ID: PMRREP35754| 199 Pages | 17 Oct 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

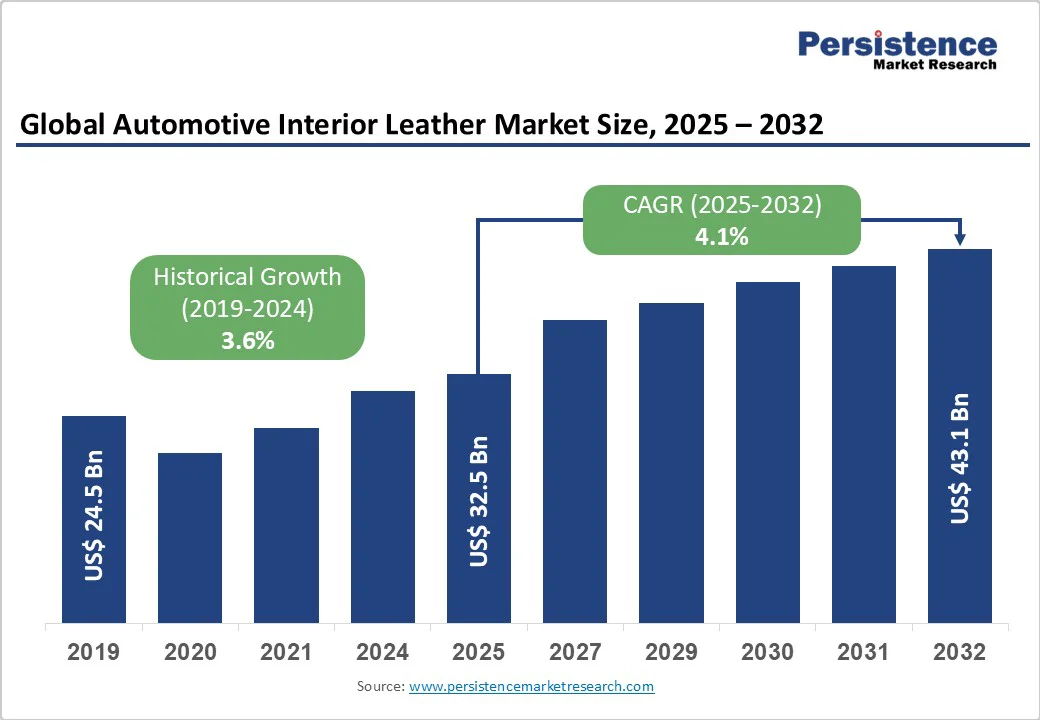

The global automotive interior leather market size was valued at US$32.5 billion in 2025, and is projected to reach US$43.1 billion by 2032, growing at a CAGR of 4.1% during the forecast period 2025 - 2032, accelerated by the auto industry's evolution toward premium materials and sustainable alternatives in response to changing consumer preferences and regulatory pressures.

The market expansion is driven by rising disposable incomes, increasing demand for luxury vehicle interiors, and technological advancements in synthetic leather manufacturing.

The growth rate is accelerated demonstrating industry's adaptation to emerging trends, particularly the rapid adoption of electric vehicles and growing emphasis on sustainable materials across all vehicle segments.

| Key Insights | Details |

|---|---|

| Automotive Interior Leather Market Size (2025E) | US$32.5 Bn |

| Market Value Forecast (2032F) | US$43.1 Bn |

| Projected Growth CAGR (2025 - 2032) | 4.1% |

| Historical Market Growth (2019-2024) | 3.6% |

The increasing global demand for luxury and premium vehicles is fundamentally driving market expansion, with consumers increasingly willing to pay premium prices for enhanced interior aesthetics and comfort. The luxury vehicle segment has experienced remarkable growth, with companies such as Porsche reporting an 18% increase in deliveries in Q1 2023 compared to the previous year, reaching 80,767 vehicles across Europe, North America, and China.

This trend is particularly pronounced in emerging markets where rising middle-class populations view premium automotive interiors as status symbols. Automakers are responding by offering extensive customization options, reflecting consumers' desire for personalized vehicle experiences that extend beyond factory specifications.

The electric vehicle (EV) revolution is creating unprecedented opportunities for automotive interior leather applications. EV manufacturers are prioritizing interior luxury to differentiate their products and justify premium pricing, with brands such as Tesla and BMW leading the integration of both traditional and synthetic leather alternatives.

