ID: PMRREP4083| 190 Pages | 13 Aug 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

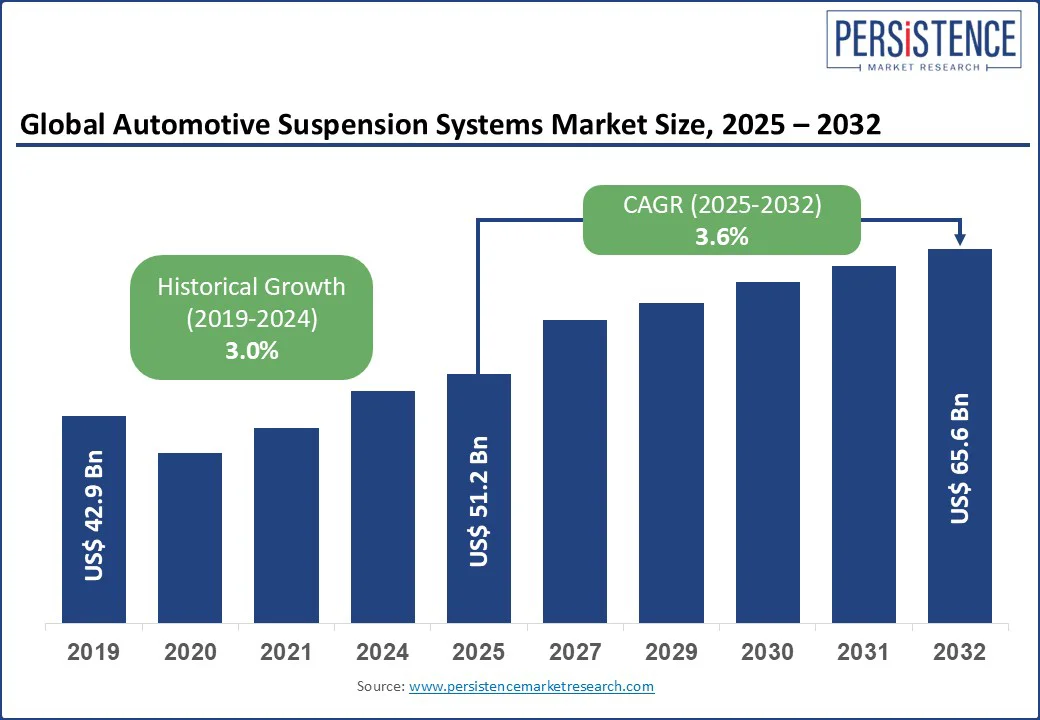

The global automotive suspension systems market size is likely to be valued at US$ 51.2 Bn in 2025 and is estimated to reach US$ 65.6 Bn by 2032, growing at a CAGR of 3.6% during the forecast period 2025 - 2032. The automotive suspension system market is driven by various factors such as consumer demand for luxury vehicle comfort systems and vehicle dynamics, and handling drives market growth. Stringent safety regulations, such as Euro NCAP and NHTSA standards, drive the adoption of active systems and semi-active suspension systems. Innovations in automotive chassis systems and air suspension market trends enhance performance.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Automotive Suspension Systems Market Size (2025E) |

US$ 51.2 Bn |

|

Market Value Forecast (2032F) |

US$ 65.6 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.0% |

The rising demand for adaptive suspension systems in electric vehicles is a primary driver of the Automotive Suspension Systems Market. The global electric vehicle (EV) market surged by 40% in 2024, according to BloombergNEF, with Tesla, BYD, and Volkswagen leading production. EVs require advanced vehicle suspension systems to manage their unique weight distribution, driven by heavy battery packs, and to enhance vehicle dynamics and handling. Adaptive suspension systems, such as semi-active systems and air suspension, improve ride comfort and stability, critical for consumer acceptance of EVs. The automotive OEMs are investing heavily, with US$ 200 billion allocated to EV development by 2025, per McKinsey, driving the adoption of car suspension innovations. This trend is particularly strong in developed markets such as the U.S. and Europe, where 30% of new vehicle sales in 2024 were EVs, per IEA, further propelling the market for automotive chassis systems and suspension parts.

High production costs pose a significant restraint to the Automotive Suspension Systems Market, particularly for advanced active system and semi-active system suspensions. These systems, which incorporate shock absorbers, struts, and springs, and air compressors, require sophisticated technologies such as electronic control units and sensors, increasing manufacturing expenses by 20-25% compared to passive systems, according to a 2024 industry report. For example, multi-chamber air spring systems used in luxury vehicles and the growth in multi-link suspension systems for SUVs rely on premium materials such as aluminum and composites, further escalating costs.

