ID: PMRREP31946| 195 Pages | 25 Jul 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

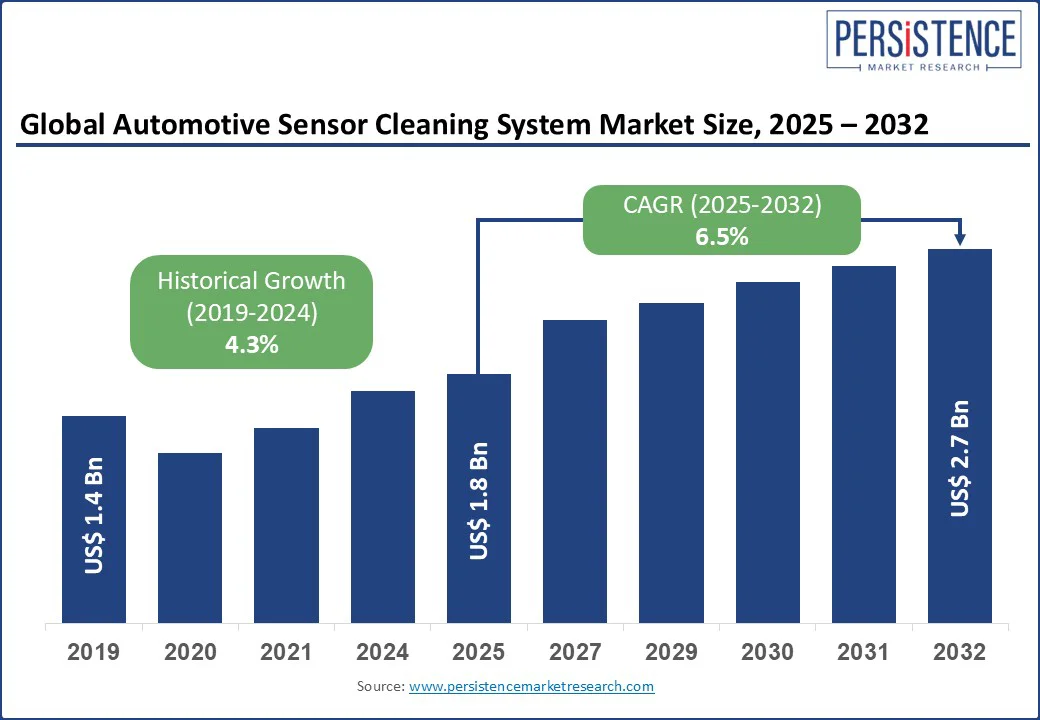

The global automotive sensor cleaning system market size is likely to be valued at US$ 1.8 Bn in 2025 and is estimated to reach US$ 2.7 Bn in 2032, growing at a CAGR of 6.5% during the forecast period 2025 - 2032. The automotive sensor cleaning system market growth is driven by the rising integration of ADAS and autonomous systems across passenger and commercial vehicles. With global car production reaching 75.5 million units in 2024 and sales expanding to 74.6 million units, the need for advanced sensor maintenance technologies, such as automotive sensor cleaners, has intensified. China, with over 35% of the world’s production and 31% of global car sales, continues to lead the demand for these cleaning systems, especially for LiDARs, radars, and cameras used in smart mobility.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

| Market Size (2024A) | US$ 1.4 Bn |

| Estimated Market Size (2025E) | US$ 1.8 Bn |

| Projected Market Value (2032F) | US$ 2.7 Bn |

| Value CAGR (2025 to 2032) | 6.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.3% |

The global automotive industry is undergoing a structural shift toward automation, with the adoption of Advanced Driver-Assistance Systems (ADAS) and semi-autonomous driving features becoming central to OEM design strategies. This evolution is increasing sensor density across vehicle platforms, particularly for radar, LiDAR, and camera units.

In this high-sensor environment, ensuring uninterrupted sensor performance is critical, creating a strong demand for automotive sensor cleaning systems that can operate consistently across weather and terrain conditions. As ADAS becomes standard in both passenger and commercial vehicles, sensor cleaning is no longer optional but a core safety and operational requirement.

Key automotive suppliers such as Vitesco Technologies are already responding with integrated solutions such as the Advanced Sensor Cleaning System (ASCS), which uses a single high-pressure pump to clean multiple sensors simultaneously. Demonstrated at IAA Germany with Schaeffler, this technology highlights the growing priority of sensor maintenance. Major OEMs, including Hyundai, BYD, and Volvo, are expanding these solutions as they accelerate EVs and semi-autonomous rollouts.

Automotive sensor cleaning systems face significant integration barriers each OEM platform uses unique vehicle structures, sensor layouts, and environmental standards. Suppliers must design tailored systems for LiDAR, radar, and camera cleaning, as a one-size-fits-all solution does not work. These platform-specific engineering requirements raise development costs and slow down adoption, especially for ADAS and autonomous driving programs that need consistency across multiple regions.

