ID: PMRREP33573| 200 Pages | 23 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

The global autonomous vehicles market size is valued at US$ 69.5 billion in 2026 and is projected to reach US$ 103.8 billion by 2033, growing at a CAGR of 19.6% between 2026 and 2033. The industry is driven by the significant demand for tech adoption by customers, road safety, connectivity, advancement in AI, and sensor technology. Continuous advancements in artificial intelligence, machine learning, sensor technologies, and connectivity play a pivotal role in enhancing the capabilities of AVs.

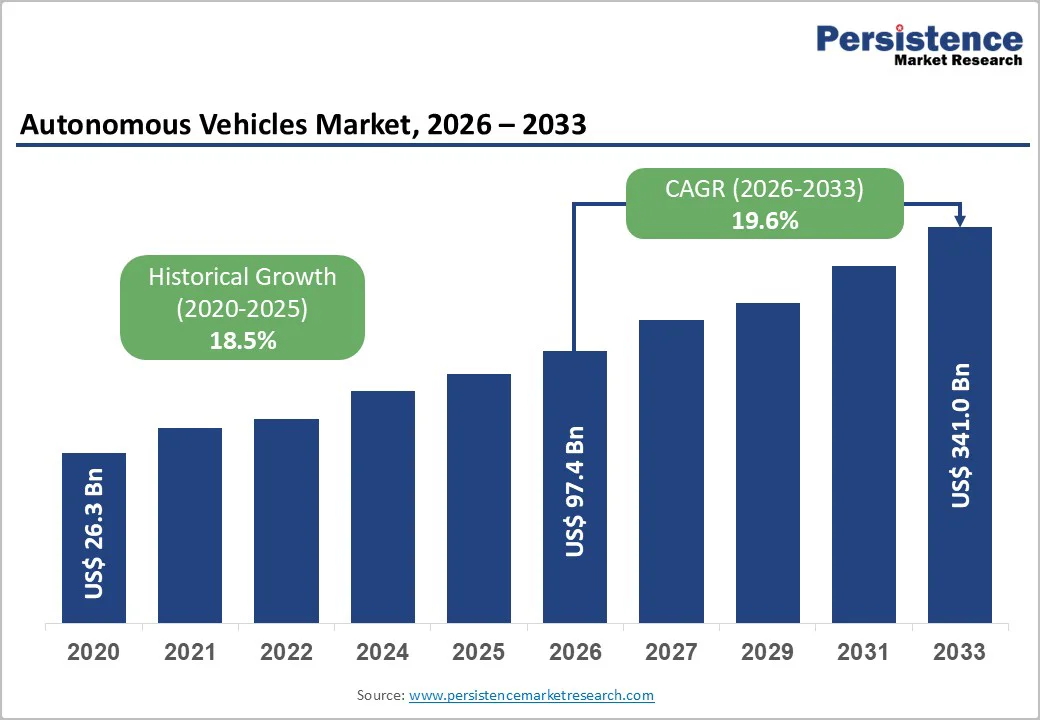

| Key Insights | Details |

|---|---|

|

Autonomous Vehicles Market Size (2026E) |

US$ 97.4 Bn |

|

Market Value Forecast (2033F) |

US$ 341.0 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

19.6% |

|

Historical Market Growth (CAGR 2020 to 2024) |

18.5% |

The maturation of artificial intelligence and machine learning algorithms, particularly transformer-based deep learning models trained on billions of miles of real-world driving data, has fundamentally accelerated autonomous vehicle commercialization timelines. Generative AI applications within autonomous driving systems enable vehicles to recognize edge cases, novel traffic scenarios, and unpredictable human behaviors with significantly improved accuracy compared to rule-based systems deployed in previous technology generations.

Waymo's transition to profitable operations at 250,000 paid autonomous rides weekly in 2024, combined with Alphabet's $5 billion capital commitment to Waymo in 2024, demonstrates investor confidence in AI-driven autonomous technology maturity for commercial deployment. Modern autonomous driving systems utilizing large language models adapted for perception tasks achieve collision avoidance accuracy improvements of 45% compared to baseline systems from 2020-2021, establishing performance thresholds meeting insurance and regulatory requirements for commercial operation without human safety drivers.

