ID: PMRREP14800| 234 Pages | 13 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

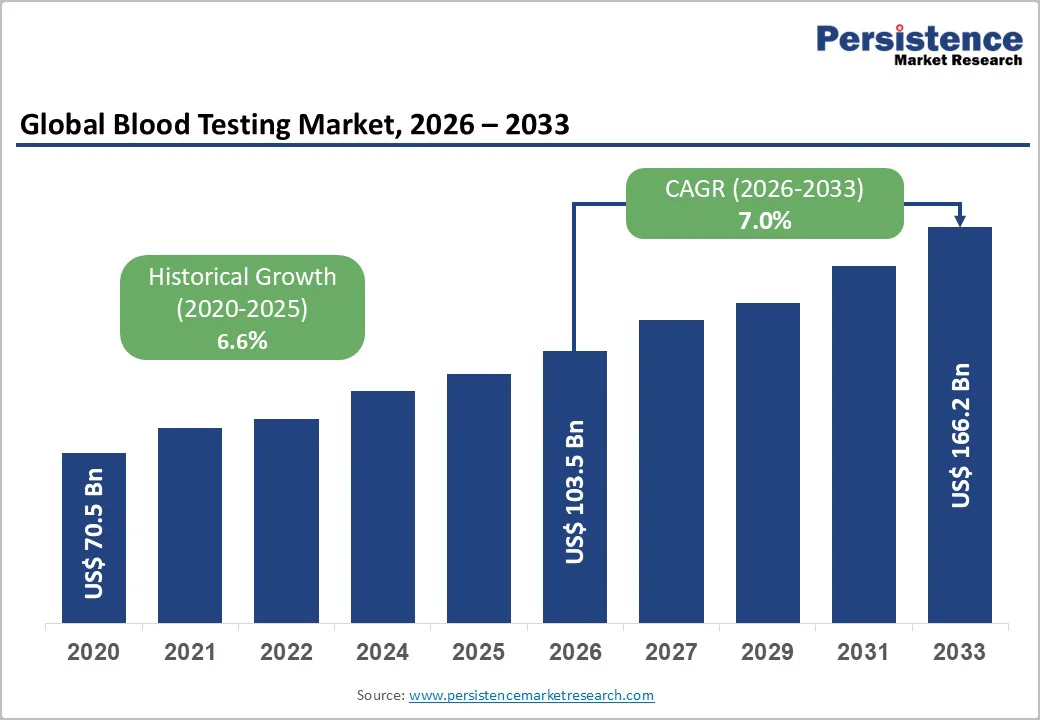

The global blood testing market size is likely to be valued at US$103.5 billion in 2026, projected to reach US$166.2 billion by 2033, growing at a CAGR of 7.0% during the forecast period from 2026 to 2033, driven by the increasing prevalence of chronic diseases, rising demand for point-of-care diagnostics, and advancements in automated testing technologies.

The rising need for early detection of diabetes and cardiovascular diseases, fueled by the growing use of glucose and lipid panel tests, is accelerating the adoption of blood testing across diverse populations. Advances in PSA and BUN testing are further supporting demand by offering faster and more accurate diagnostic results.

Growing recognition of blood testing as a core component of preventive healthcare, especially in hospitals, continues to strengthen overall market growth.

| Key Insights | Details |

|---|---|

| Blood Testing Market Size (2026E) | US$103.5 Bn |

| Market Value Forecast (2033F) | US$166.2 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.0% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.6% |

The increasing incidence of chronic illnesses, such as diabetes, cardiovascular diseases, cancer, and kidney disorders, has significantly influenced the demand for point-of-care (POC) diagnostic solutions. Chronic diseases require frequent monitoring and timely intervention to manage symptoms, prevent complications, and ensure effective treatment.

Traditional laboratory testing methods, while accurate, often involve long turnaround times, centralized facilities, and logistical challenges, which can delay diagnosis and subsequent care.

