ID: PMRREP35751| 186 Pages | 17 Oct 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

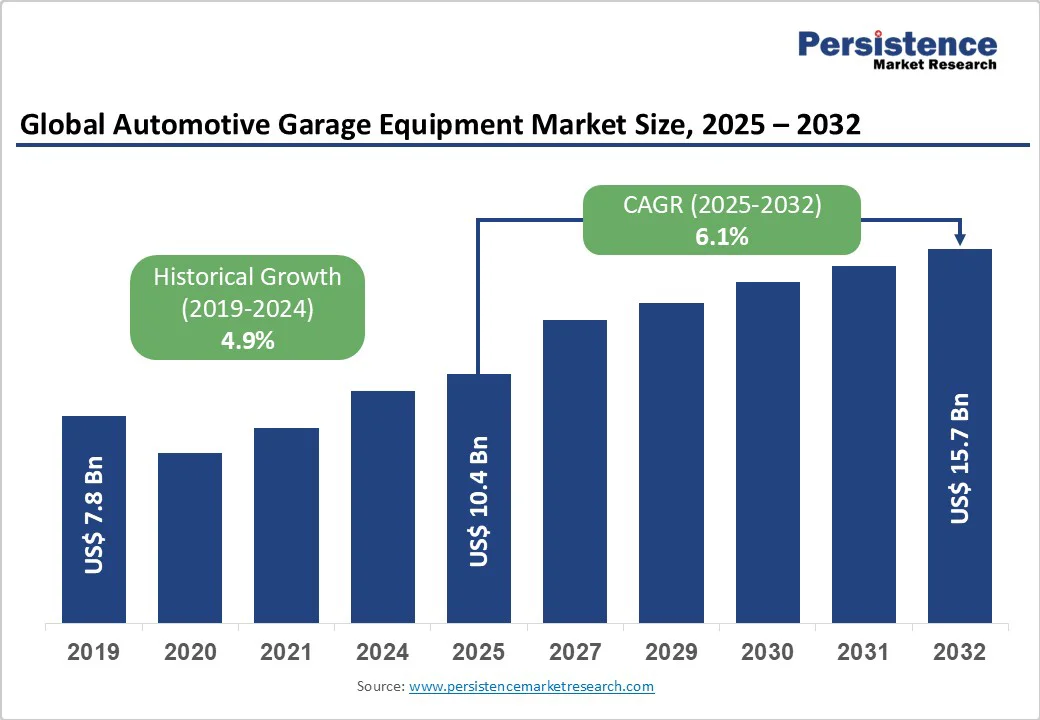

The global automotive garage equipment market size is expected to be valued at US$10.4 billion in 2025 and is projected to reach US$15.7 billion by 2032, growing at a CAGR of 6.1% during the forecast period of 2025 -2032.

Rising vehicle complexity, increasing adoption of electric vehicles, and expanding aftermarket service networks drive this robust growth trajectory. Advanced diagnostic tools, specialized lifting equipment, and EV-compatible systems are becoming essential as automotive workshops transition from traditional mechanical repair centers to high-tech diagnostic hubs capable of servicing increasingly sophisticated vehicle architectures.

| Key Insights | Details |

|---|---|

| Automotive Garage Equipment Market Size (2025E) | US$10.4 Bn |

| Market Value Forecast (2032F) | US$15.7 Bn |

| Projected Growth CAGR (2025 - 2032) | 6.1% |

| Historical Market Growth (2019-2024) | 4.9% |

The electrification of the automotive industry represents the most significant growth catalyst for garage equipment markets. This transition necessitates specialized equipment, including high-voltage battery testers, insulation monitoring systems, EV-compatible lifts, and charging infrastructure.

Toyota's commitment to launching 30 electric vehicle models and achieving 3.5 million annual EV sales by 2030, alongside Ford's projection that one-third of vehicle sales will be electric by 2026, underscores the industry's aggressive timeline for electrification.

Workshops require investment in 50-hour certification programs for technicians and high-voltage tooling to handle battery diagnostics, power electronics testing, and specialized safety protocols. The complexity of EV systems, including battery management systems (BMS), regenerative braking, and advanced thermal management, demands sophisticated diagnostic capabilities that traditional garage equipment cannot provide.

Government-mandated emission regulations and safety inspection requirements significantly drive the modernization of equipment across global markets. The Euro 7 regulations, starting in November 2026, introduce lifetime on-board emissions monitoring, compelling workshops to invest in portable emissions-measurement systems and secure data interfaces.

The European Commission's new safety certification protocols, introduced in 2024, accelerated garage modernization across the European Union (EU), requiring investments in specialized vehicle inspection tools meeting updated standards.

