ID: PMRREP35780| 198 Pages | 27 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

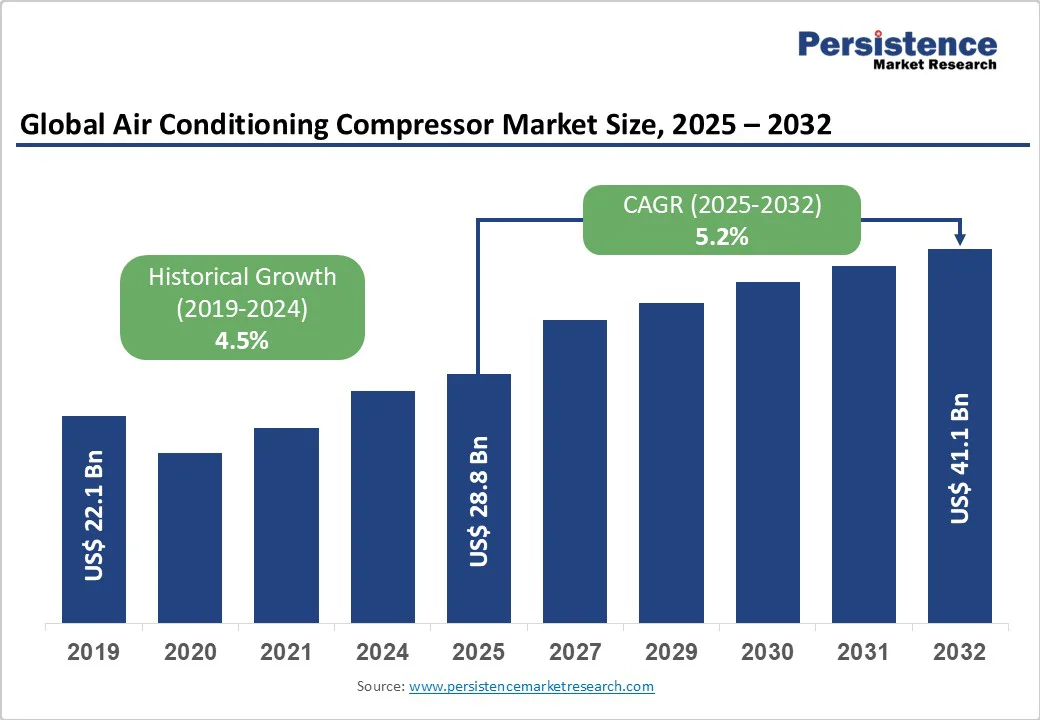

The global air conditioning compressor market is expected to reach US$28.8 billion in 2025. It is projected to reach US$41.1 billion by 2032, growing at a CAGR of 5.2% during the forecast period 2025 - 2032.

Market expansion is primarily driven by rising average global temperatures, rampant urbanization, and stringent energy-efficiency regulations implemented across major economies.

Government initiatives promoting the adoption of environmentally friendly refrigerants and rising investments in data center cooling infrastructure are accelerating market growth and technological innovation.

| Key Insights | Details |

|---|---|

| Air Conditioning Compressor Market Size (2025E) | US$28.8 Bn |

| Market Value Forecast (2032F) | US$41.1 Bn |

| Projected Growth CAGR(2025-2032) | 5.2% |

| Historical Market Growth (2019-2024) | 4.5% |

Stringent energy-efficiency regulations are shaping the growth of the air conditioning compressor market. For example, the U.S. Environmental Protection Agency (EPA)’s 2025 mandate requires higher SEER2 ratings—minimum 14.0 SEER in Northern states and 15.0 SEER in Southern regions—pushing manufacturers to develop advanced compressor systems with optimized energy performance.

In Europe, the F-gas regulation is accelerating the transition to low-GWP refrigerants, with R32 adoption growing rapidly. These evolving standards are compelling compressor manufacturers to innovate designs that balance superior efficiency with environmental compliance.

The unprecedented rate of urbanization and infrastructure expansion is significantly boosting the demand for air conditioning compressors worldwide. Rapid construction growth in the Asia Pacific, led by China and India, is generating large-scale installations across residential complexes, commercial buildings, and public infrastructure.

