SE, Dow Inc., Clariant International Ltd., Evonik Industries AG, and Croda International PLC, leverage extensive research capabilities, global distribution networks, and diversified portfolios spanning multiple ingredient categories and applications. Key differentiators include certification credentials, intellectual property protection for proprietary extraction processes, technical support services, and the ability to provide documentation supporting regulatory compliance across multiple jurisdictions. Emerging business models emphasize direct partnerships with cosmetic brands for co-development initiatives, vertical integration into agricultural production to ensure ingredient traceability, and digital platforms that facilitate ingredient selection and formulation optimization.

The global natural cosmetic ingredients market is valued at US$918.6 million in 2026 and is projected to reach US$1,484.7 million by 2033, growing at a CAGR of 7.1%.

Rising consumer awareness about synthetic chemical hazards in conventional cosmetics, combined with stringent regulatory frameworks in Europe and North America restricting parabens, sulfates, and formaldehyde-releasing agents, drives market expansion.

Emollients represent the leading segment with approximately 40% market share due to their essential moisturization and skin barrier protection functions across all personal care applications.

North America maintains market leadership through established consumer demand for transparency, clean labeling, and scientifically validated natural ingredients supported by sophisticated retail infrastructure and digital commerce platforms.

Breakthrough innovation in fermentation-derived bio-preservatives, including lactobacillus-based antimicrobials and peptide systems, offers significant opportunities by addressing traditional efficacy limitations while providing multifunctional benefits.

Leading market participants include BASF SE, Croda International PLC, Evonik Industries AG, Clariant International Ltd., and Dow Inc., with these companies investing in biotechnology research, sustainable sourcing partnerships, and portfolio expansion through strategic acquisitions.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Ingredient Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author