ID: PMRREP35567| 197 Pages | 18 Aug 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

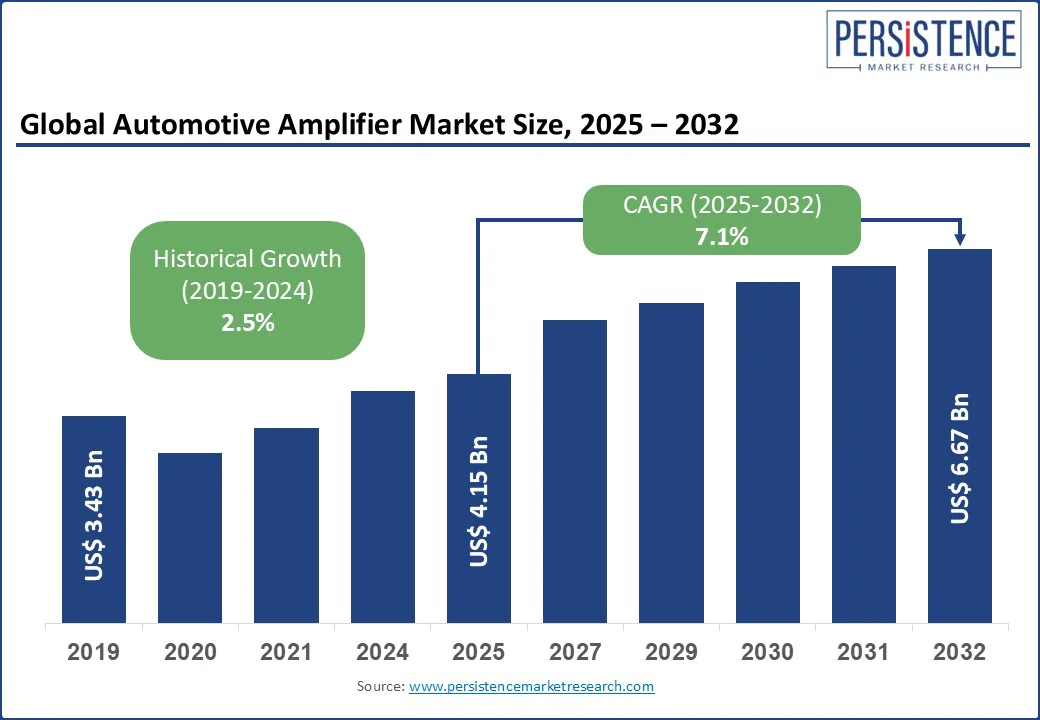

The global automotive amplifier market size is likely to be valued at US$ 4.15 billion in 2025, and is estimated to reach US$ 6.67 billion by 2032, growing at a CAGR of 7.1% during the forecast period 2025 to 2032.

Automotive amplifiers are one of the essential components that enhance in-vehicle sound quality by boosting audio signals while maintaining clarity and efficiency. With the rising demand for premium infotainment systems, EV-compatible amplifier ICs, and compact Class D technologies, these devices are becoming integral to vehicle architectures for original equipment manufacturers (OEMs) and aftermarket channels.

Innovations in Class D amplifiers powered by digital signal processors (DSPs), rapid EV integration, and high-output systems for luxury vehicles are taking the market to new heights. The miniaturization of monolithic amplifier integrated circuits (ICs), a notable rise in demand for multi-channel configurations, and a strong aftermarket growth in Asia Pacific and Latin America are further stimulating the automotive amplifier market growth. The expansion of smart infotainment and ANC offerings by OEMs is creating endless possibilities in vehicle-specific amplifier modules, IoT-compatible audio systems, and direct-to-consumer amplifier upgrades.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Automotive Amplifier Market Size (2025E) |

US$ 4.15 Bn |

|

Market Value Forecast (2032F) |

US$ 6.67 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

2.5% |

The increasing electrification of vehicles has triggered a perceptible shift toward compact, energy-efficient Class D automotive amplifiers that are optimized for the constrained architectures of EVs. Electric vehicle manufacturers are constantly pressured to design their products within tighter thermal, spatial, and battery efficiency limits. As a result, OEMs are increasingly phasing out legacy Class A/B systems in favor of high-efficiency Class D amplifier ICs that offer up to 90% power efficiency and generate minimal heat.