The development of lightweight suspension components presents a significant opportunity for the Automotive Suspension Systems Market, aligning with global trends toward fuel efficiency and sustainability. The use of advanced materials such as carbon fiber, aluminum, and high-strength composites in suspension parts such as control arms, ball joints, and struts reduces vehicle weight by 15%, per a 2024 industry report, improving fuel economy and EV range. This is critical as regulations such as the EU’s CO2 emission targets, requiring 95 g/km by 2025, push automotive OEMs to adopt automotive chassis systems that enhance efficiency. Lightweight suspension components are particularly valuable in the rising demand for adaptive suspension systems in electric vehicles, where weight reduction extends battery life by 10%, per a 2024 study. For instance, BMW incorporated aluminum shock dampeners in its iX model, boosting vehicle dynamics and handling. The independent vs dependent suspension systems in vehicles also benefit, with lightweight designs enhancing multi-link suspension systems for SUVs.

Passive System holds approximately 50% of the market share in 2025 due to its cost-effectiveness and widespread use in passenger cars. MacPherson strut suspension dominates, with 60% of passenger cars equipped in 2024, per industry data. Semi-active System is driven by its adaptability in luxury vehicle comfort systems and vehicle dynamics and handling, with 20% adoption in premium vehicles in 2024.

Shock Dampener commands a 35% market share in 2025, essential for automotive ride systems and struts and springs. Its durability drives adoption in passenger cars and SUVs. Air Compressors is fueled by air suspension market trends and multi-chamber air spring systems in luxury vehicles, with 15% growth in 2024.

Hydraulic Suspension holds a 45% market share in 2025, favored for its reliability in passenger cars and independent vs dependent suspension systems in vehicles, with 50% adoption in 2025. Air Suspension is driven by multi-chamber air spring systems in luxury vehicles and SUVs, with a 20% growth in 2025.

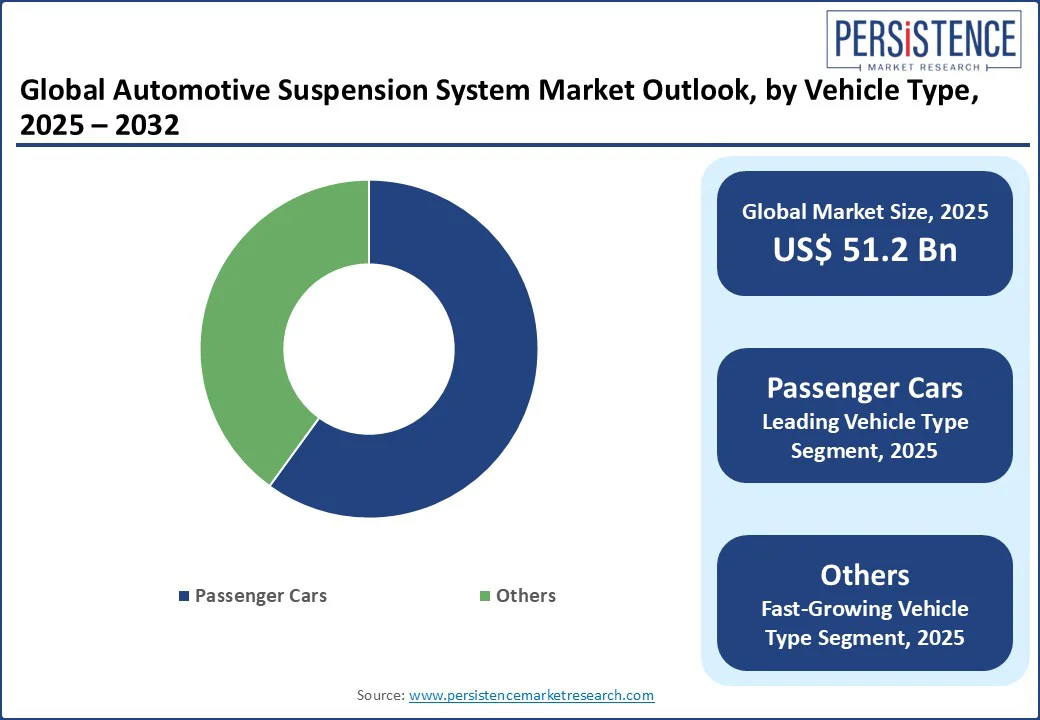

Passenger Cars account for 60% of the market share in 2025, driven by MacPherson strut suspension and luxury vehicle comfort systems, with 85 million vehicles produced globally in 2024, per OICA. Others (including SUVs and commercial vehicles) are fueled by growth in multi-link suspension systems for SUVs and air suspension adoption.