Point-of-care diagnostics address these challenges by enabling rapid testing and immediate results at the site of patient care, whether in hospitals, clinics, or even home settings. For patients with chronic conditions, POC testing enables routine monitoring of key health parameters, such as blood glucose, cholesterol levels, hemoglobin, and cardiac markers, facilitating quicker clinical decisions and adjustments to treatment plans.

The rising patient population with chronic illnesses, combined with increasing healthcare awareness and preventive care initiatives, has accelerated the adoption of POC technologies. POC devices often feature portability, ease of use, and connectivity with electronic health records, improving patient management and compliance.

Expensive innovation and limited affordability for end users pose significant challenges to the adoption and expansion of advanced diagnostic technologies, including blood-testing solutions.

The development of state-of-the-art testing platforms, such as AI-integrated point-of-care devices or automated analyzers, requires substantial investment in research and development, skilled personnel, high-precision instrumentation, and regulatory compliance. These upfront costs often translate into higher prices for the end products, making them less accessible to smaller clinics, rural healthcare centers, and emerging markets with constrained budgets.

Limited affordability restricts widespread adoption, particularly in regions where healthcare spending per capita is low or where insurance coverage is insufficient to offset costs. Hospitals and diagnostic laboratories may hesitate to replace existing manual or semi-automated systems with cutting-edge devices due to budgetary constraints, despite the potential benefits in accuracy, throughput, and efficiency.

The cost barrier can slow the adoption of innovative solutions in preventive healthcare and community-level screening programs, where large-scale deployment is essential. Addressing these challenges requires manufacturers to develop cost-optimized devices, scalable models, or leasing/subscription approaches that balance technological advancement with broader accessibility.

Next-generation point-of-care (POC) solutions with artificial intelligence (AI) support have transformed the landscape of diagnostic testing by enabling faster, more accurate, and decentralized healthcare delivery. These solutions integrate portable testing devices with advanced AI algorithms that can analyze results in real-time, identify anomalies, and provide predictive insights.

By combining POC testing with AI, healthcare providers can perform rapid diagnostics at hospitals, clinics, or even remote and home settings, reducing dependence on centralized laboratories and shortening turnaround times for critical results.

The integration of AI enhances data interpretation, reduces human error, and supports decision-making by providing actionable insights from patient history, demographics, and prior test trends. For instance, AI-enabled blood analyzers can flag abnormal glucose, lipid, or hematology results and suggest follow-up tests or alerts for clinicians.

Such innovations are particularly beneficial for chronic disease management, infectious disease monitoring, and preventive healthcare, where timely interventions are crucial. AI-supported POC solutions facilitate data aggregation and connectivity, enabling secure sharing of results with electronic health records and telemedicine platforms.

