ID: PMRREP32460| 200 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

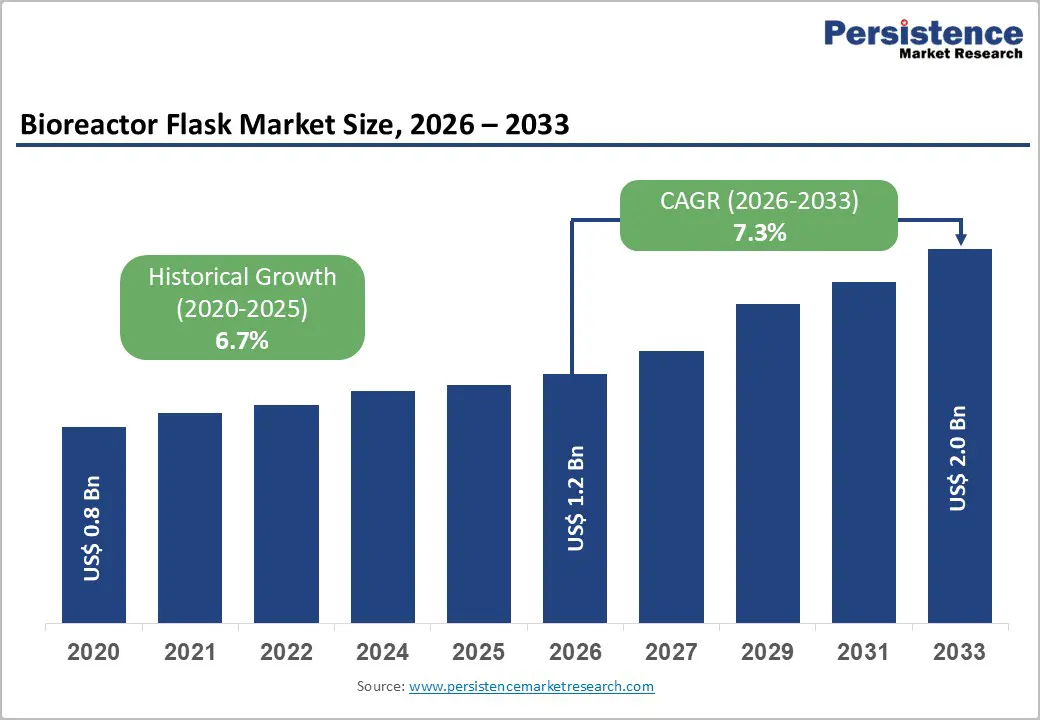

The global bioreactor flask market size is expected to be valued at US$ 1.2 billion in 2026 and projected to reach US$ 2.0 billion by 2033, growing at a CAGR of 7.3% between 2026 and 2033.

Bioreactor flasks are mainly used as tissue culture flasks designed to reduce culture maintenance and downstream processing requirements. The bioreactor flasks were implemented for testing the yield and antibody functionality as compared to existing antibody production methods.

The COVID-19 pandemic has resulted in a tremendous increase in the burden on research centers and other healthcare organizations worldwide. Due to the COVID-19 pandemic, the government announced country-wide lockdowns, social distancing measures and halt on the supply chain to prevent the collapse of their health systems that have projected a short-term negative impact on the global bioreactor flask market.

However, the increasing global need for novel coronavirus vaccines to control and suppress the spread of coronavirus infection has forced the researchers and leading manufacturers towards the cell culture-based research-study that surge the demand for the cell-cultured equipment that expects to boost the bioreactor flask market.

| Global Market Attributes | Key Insights |

|---|---|

| Bioreactor Flask Market Size (2026E) | US$ 1.2 Bn |

| Market Value Forecast (2033F) | US$ 2.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.3% |

| Historical Market Growth (CAGR 2020 to 2024) | 6.7% |

Driver – Surging biologics and cell based therapy pipelines

Rapid growth in biologics, vaccines, and advanced therapies is a primary catalyst for the bioreactor flask market. Global spending on cell, gene, and RNA based therapies alone is projected to rise from about US$ 10 billion in 2023 to US$ 33 billion by 2028, reflecting an expanding clinical pipeline and more commercial launches. Every biologic program relies on intensive upstream cell culture work, where shake flasks and T flasks are used extensively for seed trains, process optimization, and small batch production. Suppliers such as Corning and Thermo Fisher Scientific highlight that Erlenmeyer and spinner flasks are standard tools for high density suspension cultures, protein expression, and vaccine development. As pharmaceutical and biotechnology companies increase the number of parallel development programs and invest in high throughput screening, they purchase larger volumes of standardized, high quality bioreactor flasks, directly supporting market expansion.