Road safety concerns are the single strongest demand driver for autonomous vehicles (AVs). Human error contributes to nearly 90% of road accidents globally, including distractions, fatigue, impaired driving, and poor judgment. Autonomous vehicles directly address these risks by relying on sensor fusion, AI-driven perception, and real-time decision-making systems that maintain constant situational awareness. Advanced driver assistance and higher-level autonomy enable automatic braking, lane keeping, collision avoidance, and adaptive speed control with reaction times far faster than human drivers.

Governments and regulators increasingly view AV technology as a long-term solution to reduce fatalities, healthcare costs, and insurance losses associated with road accidents. Fleet operators and mobility providers also prioritize safety-driven automation to reduce liability exposure and operational disruptions. This strong alignment between public safety objectives, regulatory support, and commercial risk reduction establishes accident prevention as a foundational and durable driver of autonomous vehicle adoption.

Authentic business studies indicate autonomous vehicle technology investments have increased 30-100% since 2021 across industry participants, with full Level 4/5 autonomous deployment requiring cumulative investments exceeding $3 billion per use case before achieving commercial launch. Waymo's operational losses are estimated at between $1.5 billion annually, despite achieving profitable profitability metrics at the micro scale (per-ride basis), underscoring the substantial capital requirements and extended funding timelines required before autonomous vehicle businesses achieve self-sustaining financial performance.

Cruise's operational suspension following 2023 safety incidents, combined with General Motors' decision to exit robotaxi development in December 2024 after $10 billion cumulative investment, demonstrates financial constraints limiting competitive participation in autonomous vehicle markets. Technology development uncertainty, including validation of computer vision approaches (Tesla) versus sensor-fusion architectures (Waymo), and disagreement regarding pre-launch testing requirements, creates competitive bifurcation, fragmenting capital resources across incompatible technology platforms.

The absence of unified federal regulatory frameworks governing autonomous vehicles across North America and Europe creates state-by-state and nation-by-nation compliance requirements, exponentially increasing operational complexity and capital requirements for geographic expansion. Volvo Autonomous Solutions and competitor companies operate within varying regulatory regimes requiring substantial recertification and testing protocols when expanding from jurisdictions like Texas and Arizona into adjacent states or international markets, effectively fragmenting market addressability and extending commercialization timelines.

Cybersecurity vulnerabilities inherent in connected autonomous platforms are vulnerable to remote-access hacking, spoofed GPS signals, and sensor manipulation, which present existential regulatory risks, creating liability exposure for manufacturers and operators exceeding insurance coverage availability. Regulatory hesitation regarding autonomous vehicle expansion intensified following 2023-2024 safety incidents, including Cruise robotaxi collisions and Tesla Autopilot-related fatalities, generating consumer skepticism and regulatory caution regarding deployment authorization.

India's autonomous vehicle market, valued at $2.6 billion in 2024 with a projected 24% CAGR through 2030, represents a substantial greenfield opportunity driven by the government's "National Policy on Autonomous Vehicles" supporting regulatory framework development and R&D funding exceeding $1 billion in 2024. RideFlux's Level 4 autonomous car-sharing pilot launching March 2026 in Hwaseong-si, South Korea, expands from 10 to 20 vehicles by 2027, establishing replicable commercial models adaptable across multiple Asian and developing markets.

China's leadership, combined with government allocation of US$150 billion for autonomous vehicle development, establishes a high-growth addressable market for technology developers and equipment suppliers targeting Chinese OEM partnerships. Tier-1 supplier investment acceleration through partnerships (Tata Motors-NVIDIA autonomous vehicle collaboration, Hyundai-GM strategic alliance) creates partnership opportunities for autonomous technology developers accessing established OEM distribution channels and manufacturing scale within emerging market segments.