In the United States, for example, the Environmental Protection Agency (EPA)'s Final Rule for Control of Air Pollution introduces comparable requirements for heavy-duty vehicles, extending similar compliance obligations across North America. These regulations mandate workshops to upgrade diagnostic equipment, emission testing systems, and compliance documentation capabilities.

The emphasis on vehicle safety pushes demand for garage equipment designed to ensure optimal vehicle performance and reliability, with advanced diagnostic tools, vehicle lifts, and precision alignment systems in high demand.

The high upfront capital requirements for advanced garage equipment present significant barriers, particularly for small and medium-sized enterprises (SMEs). Modern automotive manufacturing and diagnostic equipment integrates smart components such as sensors, cameras, and automation software, which enhance functionality but increase complexity and capital requirements.

Such prohibitive costs limit SMEs' ability to invest in sophisticated equipment, with systems often requiring skilled personnel for installation, operation, and ongoing maintenance. Routine maintenance and system upgrades are crucial for reliability and efficiency; however, smaller enterprises face challenges in managing these demands due to limited internal resources.

The requirement for continuous technical support, regular reprogramming, and system adjustments to meet evolving consumer preferences can lead to increased costs and longer lead times.

Global supply chain constraints significantly impact the availability and pricing of garage equipment. Trade tensions and tariff implementations, particularly between the U.S. and other countries, directly affect hydraulic lifts, tire balancing machines, and vehicle diagnostic tools sourced from China and Italy, increasing setup costs for service centers.

Equipment-as-a-service subscription models, while offering operational flexibility, require substantial infrastructure investment and technical expertise that many traditional garages lack. The rapid pace of automotive technology evolution creates equipment obsolescence risks, where certain systems may become underutilized as product lines evolve and consumer preferences shift, impacting return on investment.

The integration of Internet of Things (IoT) technology in garage equipment represents a transformative opportunity, enabling connectivity and data sharing between different tools and devices. Connected equipment facilitates real-time monitoring, remote diagnostics, and predictive maintenance, significantly enhancing operational efficiency.

Smart garage tools integrating diagnostics, IoT sensors, and cloud-based software platforms are becoming mainstream, enabling real-time data analysis and predictive maintenance capabilities. This technological convergence enables workshops to transition into high-tech diagnostic hubs with advanced analytical capabilities.

The growth of independent garages presents substantial market expansion opportunities, particularly in post-warranty vehicle servicing. Post-warranty vehicle owners are increasingly approaching independent garages due to competitive labor costs and the growing popularity of genuine aftermarket products.

This trend increases demand for multi-brand diagnostic tools and versatile equipment that can service various vehicle makes and models. Rising repair and maintenance costs in OEM-authorized garages drive car owners toward independent facilities, creating sustained demand for garage equipment in the independent sector.

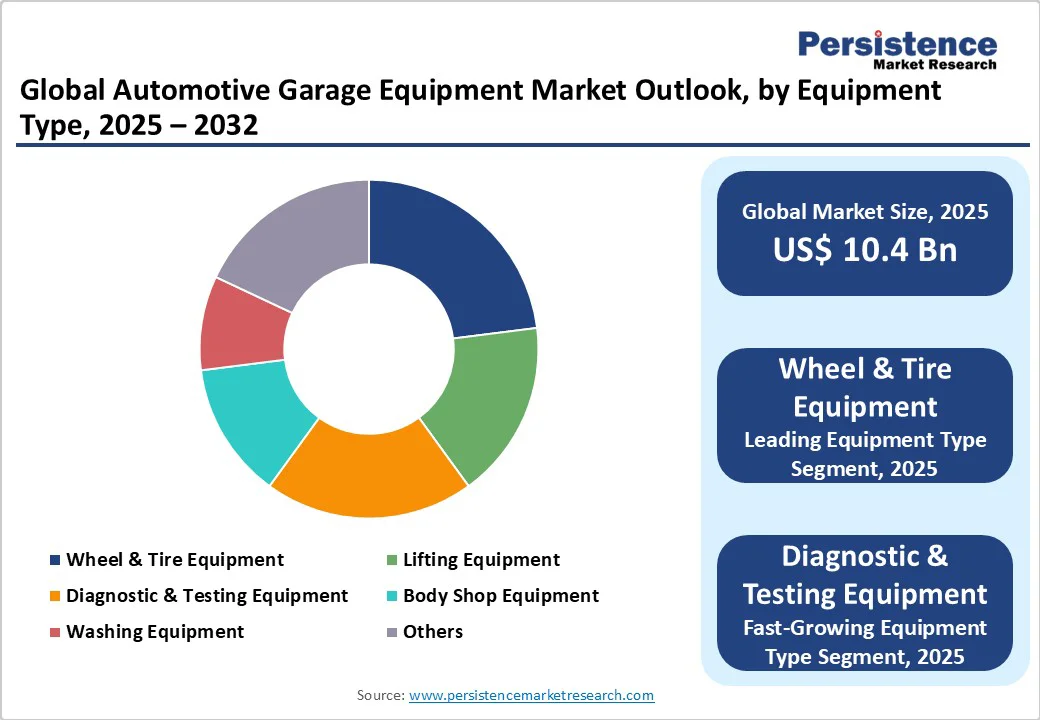

Wheel & tire equipment is set to emerge as the leading segment, holding around 23% market share in 2025, driven by universal maintenance requirements across all vehicle types. This dominance reflects the essential nature of tire-related services, including mounting, balancing, alignment, and seasonal tire changes that remain consistent regardless of vehicle propulsion type.

