ID: PMRREP35760| 195 Pages | 21 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

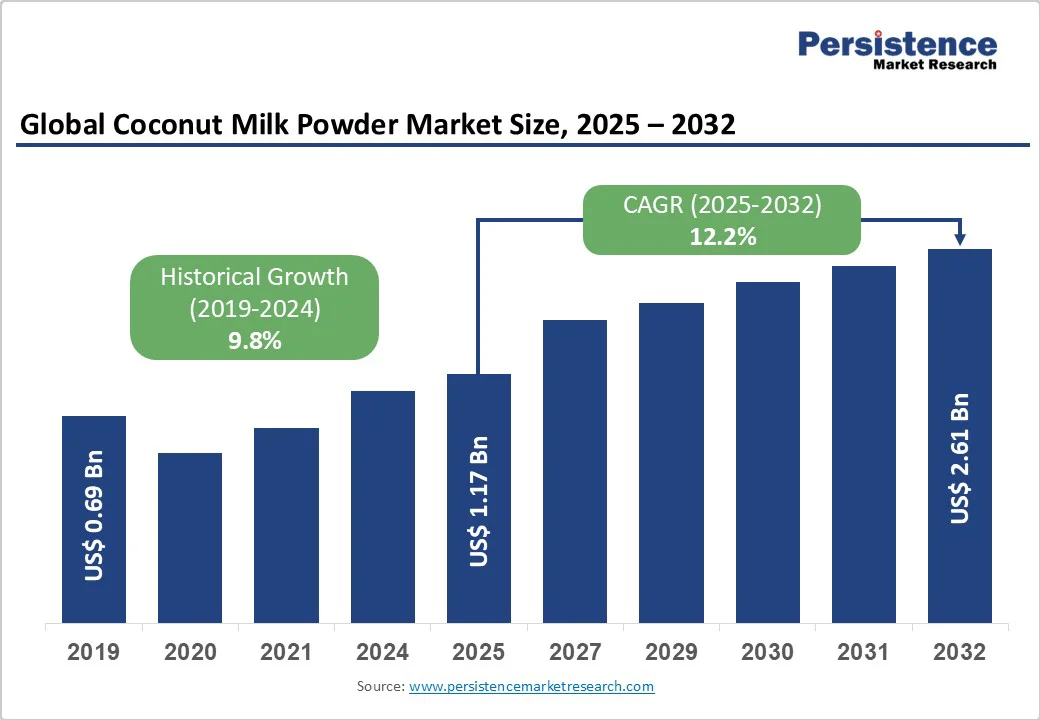

The global coconut milk powder market size is likely to be valued at US$1.17 billion in 2025. It is expected to reach US$2.61 billion by 2032, growing at a CAGR of roughly 12.2% during the forecast period from 2025 to 2032, driven by the global shift toward plant-based diets, improved spray-drying technologies, and the expanding use of coconut ingredients in food, beverage, and nutraceutical applications.

The powdered form offers longer shelf life, reduced transportation cost, and easier formulation, making it increasingly preferred across industrial and retail channels. Sustainable sourcing and clean-label consumer trends further reinforce market expansion.

| Key Insights | Details |

|---|---|

| Coconut Milk Powder Market Size (2025E) | US$1.17 Bn |

| Market Value Forecast (2032F) | US$2.61 Bn |

| Projected Growth (CAGR 2025 to 2032) | 12.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 9.8% |

Growing consumer preference for plant-based foods and lactose-free products is a primary catalyst for coconut milk powder demand. Rising awareness of lactose intolerance and vegan lifestyles has significantly boosted coconut-based dairy alternatives.

The product’s creamy texture and neutral taste make it suitable for various foods and beverages, including bakery mixes, smoothies, and desserts. The global plant-based food sector has been expanding at over 10% annually, with coconut-based ingredients capturing an increasing share due to their versatility and perceived naturalness. This demand directly translates to higher volumes for powdered variants used in large-scale production.

Innovations in spray-drying and encapsulation technologies have enabled producers to achieve finer particle sizes, improved solubility, and enhanced flavor retention. Manufacturers in Southeast Asia and India are investing heavily in automated spray-drying facilities to meet international quality standards.

These process improvements reduce wastage, optimize energy use, and enable consistent output for global export. As a result, powdered coconut milk is increasingly replacing canned or liquid formats in both industrial applications and retail product formulations, strengthening its competitive position.

Coconut milk powder is emerging as a multifunctional ingredient in processed foods, sports nutrition, and plant-based beverages. Its natural fat content and medium-chain triglycerides (MCTs) make it suitable for keto and high-protein formulations.