Shift toward single use and closed culture systems

Another strong driver is the industry wide shift from traditional reusable glass or stainless steel vessels to single use plastic cultureware, which reduces cleaning, sterilization, and validation burdens. Single use bioreactors and associated flasks employ pre sterilized disposable bags or polymer vessels, enabling rapid changeover between batches and minimizing cross contamination risk critical for multi product facilities and cell therapy workflows. Biopharmaceutical manufacturers and contract development and manufacturing organizations increasingly favor these platforms to shorten time to market and maintain flexible capacity, particularly in smaller scale and clinical manufacturing. As single use technologies penetrate upstream processing from seed expansion through pilot scale runs the demand for compatible disposable bioreactor flasks, including baffled and vent cap designs ready for shaker or incubator integration, is rising steadily across all major regions.

Market Restraints- Environmental and sustainability concerns around disposables

The rapid adoption of disposable flasks raises concerns about plastic waste and environmental impact. Life cycle assessments show that while single use systems can reduce water and energy consumption compared with stainless steel cleaning, they generate significantly more solid waste and require specialized disposal streams. Regulators, institutional review boards, and corporate sustainability programs in Europe and North America increasingly scrutinize plastic usage and carbon footprints in laboratories and manufacturing plants. This pressure can slow the conversion from reusable glass to single use flasks in some facilities, and may drive demand for hybrid or recyclable solutions, thereby tempering the pace of volume growth for conventional disposable bioreactor flasks.

Cost and scalability trade offs for single use equipment

Although single use technologies simplify operations, they introduce recurring consumable costs and face scalability limitations. Analyses of disposable bioreactors indicate that while they are highly attractive for clinical and small scale commercial production, very large volume operations still favor stainless steel or hybrid systems because of long term cost efficiency. Repeated purchases of disposable flasks and bags also expose manufacturers to supply chain volatility and resin price fluctuations, as experienced during recent global disruptions. For price sensitive academic labs or emerging market manufacturers, higher per run costs of premium single use flasks can constrain budget allocation and slow broader adoption, especially when robust glassware infrastructure is already in place.

Market Opportunities- Growth in 350 ml and mid volume flasks for intensified processing

Intensified upstream processes and high cell density cultures are creating opportunities in mid volume flask formats such as 350 ml designs, which combine scalability with efficient gas transfer. Vendors like Thermo Fisher Scientific and Corning promote baffled Erlenmeyer flasks in the 250–500 ml range for seed expansion, small bioreactor mimic runs, and scale down modeling of stirred tank systems. As more manufacturers adopt perfusion and fed batch strategies, these mid volume flasks support higher working volumes without sacrificing mixing or oxygenation, making them ideal for process development and early clinical production. With biopharma pipelines shifting toward complex molecules and cell therapies that require precise process characterization, demand for versatile 350 ml single use flasks with integrated vent filters, optical clarity, and sensor compatibility is expected to outpace the broader market.

Digitalization, automation, and advanced materials in flask design

Automation and digitalization of cell culture workflows open further opportunities for differentiated bioreactor flask offerings. Robotics compatible flasks with standardized footprints, reinforced necks, and barcoding support automated liquid handling and high throughput screening platforms increasingly deployed in large pharmaceutical laboratories. At the same time, material innovations such as optimized growth surfaces, low binding polymers, or gas permeable membranes enable improved cell attachment, viability, and reproducibility, helping suppliers like Merck, Greiner Bio One, and CELLTREAT Scientific Products capture premium segments. Emerging approaches such as 3D printed culture components are being piloted to mitigate supply chain disruptions and customize flask geometries, pointing to new, value added product lines over the coming decade. Companies that integrate smart sensor ports, connectivity for process analytical technology, and sustainability oriented resins into their flasks can tap attractive, high margin niches within the market.