The segment benefits from steady replacement cycles and the increasing complexity of modern tire pressure monitoring systems (TPMS) and advanced driver assistance systems (ADAS), which require specialized calibration equipment.

Diagnostic & testing equipment is likely to be the fastest-growing segment with an impressive 9.3% CAGR through 2032. This acceleration stems from the increasing sophistication of modern vehicles, which incorporate electric drivetrains, advanced driver-assistance systems (ADAS), and AI-enabled connectivity features.

The segment's growth is further propelled by the development of specialized tools for battery management systems, high-voltage diagnostics, and software-defined vehicle architectures requiring over-the-air testing capabilities.

The passenger vehicle segment is expected to dominate with a 69% share in 2025, reflecting the substantial global passenger car parc and consistent maintenance requirements. This segment encompasses compact cars, midsize vehicles, SUVs, and luxury automobiles, each requiring specialized equipment configurations.

The dominance is further sustained by increasing vehicle ownership globally, particularly in emerging markets, and the growing complexity of passenger vehicle systems, which require sophisticated diagnostic and repair capabilities.

The electric vehicle segment is expected to exhibit the highest growth potential with a 10.2% CAGR from 2025 to 2032. This exceptional growth rate reflects the rapid electrification of the automotive industry, with demand for EV-specific equipment increasing steadily.

The segment's expansion is driven by specialized requirements, including high-voltage safety equipment, battery diagnostic tools, charging infrastructure, and insulation testing systems. More than 400 global gigafactories scheduled for operation by 2030 place unprecedented emphasis on formation cyclers, thermal abuse rigs, and end-of-line testers, creating substantial demand for equipment.

OEM authorized workshops will lead the market with a 51% share, reflecting their access to proprietary diagnostic tools, manufacturer-specific equipment, and standardized service protocols. These facilities benefit from direct manufacturer support, access to the latest equipment technologies, and customer preference for warranty-compliant services.

Their market leadership is reinforced by the increasing complexity of vehicles, which requires specialized diagnostic capabilities and manufacturer-approved repair procedures.

Independent garages are poised to be the fastest-growing segment, with a 7.6% CAGR from 2025 to 2032, driven by competitive pricing advantages and expanding service capabilities. Independent garages typically have lower overheads compared to franchised dealerships, allowing them to offer more competitive prices for labor and parts, making them attractive to cost-conscious vehicle owners.

This price advantage, combined with increased adoption of genuine aftermarket products and multi-brand diagnostic capabilities, drives sustained growth in the independent sector.

