ID: PMRREP33853| 210 Pages | 11 Feb 2026 | Format: PDF, Excel, PPT* | Healthcare

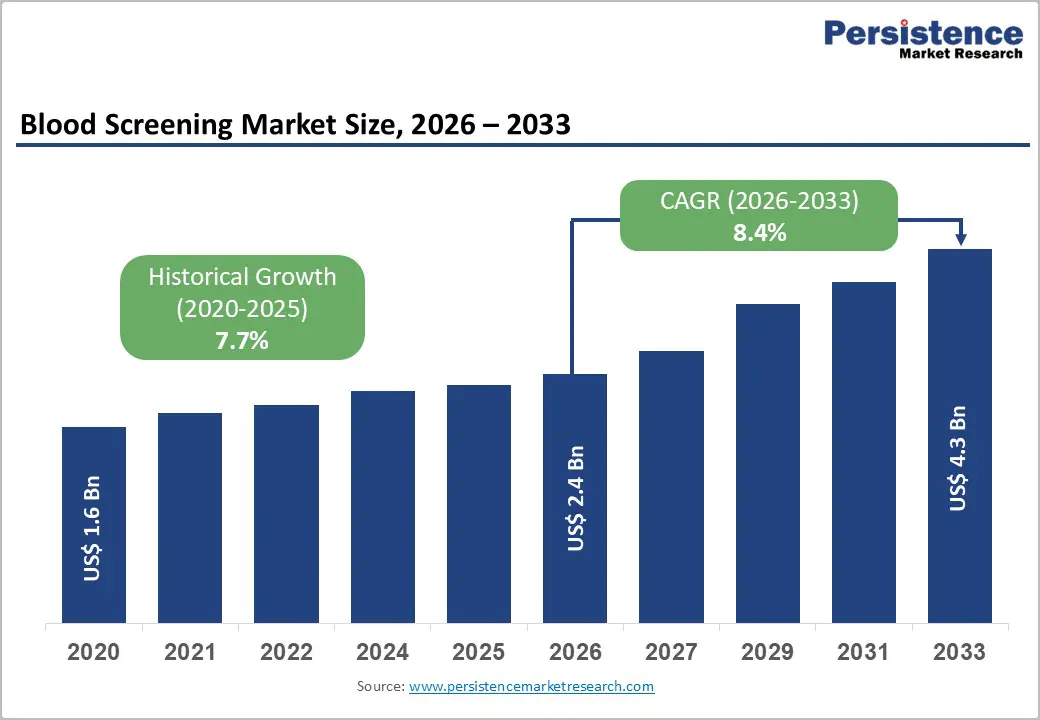

The global blood screening market size is expected to be valued at US$ 2.4 billion in 2026 and projected to reach US$ 4.3 billion by 2033, growing at a CAGR of 8.4% between 2026 and 2033.

Primary growth factors include increasing blood transfusion needs, stringent safety regulations, and technological advances in pathogen detection. The rise in chronic diseases and surgeries is increasing demand; the WHO reports 118 million blood donations annually worldwide, necessitating rigorous screening to prevent transmission. Regulatory bodies such as the FDA and EMA enforce universal protocols, significantly reducing infection risk, while innovations such as multiplex assays enhance efficiency and accuracy across global healthcare systems.

| Key Insights | Details |

|---|---|

| Blood Screening Market Size (2026E) | US$ 2.4 billion |

| Market Value Forecast (2033F) | US$ 4.3 billion |

| Projected Growth CAGR (2026 - 2033) | 8.4% |

| Historical Market Growth (2020 - 2025) | 7.7% |

Rising surgical interventions, trauma cases, cancer therapies, and chronic disorders such as anemia and hemophilia continue to push blood transfusion volumes upward worldwide. Aging populations in developed economies and expanding access to healthcare in emerging nations further accelerate demand, creating sustained pressure on blood banks to ensure absolute safety. Post-pandemic recovery has intensified this trend, as deferred elective surgeries resumed at scale, driving sharp increases in donor screening requirements. Health authorities have simultaneously strengthened testing mandates for HIV, HBV, HCV, syphilis, and emerging pathogens, translating directly into higher reagent consumption and analyzer utilization per collected unit. The shift toward universal donor screening and repeat testing in high-risk regions increases throughput requirements across centralized and regional laboratories. As transfusion networks expand and governments emphasize zero-risk blood supply policies, screening volumes are projected to rise steadily, reinforcing long-term market expansion across consumables, automation platforms, and laboratory services.

