ID: PMRREP31072| 187 Pages | 26 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

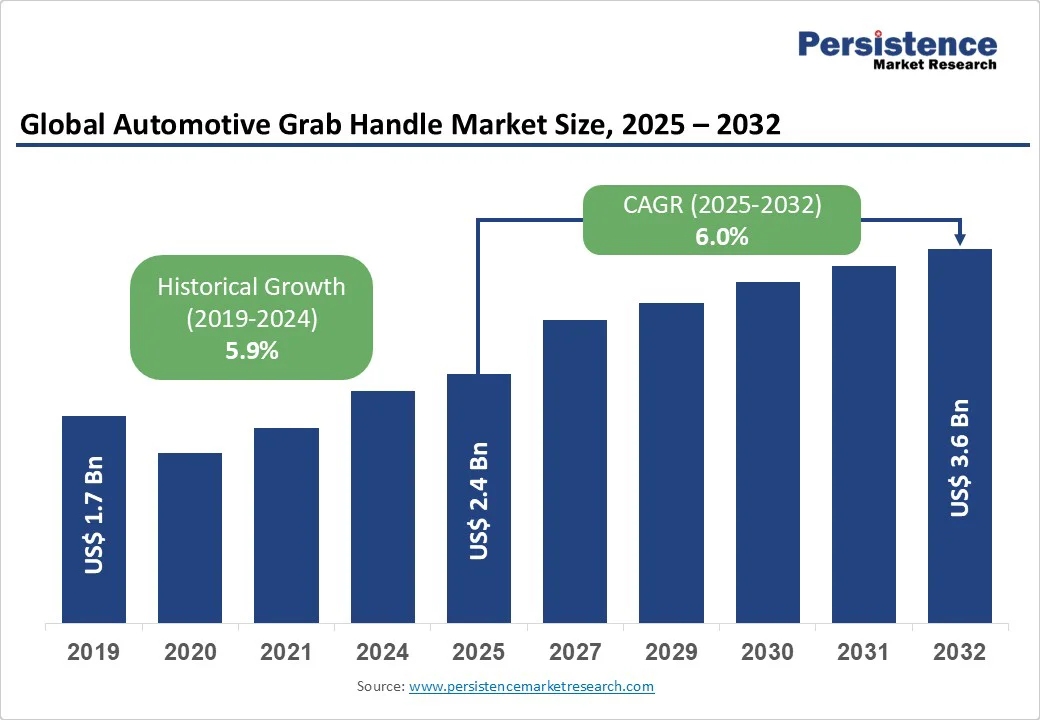

The global automotive grab handle market size is likely to value at US$ 2.4 Bn in 2025 and is expected to reach US$ 3.6 Bn by 2032, growing at a CAGR of 6.0% during the forecast period from 2025 to 2032.

The automotive grab handle market has experienced significant growth, driven by the increasing demand for enhanced vehicle interiors, rising adoption of ergonomic designs across automotive segments, and advancements in lightweight and durable materials.

| Key Insights | Details |

|---|---|

| Automotive Grab Handle Market Size (2025E) | US$ 2.4 Bn |

| Market Value Forecast (2032F) | US$ 3.6 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.0% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.9% |

The increasing demand for enhanced vehicle safety and comfort has become a key driver in the automotive grab handle market. Grab handles contribute significantly to passenger safety by providing stable support while entering, exiting, or moving within a vehicle, reducing the risk of slips and falls, especially in SUVs, commercial vehicles, and electric vehicles with higher ground clearance. In addition to safety, grab handles enhance overall passenger comfort by offering a convenient point to hold during sharp turns, sudden braking, or uneven road conditions, which improves the travel experience.

Manufacturers are responding to this demand by designing ergonomic, sturdy, and aesthetically appealing grab handles using advanced materials such as high-strength plastics, metals, and composites. For instance, Genuine Toyota parts include rear grab handle sets designed to assist passengers, especially the elderly and children, in entering the vehicle. These handles are noted for their ease of installation and functionality.

High development and regulatory costs present a significant restraint in the automotive grab handle market. The production of grab handles requires compliance with stringent safety and quality standards set by regulatory bodies such as the U.S. National Highway Traffic Safety Administration (NHTSA), the European Union’s General Safety Regulation (GSR), and other regional authorities. These regulations mandate rigorous testing for durability, flammability, material safety, and impact resistance, increasing both time and cost of development.