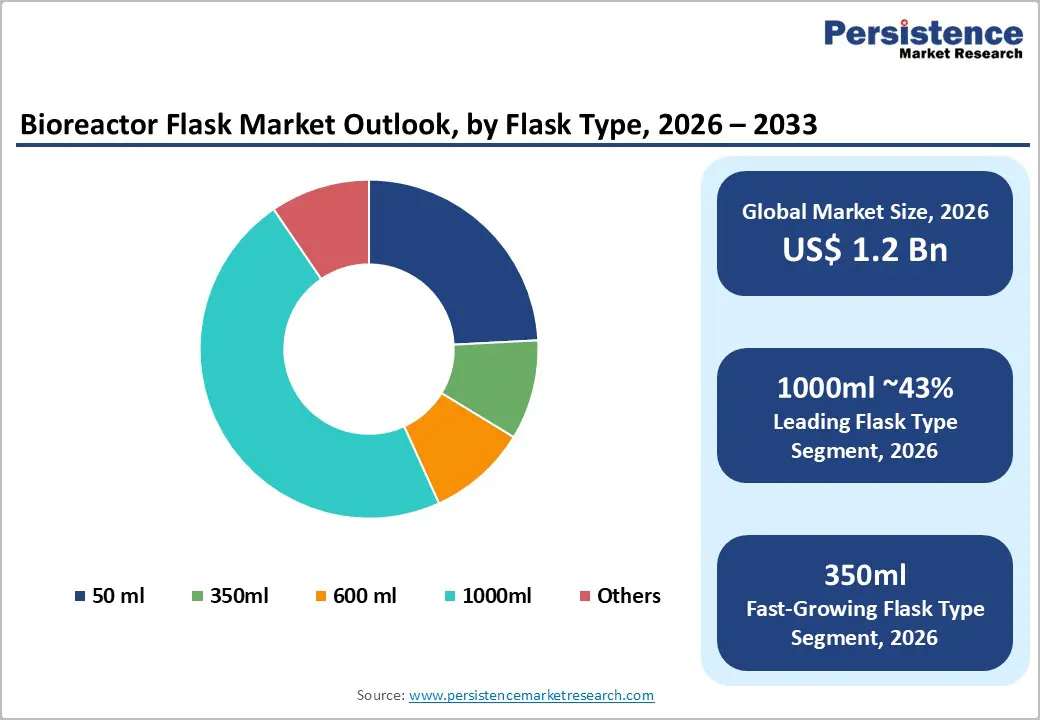

By Flask Type Analysis

Within flask types, 1000 ml bioreactor flasks are expected to be the leading segment, accounting for around 43% of market share in 2025. Large volume Erlenmeyer and spinner flasks in the 1 liter range are indispensable for seed train expansion, pilot scale production, and intensive protein expression runs, particularly in mammalian cell cultures. They provide sufficient working volume for meaningful yield while remaining compatible with standard orbital shakers and incubators, making them the default choice in many biopharmaceutical and vaccine development facilities. Suppliers emphasize design features such as baffles, wide necks, and advanced vent filters that enhance mixing and gas exchange, which are critical for high density cultures. As a result, 1000 ml flasks are widely used across pharmaceutical, biotechnology, and contract manufacturing organizations, underpinning their dominant contribution to overall bioreactor flask revenues.

By End-User Analysis

Among end users, pharmaceutical & biotechnology companies are projected to be the leading customer group, likely to account for more than 50% of global bioreactor flask consumption in 2025. These organizations conduct extensive cell culture work across discovery, process development, scale up, and commercial manufacturing of monoclonal antibodies, vaccines, recombinant proteins, and cell based therapies. Each pipeline program requires hundreds to thousands of flask based experiments for clone selection, media optimization, and stability assessment, creating recurring, high volume demand for standardized bioreactor flasks. Pharmaceutical and biotech firms also invest heavily in single use and robotics compatible cultureware to support high throughput screening and automated seed train management, reinforcing their position as the dominant revenue contributors compared with academic labs and smaller research institutions.