Similarly, commercial real estate projects, including malls and office spaces, are increasingly adopting variable refrigerant flow (VRF) and centralized HVAC systems requiring advanced compressor technologies for multi-zone climate control. Simultaneously, the expansion of data centers supporting AI, IoT, and cloud technologies is driving the need for high-capacity cooling compressors.

The adoption of advanced compressor technologies, such as inverter and variable-speed systems, involves significant upfront investment. These systems rely on precision engineering, complex electronic controls, and high-quality materials, leading to higher unit prices than conventional fixed-speed models.

Furthermore, installing VRF and smart HVAC systems requires skilled technicians and longer commissioning times, thereby increasing project costs. For small and medium-scale commercial users, these higher capital and maintenance costs pose major barriers, limiting large-scale adoption despite long-term efficiency and energy-saving benefits.

Adding to this is ongoing global supply chain instability, which continues to challenge compressor manufacturing operations. Volatile prices of essential raw materials such as copper, aluminum, and steel have significantly increased production costs. At the same time, shortages of semiconductors and electronic components have disrupted inverter compressor output and delayed deliveries.

Geopolitical tensions, trade restrictions, and fluctuating logistics costs further compound these supply chain pressures, forcing manufacturers to diversify their supplier base or relocate production facilities. Such adjustments often lead to increased operational expenses and reduced profit margins.

The accelerating adoption of electric and hybrid vehicles is strengthening the demand for advanced HVAC compressors specifically engineered for EVs. Unlike conventional systems, EV air conditioning compressors must function independently of engine power, ensuring optimal thermal comfort while conserving battery life.

The market for automotive electric HVAC compressors is projected to expand rapidly, driven by growing EV production and stricter energy-efficiency standards. Integration of inverter technology, low-noise design, and improved cooling performance tailored for EV thermal management offers significant competitive advantages and market expansion opportunities.

The surge in global data center construction, driven by AI, cloud services, and blockchain computing, has intensified the need for high-reliability cooling systems. Compressors used in these facilities must provide continuous, stable performance and support rapid restart after power interruptions. Technologies such as Daikin’s RapidRestore exemplify the focus on operational resilience and uptime efficiency.

The evolution toward liquid and hybrid cooling systems for high-density computing environments is also reshaping compressor design priorities. Manufacturers developing compressors compatible with direct-to-chip cooling, free-cooling integration, and smart, IoT-based monitoring systems stand to gain substantial opportunities in this high-performance, mission-critical market.

Rotary compressors are poised to dominate in 2025, accounting for approximately 57% of the air conditioning compressor market, mainly due to their compact design and high energy efficiency. These compressors are particularly favored in residential and light commercial applications, where space constraints and reduced energy consumption are critical.

Utilizing eccentric roller motion within cylindrical chambers, rotary compressors provide continuous compression, resulting in smoother operation with lower noise and vibration compared to reciprocating models.

Major manufacturers, including Daikin, LG, and Mitsubishi Electric, are heavily investing in rotary compressors with integrated inverter technology. The growing penetration of split AC units in emerging markets is likely to drive adoption further, offering an optimal performance-to-cost ratio for residential cooling.

R32 refrigerant is emerging as the leading choice for air conditioning compressors, with an estimated 31% market share in 2025. Its low global warming potential (GWP 675) and superior thermodynamic performance offer a 7.3% improvement in energy efficiency over R410A systems while remaining compatible with existing designs.

Markets in Europe have led R32 adoption due to F-gas regulations, with market share exceeding 80% in recent years. Major HVAC manufacturers such as Daikin, LG, and Midea have standardized R32 across product lines, leveraging its balance of environmental compliance, energy efficiency, and safety for both residential and commercial applications.