Manufacturers must invest in advanced materials, testing facilities, and certification processes to ensure compliance, which can be especially challenging for small and mid-sized automotive component producers. For instance, the European Union requires that automotive interior components, including grab handles, pass stringent flammability and strength tests before approval, resulting in higher R&D and production expenses. Additionally, integrating ergonomic designs and soft-touch materials to meet consumer comfort expectations further elevates manufacturing costs.

Companies such as Faurecia and Magna invest millions annually in research and testing to develop compliant, durable, and aesthetically pleasing grab handles. These high costs can limit market entry for new players and slow down innovation, particularly in regions with strict safety regulations.

Advancements in lightweight and sustainable materials present a significant opportunity in the automotive grab handle market. As automakers focus on improving fuel efficiency, reducing emissions, and meeting stringent environmental regulations, there is a growing demand for components made from lighter, eco-friendly materials.

Lightweight materials such as high-strength plastics, aluminum alloys, and composites help reduce overall vehicle weight, contributing to better fuel economy and enhanced performance, while maintaining durability and safety standards. For instance, BMW has incorporated carbon-fiber-reinforced composites in interior components, including grab handles, to reduce weight without compromising strength or aesthetic appeal.

Sustainable materials such as recycled plastics and bio-based polymers are gaining traction, aligning with consumer preferences for environmentally responsible products. Companies such as Faurecia and Magna are investing in research and development to create innovative, sustainable grab handles that meet ergonomic and safety requirements.

This trend not only addresses regulatory and environmental pressures but also offers automakers a competitive advantage by appealing to eco-conscious consumers, driving growth and adoption of advanced, lightweight, and sustainable grab handle solutions globally.

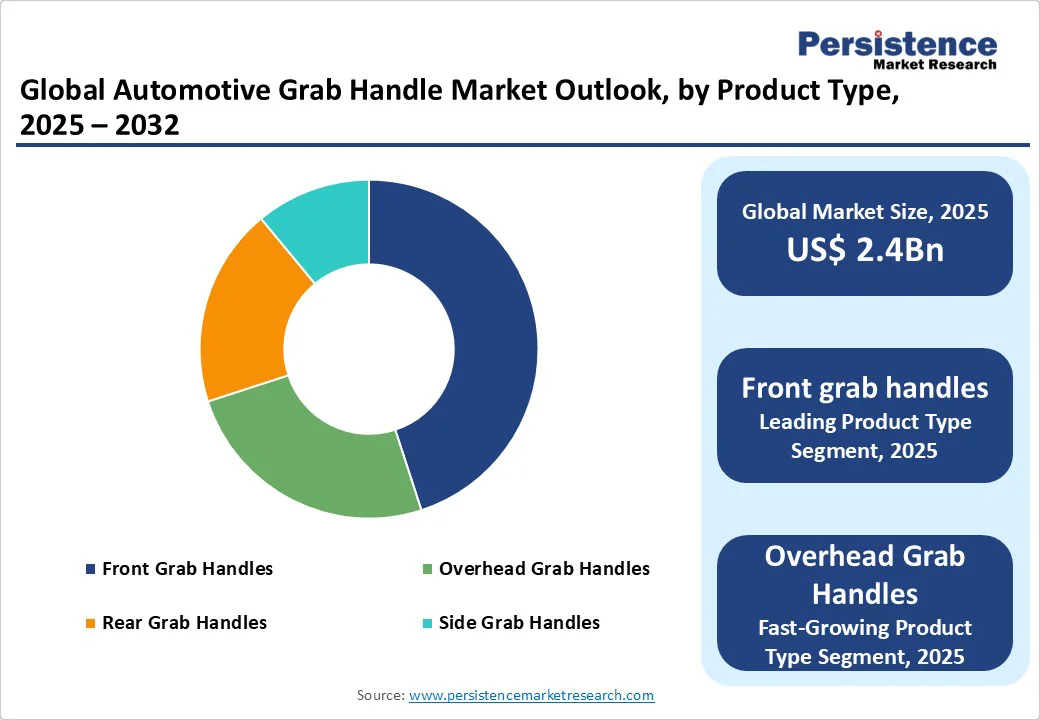

Front grab handles dominate, expected to account for approximately 45% share in 2025. Its dominance stems from its cost-effectiveness, rapid integration cycles, and ease of standardization for applications such as driver assistance and front-seat access.