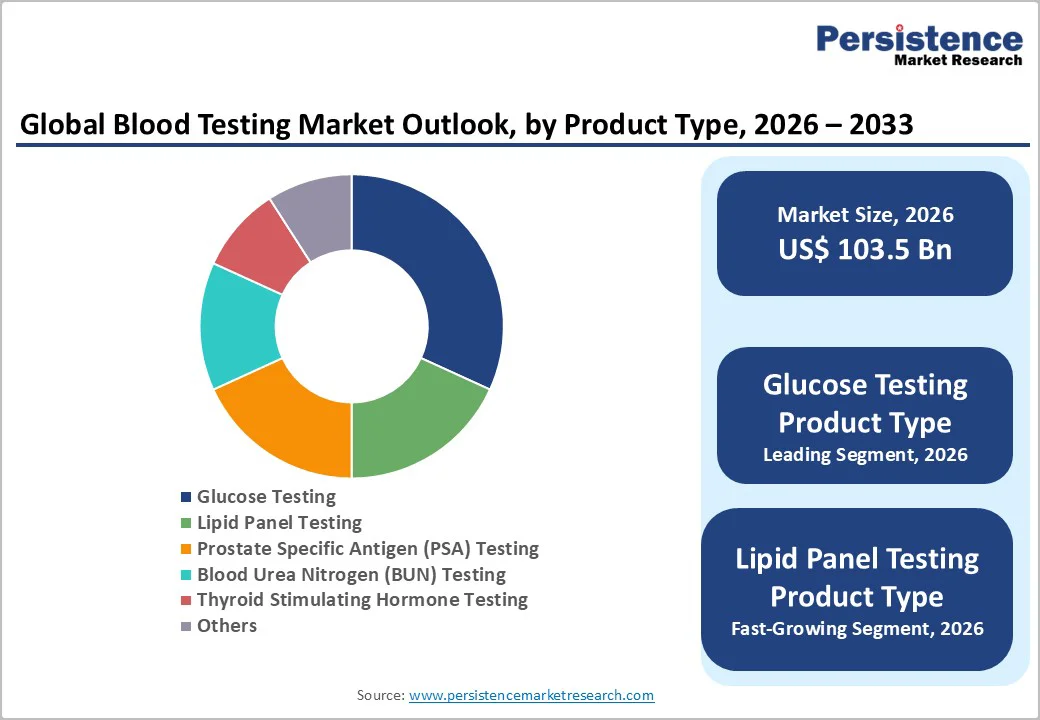

Glucose testing dominates the market, expected to account for approximately 35% of the share in 2026, driven by its essential role in diabetes screening, affordability, and the need for frequent monitoring. Its ability to deliver rapid, reliable readings makes it a preferred choice for routine use in clinics and home settings.

For example, Roche Diagnostics offers lipid-panel testing equipment used in clinics to deliver immediate cholesterol and lipid profile results, enabling timely lifestyle or treatment decisions, thereby supporting wider uptake of rapid and convenient lipid testing.

Lipid panel testing is the fastest-growing segment, driven by rising cardiovascular disease risks and increasing use of lipid profiling in preventive healthcare and wellness programs. The test’s ability to measure total cholesterol, HDL, LDL, and triglycerides makes it essential for early detection and long-term health monitoring.

Growing demand for point-of-care innovation further accelerates adoption, particularly in North America and Europe. For example, Siemens Healthineers’ Atellica® CH Analyzer and Dimension® EXL systems are widely used in clinics and hospitals to deliver rapid, accurate lipid panel results, enabling timely lifestyle and treatment decisions in routine cardiovascular risk assessments.

The automated blood testing segment is anticipated to lead the market, holding approximately 60% of the share in 2026, driven by its superior speed, accuracy, and ability to process high sample volumes. Automated systems reduce manual errors, support continuous workflow, and meet growing demand from hospitals and diagnostic laboratories.

Their scalability makes them essential for routine panels, specialized assays, and large screening programs. For example, Roche Diagnostics’ automated laboratory analyzers are widely used worldwide to run complete blood counts, metabolic panels, and lipid profiles quickly and reliably, enabling hospitals and labs to handle high-throughput testing with improved accuracy and shorter turnaround times.

Manual blood testing is projected to be the fastest-growing segment, driven by rising point-of-care needs and increasing adoption in remote or resource-limited areas. Its portability, low cost, and simple operation make it ideal for rapid screening where laboratory infrastructure is limited.

These tests enable immediate decision-making and support community-level healthcare programs. For example, Abbott Laboratories offers portable point-of-care manual blood test kits such as the i-STAT system, allowing clinics and remote care centers to perform blood tests on-site without needing a full lab.

Hospitals are expected to dominate the market, accounting for nearly 50% of revenue in 2026, driven by their extensive diagnostic needs and high patient volume. They remain the preferred setting for comprehensive testing, emergency care, and advanced treatment, ensuring consistent demand for routine and specialized blood tests.