Food manufacturers are incorporating the powder into ready-to-drink mixes, confectionery fillings, sauces, and instant soups. This expansion into value-added applications contributes to strong demand momentum and higher margins, while enabling producers to diversify revenue streams across the food industry value chain.

The coconut industry is highly vulnerable to climate variations, pest outbreaks, and fluctuations in raw material availability. Changes in rainfall patterns and aging coconut trees in major producing countries such as the Philippines, Indonesia, and India often lead to inconsistent supply.

This volatility causes price instability for raw coconut meat and copra, directly affecting powder manufacturers’ cost structures. Sudden price spikes can compress margins for processors and discourage long-term contract commitments.

Quality inconsistencies across different production facilities create challenges in maintaining uniform product standards. Differences in fat content, carrier agents, and solubility can limit cross-market interchangeability.

Compliance with stringent food safety and labeling regulations in Europe and North America adds costs for testing and certification. Small- and mid-sized exporters often face difficulties meeting these requirements, slowing market entry and increasing overhead costs associated with certification and traceability.

The demand for organic, non-GMO, and ethically sourced coconut products presents a major opportunity for premium product differentiation. Consumers, particularly in North America and Europe, are increasingly paying premium prices for certified organic coconut milk powder.

Organic variants are projected to grow at nearly twice the rate of conventional products over the forecast period. Expanding organic-certified processing facilities in India, Sri Lanka, and Vietnam can help producers capture this high-value segment, which is estimated to account for 15-20% of total market revenue by 2032.

Collaborations between ingredient suppliers and global food and beverage brands are creating new growth opportunities. Joint ventures for co-developing customized blends, such as coconut milk powder combined with proteins or fiber, enhance product appeal in ready-to-drink mixes and health foods.

Such partnerships ensure stable demand, higher contract volumes, and improved brand visibility. As large consumer goods companies invest in plant-based portfolios, ingredient suppliers with integrated R&D capabilities are positioned to benefit significantly.

Urbanization, rising disposable income, and dietary diversification in Asia-Pacific, Latin America, and the Middle East are expanding consumer bases for coconut-based products. Powdered forms are particularly favored in tropical regions with limited cold-chain infrastructure.

As modern retail and e-commerce expand, consumer awareness of plant-based and convenience products increases, providing untapped market potential. Manufacturers who localize packaging and distribution strategies can capture this fast-growing demand effectively.

Full-fat coconut milk powder remains the dominant revenue contributor in the global market, accounting for approximately 65% in 2025, due to its rich texture, authentic coconut flavor, and higher fat content. It is widely used in bakery products, such as cakes and pastries, where a creamy mouthfeel is essential, and in culinary dishes, including curries, sauces, and soups, which require an authentic coconut flavor profile.

The higher caloric content also makes it popular in packaged, ready-to-cook meals and gourmet desserts. For example, global bakery brands such as Rich’s and Dawn Foods incorporate full-fat coconut powder in cake mixes and dessert toppings to achieve premium taste and texture. Industrial manufacturers favor full-fat powders for their superior emulsification properties, which enhance product consistency and shelf life.

Low-fat coconut milk powder is experiencing rapid growth as health-conscious consumers seek lighter, calorie-controlled alternatives without compromising taste. Functional powders, fortified with proteins, vitamins, or medium-chain triglycerides (MCTs), are increasingly used in meal-replacement shakes, protein-enriched smoothies, and keto-friendly formulations.

Brands such as Orgain, Vega, and Huel have introduced coconut-based plant-protein blends to cater to this segment. Technological innovations, such as advanced spray-drying techniques and flavor stabilization, have improved solubility, texture, and taste in low-fat powders, making them more appealing for both beverage and culinary applications.

This trend is particularly strong in North America and Europe, where consumers actively seek “better-for-you” ingredients and functional benefits such as digestive health and energy-boosting properties.