Front grab handle systems, such as those offered by Grupo Antolin and Magna International, enable seamless usability, vehicle scalability, and collaboration across models, making them a preferred choice for industries such as passenger vehicles and commercial fleets. Their modular designs also reduce upfront costs, driving adoption among mid-range automakers and SMEs.

The overhead grab handles segment is the fastest-growing, driven by industries with high-comfort requirements, such as luxury vehicles and SUVs. Overhead grab handle systems offer greater accessibility and aesthetic integration, appealing to premium enterprises with complex interior needs.

The growing focus on family-oriented vehicles and off-road capabilities, such as those in Jeep's initiatives, is accelerating the adoption of overhead systems in regions such as North America and Europe, with significant growth potential in high-end applications.

Passenger Vehicles lead accounting for a 40% share in 2025. The segment’s dominance is driven by the need for enhanced comfort and safety in expanding personal transportation networks, particularly in sedans and hatchbacks. Grab handles streamline the integration with cabin layouts, reduce user fatigue, and improve operational efficiency, making them critical for providers such as Lear Corporation and Adient.

The electric vehicles segment is the fastest-growing, fueled by the rapid growth of EV adoption and the need for lightweight interiors to maximize range. The rise in battery-electric platforms and the increasing demand for ergonomic designs have spurred the adoption of grab handles in this sector. The Asia Pacific region, with its booming EV market, is driving rapid adoption in this segment.

Commercial vehicles lead the automotive grab handle market, accounting for a 30% share. The segment’s prominence is driven by the need for robust, ergonomic, and customized handles in fleets with complex operational requirements, including trucks, buses, and delivery vehicles. Grab handles in this segment enhance driver and passenger safety, streamline entry and exit, and improve operational efficiency during frequent stops or challenging routes.

The luxury vehicles are the fastest-growing, driven by the increasing adoption of premium interior technologies and the rise of high-end EV models for comfort and aesthetics. These platforms offer seamless access to advanced grab handles, enabling faster development and integration with other interior services. The growing popularity of luxury-focused vehicles among consumers is accelerating the adoption of handle solutions through this application, particularly in North America and Europe.

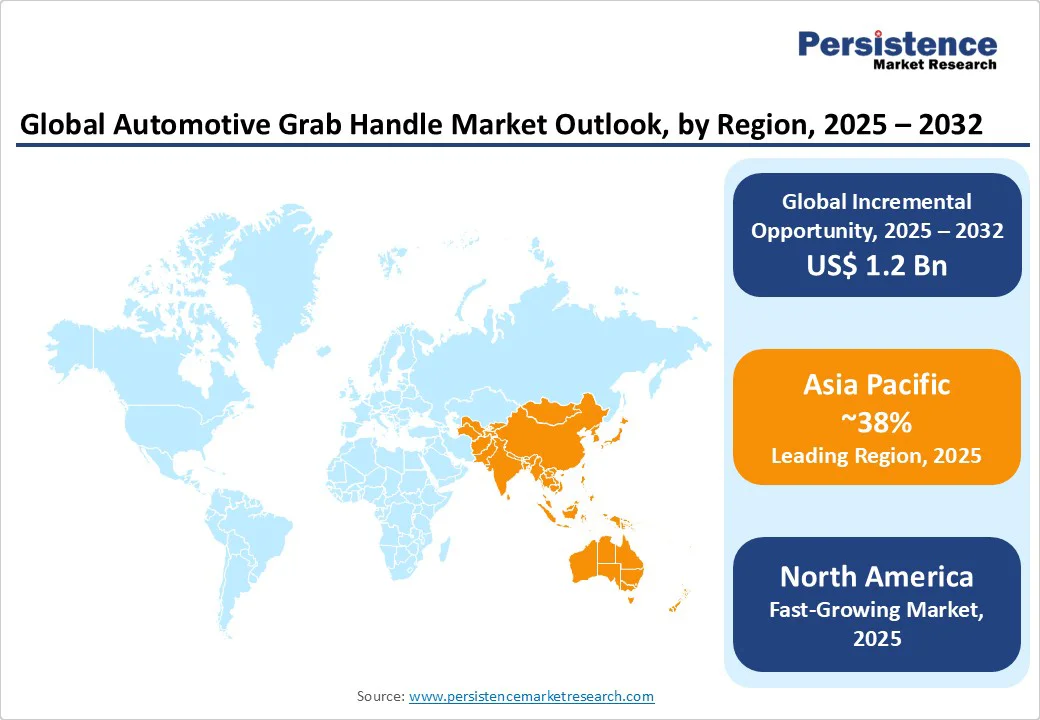

North America is emerging as the fastest-growing market for automotive grab handles, fueled primarily by increasing SUV sales and the rapid adoption of electric vehicles (EVs). The region has witnessed a significant shift in consumer preferences toward SUVs, crossover vehicles, and luxury models, which often feature higher ground clearance and larger cabin spaces. These vehicle characteristics create a greater need for grab handles to enhance passenger safety and facilitate easier entry and exit, particularly for children, elderly passengers, and individuals with mobility challenges.