Their integration of automated analyzers and centralized labs further supports efficient, large-scale testing. For example, Roche Diagnostics is widely used by hospitals worldwide. Its automated analyzers help run complete blood counts, metabolic panels, and specialized assays, enabling hospitals to support high-volume patient diagnostics reliably and efficiently.

Diagnostic laboratories are likely to be the fastest-growing segment, driven by increasing outsourcing of testing services and the need for higher operational efficiency across healthcare systems. These laboratories offered specialized testing options, advanced automation, and high-throughput capabilities, enabling faster turnaround times and improved accuracy.

Their ability to manage large sample volumes while maintaining quality standards boosted adoption among hospitals and clinics seeking cost-effective solutions. For example, a regional diagnostic lab installed high-throughput immunoassay and hematology analyzers, enabling hospitals to outsource routine and specialized blood tests, such as hormone panels and infectious disease screens, for faster, more accurate, and cost-efficient results.

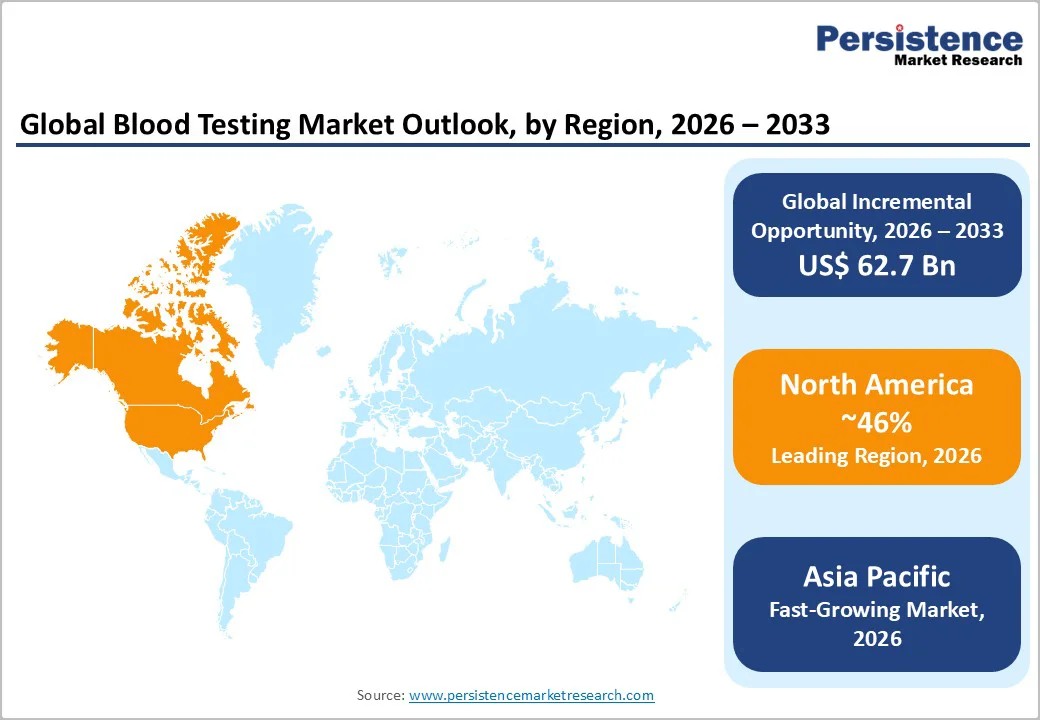

North America is projected to account for nearly 46% of the global blood testing market in 2026, supported by advanced healthcare infrastructure and a high level of diagnostic awareness across the region.

Hospitals, clinics, and independent laboratories have steadily increased their adoption of automated analyzers, digital diagnostic platforms, and high-throughput testing systems, enabling faster and more accurate results. A rising prevalence of chronic illnesses such as diabetes, cardiovascular diseases, and various cancers has driven continuous demand for routine and specialized blood tests.

The region has also seen expanded use of point-of-care testing, particularly in emergency departments, physician offices, and home-care settings. This shift toward rapid and decentralized testing has been fueled by the need for immediate clinical decisions and greater convenience for patients.

