ID: PMRREP10810| 192 Pages | 10 Feb 2026 | Format: PDF, Excel, PPT* | Automotive & Transportation

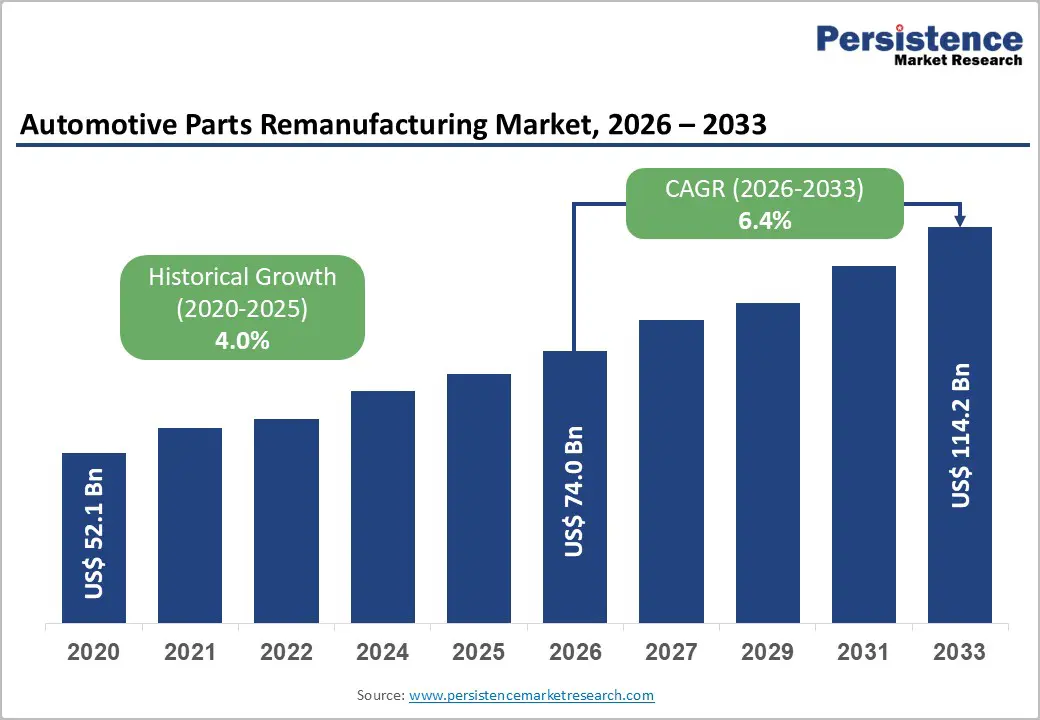

The global automotive parts remanufacturing market size is projected to be at US$74.0 billion in 2026 and is anticipated to reach US$114.24 billion by 2033, growing at a CAGR of 6.4% between 2026 and 2033.

Market expansion is driven by stringent environmental regulations mandating circular-economy practices, escalating raw-material costs that incentivize remanufacturing alternatives, and growing fleet modernization initiatives across commercial-vehicle segments. Technological advancements in diagnostic equipment and quality control systems are enhancing remanufactured component reliability and market acceptance.

| Key Insights | Details |

|---|---|

| Automotive Parts Remanufacturing Market Size (2026E) | US$ 74.0 Billion |

| Market Value Forecast (2033F) | US$ 114.2 Billion |

| Projected Growth CAGR (2026 - 2033) | 6.4% |

| Historical Market Growth (2020 - 2025) | 4.0% |

Global regulatory frameworks increasingly prioritize resource conservation and waste reduction, with the European Union's Circular Economy Action Plan aiming to achieve a 65% recycling rate for automotive materials by 2035. The U.S. Environmental Protection Agency reports that remanufacturing automotive components reduces energy consumption by 80% relative to new-part production and decreases CO2 emissions by approximately 85%. China's Ministry of Industry and Information Technology has issued comprehensive remanufacturing guidelines, designating automotive parts as a priority sector with projected annual growth targets of 15% through 2030. These regulatory drivers compel original equipment manufacturers and aftermarket suppliers to expand remanufacturing operations, thereby creating substantial market opportunities. The automotive remanufacturing industry prevents approximately 2.5 million tons of waste annually from entering landfills globally, aligning with corporate sustainability commitments and consumer preferences for environmentally responsible products.