Robotaxi services demonstrate rapid revenue growth with Waymo achieving 150,000-250,000 paid autonomous rides weekly in 2024, expanding geographic coverage to Austin, Los Angeles, Phoenix, Atlanta, and Miami, with plans for Dallas expansion in 2025. The U.S. robotaxi market, valued at $0.45 billion in 2024, is projected to expand at 74.6% CAGR through 2030, driven by elimination of safety driver labor costs and favorable urban density economics supporting fleet profitability. Shared autonomous mobility platforms represent substantially different business model architecture compared to private vehicle ownership, with platform operators optimizing routing algorithms, matching demand surges with fleet availability, and reducing vehicle-kilometer costs through enhanced utilization efficiency.

Nuro's strategic pivot toward autonomous delivery services, combined with the July 2024 partnership announcement with Lucid and Uber for the next-generation global robotaxi service launch, demonstrates software-licensing revenue opportunities for autonomous driving technology providers monetizing platforms across multiple use cases without requiring direct vehicle ownership.

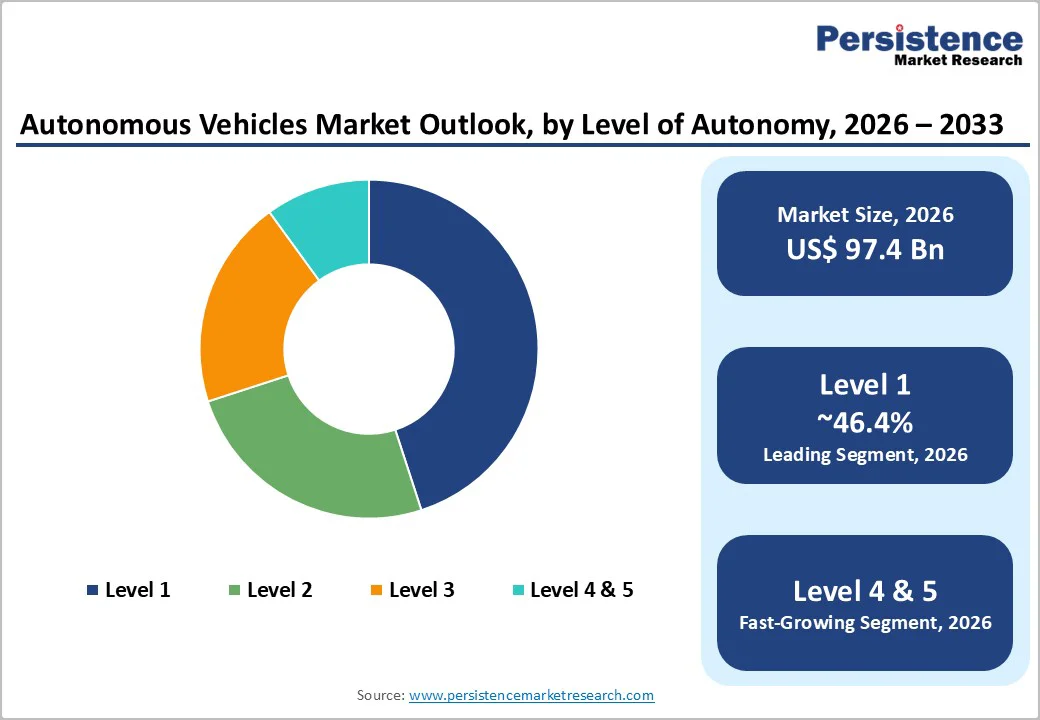

Level 1 autonomous systems, including adaptive cruise control, collision warning, and lane departure warning, hold 46.4% market share, supported by regulatory acceptance and widespread integration across passenger vehicles. Over 80% of premium and mid-range models in mature markets feature Level 1 ADAS, creating an installed base of more than 150 million vehicles. Level 2 adoption is accelerating, capturing 5.6% share in India (H1 2025) with 70.8% annual growth, indicating a strong shift toward partial automation.

Level 4 and Level 5 platforms requiring no human intervention in defined or universal scenarios represent the fastest-growing segment driven by robotaxi pilots and commercial fleet autonomy. Waymo’s 250,000 weekly paid rides and increasing investments highlight rapid long-term scalability.