Technological advancements such as AI-assisted interpretation, remote monitoring tools, and integrated laboratory information systems further supported modernization. Preventive healthcare initiatives, wellness programs, and increasing participation in annual health checkups also contributed significantly to market growth. In addition, an aging population and growing emphasis on early detection strengthened the need for comprehensive blood screening.

Europe is estimated to account for a 25% market share in 2026, supported by well-established healthcare systems and strong regulatory frameworks across major countries such as Germany, the U.K., France, and Italy.

The region’s emphasis on early disease detection, preventive care, and routine screening significantly increased the demand for blood tests in hospitals, diagnostic centers, and outpatient settings. Rising incidences of chronic and age-related conditions, including diabetes, cardiovascular diseases, and autoimmune disorders, further strengthened the need for both basic and specialized blood testing.

Europe also advanced through the rapid adoption of automation and digitalization within clinical laboratories. High-throughput analyzers, standardized laboratory workflows, and integration of electronic health records improved diagnostic accuracy and turnaround time. Governments and healthcare authorities encouraged large-scale screening programs, particularly for infectious diseases and metabolic disorders, which added momentum to market growth.

The region additionally experienced growing interest in personalized medicine, driving the use of molecular and genetic blood tests. Increasing investments in research, strong academic clinical collaborations, and rising patient awareness enhanced the adoption of innovative testing methods.

Asia Pacific is estimated to be the fastest-growing market for blood testing, driven by rapid healthcare modernization and rising demand for accurate diagnostic services across emerging economies.

Expanding hospital and laboratory infrastructure in countries such as China, India, Japan, and South Korea significantly boosted the adoption of advanced blood testing technologies, including immunoassays, molecular diagnostics, and point-of-care testing devices. A growing burden of chronic diseases such as diabetes, cardiovascular disorders, and infectious diseases further increased the need for routine and specialized blood tests.

The region also benefited from improved health insurance coverage, government-led screening programs, and rising awareness of early disease detection among the population. Investments in digital health, AI-enabled diagnostic platforms, and automated analyzers supported the shift toward high-throughput and efficient testing systems.

Additionally, the expansion of private diagnostic chains and the availability of affordable testing solutions made blood testing more accessible across urban and semi-urban areas. Local manufacturing capabilities improved as regional companies developed cost-effective kits and consumables tailored to local healthcare needs.

The global blood testing market is highly competitive, characterized by a diverse mix of multinational diagnostic leaders and specialized regional players. In developed regions such as North America and Europe, major companies, including Abbott and F. Hoffmann-La Roche Ltd., maintained dominance through strong R&D capabilities, extensive product portfolios, and well-established distribution networks.

Their continuous advancements in automated analyzers, molecular diagnostics, and high-throughput platforms strengthened their market position. In the Asia Pacific region, companies like Biomerica gained notable traction by offering localized, affordable, and rapid testing solutions tailored to regional healthcare needs and expanding laboratory infrastructures.

Competition had intensified as manufacturers focused heavily on point-of-care (POC) innovation, which had become a critical differentiator, especially in emergency care, home testing, and resource-limited settings. Strategic partnerships, mergers, and acquisitions were widely pursued to expand technological capabilities and global reach.

Furthermore, the integration of artificial intelligence into blood testing, such as AI-assisted analyzers, automated interpretation systems, and predictive diagnostics, has accelerated the pace of innovation.

The global blood testing market is projected to reach US$103.5 billion in 2026.

The rising prevalence of chronic diseases and demand for point-of-care diagnostics are the key drivers.

The blood testing market is poised to witness a CAGR of 7.0% from 2026 to 2033.

Advancements in point-of-care and AI-integrated testing are the key opportunities.

Abbott, F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Inc., bioMérieux, and Quest Diagnostics Incorporated are the key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Methods

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author