ID: PMRREP22252| 216 Pages | 4 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

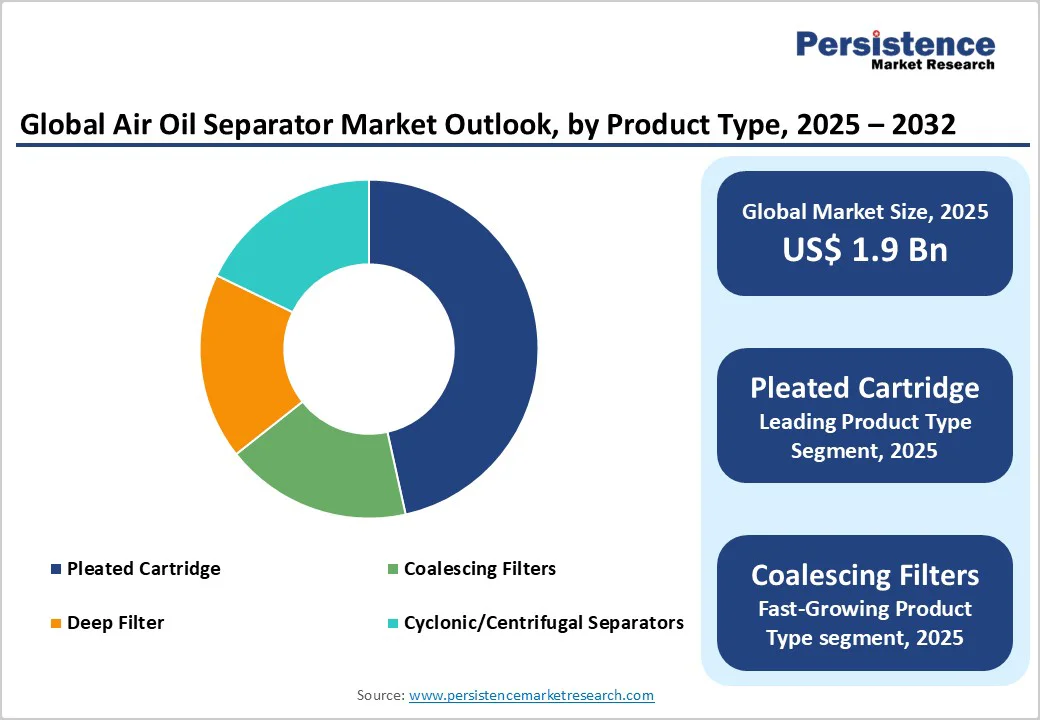

The global air oil separator market is expected to reach approximately US$1.9 billion in 2025. It is expected to reach about US$2.7 billion by 2032, growing at a CAGR of around 5.6% during the forecast period from 2025 to 2032, driven by increased use of oil-lubricated compressors in heavy industry, stricter emissions and discharge standards that boost demand for high-efficiency separation media, and greater investment in compressed-air reliability and energy efficiency programs.

| Key Insights | Details |

|---|---|

| Air Oil Separator Market Size (2025E) | US$1.9 Bn |

| Market Value Forecast (2032F) | US$2.7 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.3% |

Stricter emissions and wastewater discharge rules targeting fine oil aerosols in industrial effluents, alongside sector-specific standards for compressed-air purity in industries such as food, pharmaceuticals, and aerospace, are driving demand for upgraded separators and advanced filtration media.

The growing regulatory focus on oil-in-air and aqueous discharge has created a steady pull for high-efficiency coalescing and pleated separators. This trend supports mid-single-digit annual growth rates reported across multiple market trackers and underpins investment in improved performance internals and monitoring systems.

Oil-lubricated rotary screw and reciprocating compressors continue to dominate compressed-air systems in heavy manufacturing, petrochemicals, and utilities. Expansion in manufacturing capacity, LNG and petrochemical projects, and utility infrastructure, particularly across Asia Pacific, has led to a rise in installed compressor bases, generating recurring aftermarket demand for replacement separators and service kits. As capital projects grow and installed-base replacement cycles mature, analysts anticipate steady aftermarket revenue that will sustain the market’s growth through the early 2030s.