The passenger cars segment dominated the autonomous vehicle market in 2026, primarily driven by the expansion of ride-hailing and ride-sharing services. Automakers and tech companies are increasingly integrating autonomous technologies into passenger cars to support on-demand mobility and improve user experience. A notable example is Volkswagen’s July 2024 announcement detailing plans to deploy autonomous vehicles for ride-hailing and goods delivery services in Austin, Texas, with commercial rollout targeted for 2026.

The commercial vehicles segment is projected to witness the highest CAGR during the forecast period, supported by strong adoption in logistics and long-haul transport. Trucking companies are incorporating self-driving capabilities to improve freight efficiency and operational safety. In July 2023, Kodiak Robotics joined the CVSA Enhanced CMV Inspection program, enabling autonomous trucks to undergo pre-clearance roadside inspections, further accelerating market growth.

The transportation segment captured the highest market share of 82.6% in 2026, supported by its vast potential for efficiency, innovation, and operational transformation. Autonomous technologies are reshaping travel and logistics by offering safer and more efficient mobility solutions. Sectors such as logistics, shipping, and ridesharing are increasingly deploying autonomous vehicles to streamline operations, reduce operational costs, and meet rising demand for reliable transportation services. This strong focus on improved logistics, enhanced safety, and long-term cost savings continues to drive segment dominance.

The defense segment is expected to grow rapidly during the forecast period as governments invest in advanced technologies to strengthen national security and reduce human risk in conflict zones. Autonomous vehicles are being adopted for surveillance, reconnaissance, logistics, and combat support, driven by advances in AI, robotics, and autonomous navigation. Increasing defense budgets and the need for unmanned systems are accelerating adoption, enabling safer and more effective military operations.

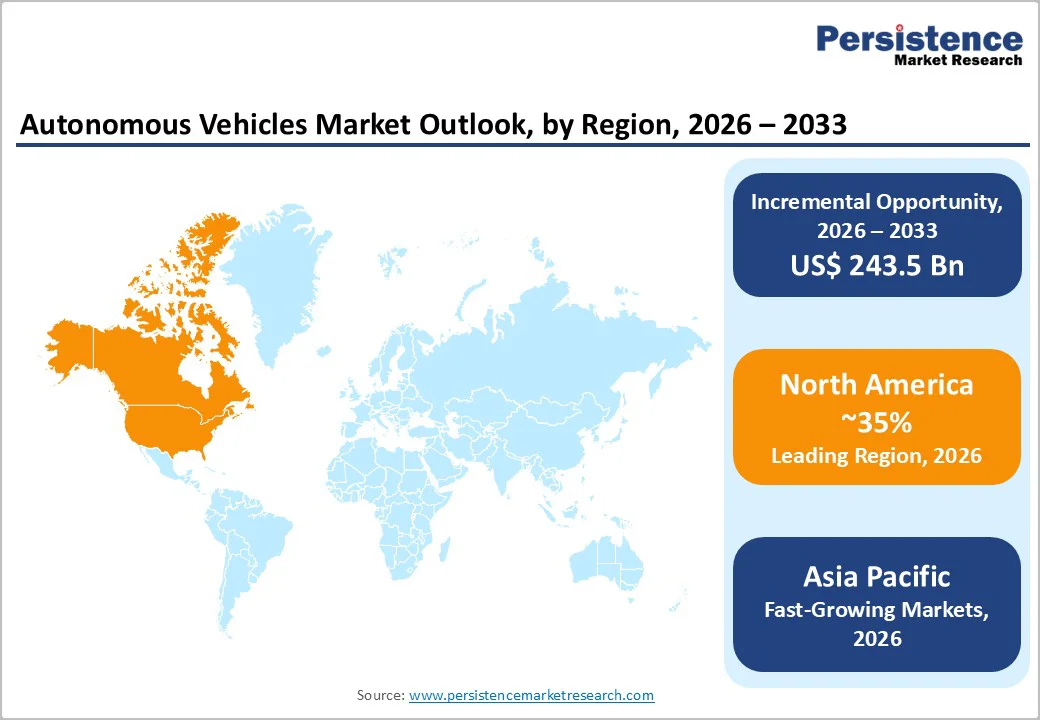

North America remains the global hub for autonomous vehicle development, accounting for nearly 34.8% market share and an estimated USD 22.4 billion valuation in 2026 The U.S. leads adoption, enabled by active robotaxi operations from Waymo across major cities including San Francisco, Phoenix, Los Angeles, Austin, and Atlanta, recording 150,000–250,000 weekly paid rides by mid-2024. Regulatory progress through NHTSA’s AV STEP framework is improving commercialization pathways, though inconsistent state regulations still restrict seamless expansion.