Fleet operators managing commercial vehicles face mounting pressure to reduce total cost of ownership, with maintenance and parts replacement accounting for 30-40% of operational expenditures, according to the American Trucking Associations. Remanufactured components typically cost 30-70% less than new parts while maintaining equivalent performance standards and warranty coverage. The International Labour Organization estimates global logistics costs increased 18% between 2020-2024, intensifying demand for cost-effective maintenance solutions. Heavy commercial vehicle operators are increasingly adopting preventive maintenance programs incorporating remanufactured transmissions, engines, and electrical systems to extend asset lifecycles. The total addressable market for commercial vehicle remanufacturing exceeded $27 billion in 2024, with independent remanufacturers and OEM programs capturing growing market share as fleet electrification timelines extend internal combustion engine utilization periods beyond initial projections.

Despite technological improvements, consumer skepticism regarding remanufactured component reliability remains a significant market barrier, particularly in premium vehicle segments. Industry surveys indicate 42% of vehicle owners prefer new replacement parts due to perceived quality risks and shorter service life expectations. The lack of standardized certification across global markets leads to inconsistent quality assurance, with counterfeit products undermining the reputation of legitimate remanufacturers. Insurance companies and extended warranty providers often exclude remanufactured components from coverage terms, limiting adoption among risk-averse consumers. This perception gap requires continued investment in education, certification programs, and performance validation to achieve mainstream market acceptance and expand beyond cost-sensitive commercial applications.

Remanufacturing business models depend on consistent access to quality cores (used components suitable for rebuilding), yet collection networks remain fragmented across geographic markets. Transportation costs for core acquisition can represent 15-20% of total remanufacturing expenses, particularly for bulky components like engines and transmissions. Vehicle design complexity and proprietary electronic systems increasingly complicate disassembly and remanufacturing processes, necessitating investments in specialized equipment. The transition to electric vehicles threatens the long-term availability of core components for traditional powertrains, creating strategic uncertainty. Supply chain disruptions experienced during 2020-2023 highlighted vulnerability to logistics bottlenecks, with core acquisition delays extending remanufacturing lead times by 30-45% during peak disruption periods and constraining market growth potential.

Developing economies present substantial growth opportunities as vehicle populations expand and aging fleets increase demand for remanufactured parts. India's automotive aftermarket is projected to reach $32 billion by 2033, with remanufactured components capturing an increasing market share as regulatory frameworks mature. Southeast Asian nations, including Indonesia, Thailand, and Vietnam, maintain vehicle fleets averaging 12-15 years old, creating ideal conditions for remanufacturing penetration. Brazil and Mexico represent Latin America's largest opportunities, with combined automotive parts markets and growing middle-class populations prioritizing value-oriented maintenance solutions. Establishing localized remanufacturing facilities and distribution networks in these markets could unlock $18-22 billion in incremental revenue by 2033, particularly targeting commercial vehicle operators and independent repair facilities seeking certified alternatives to counterfeit components.

E-commerce platforms and digital marketplaces are transforming the distribution of remanufactured parts, reducing dependence on traditional distributors and improving price transparency. Online sales of automotive components grew 28% annually between 2020 and 2024, with remanufactured parts representing an expanding category through platforms like Amazon Automotive and specialized aftermarket sites. Direct-to-consumer models eliminate intermediary margins, improving remanufacturer profitability while offering consumers 15-25% cost savings versus traditional retail channels. Digital platforms enable enhanced product authentication through blockchain-based certification, QR code traceability, and customer review systems addressing quality perception concerns. The total addressable market for online automotive parts sales is projected to exceed $95 billion by 2030, with remanufactured components well-positioned to capture a 12-15% share through improved discovery, transparent quality standards, and competitive pricing strategies.