End users are increasingly focused on total cost of ownership. Separators that minimize oil carry-over reduce downstream maintenance, extend dryer and tool life, and decrease oil consumption, improving operational efficiency. Buyers are willing to pay premiums for pleated or coalescing separators with better particulate capture and lower pressure drop, supporting value growth even where unit volumes remain stable. Vendors are responding with innovations in filter media and integrated monitoring features that extend service intervals and lower lifecycle costs.

Low-cost manufacturers, particularly in Asia, supply basic carbon-steel and low-spec separators at aggressive prices, creating margin pressure for premium brands in mature markets. While high-efficiency and engineered filters retain value, commoditized replacement elements limit average selling-price growth in cost-sensitive sectors. Analysts note this as persistent downward pressure on pricing, especially among industrial users, where lifecycle cost arguments are less persuasive.

Advanced separator designs rely on specialty filter media and corrosion-resistant alloys that face raw-material price swings and unpredictable lead times. Applications requiring stainless or duplex materials for sour or marine service often encounter procurement delays, raising project risk and working-capital requirements. These supply-chain constraints create operational uncertainty and can defer capital orders in tight market conditions.

The global installed base of compressors generates predictable replacement cycles for separator elements and service kits. Aftermarket and retrofit services can yield margins 30-40% higher than new equipment sales. By targeting existing compressor fleets with predictive maintenance packages combining sensors, upgraded media, and service contracts, suppliers can unlock recurring revenue streams. Converting one-time buyers into service subscribers substantially increases customer lifetime value and is one of the most reliable routes to near-term profitability.

Integration of differential pressure sensors and IoT-enabled telemetry into separator housings enables predictive maintenance and enhances service differentiation. Early adopters can monetize data-driven service agreements that minimize downtime, particularly in sectors such as food, pharmaceuticals, and semiconductors where contamination risk carries high operational costs. Smart separators represent an emerging premium segment capable of commanding higher prices and expanding the market share of technologically advanced system suppliers.

Pleated cartridge-style air oil separators dominate the market with a 47.5% revenue share, favored for their balance of high filtration efficiency, long service life, and easy compatibility with rotary screw and reciprocating compressors. Using multilayer synthetic or cellulose media, they effectively remove submicron oil aerosols while maintaining low pressure drop.

Their leadership is reinforced by strong aftermarket demand, as most compressors require filter replacement every 2,000-4,000 operating hours. OEMs such as Atlas Copco, Ingersoll Rand, Kaeser Kompressoren, and Sullair standardize pleated cartridge designs for universal fit, ensuring consistent replacement volumes. Industries such as petrochemical, steel, and cement manufacturing rely on these separators to achieve clean, efficient air systems without compromising performance.

Coalescing and engineered media separators represent the fastest-growing segment, leveraging advanced fiberglass, nanofiber, and hydrophobic polymeric layers to remove fine oil mist below 0.1 µm. Their rise is driven by stricter ISO 8573-1 standards and contamination control requirements in sensitive industries such as pharmaceuticals, food, electronics, and aerospace.

Companies such as Rolls-Royce and Safran require oil-free compressed air for precision applications, accelerating adoption. Manufacturers, including Parker Hannifin, Donaldson, and MANN+HUMMEL, are investing in nanofiber and composite media innovations that extend service life and reduce differential pressure for high-efficiency performance.

The oil & gas and general manufacturing sectors account for over 40% of global air oil separator revenue, relying on large-capacity compressor systems for continuous operations, pneumatic controls, and safety-critical instrumentation. In oil and gas facilities, compressors support gas-lift, refinery, and LNG processes where oil carryover risks contamination and mechanical wear, making separator replacement essential in preventive maintenance.

General manufacturing-including metalworking, chemical processing, and power generation-also drives strong replacement demand. Automotive and tire plants in China and India, for example, use rotary screw compressors requiring regular separator servicing to maintain efficiency. OEMs such as Atlas Copco and ELGi Equipments benefit significantly from this industrial base through long-term contracts and certified service kits.

The automotive and aerospace sectors are growing rapidly due to rising precision and contamination-control requirements. EV battery plants and component suppliers such as Tesla, Hyundai Mobis, and Panasonic Energy use advanced oil-separation systems to ensure clean manufacturing environments.

