ID: PMRREP33622| 189 Pages | 4 Nov 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

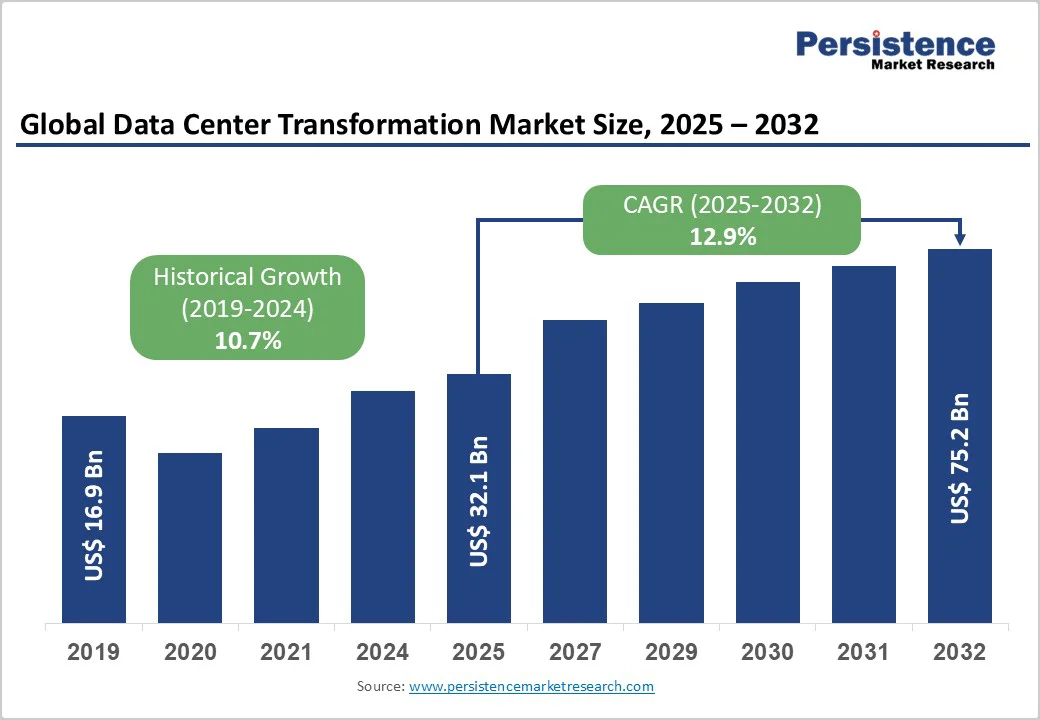

The global data center transformation market size is projected to rise from US$32.1 billion in 2025 and is projected to reach US$75.2 billion by 2032, growing at a CAGR of 12.9% during the forecast period from 2025 to 2032. Rapid cloud adoption, AI workloads, edge computing, and IoT data growth are driving a fundamental shift in global digital infrastructure. Organizations are replacing legacy systems with agile, scalable, and hybrid environments that boost automation, sustainability, and real-time processing. Growing use of software-defined data centers and AI-driven orchestration highlights the market’s pivotal role in powering next-generation digital ecosystems.

| Key Insights | Details |

|---|---|

|

Data Center Transformation Market Size (2025E) |

US$32.1 Bn |

|

Market Value Forecast (2032F) |

US$75.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

12.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

10.7% |

The rising sophistication of cyberattacks and the enforcement of stricter data protection regulations have made data center security transformation a strategic necessity. According to the FBI’s 2024 Internet Crime Report, over 859,000 cybercrime complaints were filed, with reported losses surpassing $16 billion, a 33% rise from 2023, driven largely by phishing, extortion, and cryptocurrency-related investment fraud exceeding $6.5 billion.

Legacy data centers lack the resilience to counter advanced threats such as ransomware and DDoS attacks, pushing organizations toward zero-trust architectures, AI-based threat detection, and multi-layered encryption. With average downtime costs now reaching $9,000 per minute, compliance with frameworks like GDPR, HIPAA, and ISO standards underscores the urgent need for secure, continuously monitored data center environments. Therefore, the data center security market is projected to surpass US$ 52 billion, reflecting a CAGR of 14.2% by 2032.

The explosive expansion of AI and machine learning is the foremost catalyst driving global data center transformation, with GPU-accelerated servers pushing rack power densities up to 100–120 kW, far beyond the 5–10 kW typical of conventional systems. Global data center electricity consumption is projected to surpass 945 TWh by 2030, largely due to AI-driven workloads, while training large-scale models like GPT-4 can require 30 MW of power. To meet these demands, operators are overhauling infrastructure with 800-volt power architectures, advanced liquid cooling, and high-bandwidth interconnects for AI cluster data exchange. The AI surge is propelling over US$ 5 trillion in cumulative capex toward next-generation data centers by 2030.

The pervasive adoption of cloud computing and hybrid IT strategies is reshaping traditional data centers into flexible, interconnected ecosystems, with 94% of enterprises already using cloud services and over 80% of large organizations expected to implement hybrid models by 2027. Multi-cloud adoption exceeding 80% enables workload optimization and vendor flexibility, while global public cloud spending is projected to surpass $700 billion in 2025. This shift demands SDN, virtualization, and programmable infrastructure to ensure workload mobility and unified management across hybrid ecosystems. As 75% of enterprise data will be generated and processed outside centralized facilities, integrating edge computing is becoming essential for performance, scalability, and compliance.