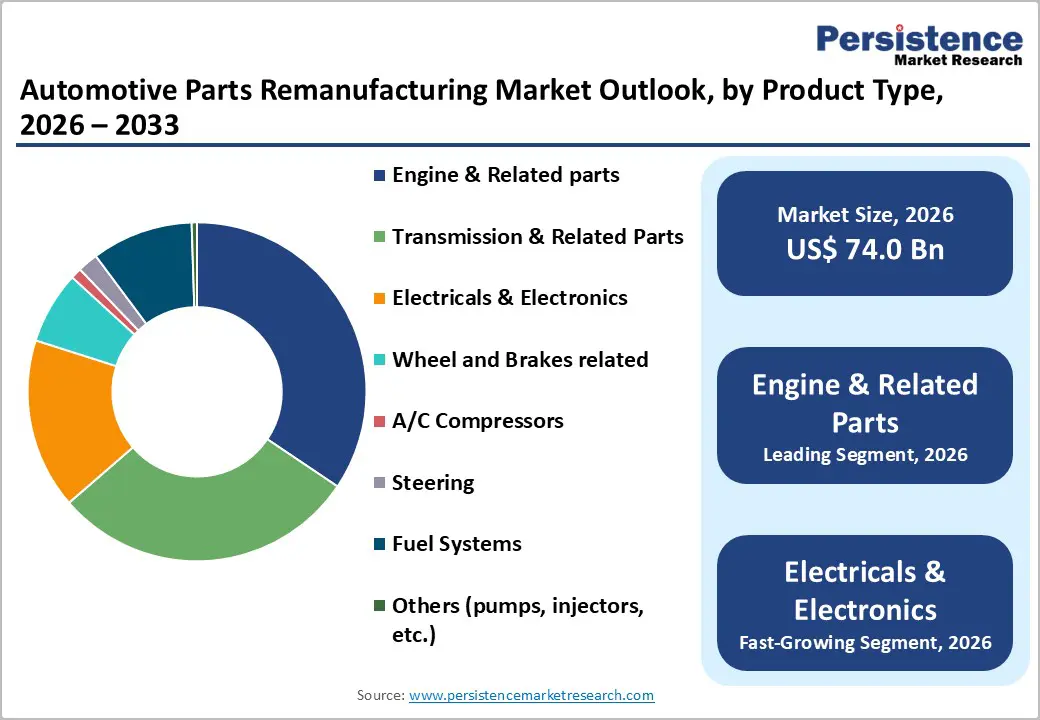

The engine and related parts command a leading market position, with approximately 34% of the global automotive parts remanufacturing market. Within this category, complete engine assemblies represent the dominant subcategory due to their high replacement value and established remanufacturing infrastructure across passenger and commercial vehicle applications. The widespread adoption of standardized engine platforms by major manufacturers has created economies of scale in core collection, rebuilding processes, and quality certification. Commercial vehicle operators particularly favor remanufactured engines as cost-effective alternatives.

Electricals & Electronics constitute the fastest-growing product segment with projected CAGR 8.1% between 2026-2033, reflecting increasing electrical complexity across modern vehicles. Starters benefit from electrification trends using 48-volt systems requiring robust starter-generators experiencing higher duty cycles, creating replacement demand and remanufacturing opportunities across expanding hybrid fleets worldwide rapidly growing markets.

Passenger Cars constitute the leading vehicle segment, with approximately 43% market share in the automotive parts remanufacturing market, reflecting a vast global installed base of more than 1.2 billion units. The mature aftermarket infrastructure for passenger vehicles supports established distribution channels, core collection networks, and strong consumer familiarity with remanufactured components. Common replacement parts, including starters, alternators, brake calipers, and steering components, benefit from high standardization across platforms, enabling efficient remanufacturing operations, rapid inventory turnover, and broad service coverage. Extended ownership periods averaging 12-15 years in developed markets sustain steady demand for affordable maintenance alternatives.

Passenger cars are simultaneously the fastest-growing category as vehicle populations rise in emerging markets, thereby expanding the addressable base. Meanwhile, Light and Heavy Commercial Vehicles are growing strongly due to e-commerce expansion, last-mile delivery, and freight demand, with operators favoring remanufactured transmissions, engines, and brake systems for predictable costs and minimized downtime.