In aerospace, stringent safety and environmental standards drive adoption of high-performance coalescing separators for engine and component testing by GE Aerospace, Airbus, and Pratt & Whitney. Increasing focus on sustainability, reliability, and maintenance optimization continues to support demand for high-efficiency, long-life air oil separators across both industries.

North America represents a mature yet high-value market, accounting for nearly 28-30% of global revenue in 2025. The region’s demand is concentrated in the U.S., followed by Canada and Mexico, where large-scale industrial air systems are integrated across oil & gas, food processing, and advanced manufacturing plants. The U.S. market remains driven by a combination of industrial modernization, oilfield recovery, and aftermarket maintenance activity.

Rising investment in shale gas compression stations and natural gas pipeline projects continues to generate steady consumption of air oil separators. The Energy Information Administration (EIA) projects over 1.2 million miles of U.S. natural gas pipelines in operation by 2030, reinforcing demand for compressor systems equipped with efficient separation technology.

The food & beverage sector, supported by compliance with FDA and ISO 8573 standards, also contributes to consistent replacement cycles for coalescing separators.

Leading regional manufacturers such as Ingersoll Rand, Parker Hannifin, Donaldson Company, and Gardner Denver dominate the North American landscape through integrated service networks and local production bases. In parallel, aftermarket suppliers are emphasizing sustainability-driven products featuring recyclable filter media and energy-efficient designs.

The regulatory emphasis on energy conservation and air quality under the U.S. Clean Air Act continues to incentivize industrial users to upgrade to low-loss, high-efficiency air separation systems. As a result, North America maintains a strong replacement-driven market structure with stable margins and high product standardization.

Europe remains a cornerstone for technological innovation and regulatory compliance. The region’s growth trajectory is strongly influenced by the EU’s Industrial Emissions Directive (IED) and increasing adoption of ISO 14001-certified compressor systems. Countries such as Germany, Italy, and the U.K. anchor regional demand due to their dense manufacturing clusters and automation-driven industrial bases.

Germany leads the regional market through its concentration of automotive, aerospace, and machinery production, where the demand for precision compressed air systems is critical. Leading OEMs such as Kaeser Kompressoren, MANN+HUMMEL, and Beko Technologies have developed advanced multi-stage separators integrating nanofiber and PTFE media to comply with strict particulate emission thresholds.

The ongoing transition to Industry 4.0 and decarbonization initiatives under the European Green Deal are reshaping compressor system design, with emphasis on lower energy losses and recoverable oil filtration. For example, industrial end-users in France and the Netherlands are investing in closed-loop separator systems to minimize waste and enhance lifecycle sustainability.

The European aftermarket remains highly competitive but fragmented, with regional service providers offering refurbishment and OEM-certified replacement kits. As environmental regulation tightens and industrial plants move toward predictive maintenance, Europe is poised to remain a key innovation hub for next-generation air separation technologies.