Companies also face extensive validation cycles to meet performance standards across global climates. Even advanced solutions such as Kautex Textron’s Allegro Premium platform had to undergo rigorous testing. In September 2023, Kautex launched a dynamic simulation bench to replicate real-world conditions, handling wind speeds up to 140 km/h and temperature swings between -20°C and +50°C. While this improves precision for different markets, it demands heavy R&D investments and extends production timelines for OEM deployment.

The challenge increases in compact electric vehicles and sensor-dense environments, where available space is highly restricted. Manufacturers must miniaturize and redesign cleaning systems while still meeting durability and visibility standards. These repeated redesigns and testing stages increase costs and delay mass-market adoption.

Collaborations between OEMs and Tier-1 suppliers are creating strong momentum for scalable, localized sensor cleaning technologies. With a rising focus on regional supply chain resilience, manufacturers such as Hyundai are designing in-house platforms, including the Rotator-Cam, featuring real-time dirt detection and AI-based washer integration tailored to both premium and mass-market models.

These innovations not only ensure system compatibility across vehicle types but also reduce reliance on imports by enabling localized manufacturing of critical components such as nozzles and wipers. Start-ups and mid-sized tech players have a key role in these developments. Actasys’ partnership with Volvo Cars and Webasto supports sensor cleaning integration in roof modules for premium vehicles, targeting use cases in weather-volatile regions such as Europe and North America.

Cebi Luxembourg’s modular washer systems, designed for multi-sensor flexibility, are also gaining OEM traction for global deployment. As ADAS regulations tighten across the U.S., South Korea, and European Union markets, the need for region-specific, modular solutions continues to expand, creating tangible growth opportunities for both large players and emerging innovators.

The market is moving rapidly toward predictive, intelligent sensor cleaning solutions designed for precision, minimal fluid consumption, and seamless software integration. Automakers and Tier-1 suppliers are phasing out traditional washer-based systems and adopting smart cleaning platforms that can self-regulate based on external conditions. Kautex Textron’s AI-driven system adjusts fluid pressure and spray angles using real-time environmental inputs, ensuring efficient performance with minimal resource use, key for EVs and autonomous fleets.

Hyundai’s patent-pending Rotator-Cam and dlhBOWLES’ Cler™ system, co-developed with RAPA Group, further showcase this shift, offering intelligent fluid delivery through solenoid-based air-water combinations that reduce waste and maintenance needs.

Kongsberg Automotive’s recent acquisition of advanced cleaning patents reflects growing interest in software-integrated cleaning modules. As OEMs align with evolving vehicle software stacks, predictive sensor cleaning becomes a critical enabler of autonomy, efficiency, and sustainability, marking a clear market trend toward embedded intelligence in vehicle hygiene systems.

