ID: PMRREP12604| 212 Pages | 30 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

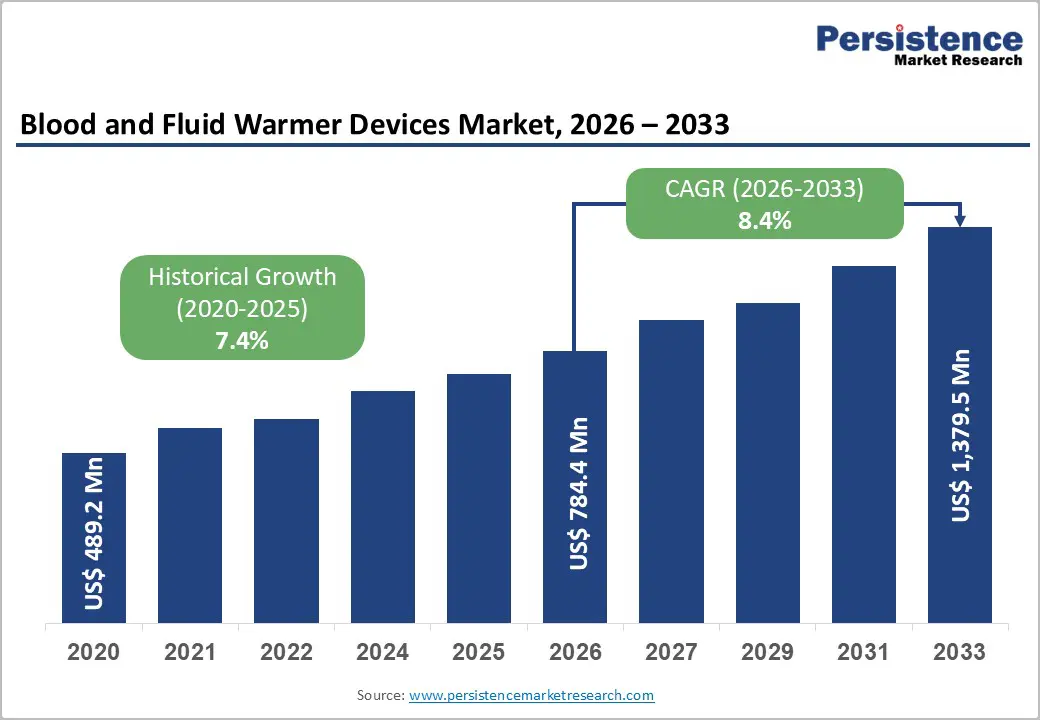

The global blood and fluid warmer devices market is estimated to grow from US$ 784.4 Mn in 2026 to US$ 1,379.5 Mn by 2033. The market is projected to record a CAGR of 8.4% during the forecast period from 2026 to 2033.

