ID: PMRREP23536| 200 Pages | 29 Dec 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

The global data integration software market size is likely to be valued at US$ 6.8 billion in 2026 and projected to reach US$ 16.1 billion by 2033, growing at a CAGR of 13.1% between 2026 and 2033.

Market expansion is propelled by enterprises managing increasingly complex multi-cloud and hybrid environments, escalating demand for real-time data synchronization across disparate systems, and widespread organizational adoption of AI-powered integration solutions enabling intelligent automation and governance. Supporting evidence includes 89% of enterprises already employing multi-cloud strategies, organizations adopting hybrid clouds and AI-driven data integration tools, and substantial government digital transformation initiatives allocating billions globally, establishing data integration software as foundational infrastructure for competitive enterprise positioning in the AI-driven digital economy.

| Key Insights | Details |

|---|---|

| Data Integration Software Market Size (2026E) | US$ 6.8 Bn |

| Market Value Forecast (2033F) | US$ 16.1 Bn |

| Projected Growth CAGR (2026 - 2033) | 13.1% |

| Historical Market Growth (2020 - 2025) | 11.5% |

Enterprise data environments have fundamentally transformed with organizations managing average 897 applications across multiple clouds and on-premise systems simultaneously, creating unprecedented integration complexity. Organizations increasingly require sophisticated data integration platforms connecting applications, data files, and business partners across cloud and on-premises systems to maintain unified operational visibility and data consistency. The complexity of managing data across AWS, Azure, Google Cloud, and on-premise infrastructure simultaneously drives demand for comprehensive integration solutions providing cross-platform orchestration capabilities. Large enterprises allocate 2-3% of annual revenue to integration and enterprise systems, with mid-market organizations allocating 3-5%, demonstrating financial commitment to addressing integration complexity. This complexity-driven demand creates sustained market expansion through 2033 as enterprises continue multi-cloud adoption and require increasingly sophisticated integration infrastructure.

Organizations are transitioning from batch-based integration processes to real-time data synchronization architectures supporting continuous business intelligence and predictive decision-making. 60% of organizations are projected to adopt AI-driven data integration tools by 2026, compared to just 20% in 2022, indicating accelerating AI adoption in integration workflows. Real-time data integration enables enterprises to detect market trends 30% faster, automate compliance monitoring, and implement predictive analytics at scale across distributed operations. Companies implementing advanced data integration report 171-295% ROI with average payback periods of 6-9 months, establishing compelling financial justification for integration investments. The convergence of real-time requirements, AI adoption, and documented ROI advantages creates sustained market growth through 2033 as enterprises prioritize data-driven decision-making capabilities.

Data integration platform deployment requires substantial technical expertise and specialized integration skills that remain scarce in labor markets. Data scientist employment is growing 36% from 2023 to 2033, yet this growth fails to satisfy organizational demand, with 70% of large enterprises outsourcing analytics services to address skills shortages. Organizations struggle to manage 897 applications on average, with only 29% fully integrated, indicating substantial gaps between integration aspirations and implementation capabilities. Integration projects face extended timelines and cost overruns when skilled resources are unavailable, with organizations requiring specialized knowledge in cloud architectures, API management, data governance, and compliance frameworks. SMBs particularly struggle with resource constraints, facing disproportionate implementation burden when lacking dedicated integration expertise. These skills constraints create barriers to rapid adoption, particularly for mid-market and smaller organizations unable to attract specialized integration talent, thereby limiting market penetration in cost-sensitive segments.

Data integration platforms face persistent regulatory complexity from evolving privacy frameworks and industry-specific compliance mandates across diverse jurisdictions. 75% of countries now enforce some form of data residency law, creating patchwork compliance requirements and geographic constraints on data movement and storage. Regulated sectors including healthcare requiring HIPAA compliance, financial services requiring PCI-DSS and SOX compliance, and government contractors requiring FedRAMP and FISMA standards demand robust integration platforms with advanced governance, encryption, and audit capabilities. EU regulations including DORA (Digital Operational Resilience Act) and UK Data Protection and Digital Information Bill introduce stricter incident response and breach notification requirements, increasing platform complexity and implementation costs. Integration platforms must provide comprehensive data classification, automated compliance monitoring, centralized logging, and data residency enforcement capabilities addressing regulatory requirements across multiple jurisdictions simultaneously. These compliance complexities increase vendor development costs and platform pricing, thereby limiting adoption among price-sensitive customers and slowing market growth in regulated industries.