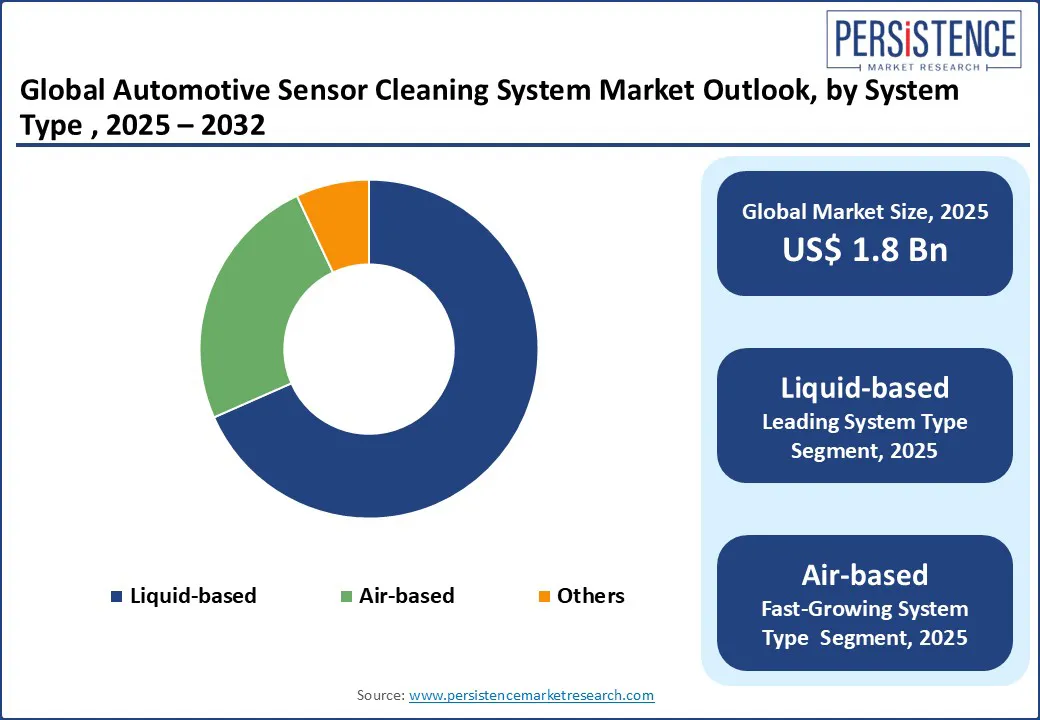

Liquid-based system type holds a market share of around 68% in 2025, driven by its established reliability and superior cleaning efficiency for camera, LiDAR, and radar sensors. As vehicles increasingly depend on vision-based ADAS features, automakers are prioritizing solutions that maintain consistent sensor performance in real-world driving conditions such as mud splashes, road salt, rain, and snow.

The ability of liquid-based systems to integrate with existing windshield washer infrastructure also makes them highly adaptable across both passenger and commercial vehicle segments. Their structural simplicity, proven cleaning capability, and compatibility with existing fluid systems make liquid-based cleaning solutions the preferred choice for OEMs looking to embed ADAS and safety systems without altering core vehicle architecture. As electrification and autonomous driving continue to scale, the demand for sensor uptime and modular cleaning functionality is intensifying.

Liquid-based systems are positioned to remain the dominant technology, driven by their scalability, ease of integration, and suitability for global deployment across mid- and high-end vehicles.

OEMs are projected to hold the market share of around 85% in 2025, driven by the increasing demand for factory-integrated ADAS features and the industry's shift toward smarter, safety-focused vehicle platforms.

Automakers are embedding sensor cleaning systems as a standard component during production to ensure optimal performance of LiDAR, radar, and camera-based systems. As regulatory bodies push for higher safety compliance, OEMs are prioritizing the seamless integration of cleaning systems that work in sync with in-vehicle sensors, enhancing reliability in real-world driving conditions.

This dominance also reflects how OEMs are aligning with evolving mobility trends. As electric and autonomous vehicle adoption rises, manufacturers are expanding globally with platforms designed to support advanced sensor infrastructure. Tier-1 suppliers working directly with OEMs are developing modular, scalable cleaning systems tailored to these next-gen vehicles. As OEMs can ensure system compatibility and offer end-to-end integration from the design stage, they continue to lead the adoption curve, keeping their channel at the forefront of market growth through the forecast period.

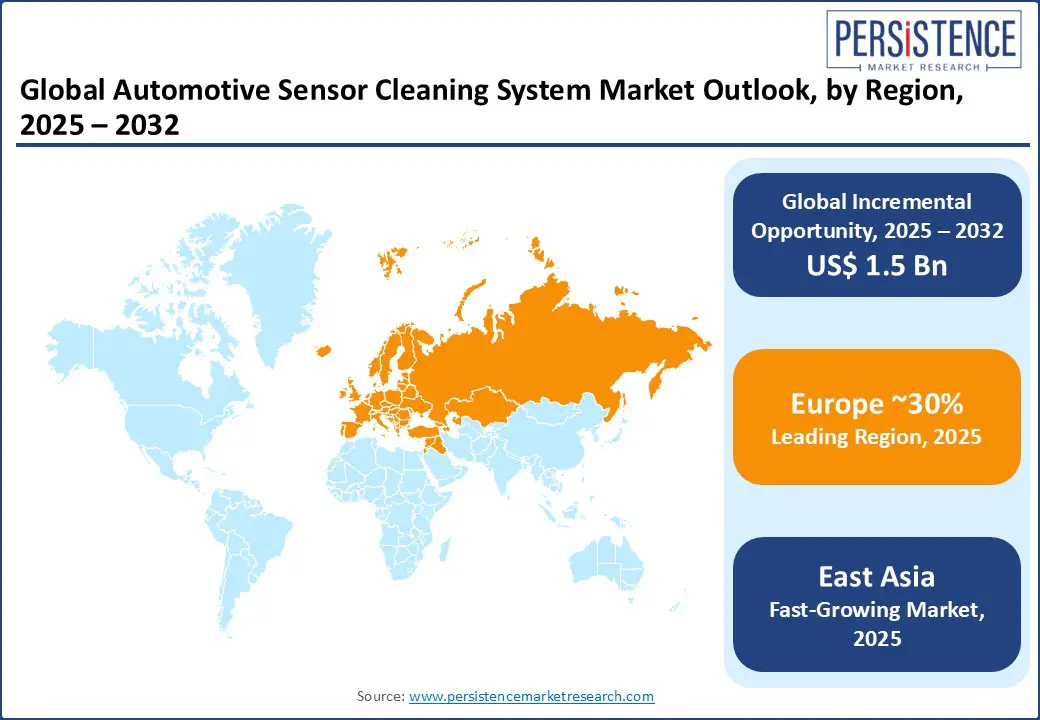

Europe holds the market share of around 30% in 2025, driven by strong regulatory frameworks, rising vehicle sophistication, and growing adoption of ADAS technologies. The region recorded 16.1 million new car registrations, reflecting a steady 3.9% annual growth, with key markets including the UK showing positive momentum. While overall car production dipped by 4.6%, the market shift toward smarter, sensor-heavy vehicles continues.