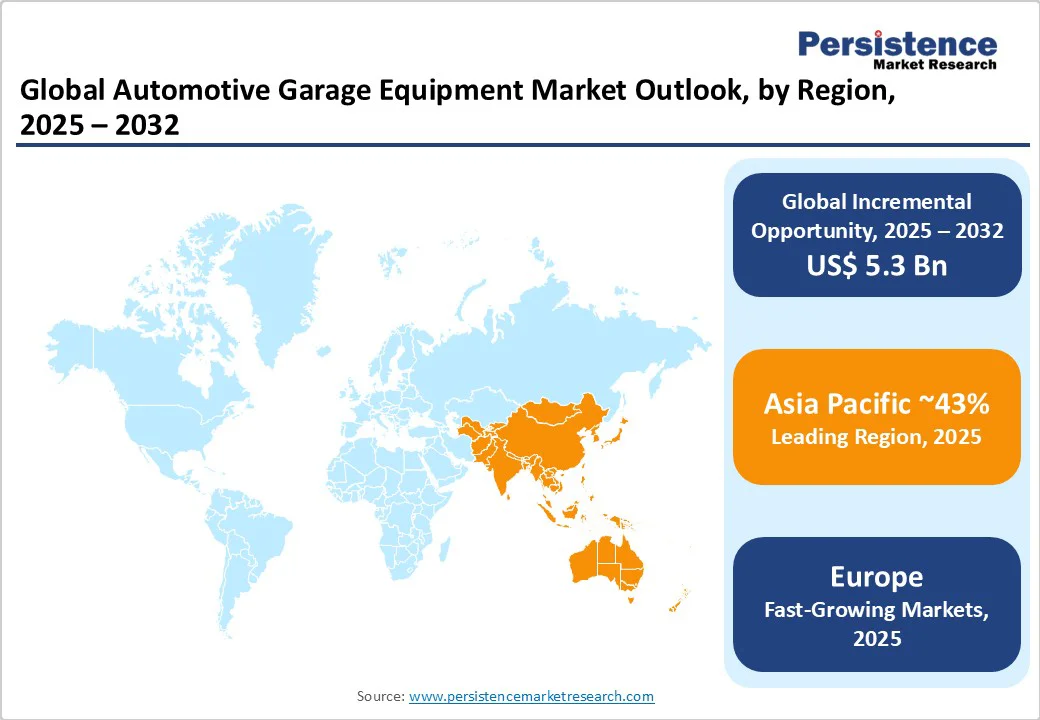

Asia Pacific is poised to dominate with a 43% of the automotive garage equipment market share in 2025, representing the largest and fastest-growing regional segment. The regional market is expected to witness a 7.9% CAGR during the forecast period of 2025 -2032.

China's dominance stems from its position as the world's largest automotive market, its extensive manufacturing capabilities, and the rapid adoption of electric vehicles, supported by government policies and infrastructure development.

Market growth in India is primarily driven by rising disposable incomes, an exponential increase in vehicle ownership, and growing awareness of vehicle maintenance needs. The region is a major tourist destination with a thriving tourism industry, which drives demand for garage equipment due to the maintenance requirements of rental fleets and vehicles used in the sector.

North America is expected to deliver robust market performance, supported by advanced automotive industry infrastructure and favorable regulatory frameworks. The United States leads regional growth as a major contributor to innovation, technology development, and the manufacturing of high-performance vehicles.

The regional market also benefits from the North American Free Trade Agreement (NAFTA), which has fostered the growth of the automotive industry, a large customer base, and high disposable income levels, fueling demand for premium connected vehicles.

Moreover, the region's regulatory environment significantly influences equipment modernization requirements, with EPA compliance standards driving diagnostic equipment upgrades. Commercial vehicle sales increased by 13.6% according to the International Organization of Motor Vehicle Manufacturers (OICA), reaching 14.3 million units in 2023. This growth was driven by rising logistics demand and innovation from American OEMs, which in turn influenced demand for garage equipment.

The country's expected leadership role in autonomous vehicle growth creates additional demand for specialized diagnostic and calibration equipment. Investment in digital infrastructure, IoT integration, and advanced manufacturing capabilities positions North America as a key market for premium garage equipment solutions.

Europe is expected to maintain a substantial 21% share of the automotive garage equipment market, driven by stringent regulatory standards and technological advancements. Germany leads regional performance due to its strong automotive industry presence, housing manufacturers such as Volkswagen, BMW, and Mercedes-Benz, which drives demand for high-quality garage equipment.

The European market benefits from EU-wide regulations that enable harmonized standards, accelerate regional product deployments, and receive strong government backing, with EU funding driving market expansion. The region's focus on digitization in garage operations, increasing vehicle ownership, and emphasis on emission control systems create conducive growth environments.

The Euro 7 regulations, starting in November 2026, have mandated lifetime on-board emissions monitoring, compelling workshops to invest in portable emissions-measurement systems and secure data interfaces.

France and the U.K. demonstrate significant market activity, with France benefiting from structured public funding and national digitalization strategies, while the U.K.'s post-Brexit regulatory reforms enhance the attractiveness of deploying automotive tools. Spain's well-established automotive industry and role as a key vehicle manufacturing center in Europe support the development of advanced service stations equipped with the latest diagnostic technologies.

The global automotive garage equipment market structure exhibits moderate fragmentation, featuring a balanced mix of established international players and growing regional specialized manufacturers. Larger firms typically dominate high-tech and precision equipment segments, including vehicle diagnostics, emission testing, and advanced lifting systems, while smaller players cater to niche applications and local service markets.

Market concentration remains moderate with ongoing competition driven by price sensitivity in emerging markets and rising demand for feature-rich, durable, and compliant tools in mature regions. The competitive landscape encourages continuous product differentiation, particularly through technology integration, IoT connectivity, and comprehensive service support capabilities.

The global automotive garage equipment market is projected to reach US$ 10.4 billion in 2025.

Rising vehicle complexity, increasing electric vehicle adoption, and expanding aftermarket service are driving the market.

The market is poised to witness a CAGR of 6.1% from 2025 to 2032.

Growing importance of advanced diagnostic tools, specialized lifting equipment, and EV-compatible systems and the heightening need for automotive workshops to transition from traditional mechanical repair centers to high-tech diagnostic hubs are key market opportunities.

Robert Bosch GmbH, Continental AG, and ISTOBAL S.A. are some of the key players in this market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Equipment Type

By Vehicle Type

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author