The unique design philosophies of EVs, emphasizing minimalistic yet sophisticated aesthetics, have opened new applications for microfiber and synthetic leather materials that align with sustainability goals while maintaining premium appeal.

The leather industry faces mounting pressure from environmental regulations and sustainability mandates that threaten traditional leather production methods. Cattle ranching is responsible for 80% of deforestation in the Amazon, with 20% of global leather being purchased by the automotive industry, creating significant supply chain risks for automakers.

The European Union's Deforestation Regulation (EUDR), effective in 2025, requires full traceability of leather back to farm origins, imposing substantial compliance costs and operational complexity. Furthermore, traditional chrome tanning processes, used in 90% of global leather production, have created severe environmental challenges, including water pollution, soil contamination, and toxic waste generation that require costly remediation and process modifications.

The automotive interior leather market growth also faces significant cost pressures from fluctuating raw material prices and complex supply chain dependencies. Hide availability has become increasingly constrained as beef production patterns change and alternative protein sources gain market share, creating upward pressure on genuine leather costs.

The industry's reliance on global supply chains exposes manufacturers to geopolitical risks, currency fluctuations, and transportation cost variations that can significantly impact profit margins. Small and medium producers particularly struggle with these cost pressures, leading to market consolidation and reduced competitive dynamics in regional markets.

Rapid economic development in the Asia Pacific and other developing economies presents substantial growth opportunities, fueled by rising urban incomes and expanding vehicle production. Indonesia and Vietnam demonstrate excellent growth patterns, supported by government incentives and growing middle-class populations.

These markets offer significant potential for both genuine and synthetic leather applications as local automotive assembly plants increase demand for quality interior materials and aftermarket customization gains momentum among younger demographics.

The development of bio-based leather alternatives represents a transformative opportunity for market expansion, with over 60 ongoing development projects globally focused on castor oil PU leather and other plant-based materials.

Companies like Hyundai are partnering with biomaterial startups such as Uncaged Innovations to develop grain-based, plastic-free leather alternatives that eliminate reliance on both livestock and fossil fuels. These innovations address multiple market needs simultaneously by meeting environmental sustainability standards, enabling cost optimization, and enhancing performance, positioning early adopters for competitive advantage as regulatory pressures intensify.

Synthetic leather is slated to maintain leadership with over 50% market share in 2025, owing to its superior cost-effectiveness, versatility, and alignment with sustainability trends. Within the synthetic segment, PU leather commands 55% market share in 2025 due to its exceptional balance of aesthetic appeal, durability, and environmental friendliness compared to PVC alternatives.

PU leather's dominance stems from its ability to replicate genuine leather's tactile properties while offering easier maintenance, enhanced durability, and freedom from harmful chemicals such as dioxins present in PVC formulations. The segment's growth is further accelerated by technological advances in bio-based PU materials and antimicrobial treatments that expand application possibilities across vehicle segments.

The microfiber leather sub-segment, including premium brands such as Alcantara, Ultrasuede, and Dinamica, represents the fastest-growing category within synthetic materials. This segment benefits from its unique combination of luxury appeal, superior performance characteristics, and sustainability credentials, making it particularly attractive for premium and EV applications where weight reduction and environmental responsibility are prioritized.