Advances in nucleic acid testing (NAT), chemiluminescent immunoassays, and multiplex molecular platforms have transformed blood screening by sharply reducing diagnostic window periods and improving sensitivity for low-titer infections. Automated, high-throughput analyzers now integrate sample preparation, amplification, and result interpretation within a single system, enabling large transfusion centers to process thousands of donations daily while reducing human error and contamination risk. Digital connectivity and middleware further enhance laboratory efficiency by linking instruments to blood bank information systems to support traceability and regulatory reporting. Continuous FDA and CE approvals for next-generation assays validate performance improvements and encourage global adoption. Over time, economies of scale and platform standardization reduce per-test costs, making sophisticated screening viable for mid-tier hospitals. These innovations not only strengthen patient safety outcomes but also support consolidation of regional testing hubs, driving replacement cycles for legacy equipment and fueling rapid uptake of premium analyzers and reagent portfolios.

Despite their clinical advantages, NAT platforms and fully automated screening systems remain capital-intensive, limiting penetration in low- and middle-income regions. Instrument procurement requires substantial upfront investment, whereas recurring reagent costs significantly exceed those of conventional ELISA-based testing, thereby straining constrained public healthcare budgets. Added financial pressure arises from infrastructure upgrades, service contracts, calibration requirements, and specialized workforce training, which can increase total operating expenditure by double-digit percentages annually. Smaller blood banks often lack sufficient testing volume to justify automation, thereby necessitating continued reliance on manual or semi-automated methods, which yield lower margins for suppliers. Funding shortfalls within national transfusion programs delay replacement cycles and restrict access to multiplex assays for emerging pathogens. As a result, cost sensitivity remains a major barrier to adoption, particularly in rural or decentralized settings, thereby slowing market penetration of premium technologies even as regulatory expectations and disease burdens continue to rise.

Blood screening products undergo some of the most rigorous regulatory scrutiny in diagnostics, as errors can have life-threatening consequences. Approval pathways require extensive analytical validation, clinical trials, and post-market surveillance, thereby extending commercialization timelines by more than a year in many jurisdictions. Divergent standards across the U.S., Europe, and Asia complicate global launches and raise compliance costs for manufacturers seeking multinational reach. Frequent updates to pathogen panels and evolving safety guidelines force companies to continually modify assays and resubmit documentation, straining R&D resources. Blood banks also confront heavy documentation and audit requirements when upgrading platforms, which can delay procurement decisions. Additionally, concerns about false-positive results and donor deferrals create ethical and operational complexities, which can reduce donor pools and trigger public scrutiny. Together, these regulatory pressures elevate barriers to entry for smaller players and slow deployment of innovative solutions, tempering otherwise strong technological momentum in the market.