Investment momentum remains strong, with Alphabet committing $5 billion to Waymo, Tesla exceeding $25 billion in autonomous infrastructure, and over $7.5 billion in venture funding in 2024. Tesla’s Austin robotaxi pilot in 2025 intensifies competition, while GM’s Cruise pivot toward personal autonomy reflects strategic adaptation to robotaxi market challenges.

The European autonomous vehicle market was valued at USD 13.3 billion in 2023 and is projected to reach USD 47.4 billion by 2030, registering a 19.9% CAGR, the fastest among mature automotive regions. Germany leads with its 2021 Level 4 regulatory framework, enabling autonomous operation in controlled zones, supported by active testing in Frankfurt, Hamburg, and Munich involving Bosch, Continental, ZF, BMW, Mercedes-Benz, and Volkswagen. France and Spain show similar regulatory momentum with strong government funding pipelines.

The UK has built an independent post-Brexit approval framework, with London, Edinburgh, and Birmingham serving as primary test hubs, backed by the CCAV program. While Europe maintains a safety-first deployment approach, slowing near-term commercialization, it ensures long-term stability. Limited Waymo presence contrasts with strong regional OEM-driven competition.

Asia Pacific is the world’s fastest-growing autonomous vehicle market, valued at USD 400 billion in 2024 and expanding to 16.3% CAGR to 2033, outpacing North America and Europe. China leads with 35% share, driven by the Made in China 2025 initiative, $150 billion investment, and over 30 pilot zones in Beijing, Shanghai, and Shenzhen. Baidu and Didi dominate, with Apollo Level 3 operations and expanding robotaxi programs.

Japan holds 20% share, leveraging robotics expertise, with Toyota and Honda advancing Level 3 systems and government-funded Level 4 shuttles for aging populations. India, valued at $2.6 billion in 2024, grows 24% CAGR with strong R&D policy support. South Korea also progresses through RideFlux pilots and OEM partnerships. Overall, sustained government funding across China, Japan, and India forms the region’s competitive core.

The global autonomous vehicle market exhibits moderate-to-low concentration characteristics, with dominant participants (Waymo, Tesla, Cruise, and emerging Chinese platforms Baidu, Didi) collectively commanding approximately 45% of identifiable market share, indicating neither extreme fragmentation nor monopolistic positioning. The market structure reflects bifurcation between technology developers creating autonomous driving software platforms (Waymo, Aurora, Nuro, Cruise) and OEMs integrating autonomous capabilities within existing vehicle platforms (Tesla, General Motors, Ford, Toyota, Volkswagen Group).

Market barriers to entry include substantial capital requirements ($2-5 billion per viable commercial platform), technical expertise scarcity in machine learning and sensor fusion, regulatory approval complexity, and existing competitor advantages through accumulated real-world driving data exceeding 20+ million autonomous miles.

The Autonomous Vehicles market is estimated to be valued at US$ 97.4 Bn in 2026.

The key demand driver for the Autonomous Vehicles (AV) market is the growing need for enhanced safety, efficiency, and cost reduction in transportation and logistics.

In 2026, the North America region will dominate the market with an exceeding 35% revenue share in the global Autonomous Vehicles market.

Among the levels of Autonomy, Level 1 holds the highest preference, capturing beyond 46.4% of the market revenue share in 2026, surpassing other levels of Autonomy type.

The key players in Autonomous Vehicles are AUDI AG., Ford Motor Company, Mercedes-Benz Group, Nuro, Inc., and Pony.ai.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Vehicle Type

By Application

By Level of Autonomy

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author