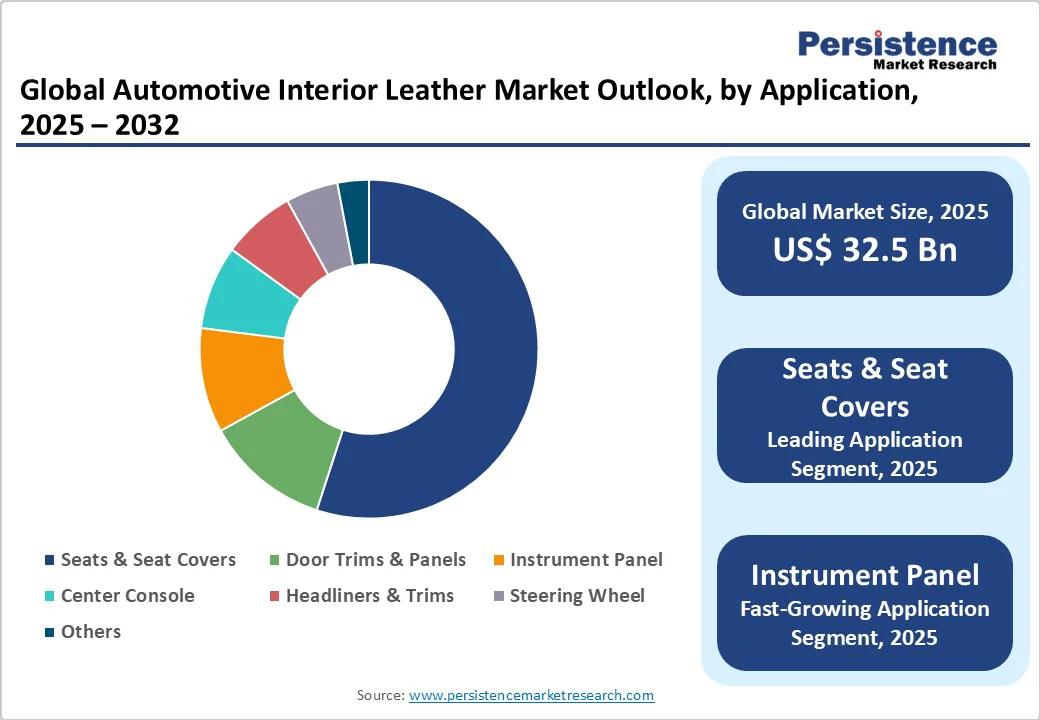

The seats & seat covers segment is likely to dominate with over 55% market share in 2025, reflecting the critical importance of seating comfort and aesthetics in vehicle purchase decisions. This segment benefits from high consumer visibility, direct impact on comfort perception, and significant aftermarket upgrade potential that drives both OEM and replacement demand.

The prominence of seating applications also reflects the substantial material requirements per vehicle and the premium pricing achievable for high-quality leather seating systems across all vehicle categories.

The instrument panel segment represents the fastest-growing application area for the 2025 - 2032 period, driven by evolving vehicle interior design trends that emphasize integrated, premium dashboard aesthetics. Modern vehicle designs increasingly incorporate leather-wrapped instrument panels as key differentiating elements that enhance perceived quality and luxury positioning.

This trend is particularly pronounced in electric vehicles where traditional engine noise reduction allows greater focus on interior refinement and premium material application across expanded surface areas.

Passenger cars are set to command over 65% market share in 2025, indicating the large production volumes, diverse model ranges, and varying price points of these vehicles that accommodate both genuine and synthetic leather applications.

This dominance spans from economy vehicles utilizing cost-effective synthetic alternatives to luxury models featuring premium genuine leather appointments. The segment's breadth enables suppliers to leverage economies of scale while serving diverse consumer preferences and price sensitivity levels across global markets.

Electric vehicles represent the fastest-growing segment with a CAGR exceeding 10% through 2032, aided by rapid EV adoption globally and manufacturers' focus on interior luxury as key differentiation strategies. The considerable size of the EV interior leather market reflects both volume growth and premium positioning of electric vehicle interiors.

EV manufacturers prioritize sustainable material choices, creating opportunities for bio-based and recycled leather alternatives that align with overall vehicle environmental positioning.