German and French automakers, known for high-tech integration, are accelerating the inclusion of sensor cleaning systems to support lane-keeping, adaptive cruise control, and automated emergency braking features that demand consistent sensor visibility under real-world driving conditions.

On the commercial front, rising van and bus sales across the EU have kept the fleet sector vibrant. Electrically chargeable bus registrations surged by nearly 27%, underlining the region’s tilt toward electric mobility and urban automation. These electric fleets rely heavily on clear sensor visibility to ensure smooth operations in dense city environments. Spain, Italy, and France recorded notable growth in new bus and van volumes, reinforcing Europe's status as a technology-forward automotive hub. As sensor density per vehicle increases and clean sensor functionality becomes essential, Europe is set to maintain its lead through the forecast period.

North America holds a market share of around 25% in 2025, driven by a strong base of ADAS-enabled vehicle sales and rising integration of sensor-dependent safety systems. Despite a 3.2% drop in vehicle production, the region's passenger car registrations remained resilient, growing by 3.8% with the U.S. contributing 12.7 million units.

Automakers continued to equip vehicles with high-precision sensors to support features such as adaptive cruise control and collision avoidance. This push, alongside seasonal extremes such as snow, ice, and dust, makes the adoption of sensor cleaning systems not just a premium add-on but a critical functionality for vehicle safety and reliability.

On the commercial side, North America led the global market with 4 million new vehicle registrations in 2024, representing 30% of the global commercial vehicle market. The region’s continued reliance on large trucks and delivery fleets, especially in e-commerce and logistics, is driving demand for robust sensor maintenance systems to ensure operational uptime. Although the bus segment saw a slight 4% dip, fleet operators are focusing more on vehicle uptime and ADAS reliability in high-traffic urban zones.

As regulatory focus tightens around vehicle safety tech and OEMs increase ADAS penetration across all segments, North America is set to remain one of the most lucrative markets for sensor cleaning systems through the forecast period.

The global automotive sensor cleaning system market exhibits a consolidated structure, with a few key players dominating through deep technological capabilities, strategic partnerships, and a strong presence in advanced driver-assistance and autonomous vehicle ecosystems.

Companies such as Vitesco Technologies, Kautex Textron, Cebi Group, and Röchling Group are leading the innovation race with modular, scalable systems that cater to both passenger and commercial vehicle segments. Their solutions are increasingly integrated into OEM vehicle platforms, driven by rising ADAS deployment and automation levels.

As demand for sensor clarity grows across electric, autonomous, and connected vehicles, companies such as Actasys Technologies, Ficosa, and Valeo are intensifying R&D, targeting performance in diverse climates and real-world conditions.

The market is expected to become more competitive yet remain largely consolidated due to high entry barriers related to proprietary technologies and integration with vehicle electronics. With OEM demand shifting toward energy-efficient, intelligent cleaning systems, top players are poised to expand through cross-sector collaborations and sensor-specific innovations.

The automotive sensor cleaning system market is projected to be valued at US$ 1.8 Bn in 2025.

Liquid-based systems are expected to hold approximately 68% market share in 2025, driven by their reliability, compatibility, and effectiveness in maintaining sensor clarity across diverse conditions.

The automotive sensor cleaning system market is poised to witness a CAGR of 8.7% from 2025 to 2032.

Growth is primarily fueled by rising ADAS adoption and autonomous integration, with OEMs embedding advanced sensors that require consistent visibility for safety and performance.

Key opportunities lie in strategic collaborations and localization, enabling scalable, modular sensor cleaning technologies tailored for regional and platform-specific deployment.

Prominent players in the automotive sensor cleaning system market include Vitesco Technologies GmbH, Kautex Textron GmbH & Co. KG, Röchling Group, RAPA Gruppe, Cebi Group, Mettler Toledo, Ficosa, and Actasys Technologies.

| Report Attribute | Details |

| Forecast Period | 2025 to 2032 |

| Historical Data Available for | 2019 to 2024 |

| Market Analysis | USD Bn |

| Key Regions Covered |

|

| Segmental Coverage |

|

| Competitive Landscape |

|

| Report Highlights |

|

| Customization and Pricing | Available on Report |

By System Type

By Sales Channel

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author