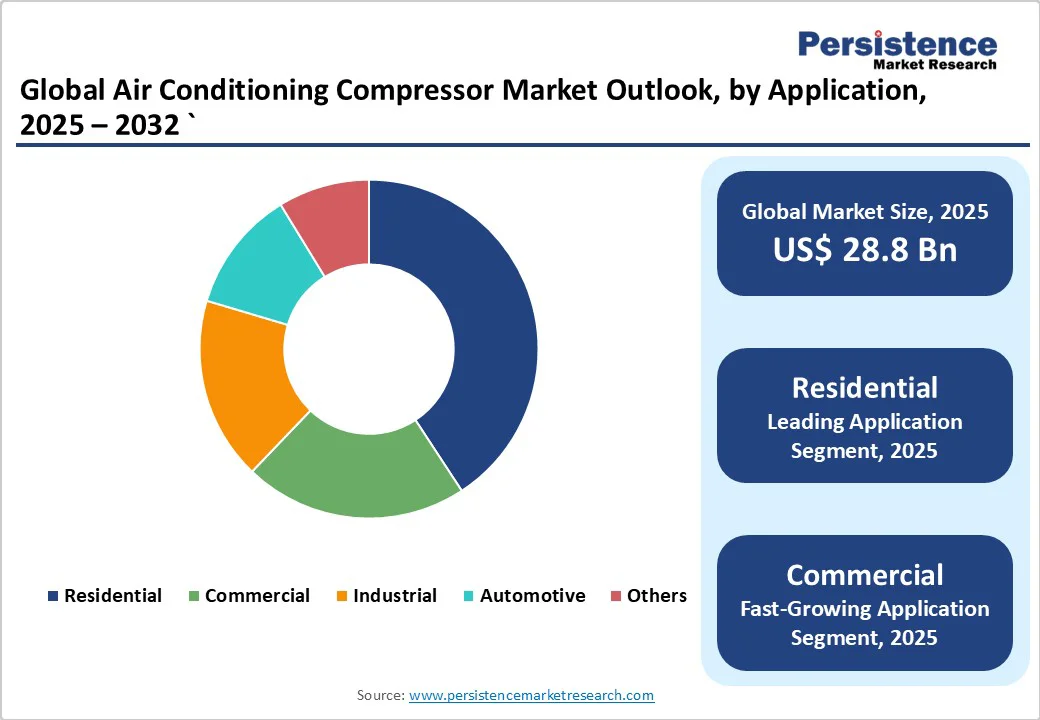

Residential applications are anticipated to dominate the air conditioning compressor market with about 42% share in 2025, fueled by global housing expansion and improving living standards in emerging economies. The segment benefits from rising consumer preference for energy-efficient split ACs that offer comfort and lower operating costs.

Inverter compressors have accelerated residential adoption by delivering up to 35% energy savings over fixed-speed units while maintaining precise temperature control. Smart home integration trends, including Wi-Fi connectivity and AI-driven optimization, further enhance demand. Government incentive programs promoting energy-efficient installations and the replacement of outdated systems also support sustained growth in the residential segment.