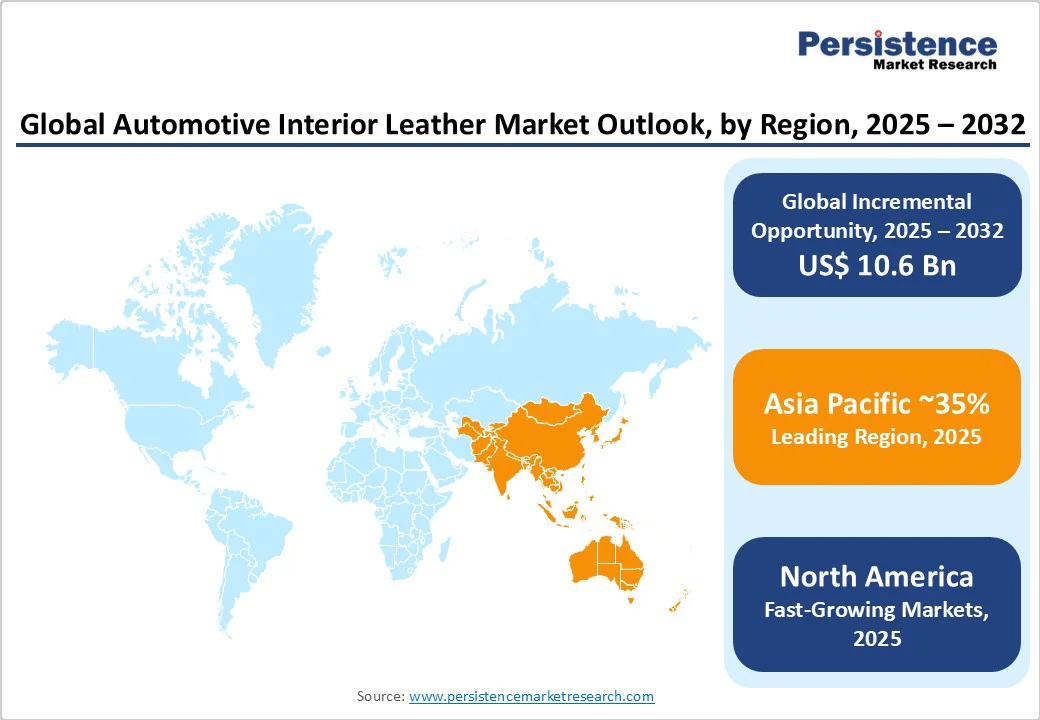

Asia Pacific represents the largest and fastest-growing regional market, controlling over 35% of global consumption in 2025 with China being the major contributor. The region's dominance is bolstered by massive automotive production volumes, rapidly growing middle-class populations, and increasing consumer preference for premium interior features across both domestic and export-oriented vehicle manufacturing.

China's market leadership stems from its position as the world's largest automotive producer and consumer, with domestic manufacturers increasingly incorporating premium interior materials to compete with international brands in both domestic and export markets.

In India, the market is anticipated to demonstrate exceptional growth potential, driven by rising disposable incomes, expanding automotive production, and increasing preference for premium vehicle features among emerging middle-class consumers.

The India market benefits from government support for automotive manufacturing and export growth, increasing demand for high-quality interior materials. Most importantly, Asia Pacific’s unparalleled advantages, such as lower labor costs and established supply chains, make it a key production hub for genuine and synthetic leather in global automotive markets.

The North America automotive interior leather market will experience steady growth with significant opportunities in sustainable vehicle luxury applications. The U.S. market is projected to reach US$ 5.4 billion by 2032, supported by strong luxury vehicle demand and technological innovation ecosystems.

The regulatory environment of the U.S. emphasizes innovation in eco-friendly manufacturing processes while maintaining stringent safety and performance standards that favor technically advanced synthetic alternatives. The region's strong aftermarket segment, representing significant customization demand, supports both premium pricing and market expansion opportunities.

Further, the regional competitive landscape is characterized by established automotive manufacturing infrastructure, strong research and development capabilities, and sophisticated consumer preferences that drive demand for both traditional luxury materials and innovative sustainable alternatives. The region's leadership in EV deployment creates additional growth vectors for premium interior leather applications.

The Europe market revolves around regulatory harmonization, sustainability mandates, and premium vehicle manufacturing excellence that drive demand for high-quality, environmentally responsible leather alternatives. Germany, the U.K., France, and Spain represent key performance markets with distinct characteristics reflecting regional automotive manufacturing strengths and consumer preferences.

Germany leads the demand for automotive leather interiors owing to its well-established auto manufacturing excellence and consumer preference for premium materials. The Germany market's emphasis on strict sustainability requirements, including standards that exceed EU REACH legislation, creates opportunities for suppliers capable of meeting enhanced environmental performance criteria.

Major German automotive brands such as BMW, Mercedes-Benz, and Audi drive substantial demand for high-quality leather materials that meet both luxury positioning and environmental responsibility requirements.

The global automotive interior leather market structure is moderately consolidated, with established players leveraging scale, technology, and partnerships with major manufacturers.

These companies utilize global manufacturing networks and R&D to maintain competitive advantages in both premium and volume segments. While the market is capital-intensive and favors larger players due to strict quality and supply chain demands, there is still room for specialized suppliers targeting niche applications or sustainable materials.

The global automotive interior leather market is projected to reach US$ 32.5 billion in 2025.

The auto industry's movement toward premium materials and sustainable alternatives in response to changing consumer preferences and increasing regulatory pressures on automakers are driving the market.

The market is poised to witness a CAGR of 4.1% from 2025 to 2032.

Increasing demand for luxury vehicle interiors, technological advancements in synthetic leather manufacturing, and surging adoption of electric vehicles globally are key market opportunities.

Lear Corporation, Asahi Kasei Corporation, and Toyota Boshoku Corporation are some of the key players in this market.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author