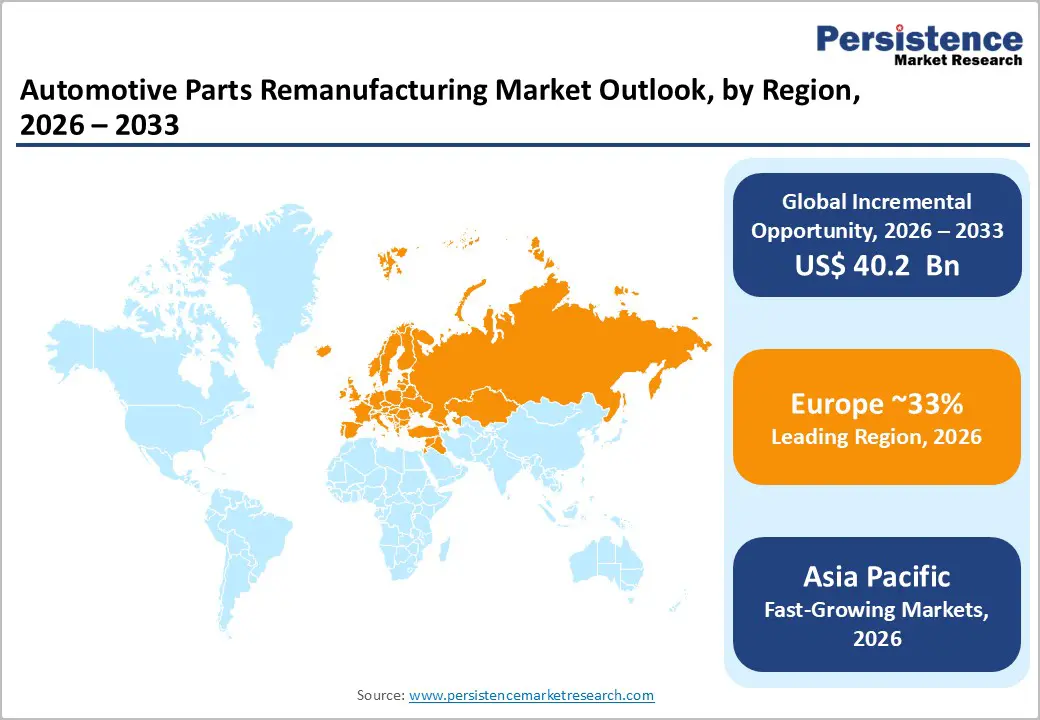

North America maintains a considerable market position with approximately 24% of global automotive parts remanufacturing revenue, supported by the region's mature aftermarket infrastructure and robust regulatory framework. The United States dominates regional performance, with the Automotive Parts Remanufacturers Association reporting that the domestic industry's value exceeds $17 billion and supports over 175,000 jobs across specialized facilities. Canada contributes significantly through established remanufacturing clusters in Ontario and Quebec, serving cross-border supply chains. Primary growth drivers include stringent Environmental Protection Agency emissions standards encouraging extended vehicle lifecycles, total cost of ownership optimization among commercial fleet operators managing 33 million registered trucks, and advanced technological capabilities in precision remanufacturing processes. The regulatory environment provides clarity through Magnuson-Moss Warranty Act protections ensuring consumer rights for remanufactured component usage without voiding vehicle warranties.

The competitive landscape features a balanced mix of independent remanufacturers, OEM-certified programs from Ford, General Motors, and Stellantis, and specialized players focusing on premium segments. Investment trends emphasize automation technologies, with facilities deploying robotic disassembly systems and AI-powered quality inspection to improve efficiency and consistency. The region's innovation ecosystem supports continuous advancement in remanufacturing methodologies, positioning North America as a global center of excellence.

Europe holds approximately 32% of the global automotive parts remanufacturing market, the largest regional share, driven by comprehensive circular-economy policies and environmental sustainability commitments. Germany leads continental performance with a highly developed remanufacturing industry valued at over $8 billion, supported by automotive manufacturing expertise and stringent quality standards. The United Kingdom, France, and Spain contribute substantially through established aftermarket distribution networks and growing consumer acceptance of certified remanufactured components. Primary growth drivers include the European Union's Circular Economy Action Plan, which mandates resource-efficiency improvements; Extended Producer Responsibility directives that incentivize OEM remanufacturing programs; and high vehicle ownership costs, which encourage maintenance optimization.

The regulatory environment emphasizes harmonized quality standards through ISO 13053 certification requirements, creating competitive advantages for compliant remanufacturers while limiting gray market alternatives. Investment opportunities center on electric-vehicle component remanufacturing capabilities as the region transitions to electrified mobility, with early-stage ventures targeting battery module refurbishment and electric motor rebuilding.

Asia-Pacific is experiencing robust growth at an approximately 9.6% CAGR, positioning it as the fastest-growing automotive parts remanufacturing market. China leads with government-backed initiatives that promote remanufacturing as a strategic industry, supported by the National Development and Reform Commission. Japan contributes advanced quality systems and precision engineering, while India offers high-growth potential from expanding vehicle populations and cost-sensitive aftermarket demand. ASEAN nations, including Thailand, Indonesia, and Vietnam, are emerging as key markets, driven by aging fleets and the development of regulatory frameworks.

Manufacturing advantages include lower labor costs, proximity to production hubs, and growing middle-class demand. Rising vehicle ownership, expanding logistics infrastructure, and increasing OEM participation drive growth. Investment focuses on capacity expansion, technology transfer, localized production, and early-mover advantages through certification, partnerships, and brand establishment.

Market leaders prioritize innovation through automated disassembly, precision machining, and advanced quality testing. Cost leadership is achieved via optimized logistics, lean operations, and scale efficiencies. Geographic expansion into emerging markets drives growth. OEM partnerships deliver certification advantages. Digital transformation, including e-commerce, analytics, and blockchain certification, enhances differentiation, transparency, customer trust, and operational performance globally.

The global automotive parts remanufacturing market is projected at US$74.00 billion in 2026, expected to reach US$114.24 billion by 2033.

Environmental regulations mandating circular economy practices, cost optimization pressures among commercial fleet operators, and advanced remanufacturing technologies enhancing component quality and reliability drive market expansion.

The market is projected to grow at a 6.4% CAGR between 2026 and 2033.

Emerging market expansion in Asia-Pacific and Latin America, electric vehicle component remanufacturing diversification, and digital marketplace integration represent primary growth opportunities.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author