Low-code and no-code integration platforms represent substantial growth opportunity by enabling business users and citizen integrators to develop integrations without specialized programming expertise. Dell Boomi processes over 50 billion transactions annually and reduces development time by 70%, demonstrating platform impact on operational efficiency. Platforms featuring AI-driven schema detection reducing manual mapping time by up to 45%, intelligent automation capabilities, and pre-built connector libraries are democratizing integration access. 90% of SMBs prefer all-in-one platforms rather than multiple specialized tools, creating an opportunity for vendors developing integrated low-code solutions addressing comprehensive integration requirements. The convergence of AI automation, low-code interfaces, and comprehensive connector libraries enables smaller organizations to deploy enterprise-grade integration without substantial IT investment, representing a substantial addressable market expansion opportunity through 2033. eZintegrations and similar platforms demonstrating 50% efficiency improvements through automated integration mapping exemplify this opportunity’s market potential.

Manufacturing sector digital transformation initiatives are creating substantial demand for advanced data integration solutions connecting IoT sensors, production systems, legacy manufacturing equipment, and real-time analytics platforms. The manufacturing segment is anticipated to grow at the highest CAGR, driven by IoT and smart manufacturing technology adoption, enabling real-time data capture and analysis. Manufacturers utilizing AI-driven predictive maintenance extend equipment lifecycle and enhance production efficiency through data integration from distributed sensors and systems.

Supply chain visibility requirements across manufacturing networks, sustainability compliance mandates, and labor shortage responses drive organizational investment in integration solutions providing real-time operational transparency. Retailers and manufacturers utilize AI-powered integration, syncing inventory and POS data in real-time to manage supply chains efficiently, reduce stock-outs, and optimize inventory turns. Government manufacturing initiatives, including China’s smart manufacturing investments and Germany’s Industry 4.0 programs, create structured procurement opportunities for data integration platform vendors. This manufacturing-driven demand represents a substantial growth opportunity through 2033 as production systems increasingly require real-time integration with analytics, predictive systems, and supply chain platforms.

On-premise deployment represents the leading segment, commanding approximately 62% market share in 2025, particularly dominant among regulated industries and enterprises prioritizing data security and compliance. Enterprises in healthcare, government, BFSI, and manufacturing sectors prioritize hosting critical data platforms within internal infrastructure to satisfy stringent regulatory requirements, including HIPAA compliance for healthcare, GDPR compliance for European operations, and industry-specific data governance mandates. On-premise deployments provide organizations with complete data control, compliance auditability, and integration with legacy systems that remain prevalent across established enterprises.

Organizations allocate 2-3% of annual revenue to integration systems, including on-premise platforms, demonstrating substantial budget availability for on-premise solutions. The on-premise segment captures dominant market share due to security prioritization among large enterprises managing sensitive data, regulatory compliance requirements, and integration needs with legacy infrastructure. However, the segment faces growth pressure from cloud-based alternatives offering operational expense models and scalability advantages, positioning on-premise as mature but declining segment through the 2033 forecast period.

Manufacturing represents the fastest-growing end-user segment with projected CAGR of 16.8% from 2026 - 2033, substantially exceeding overall market growth rates and reflecting sector-specific digital transformation imperatives. Manufacturing organizations increasingly integrate IoT sensors, production systems, supply chain platforms, and analytics tools to achieve real-time operational visibility. AI-driven predictive maintenance integrated through data platforms extends equipment lifecycle, reduces unplanned downtime, and optimizes production efficiency across manufacturing networks. Smart manufacturing initiatives require seamless data integration connecting production floor equipment, resource planning systems, quality management platforms, and supply chain visibility tools. Government initiatives, including China’s smart manufacturing investments and India’s Production-Linked Incentive Scheme create structured procurement opportunities supporting manufacturing technology adoption. Manufacturing sector emphasis on supply chain resilience, sustainability compliance, and labor efficiency creates sustained demand for advanced integration solutions connecting distributed systems. The convergence of IoT adoption, AI-driven analytics requirements, and government manufacturing programs establishes Manufacturing as the fastest-growing segment capturing accelerating organizational investment through the 2033 forecast period.