While boosting the demand for automotive amplifier modules among OEMs, this trend is also influencing aftermarket upgrades in EVs. With vehicle infotainment, active noise cancellation, and digital cockpit systems becoming central to delivering an elevated experience to EV users, Class D amplifiers have occupied a foundational place in the EV industry.

Two major constraints holding back the progress of the automotive amplifier market are the exorbitant costs of these advanced audio systems and the difficulties associated with integrating them into vehicle architectures. Notwithstanding their essentiality for next-gen in-vehicle infotainment and premium audio experiences, these technologies can bloat production costs by anywhere in the range of US$ 500 to US$ 1,500.

At these prices, such amplifiers automatically become less viable for economy and mid-segment vehicles in cost-sensitive markets. Compounding this challenge are the hindrances facing aftermarket adoption of automotive amplifier systems due to technical issues related to compatibility with factory electronics, risk of warranty voids, and the need for specialized installers. This dual pressure has inhibited the expected scale of uptake of high-performance car audio amplifiers, despite growing consumer demand for immersive, DSP-powered vehicle audio solutions.

The rising adoption of electric vehicles and the incorporation of advanced driver-assistance systems (ADAS) is heightening the need for compact, high-efficiency Class D amplifiers and DSP-powered audio modules. EVs require low-power, thermally efficient amplifier solutions to support advanced infotainment, voice interaction, and ANC features, driving OEMs to adopt integrated, multichannel amplifier ICs with built-in diagnostics and digital signal processing.

On the aftermarket side, EV users are fueling the demand for premium car amplifier upgrades, particularly in the 500 - 1000 W range, to enhance in-cabin audio richness in the absence of engine noise. In the backdrop of these changes, manufacturers can open up new revenue streams by focusing on the development of EV-specific amplifier modules, multi-channel DSP amplifier systems, and aftermarket-ready car audio upgrades, offering substantial value to consumers and capturing a larger market share in the process.

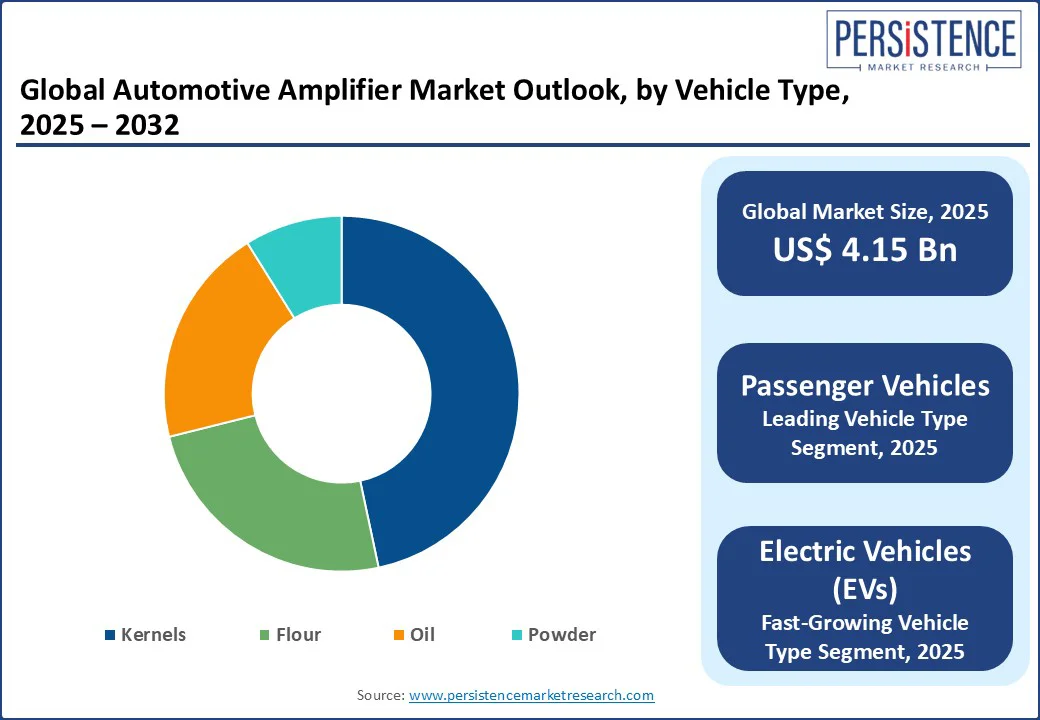

Passenger vehicles are anticipated to remain the largest revenue contributor in the automotive amplifier market on account of the already widespread integration of in-car entertainment systems, multichannel audio setups, and voice-assisted infotainment units in sedans, hatchbacks, and sports utility vehicles (SUVs). OEMs actively favor compact Class D automotive amplifiers and digital signal processor-powered modules for factory-installed sound systems in mid- to high-end passenger vehicles. The trend is highly evident in the high-volume production markets such as China, India, and Southeast Asia.