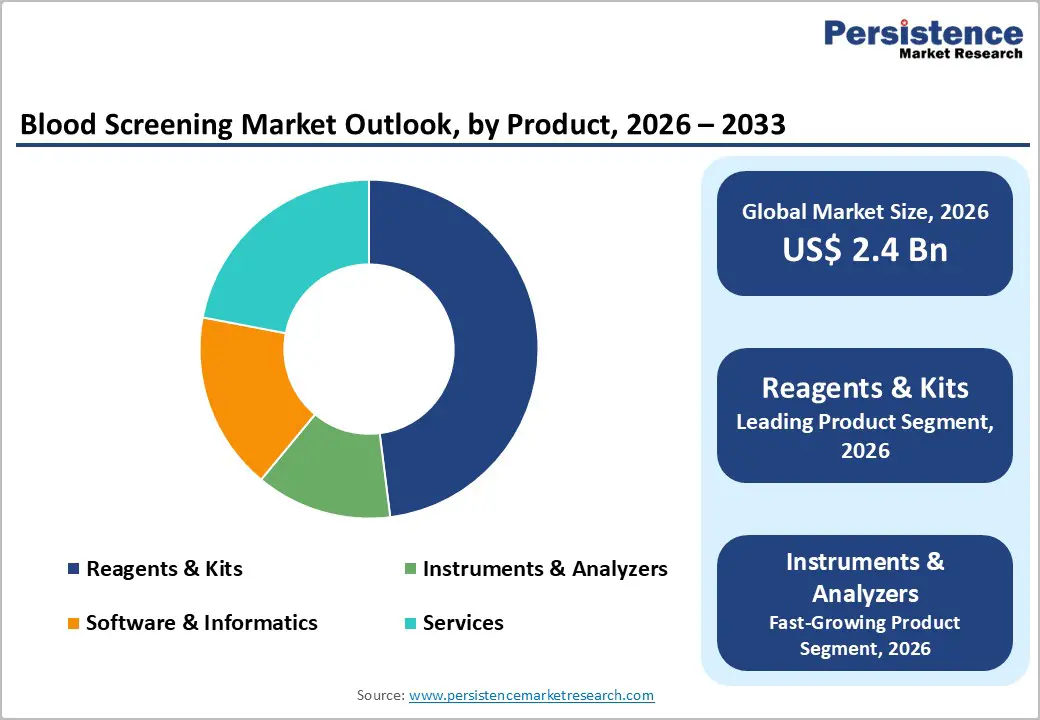

Rapid, portable screening platforms integrated with artificial intelligence offer a compelling growth opportunity, particularly in remote or resource-limited regions that lack centralized laboratories. Compact analyzers capable of delivering results within hours enable emergency transfusions, mobile blood drives, and disaster-response operations while maintaining safety standards. AI-driven algorithms improve pattern recognition, flag anomalous results, and optimize workflow scheduling, boosting laboratory productivity and reducing repeat testing. Rising regulatory acceptance of rapid molecular assays further accelerates adoption, especially across the Asia Pacific, where healthcare infrastructure expansion and high transfusion demand support premium growth rates. International health agencies increasingly promote decentralized testing to close equity gaps in care delivery between urban and rural areas. As machine-learning models mature and datasets expand, predictive analytics may enhance donor screening strategies and outbreak detection. These innovations position instruments and analyzers as the fastest-growing segment, opening new revenue streams for manufacturers through software subscriptions, cloud analytics, and integrated service contracts.

Government-led healthcare modernization programs across Asia-Pacific, Latin America, and parts of the Middle East are reshaping blood screening infrastructure and creating large-scale procurement opportunities. National transfusion networks increasingly mandate advanced assays, including NAT, to align with global safety benchmarks and reduce the risk of transfusion-transmitted infections. Public funding initiatives, insurance coverage expansion, and centralized tendering systems encourage hospitals and blood banks to upgrade legacy equipment. Simultaneously, local manufacturing incentives and technology-transfer partnerships lower production costs by 20-40%, making high-end systems more affordable and supporting rapid scale-up. Growing urban populations and rising surgical volumes further strengthen demand from public health services, the fastest-growing end-user group. As regulatory frameworks mature and domestic suppliers expand capabilities, emerging markets are expected to deliver double-digit growth, creating long-term opportunities for multinational and regional players across reagents, analyzers, and service portfolios alike.

Reagents and kits dominate the blood screening market because they are consumed with every donation, creating steady, repeat purchasing cycles for laboratories and blood banks. NAT, ELISA, and chemiluminescent immunoassay kits form the backbone of routine donor testing for major transfusion-transmitted infections such as HIV, hepatitis B and C, syphilis, and emerging pathogens. Regulatory mandates and national screening programs continually expand test menus, thereby increasing reagent volumes even as instrument installations plateau. Manufacturers are enhancing shelf stability, cold-chain resilience, and multi-analyte formats to reduce waste and simplify logistics in both high-throughput and remote settings. The growing adoption of multiplex panels, which screen for multiple pathogens from a single sample, further strengthens their value proposition for constrained laboratories. Combined with frequent batch turnover and strict quality-control requirements, these factors keep reagents and kits firmly positioned as the largest revenue-generating product category.

Blood banks and collection centers represent the largest end-user group because they serve as the primary gateway between donors and healthcare systems, conducting mandatory screening before any unit enters clinical use. Operating at national and regional scales, these facilities manage millions of donations annually and must comply with stringent regulatory and hemovigilance frameworks set by authorities such as the FDA and EMA. High daily sample volumes encourage centralized testing models, where automation and standardized protocols improve turnaround times and reduce error rates. Government funding programs and public-private partnerships often prioritize these hubs for technology upgrades, reinforcing their leadership in analyzer installations and reagent procurement. In addition, rising voluntary donation campaigns and disaster-preparedness initiatives continue to channel resources toward collection centers. Their central logistical role, combined with expanding safety requirements and data-tracking obligations, ensures sustained dominance within the blood screening ecosystem.