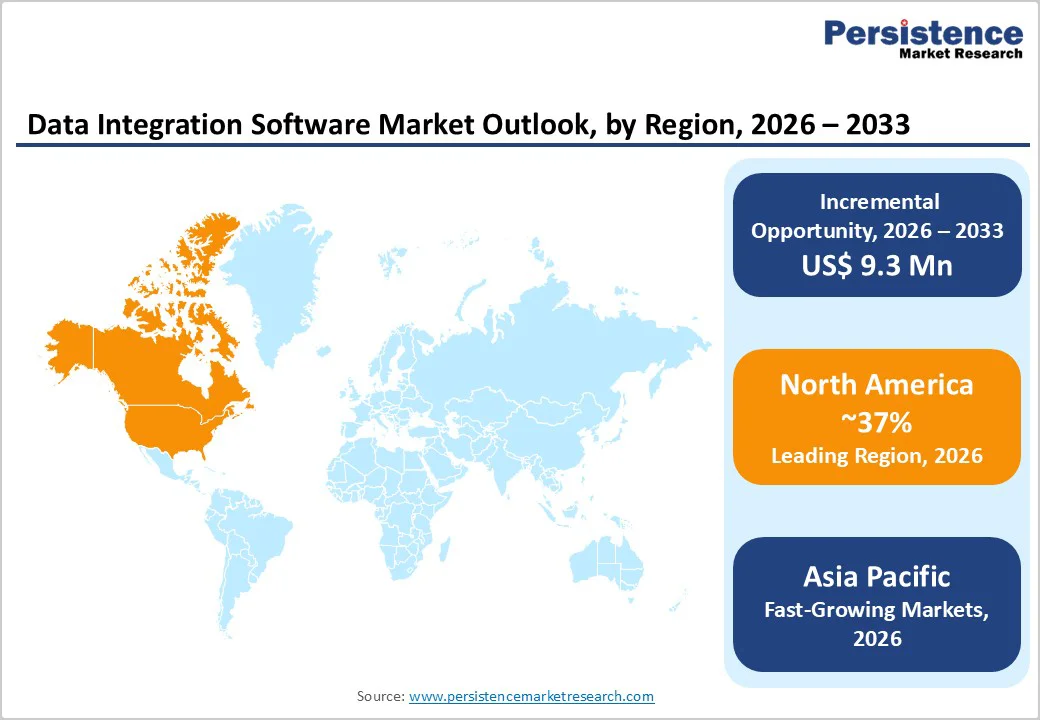

North America maintains dominant regional position, commanding approximately 37% global market share in 2025, driven by early technology adoption, extensive cloud infrastructure deployment, and strong presence of major data integration platform vendors. North America generated over US$ 2.5 Bn revenue in 2025, with the U.S. data integration market growing at a CAGR of 12% till 2033. The region benefits from a mature technology ecosystem with over 90% of Fortune 500 companies having adopted multi-cloud or hybrid data strategies, creating sustained demand for integration platforms managing interoperability across AWS, Azure, and on-premise systems.

North American organizations benefit from a substantial venture capital ecosystem supporting data integration startups and platforms, fostering continuous innovation in low-code solutions, AI automation, and compliance capabilities. The region hosts major platform vendors, including Informatica, MuleSoft, Talend, Denodo, and SnapLogic, maintaining competitive innovation driving regional technology leadership. Government digital transformation initiatives, including smart city programs and federal modernization efforts, create procurement opportunities supporting integration platform adoption across both public and private sectors. The region’s established BFSI sector, advanced manufacturing capabilities, and IT and Telecom industry presence drive continuous integration complexity and platform investment through 2033.