The growing popularity of electric vehicles has spurred demand for innovative interior components, including ergonomically designed grab handles, as automakers seek to provide a premium and comfortable user experience while differentiating their products in a competitive market.

Companies in North America, such as Lear Corporation and Adient, are focusing on developing lightweight, durable, and aesthetically appealing grab handles that align with vehicle design trends and consumer expectations. Moreover, increasing regulatory emphasis on vehicle safety and interior ergonomics further drives adoption. Rising disposable incomes, urbanization, and the expansion of personal mobility solutions are also contributing factors, reinforcing North America as a high-potential and rapidly growing market for automotive grab handles in the coming years.

Europe is emerging as a significant player in the automotive grab handle market, supported by strong regulatory frameworks and collaborative automotive programs. The European Union’s automotive directives, along with national agencies such as Germany’s Federal Motor Transport Authority (KBA) and France’s automotive clusters, are driving extensive investments in vehicle interiors for safety, sustainability, and comfort. These initiatives are fueling demand for advanced and modular grab handles capable of supporting multi-vehicle requirements.

The region is also home to leading suppliers, including Grupo Antolin (Spain), Faurecia (France), and Magna International’s European divisions, which are at the forefront of developing cutting-edge handle technologies. With a focus on lightweight composites, ergonomic designs, and eco-friendly materials, European manufacturers are increasingly catering to both commercial and premium end-users. Europe’s growing emphasis on sovereign manufacturing capabilities and reducing reliance on external suppliers is encouraging greater R&D in handles that enhance accessibility and resilience.

Asia Pacific is expected to hold 38% share of the automotive grab handle market in 2025, driven by several key factors, including high vehicle production, rising disposable incomes, and rapid urbanization. Countries such as China, India, Japan, and South Korea are major hubs for automotive manufacturing, producing a wide range of vehicles from compact cars to SUVs and commercial trucks.

The high volume of vehicle production directly fuels demand for automotive components, including grab handles, which are essential for passenger safety and comfort. Rising disposable incomes and an expanding middle class have increased vehicle ownership, leading to higher demand for vehicles equipped with ergonomic and aesthetically appealing grab handles.

Rapid urbanization in major metropolitan areas has created a need for personal and commercial mobility solutions, further boosting vehicle sales and component adoption. Automakers and component manufacturers are responding by developing advanced grab handles using durable and lightweight materials, including plastics, metals, and composites, to meet regional consumer expectations. These trends collectively position Asia Pacific as the largest and fastest-growing market for automotive grab handles.

The global automotive grab handle market is characterized by intense competition, regional strengths, and a mix of global and niche players. In developed regions such as North America and Europe, large firms such as Magna International, Lear Corporation, and Adient dominate through scale, advanced R&D capabilities, and established partnerships with automakers. In the Asia Pacific, rapid vehicle production and increasing demand for cost-effective interiors are attracting significant investments from both international players, such as Grupo Antolin and BASF, and regional vendors.

Companies are focusing on product innovation, lightweight designs, and strategic alliances to gain a competitive edge. The development of composite and sensor-integrated grab handles has emerged as a key differentiator, enabling faster adoption in passenger, commercial, and EV sectors.

Strategic collaborations, acquisitions, and digital-first approaches for supply chain and marketing are further intensifying the competitive landscape. The industry exhibits a dual nature, consolidated at the top by global giants while remaining fragmented across numerous regional and niche players catering to local preferences and cost-sensitive segments.

The global automotive grab handle market is projected to reach US$ 2.4 Bn in 2025.

The increasing demand for enhanced vehicle safety and comfort is a key driver.

The automotive grab handle market is poised to witness a CAGR of 6.0% from 2025 to 2032.

Advancements in lightweight and sustainable materials are a key opportunity.

Grupo Antolin, BASF, Dura Automotive Systems, Magna International, and Lear Corporation are key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author