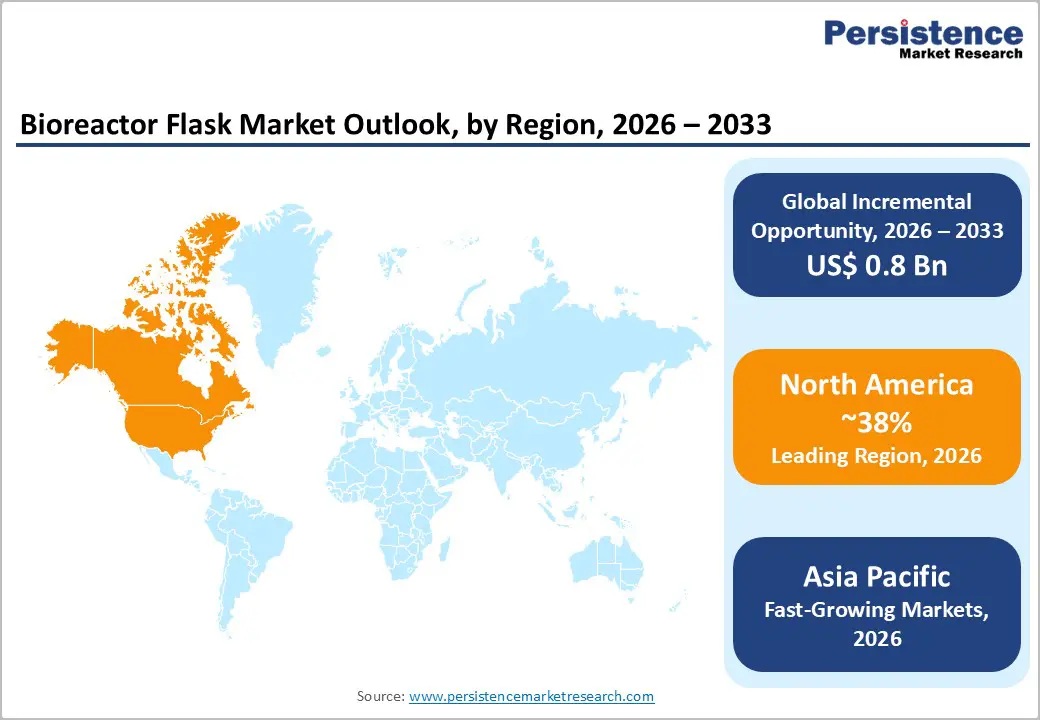

North America Bioreactor Flask Market Trends

North America is expected to remain the leading regional market, contributing around 38% of global bioreactor flask revenues in 2025, supported by a strong base of biopharmaceutical manufacturing and cutting edge life science research institutions. The U.S. hosts many of the world’s largest pharmaceutical and biotechnology companies, as well as a dense network of contract development and manufacturing organizations that rely on flasks for upstream process development and clinical scale production. Substantial R&D investment health industries in the EU alone invested about €261.4 billion in 2022, with the U.S. contributing a comparable, innovation heavy ecosystem sustains high utilization of cultureware, including bioreactor flasks.

Regulatory agencies such as the U.S. Food and Drug Administration (FDA) foster adoption of advanced bioprocessing technologies by clarifying expectations for single use systems and encouraging quality by design, which accelerates deployment of disposable and sensor enabled flasks in commercial facilities. Suppliers including Thermo Fisher Scientific, Corning, and Merck maintain major manufacturing, distribution, and technical support hubs in the region, ensuring rapid product availability and close collaboration on process optimization. Taken together, these factors underpin North America’s leadership in the global bioreactor flask market and its central role in driving product innovation.

Asia and Pacific Bioreactor Flask Market Trends

Asia Pacific is projected to be the fastest growing region in the bioreactor flask market, driven by rapid expansion of biopharmaceutical manufacturing capacity and clinical research activity in China, Japan, India, and leading ASEAN economies. Countries such as China and South Korea have implemented national strategies to build competitive biologics and vaccine industries, leading to new facilities that extensively use shake flasks in seed trains, process development, and technology transfer. Japan and Singapore host sophisticated bioprocessing hubs with strong adoption of single use systems and high end cell culture plastics from global brands including Thermo Fisher Scientific, Corning, and Merck.

Lower labor costs and supportive industrial policies make Asia Pacific an attractive destination for contract research and manufacturing, including biologics contract research organizations whose market is forecast to grow through 2033. These organizations rely heavily on standardized, disposable flasks to maintain flexibility and meet international quality standards in multi client projects. Academic and government research institutes across China and India are also investing in cell and gene therapy programs, further boosting demand for robust, affordable bioreactor flasks. As local suppliers emerge alongside multinational vendors, Asia Pacific is set to deliver the highest incremental volume growth for the global market.

The bioreactor flask market is moderately fragmented but features several prominent global players with strong brand recognition and broad distribution networks. Companies such as Thermo Fisher Scientific Inc., Corning, Merck, Sartorius AG, and Greiner Bio One offer comprehensive portfolios of cell culture flasks, shake flasks, and related accessories, competing on product quality, material science, and application specific design. At the same time, specialized suppliers including CELLTREAT Scientific Products, Crystalgen, Sorfa Life Science, Himedia Laboratories, and regional manufacturers in Asia provide cost competitive alternatives and customized solutions. Key strategic themes include expansion of single use offerings, integration of sensor and automation features, geographic expansion into high growth Asian markets, and sustainability oriented innovations such as recyclable plastics or hybrid reusable systems.

Key Industry Developments:

The global market is projected to be valued at US$ 1.2 Bn in 2026.

Increasing biopharmaceutical research, rising biologics production, expanding cell culture applications, growth in CROs, and investment in advanced laboratory infrastructure drive market demand.

The global market is poised to witness a CAGR of 7.3% between 2026 and 2033.

Development of scalable flask designs, integration with automation, expansion in emerging markets, demand from personalized medicine, and growth in stem cell and vaccine research.

Key companies include Thermo Fisher Scientific Inc., Corning, Merck & Co. Ltd., Sartorius AG, Greiner Bio-One, CELLTREAT Scientific Products, and Crystalgen.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn and Volume (if Available) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Flask Type

By Usage

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author