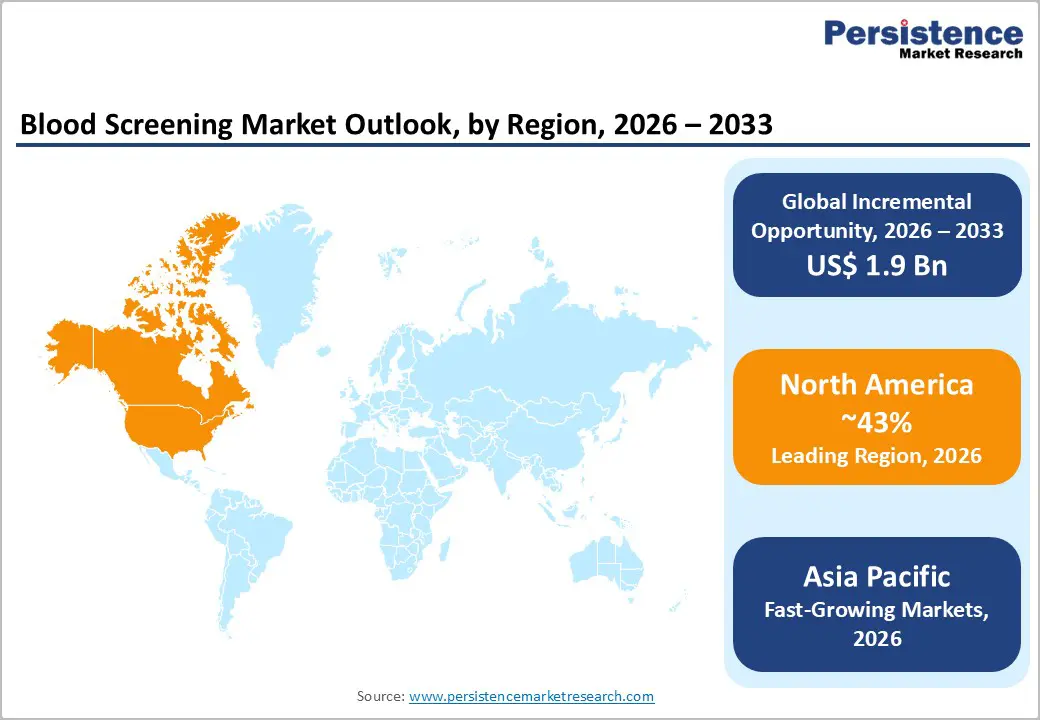

North America continues to dominate the global blood screening market due to its highly regulated transfusion ecosystem and early adoption of advanced diagnostic technologies. In the United States, mandatory nucleic acid testing for all donated blood drives consistent demand for high-throughput analyzers and premium reagent panels across centralized laboratories. Leading academic and reference laboratories invest heavily in automation, robotics, and multiplexing platforms to reduce turnaround times while maintaining stringent quality standards.

Strong reimbursement structures and public funding programs further facilitate the rapid adoption of next-generation assays and software-enabled workflows. Accreditation bodies such as the AABB reinforce safety requirements through continuous audits and evolving pathogen panels, encouraging regular system upgrades. In addition, high voluntary donation rates and well-established hemovigilance networks sustain testing volumes. Together, regulatory rigor, technological leadership, and financial capacity secure North America’s long-term leadership position in the global blood screening market.

Asia-Pacific is emerging as the fastest-growing region in blood screening, driven by rising healthcare investment, expanding donor pools, and government-led modernization of transfusion services. China’s centralized testing infrastructure and nationwide safety initiatives are rapidly scaling molecular screening capacity, while Japan continues to pioneer precision diagnostics and automated laboratory platforms. India’s national transfusion policies increasingly emphasize advanced pathogen detection methods, accelerating procurement across public hospitals and regional blood centers. Southeast Asian countries benefit from expanding domestic manufacturing bases that reduce system and reagent costs, thereby improving affordability for large-scale deployment.

Support from global health organizations strengthens workforce training and laboratory standardization across developing markets. Rapid urbanization, increasing surgical volumes, and persistent infectious disease burdens further increase testing demand. Collectively, these structural shifts position the Asia-Pacific region for sustained high-single- to double-digit growth over the coming decade.

The blood screening market features a highly competitive landscape dominated by multinational diagnostics leaders alongside specialized regional manufacturers. Major players focus on expanding NAT platforms, multiplex assay portfolios, and fully automated analyzers to secure long-term reagent contracts with national blood services and large hospital networks. Strategic collaborations with government agencies, centralized tender wins, and long-term service agreements are key revenue drivers. Companies increasingly invest in software integration, AI-enabled workflow tools, and aftermarket services to differentiate offerings and raise switching costs for customers.

The blood screening market is likely to be valued at US$ 2.4 billion globally.

Infectious diseases (HIV, HBV) and transfusion volumes as per World Health Organization.

North America (43% 2025 share) via U.S. FDA.

AI instruments for rapid testing is likely to propel more opportunities in the years ahead.

Abbott, Roche, BD, Grifols and others

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn/Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author