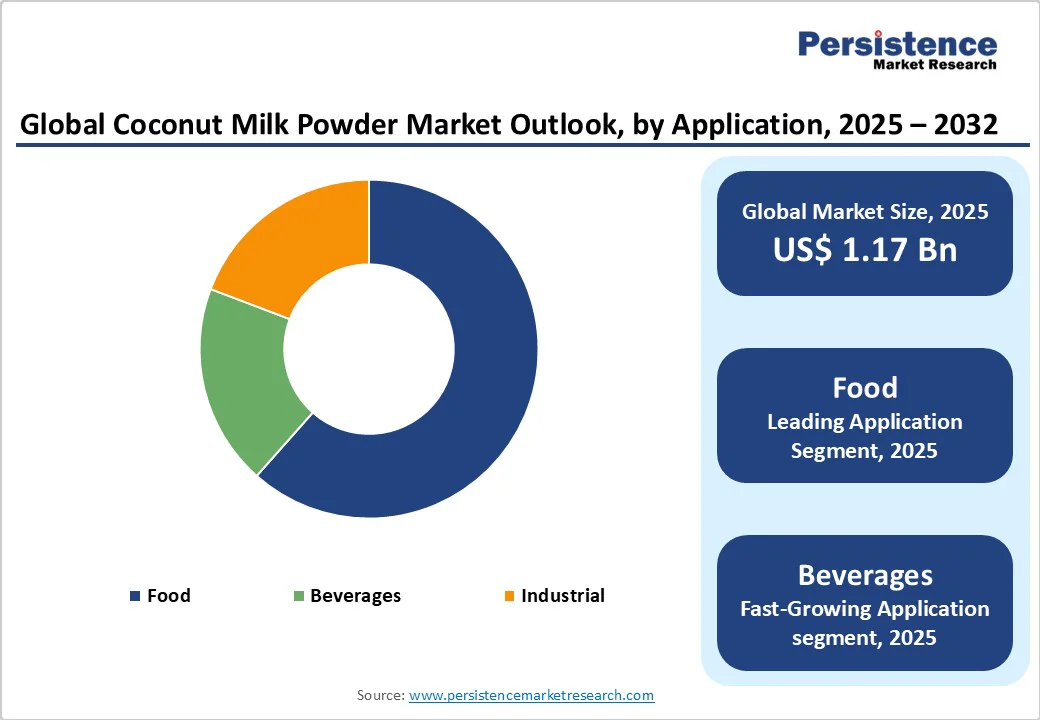

Food applications, including bakery, confectionery, ready-to-cook products, and culinary sauces, are projected to account for approximately 64% of coconut milk powder consumption in 2025. Manufacturers prefer the powdered form due to its extended shelf life, ease of transportation, and consistency in large-scale production.

For instance, bakery mix manufacturers such as General Mills and Pillsbury utilize coconut milk powder to deliver stable flavor and texture across batches. In confectionery, brands such as Nestlé and Lindt use full-fat coconut powder in truffles and fillings for its creamy mouthfeel.

The segment also sees adoption in ready-to-eat meals, particularly in frozen curries, soups, and ethnic meal kits, where coconut powder provides both taste and convenience. Increasing demand for international cuisines, such as Thai, Indian, and Caribbean, is driving higher consumption in the food sector globally.

The beverage segment is forecast to register the fastest growth over the next decade due to increasing consumption of plant-based drinks, protein shakes, smoothie powders, and instant coffee or tea mixes enriched with coconut. Coconut milk powder offers solubility, stability, and natural creaminess, making it a preferred base for ready-to-drink (RTD) beverages and powdered mixes.

Brands such as Vita Coco, Silk, and Califia Farms have leveraged coconut milk powder in protein shakes, coffee creamers, and plant-based milk alternatives. Functional beverages targeting energy, digestive health, and immunity often incorporate coconut powder as a natural source of MCTs and minerals. Growth in the e-commerce and health beverage sectors, along with the proliferation of smoothie bars and wellness cafes, is further accelerating demand.