Electric vehicles, on the other hand, are projected to register a positive CAGR between 2025 and 2032 in the automotive amplifier industry, as EVs have niche requirements for lightweight, energy-efficient audio systems. Global EV adoption has accelerated beyond comparison in the last few years and is expected to continue its run in 2025, in China, the U.S., and Europe.

The Electric Vehicles Outlook (EVO) by BloombergNEF predicts that global passenger EV sales is likely to hit 22 million in 2025, jumping by 25% from 2024, with China leading the pack, followed by Europe and the U.S. In response, automakers are equipping battery-powered models with smart audio amplifier ICs that support advanced noise cancellation, digital cockpit interfaces, and personalized acoustic zones. The lack of engine noise in EVs creates a void that can then be filled with richer in-cabin audio quality, spurring the adoption of high-efficiency Class D car amplifiers with integrated diagnostics.

Class D amplifiers are set to dominate the amplifier type segment, capturing over 65% of the revenue share due to their superior power efficiency, compact size, and thermal performance. With the automotive sector giving higher priority to space-saving and energy-efficient audio solutions, Class D amplifier ICs are becoming standard in both premium and economy vehicles. What sets this class of automotive amplifiers apart from its peers is their ability to deliver high-fidelity sound with minimal power loss, making them a preferred choice among OEMs, particularly for factory-installed infotainment systems and EVs. Reinforcing this transition is the incorporation of smart Class D chipsets with diagnostic and thermal management features by major automakers, injecting vibrancy in the car amplifier landscape.

Class D automotive amplifiers are also poised to be the fastest-growing sub-segment through 2032, exhibiting a 9.1% CAGR, with their growth rooted in the central role they play in ADAS, digital cockpits, and EV audio platforms. These are applications where high-efficiency, low-heat amplifier designs are fundamental. Automotive electronics platforms are becoming more software-defined and modular, building a foundation of Class D amplifiers as they offer the scalability and efficiency automakers require to stay competitive.