Europe represents fastest-growing regional market with projected CAGR of 15.2% from 2026 - 2033, driven by coordinated regulatory harmonization efforts, government digitalization programs, and emphasis on data sovereignty and privacy compliance. German manufacturing sector strength and UK financial services industry presence drive substantial integration platform adoption, addressing complex multi-system requirements. EU regulations including GDPR, DORA (Digital Operational Resilience Act), and emerging privacy frameworks, create compliance-driven demand for integration platforms offering robust data governance, encryption, and audit capabilities. European enterprises increasingly adopt hybrid integration solutions connecting applications, data files, and business partners across cloud and on-premises systems to meet data compliance requirements while maintaining operational efficiency.

Government initiatives across France, Germany, Spain, and the United Kingdom allocate substantial funding for business digitalization programs, including integration technology adoption. GDPR compliance requirements and evolving European data protection regulations drive organizational investment in integration platforms providing comprehensive data residency enforcement, automated compliance monitoring, and governance capabilities. European emphasis on regulatory compliance, coupled with strong manufacturing and financial services sectors requiring sophisticated integration orchestration, positions Europe as the fastest-growing regional market, sustaining expansion through the forecast period.

Asia Pacific emerges as fastest-growing regional market globally, projected to achieve CAGR of 15.6% from 2026 - 2033, driven by rapid economic development, digital transformation acceleration, and substantial government digitalization investment programs. China dominates regional market with massive data integration requirements across manufacturing, e-commerce, and financial sectors, supported by aggressive government investments in digital infrastructure. India’s Digital India initiative, allocating Rs 14,903 crores for 2024-25, specifically targets business process digitalization, including integration technology adoption, creating structured procurement demand.

Japan’s Society 5.0 program and South Korea’s Ministry of SMEs are providing subsidies for small business digitalization drive regional technology adoption. Asia Pacific e-commerce sector growth creates sustained demand for integration solutions connecting retail, supply chain, payment, and analytics platforms. Manufacturing sector emphasis across China, India, and ASEAN nations on smart manufacturing, Industry 4.0 adoption, and supply chain modernization drives organizational investment in advanced data integration platforms. The region’s emphasis on manufacturing digitalization, emerging market competitiveness, and government-backed technology adoption positions Asia Pacific as the primary growth driver sustaining global market expansion.

The data integration software market exhibits a moderately consolidated structure, comprising established enterprise software vendors, specialized iPaaS platforms, and emerging AI-driven startups competing across diverse segments. Leading players leverage comprehensive feature sets, extensive customer networks, and platform ecosystems to maintain market positioning. Strategic acquisitions have accelerated consolidation, signaling the critical role of data integration within enterprise platforms. Vendors pursue differentiated business strategies that balance innovation investment with profitability, emphasizing AI-driven automation, low-code interfaces, governance, and real-time integration capabilities.

Cloud-based SaaS delivery models, standardized APIs, and automated compliance increasingly shape competitive dynamics, compelling participants to offer frictionless, scalable, and secure integration solutions. Platforms also aim to expand ecosystems through mergers and acquisitions, enhancing scale advantages and end-to-end functionality. Overall, competition is driven by the ability to deliver highly automated, interoperable, and governance-compliant integration platforms, with differentiation achieved through technological innovation, platform extensibility, and seamless enterprise adoption.

The market is projected to reach US$16.1 Bn by 2033, growing at a CAGR of 13.1% from 2026.

Key drivers include multi-cloud complexity, widespread AI adoption, and government digitalization programs funding integration initiatives.

Manufacturing is the fastest-growing segment with a projected 16.8% CAGR through 2032.

North America leads with 37% market share, while Asia Pacific is the fastest-growing region at a projected 15.6% CAGR.

AI-powered low-code integration platforms represent the primary growth opportunity, enabling democratized integration and broad adoption among SMBs and mid-market organizations.

Leading vendors include Salesforce-Informatica, MuleSoft, Talend, Dell Boomi, SnapLogic, Denodo, TIBCO Software, Precisely, and Microsoft Azure Data Factory.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: Units Deployed |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Deployment

By End-user

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author