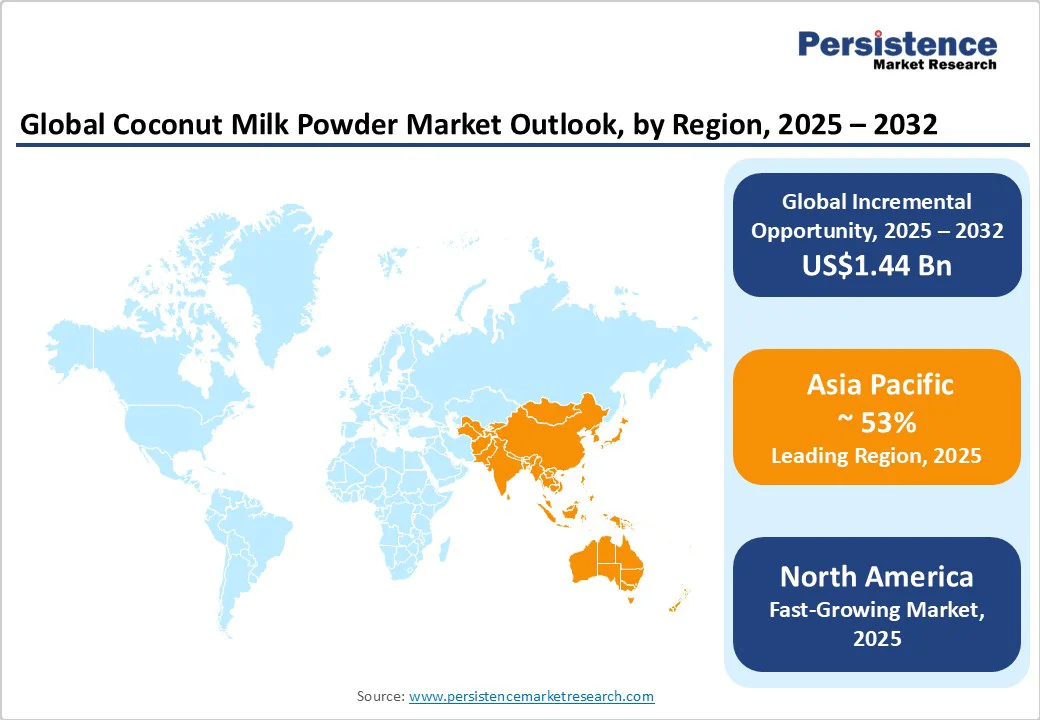

Asia Pacific dominates global production and export of coconut milk powder, accounting for 53% of the market share in 2025, with the Philippines, Indonesia, India, and Sri Lanka serving as the primary suppliers.

These countries benefit from abundant coconut resources, favorable climates, and well-established export infrastructure. On the consumption side, China, Japan, and India are emerging as major markets due to rising awareness of plant-based nutrition, functional foods, and convenience products.

Governments in the region are promoting value-added processing, such as spray-dried powders and fortified blends, to enhance export revenue and increase farmer income. Recent initiatives include India’s support for modernized coconut processing plants in Kerala and Tamil Nadu in 2024, and Indonesia’s expansion of its organic coconut powder production to meet European and North American demand.

The ASEAN trade framework is helping harmonize regulations and facilitate cross-border trade. Industrial expansion, low labor costs, and rising domestic demand ensure Asia Pacific remains the fastest-growing region, with both production and consumption driving long-term market growth.

Europe remains the fastest-growing market for coconut milk powder, driven by strong consumer preference for organic, sustainably sourced, and ethically produced products. Germany, the U.K., France, and Spain collectively account for the largest share of regional consumption. The European Union’s stringent food safety regulations, sustainability mandates, and clean-label initiatives have encouraged manufacturers to adopt traceable sourcing and ethical supply chain practices.

Recent developments include Kerry Group’s 2023 launch of organic coconut-based ingredient blends in the U.K. and Germany, targeting plant-based dairy alternatives, and Olam International’s investment in port-based blending facilities in the Netherlands, which enhances storage capacity and reduces logistical bottlenecks.

The regional trend of reducing dairy intake and increasing plant-based product adoption continues to fuel demand. Fair-trade certifications and transparent sourcing practices are becoming essential for brand differentiation, particularly in premium segments.

North America represents one of the largest consumer markets for coconut milk powder, with the U.S. accounting for the majority of regional demand. Rising awareness of plant-based diets, lactose intolerance, and clean-label preferences is driving both retail and industrial consumption. Major foodservice companies and CPG brands are incorporating coconut milk powder into bakery mixes, sauces, ready-to-drink beverages, and protein shakes.

Recent developments include ADM’s expansion of its plant-based ingredient facilities in California in 2024, aimed at improving supply chain efficiency and meeting growing demand for vegan and functional food ingredients.

The regulatory environment, governed by the U.S. Food and Drug Administration (FDA), emphasizes accurate labeling, allergen declarations, and traceability, favoring compliant suppliers. Co-manufacturing facilities located near major ports are reducing transportation costs and lead times, while partnerships with certified suppliers ensure product consistency and adherence to organic or non-GMO standards.

The global coconut milk powder market is moderately concentrated, with a mix of multinational ingredient companies and regional processors. Large global players account for roughly one-third of market revenue, while numerous mid-sized producers in Asia supply regional and organic variants. Market competition centers on quality certification, supply reliability, and innovation in product formulation.

Market leaders emphasize innovation partnerships, origin integration, and sustainable sourcing. Strategies focus on co-developing functional ingredient systems, expanding organic portfolios, and ensuring long-term supply stability through farmer network programs and regional capacity investments.

The market size was valued at US$1.17 Billion in 2025.

The coconut milk powder market is projected to reach US$2.61 Billion by 2032.

The coconut milk powder market is expected to grow at a CAGR of 12.2% between 2025 and 2032.

Key trends include increasing adoption of plant-based and lactose-free alternatives, growth in organic and functional coconut powders, expansion in ready-to-drink beverages, and rising use in bakery, confectionery, and culinary applications.

The full-fat coconut milk powder segment is the leading category, accounting for approximately 65% of the revenue share, preferred for bakery, dessert, and culinary applications.

Major players include Cargill, Incorporated, Archer Daniels Midland Company (ADM), Olam International Ltd., Kerry Group plc, and The Vita Coco Company, Inc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Source

By Nature

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author