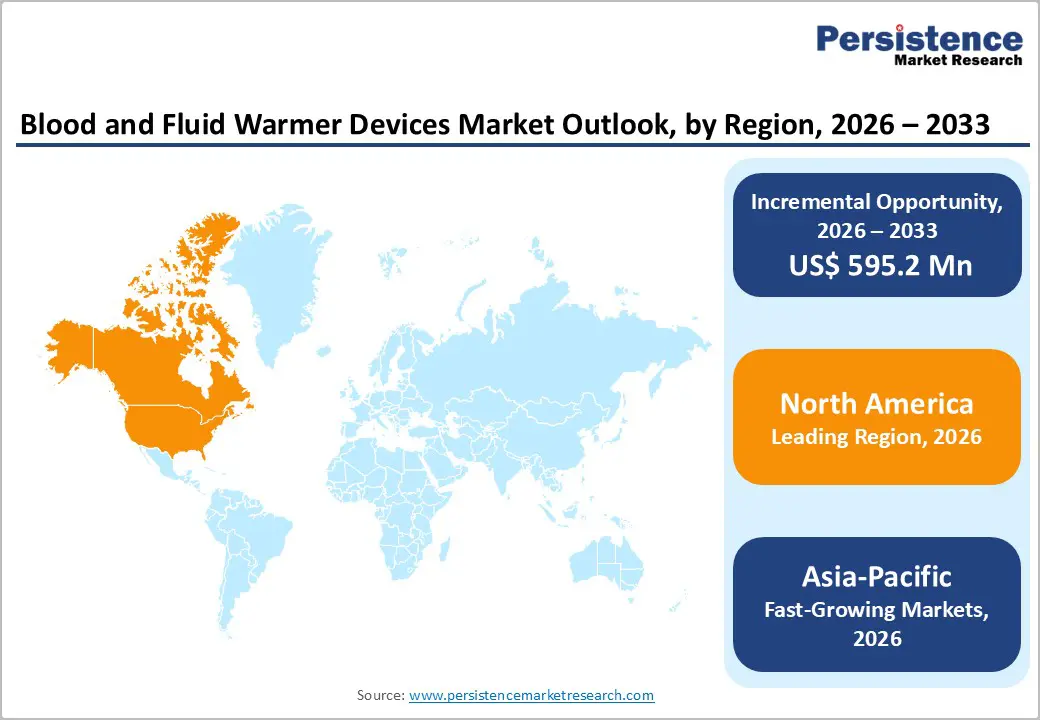

The global blood and fluid warmer devices market is growing steadily due to aging populations, rising surgical volumes, and increasing demand for critical care. North America dominates, supported by advanced healthcare infrastructure and high technology adoption. Asia-Pacific is the fastest-growing region, driven by expanding healthcare access, supportive government policies, local manufacturing growth, and rising investments in modern medical technologies.

| Global Market Attributes | Key Insights |

|---|---|

| Global Blood and Fluid Warmer Devices Market Size (2026E) | US$ 784.4 Mn |

| Market Value Forecast (2033F) | US$ 1,379.5 Mn |

| Projected Growth (CAGR 2026 to 2033) | 8.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 7.4% |

Perioperative hypothermia, defined as a core body temperature below 36 °C is a common complication in surgical settings. Clinical studies have documented that the incidence of intraoperative hypothermia ranges widely from about 20% to over 70% in adult surgical patients when warming measures are not uniformly applied, illustrating how frequent temperature drops occur during anesthesia and procedures. Such involuntary hypothermia is associated with significant adverse effects, including impaired coagulation, increased blood loss, prolonged anesthesia metabolism, and extended recovery times.

In one cross-sectional study at Brazilian referral hospitals, nearly 57% of surgical patients experienced inadvertent perioperative hypothermia, highlighting the persistent clinical challenge globally. Another observational analysis showed intraoperative temperature declines in a majority of major surgical cases, reinforcing why maintaining normothermia is a standard quality metric in perioperative care. Because hypothermia contributes to complications and longer hospital stays, clinicians increasingly adopt active warming solutions, boosting demand for blood and fluid warmer devices that help maintain patient core temperatures and improve outcomes.

The high upfront cost of advanced medical devices continues to be a significant restraint on adoption, especially in resource-constrained settings. Durable hospital technologies, including sophisticated temperature control systems with integrated sensors and rapid warming capabilities often carry price tags that are difficult for smaller clinics or rural hospitals to justify within limited budgets. Publicly available equipment data shows many home and specialized clinical devices (e.g., advanced mobility or respiratory equipment) can range from several thousand to over US $15,000 per unit, which serves as a proxy for the price sensitivity in similar medical device categories.

Beyond acquisition cost, insurance reimbursement limitations further dampen uptake; many payers impose strict qualification criteria or exclude certain devices, shifting the financial burden to patients or healthcare providers. This financing gap means even when clinical benefits are evident, institutions may delay procurement or prioritize lower-cost alternatives. In markets with constrained healthcare spending, particularly in low- and middle-income countries, these cost barriers restrict widespread integration of advanced warming systems despite clear clinical needs, slowing market growth.