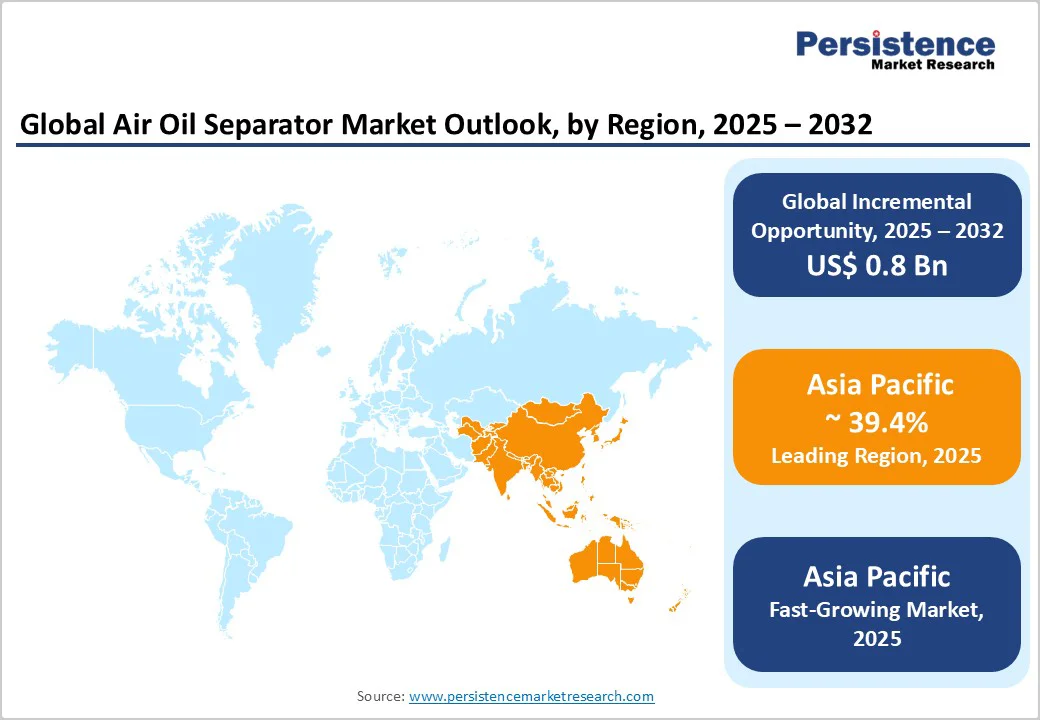

Asia Pacific dominates the global air oil separator landscape, accounting for more than 39.4% of global revenue in 2025, and is expected to be the fastest-growing regional market with a projected CAGR above 6.8% through 2032. This leadership is attributed to rapid industrialization, expanding manufacturing output, and rising investment in oil & gas infrastructure across China, India, Japan, and Southeast Asia.

China remains the largest contributor, driven by its extensive base of rotary screw compressor installations across steel, electronics, and automotive manufacturing sectors. The Chinese government’s focus on industrial efficiency under the 14th Five-Year Plan is catalyzing upgrades from basic filtration units to high-efficiency coalescing systems.

India is witnessing growing adoption of air oil separators in textile, automotive, and construction materials production, supported by its rapidly expanding industrial compressor fleet and localization of OEM manufacturing by players such as ELGi Equipments and Atlas Copco India.

In Southeast Asia, industrialization in Thailand, Indonesia, and Vietnam is fueling the establishment of new compressor assembly and service facilities, supporting both OEM and aftermarket demand. Regional players are also benefiting from government-led incentives promoting clean manufacturing and energy efficiency.

Global brands such as Atlas Copco, Sullair, and Hitachi Industrial Equipment are strengthening their presence through regional distribution partnerships and localized production hubs.

The region’s competitive advantage lies in its cost-effective manufacturing base, favorable regulatory outlook, and strong export-oriented industrial structure. As sustainability and energy efficiency become central to plant optimization strategies, Asia Pacific is positioned to remain the world’s most dynamic growth frontier for air oil separator manufacturers.

The global air oil separator market is moderately consolidated. Global compressor and filtration OEMs hold substantial OEM fitment and branded aftermarket shares, while regional producers dominate the lower-cost replacement segment.

The top five global players, including Donaldson, Atlas Copco, Ingersoll Rand, Parker-Hannifin, and Alfa Laval, account for a significant but not monopolistic portion of total revenue. Competition centers on proprietary media technology, OEM integration, and service network strength.

Leading firms emphasize product premiumization, predictive maintenance services, regional production localization, and distribution network consolidation. Differentiation increasingly depends on validated performance data, digital service capability, and the ability to integrate hardware with telemetry and subscription-based service contracts.

The air oil separator market size is valued at US$1.9 Billion in 2025.

By 2032, the market is projected to reach US$2.7 Billion, reflecting sustained industrial expansion and regulatory emphasis on clean air standards.

Key trends include the shift toward high-efficiency coalescing filters, the adoption of nanofiber and composite filtration media, increased aftermarket replacement activity, and localized production expansion in Asia Pacific.

By product type, pleated cartridge separators dominate with 47.5% revenue share, while coalescing and engineered media separators are the fastest-growing due to their superior fine-particle capture efficiency and compliance with stricter air purity norms.

The air oil separator market is expected to grow at a CAGR of 5.6% between 2025 and 2032.

Major players include Atlas Copco AB, Ingersoll Rand Inc., Parker Hannifin Corporation, MANN+HUMMEL Group, and Donaldson Company, Inc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-Use Industry

By Flow

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author