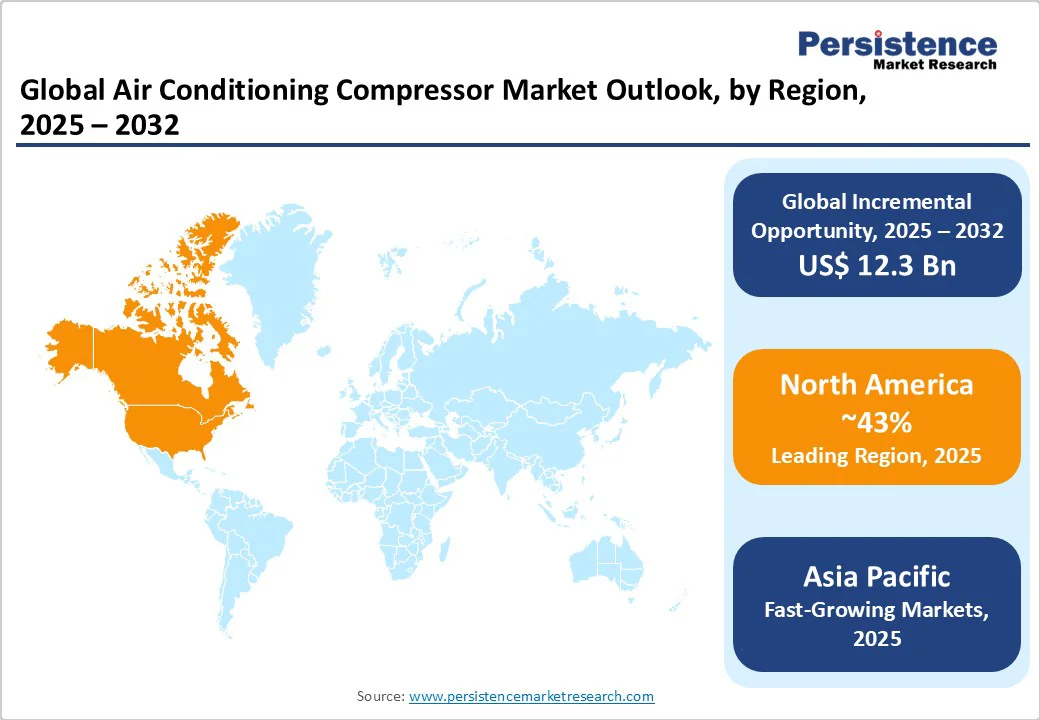

Asia Pacific is expected to dominate the air conditioning compressor market with approximately 49.6% market share in 2025, driven by rapid urbanization, industrialization, and infrastructure development in China, India, and Southeast Asia. Rising middle-class populations and higher comfort expectations are further boosting demand for residential and commercial HVAC systems.

China is the largest manufacturing hub, producing over 200 million units annually. Japan and South Korea lead technological innovation in inverter compressors, with manufacturers developing AI-driven smart HVAC systems. Strong supply chains, skilled labor, and supportive government policies are accelerating the adoption of low-GWP refrigerants and high-efficiency compressors across the region.

North America holds a formidable position in the air conditioning compressor market, with the United States accounting for US$126.26 billion in HVAC revenue in 2024. The regional market is shaped by EPA 2025 regulations mandating higher energy-efficiency standards and the phase-out of high-GWP refrigerants, driving equipment replacement cycles across both residential and commercial sectors.

Innovation hubs are fostering the development of variable-speed and digital compressor technologies that optimize energy use. Expanding data center infrastructure for cloud computing and AI is creating demand for high-capacity cooling solutions, while regulatory incentives promoting electrification and decarbonization encourage adoption of heat pump systems requiring sophisticated compressors for year-round efficiency.

Europe is witnessing accelerated adoption of low-GWP refrigerants and energy-efficient compressor technologies, driven by strict F-gas regulations and carbon reduction targets. The HVAC market was valued at US$64.33 billion in 2023, with government incentives supporting energy-efficient upgrades across residential and commercial sectors.

Germany, France, and the U.K. are leading the transition toward natural refrigerants, with R290 gaining traction in residential heat pumps. Sustainability initiatives, heat recovery, and energy optimization, combined with construction and renovation programs, are driving demand for advanced HVAC compressors that meet efficiency and environmental standards throughout the forecast period.

The global air conditioning compressor market is moderately concentrated, with leading players collectively accounting for around 80% of the market share through strong brand presence and technological expertise. This concentration ensures product quality, reliability, and consistent performance across regions, but also poses pricing challenges for smaller competitors seeking market entry.

Key market strategies include technological innovation, focusing on inverter-driven compressors, smart connectivity, and compatibility with low-GWP refrigerants. Companies are also pursuing strategic expansions, including mergers and acquisitions, to strengthen market positioning and broaden product portfolios. These initiatives aim to enhance competitiveness, capture emerging opportunities, and address evolving regulatory and energy efficiency requirements.

The global air conditioning compressor market is projected to reach US$ 28.8 billion in 2025.

Key demand drivers include rising global temperatures, stringent energy efficiency regulations such as EPA's SEER2 standards, accelerating urbanization in Asia Pacific markets, and expansion of data center infrastructure requiring specialized cooling solutions.

The market is poised to witness a CAGR of 5.2% from 2025 to 2032.

Data center cooling applications present the largest growth opportunity, with specialized demand for high-capacity compressor systems supporting AI, cloud computing, and cryptocurrency operations requiring continuous operation and rapid restart capabilities.

Leading market players include Daikin Industries, Copeland (formerly Emerson Electric), Mitsubishi Electric, LG Electronics, and Danfoss, among others.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Refrigerant Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author