The increasing emphasis on pre-hospital care, emergency response, and home-based medical support presents a clear opportunity for portable and battery-operated warming devices. As outpatient care models and chronic disease management shift care outside traditional settings, clinicians and caregivers alike demand more compact, user-friendly warming devices suitable for ambulances, field settings, and patients’ homes.

Portable blood and fluid warmers with battery operation can address thermal management needs in trauma rescues, emergency medical services, and rural clinics where infrastructure may be limited. Furthermore, aging global demographics and rising chronic comorbidities necessitate devices that facilitate safe fluid administration without reliance on centralized OR systems. With healthcare delivery evolving toward decentralized and versatile frameworks, including telehealth and mobile clinics, manufacturers that innovate lightweight, efficient, and adaptable warming solutions will capture emerging markets and expand overall industry reach.

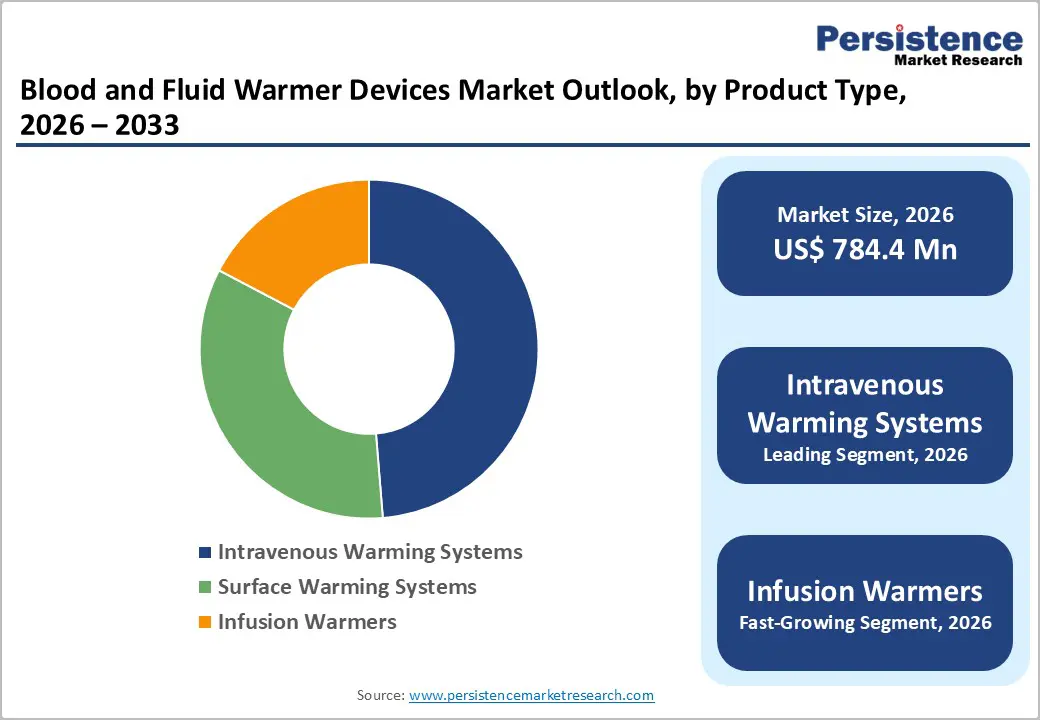

Intravenous Warming Systems are leading with 48.7% share in 2025, because they are the most direct and effective method for maintaining patients’ core temperature during fluid and blood administration, an essential need in many clinical scenarios. These systems actively heat IV fluids and blood products just before or during infusion, minimizing heat loss that occurs when cold fluids enter the bloodstream. Maintaining normothermia is critical; unwarmed IV fluids can exacerbate hypothermia, especially during large-volume infusions seen in surgery and trauma care, leading to adverse physiologic responses like impaired coagulation and cardiac stress. Active IV warming has been shown to help keep core body temperatures closer to normal compared to room-temperature fluids, improving patient comfort and stability during care. Because fluid administration is nearly universal across healthcare settings, from emergency departments to operating rooms IV warming systems are widely adopted and central in protocols for perioperative and critical care thermal management.