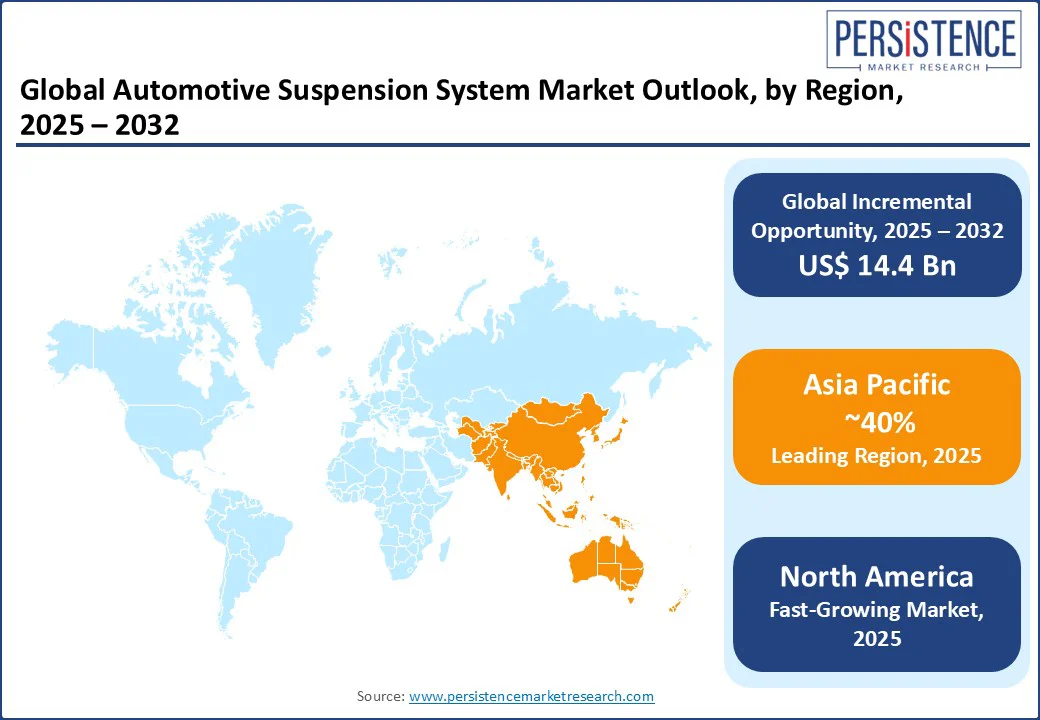

In North America, the Automotive Suspension Systems Market holds a distinct position, commanding a 18% market share in 2025. The U.S. dominates due to its robust automotive industry and consumer preference for luxury vehicle comfort systems. The U.S. market grows at a CAGR of 4.0%, driven by rising demand for adaptive suspension systems in electric vehicles, with 40% of EVs equipped with semi-active systems in 2024, per industry data. MacPherson strut suspension dominates passenger cars, with 65% adoption, per NHTSA. The growth in multi-link suspension systems for SUVs supports 20% market growth in the SUV segment. Lightweight suspension components and shock absorbers are key, with Tesla and Ford leading EV suspension innovations. Automotive OEMs such as General Motors contribute 25% of regional revenue, per a 2024 report, supported by advanced manufacturing.

In Europe, the Automotive Suspension Systems Market accounts for a 20% share, led by Germany, the UK, and France. Germany’s market driven by suspension technology for automobiles from BMW and Mercedes-Benz, with 50% of luxury vehicles using air suspension. The EU’s emission regulations boost lightweight suspension components, with 15% weight reduction in 2024, per industry data. The UK’s focus on vehicle dynamics and handling supports Jaguar Land Rover in adopting multi-chamber air spring systems. France’s demand for passenger cars drives MacPherson strut suspension, with 20% growth in 2024. Automotive OEMs invest €300 million in suspension R&D, per a 2024 report, enhancing automotive ride systems.

Asia Pacific is the most prominently growing region, holds 40% market share, led by China, Japan, and India. China, driven by a 30% increase in vehicle production in 2024, per OICA, is boosting car suspension and suspension parts. Japan’s market is fueled by growth in multi-link suspension systems for SUVs, with Toyota and Honda integrating active systems. India’s market is driven by passenger car sales and hydraulic suspension, with 90% of new vehicles equipped in 2024, per government data. The rising demand for adaptive suspension systems in electric vehicles and lightweight suspension components drives innovation, supported by US$50 Bn in automotive investments by 2030.

The global automotive suspension systems market is marked by fierce competition, with automotive OEMs and suppliers competing on innovation, cost-efficiency, and sustainability. ZF Friedrichshafen AG and Continental AG dominate in developed markets through suspension technology for automobiles, while Gabriel India and BWI Group lead in emerging markets with cost-effective solutions. Independent vs dependent suspension systems in vehicles, multi-chamber air spring systems, and lightweight suspension components add a competitive layer. Strategic partnerships and R&D investments are key differentiators.

The automotive suspension system market is projected to reach US$ 51.2 Bn in 2025, driven by vehicle suspension and luxury vehicle comfort systems.

Demand for vehicle dynamics and handling, rising demand for adaptive suspension systems in electric vehicles, and safety regulations are key drivers.

The automotive suspension system market grows at a CAGR of 3.6% from 2025 to 2032, reaching US$65.6 Bn by 2032.

Opportunities include adaptive suspension systems for EVs, lightweight suspension components, and emerging market expansion.

Key players include ZF Friedrichshafen AG, Continental AG, Tenneco Inc., KYB Corporation, Thyssenkrupp AG, Hitachi Astemo Ltd., BWI Group, Marelli Corporation, Benteler, Gabriel India, and Hendrickson.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Units |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By System

By Component

By Suspension Type

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author