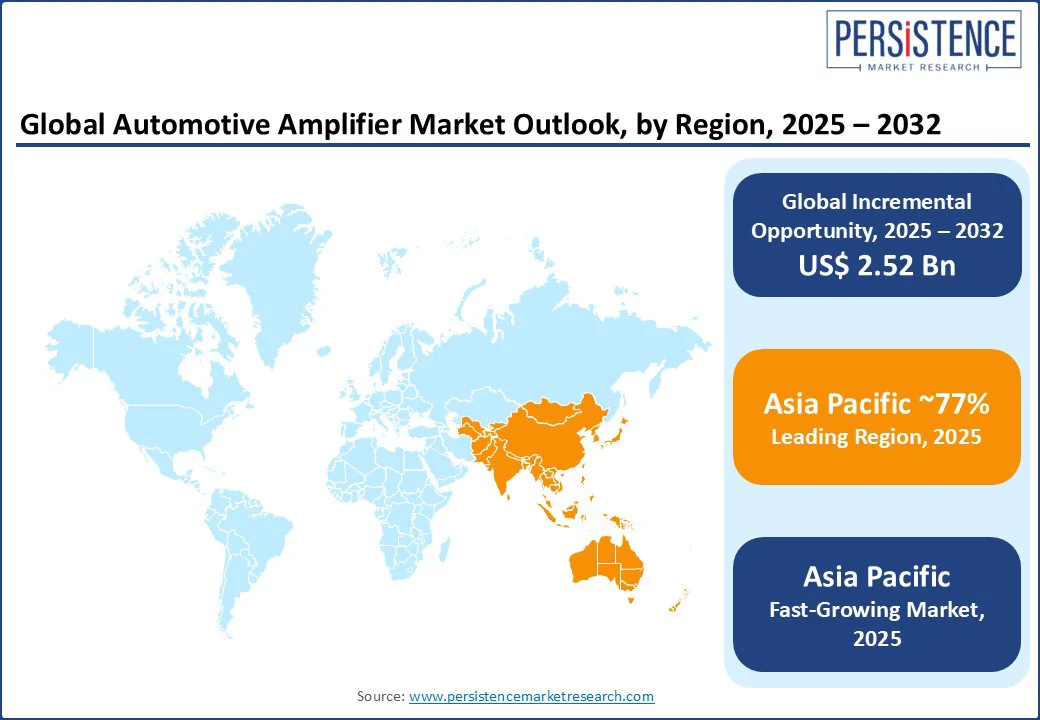

Asia Pacific is poised to command an astounding 77% of the automotive amplifier market share in 2025, and the region is also set to register the highest CAGR through 2032. The prominent position of the Asia Pacific is predominantly a result of the overwhelming leadership of China in electric vehicle production, which in turn is stoking the demand for in-vehicle entertainment and noise control systems.

OEMs are responding by increasingly embedding energy-efficient Class D amplifier chips, digital signal processors, and active noise cancellation modules into mainstream EVs to deliver premium acoustic experiences without compromising power efficiency. In India and Thailand, the thriving aftermarket is boosting sales of multi-channel car audio amplifiers, driving the regional amplifier market expansion at both OEM and consumer levels.

North America is anticipated to hold approximately 15% of the market share in 2025, supported by an increasing adoption of connected infotainment systems, digital dashboards, and in-vehicle audio upgrades across premium vehicle lines.

Although the deployment of advanced amplifier systems is seemingly more concentrated in luxury and mid-range passenger vehicles, OEMs in the region are observing a steady yet rising demand for aftermarket car audio amplifiers with built-in diagnostics and intelligent tuning. Broadly, the market for automotive amplifiers in North America is benefiting from the strong focus of automakers on vehicle personalization and sound quality, brightening market prospects in the region.

In Europe, a budding culture of sustainable mobility, strengthened by the low-emission mandates of the European Union (EU), is boosting EV adoption across the continent. The IEA’s Global EV Outlook 2025 revealed that the EU is the second-largest electric car manufacturing region in the world, and in 2024, the region’s EV production overtook domestic EV sales by 5%. Automotive giants such as BMW, Mercedes-Benz, and Audi are pushing boundaries with high-fidelity amplifier systems incorporated in smart cockpit architectures, mainly powered by compact, thermally optimized Class D modules. With sustainability considerations forming one of the central pillars of business strategy in the EU, amplifier solutions are being tailored to support lightweight EV platforms without compromising audio clarity.

The global automotive amplifier market stands at the intersection of technological leadership, OEM collaboration, and component innovation, particularly around energy-efficient Class D amplifier ICs integrated with DSP functionality. Among those operating within this competitive landscape, top semiconductor firms such as STMicroelectronics, Texas Instruments, NXP Semiconductors, and Analog Devices are ushering in a new era for the auto industry by engineering automotive-grade amplifier chips that meet AEC-Q100 standards, offer in-car diagnostics, and support ANC and digital cockpits.

These players are securing design wins through strategic alliances with automakers, supplying both OEM infotainment systems and aftermarket-ready modules. Going toe-to-toe with the established semiconductor giants are the traditional consumer-audio companies such as Bose, Harman International, Alpine, Pioneer, Sony, and Denso Ten. Most of these firms are competing to enlarge their market presence by offering ultra-premium, multi-channel amplifier systems tailored for luxury vehicles and sound-conscious customers.

The global automotive amplifier market is projected to reach US$ 4.15 billion in 2025.

Advancements in Class D amplifiers powered by digital signal processors (DSPs), rapid EV integration, and high-output systems for luxury vehicles are driving the market.

The market is poised to witness a CAGR of 7.1% from 2025 to 2032.

The soaring adoption of electric vehicles worldwide and the incorporation of advanced driver-assistance systems (ADAS) are key market opportunities.

Panasonic Corporation, Pioneer Corporation, and Sony Corporation are some of the leading market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Amplifier Type

By Vehicle Class

By Vehicle Type

By Channel Configuration

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author