Surgical applications dominate the market because a large proportion of perioperative patients are at high risk for inadvertent hypothermia, a common complication during anesthesia and operative procedures. Research shows that perioperative hypothermia can occur in 30–75 % of cases, largely due to anesthetic-induced impairment of thermoregulation and exposure to cold operating room environments. Hypothermia during surgery increases risks of infection, coagulopathy, cardiovascular stress, and extended recovery times, making active temperature management a priority for surgical safety. Because there are hundreds of millions of surgical procedures globally each year, warming systems especially for blood and IV fluids, are standard equipment in operating suites to preserve core temperature and improve outcomes. Consequently, surgical settings account for the most frequent and intensive use of blood and fluid warmers, driving their dominant share in the market.

North America leads the global blood and fluid warmer devices market because of its highly developed healthcare infrastructure and substantial procedural volumes. The region accounts for roughly 41.2% of global installations, reflecting widespread hospital adoption of warming protocols in ORs, trauma centers, and critical care units. U.S. hospitals alone perform millions of blood transfusions annually, with surge capacity and emergency services integrating warming systems widely. Advanced clinical guidelines in perioperative and emergency care emphasize temperature management to improve outcomes and reduce complications, boosting device utilization. Additionally, high healthcare expenditure per capita in the United States and Canada supports adoption of state-of-the-art warming technologies in both fixed and portable formats, reinforcing North America’s leadership position.

Europe is a key market for blood and fluid warmer devices due to its well-established healthcare systems, strong clinical protocols, and emphasis on patient safety. Hospitals across Germany, the UK, France, and other EU nations routinely use warming systems in surgery, emergency care, and blood banks to prevent hypothermia-related complications. In Europe, significant proportions of operating rooms and trauma centers have adopted advanced warming devices, driven by clinical guidelines and regulatory emphasis on perioperative care quality. The region’s public healthcare investments and aging population also contribute to steady device demand, particularly as surgical volumes and chronic disease prevalence rise. Robust medical device standards and reimbursement frameworks further support market penetration of both fixed and portable warming technologies across European healthcare networks.

Asia-Pacific is the fastest-growing region for blood and fluid warmer devices due to rapid healthcare infrastructure expansion and increasing procedural volumes in countries like China, India, and Japan. Investments in hospital construction, ICU capacity, and emergency care systems are rising sharply to meet burgeoning healthcare demand, with many new facilities integrating warming technologies into surgical and critical care units. Asia-Pacific’s large and aging population increases the number of surgeries, trauma cases, and transfusions requiring temperature management, while government initiatives in China and India promote broader access to advanced medical devices. Expanding medical tourism and rising patient awareness about quality care also accelerate adoption. Growth is further supported by the increasing deployment of portable warmers in EMS and rural healthcare settings.

The competitive landscape of the blood and fluid warmer devices market is moderately consolidated, led by established global med-tech companies like 3M, Smiths Medical, Stryker, GE Healthcare, BD, and Baxter International, which together supply a large portion of warming systems worldwide. These players compete through continuous product innovation, strategic partnerships, and expanded global distribution to strengthen adoption in hospitals and emergency care centers. A tier of specialized and regional manufacturers, such as Barkey GmbH, Belmont, The 37Company, and Estill Medical, contributes niche products and cost-effective alternatives, supporting diverse clinical needs and reinforcing competition.

The global blood and fluid warmer devices market is projected to be valued at US$ 784.4 Mn in 2026.

Rising surgical volumes, trauma cases, hypothermia prevention needs, aging populations, and adoption of advanced temperature management technologies.

The global blood and fluid warmer devices market is poised to witness a CAGR of 8.4% between 2026 and 2033.

Growing demand for portable warmers, expansion in emerging markets, homecare adoption, EMS use, and smart device integration.

3M Company, BD, GE Healthcare, Stryker Corporation, Barkey GmbH & Co. KG, Geratherm Medical.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Mn Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author