High capital investment requirements remain a key challenge, particularly for SMEs modernizing legacy infrastructure. Construction costs range from $5 million to over $200 million, with Tier III facilities averaging US $7–10 million per MW and AI-optimized designs exceeding US $12 million per MW, typically requiring 18–30 months for completion. Between 2022–2024, inflation, supply chain disruptions, and labor shortages sharply higher costs, while financing rates added pressure. Organizations face ongoing operational costs encompassing power consumption accounting for up to 30-40% of total expenses, cooling infrastructure, hardware refresh every 4–6 years, and skilled staff, further straining budgets. The adoption of liquid cooling, high-density computing, and AI-optimized systems also demands major upgrades in plumbing, power, and facility design, elevating total transformation costs.

The global sustainability push is creating major opportunities through green energy adoption and carbon neutrality. Data centers, currently consuming 1–1.5% of global electricity and emitting 0.5% of CO2, risk doubling these figures within five years without intervention. European initiatives such as the EU Green Deal and Climate Neutral Data Center Pact drive net-zero targets, while AI-driven energy management reduces cooling energy by 30–40% and adiabatic free cooling saves 70% over traditional systems. Waste heat recovery enables revenue via district heating, and on-site renewables, solar, wind, and hydrogen fuel cells reduce grid dependency, positioning operators as leaders in sustainable digital infrastructure.

Network modernization, powered by high-bandwidth fabrics, advanced optics, and AI-grade interconnects, is reshaping the market by addressing latency and throughput limitations in traditional infrastructures. These technologies enable faster server-to-storage communication, GPU interconnect acceleration for AI workloads, and energy-efficient long-distance data transfer. According to OECD, fibre-based broadband (FTTP/FTTH) reached 47% of total subscriptions across OECD countries by end-2024, up from 28% in 2019, while global data-centre bandwidth rose nearly 300% from 2020 to 2024, reflecting hyperscale and AI-driven expansion. Such advances fuel investments in SDN-enabled automation and high-performance network architectures.

Hardware is expected to account for more than 52% share in 2025, driven by the need to modernize physical infrastructure for advanced computational workloads. Data center servers alone are expected to account for over 30%, led by GPU-accelerated systems for AI, high-density computing, and terabit-scale networking hardware. The expansion of edge and hyperscale data centers, along with hybrid and multi-cloud adoption, is fueling demand for robust, low-latency, and scalable hardware to ensure performance and reliability.

Services are expected to grow at a significant rate due to the increasing need for expert guidance in modernization, migration, and hybrid cloud integration. Enterprises are seeking managed, consulting, and integration services to optimize workloads, improve scalability, and ensure seamless digital transformation. The rising complexity of multi-cloud environments and cybersecurity compliance is driving reliance on specialized service providers. The demand for AI-driven automation, predictive maintenance, and sustainability consulting is expanding service opportunities. As organizations focus on agility and efficiency, service-based models are becoming critical to long-term data center evolution.

Tier-3 data centers dominate the market with over 38% market share in 2025, reflecting enterprise preferences for balanced redundancy, availability, and cost-effectiveness. Tier-3 facilities offer N+1 redundancy, providing concurrently maintainable site infrastructure, approximately 99.982% availability with 1.6 hours of annual downtime, and the capability to perform maintenance without operational disruption. These characteristics align with enterprise requirements for robust digital infrastructure supporting mission-critical applications while maintaining reasonable capital and operational expenditure profiles.

Tier-4 is emerging as the fastest-growing segment with a CAGR of 15.2%, driven by demand for fault-tolerant infrastructure from hyperscalers, financial services institutions, and government agencies requiring maximum uptime guarantees. Tier-4 data centers deliver 2N+1 redundancy with fully redundant capacity components and distribution paths, 99.995% availability with only 0.4 hours annual downtime, and complete fault tolerance enabling infrastructure component failure without service disruption. Organizations operating 24/7 services where downtime translates to immediate revenue loss and reputational damage are increasingly investing in Tier-4 infrastructure despite higher capital requirements.

Enterprise data centers are expected to account for more than 26% share in 2025 due to enterprises’ urgent need to modernize legacy infrastructure to support AI, analytics, and hybrid cloud workloads. These organizations require scalable, energy-efficient systems to handle exponential data growth and ensure business continuity. The rising demand for high-density computing, automation, and secure private cloud environments drives investments in upgrading enterprise-owned facilities. Compliance with data sovereignty and regulatory mandates encourages companies to retain and modernize on-premises infrastructure.

Cloud data centers are expected to grow at the highest rate due to the rising need for scalable, on-demand infrastructure that supports AI, analytics, and IoT workloads. Enterprises are shifting from legacy systems to cloud environments to enhance agility, reduce CAPEX, and improve time-to-market. Remote workforce expansion and edge-cloud integration are driving demand for distributed, resilient cloud architectures. The increasing focus on sustainability and automation further accelerates cloud data center modernization initiatives.

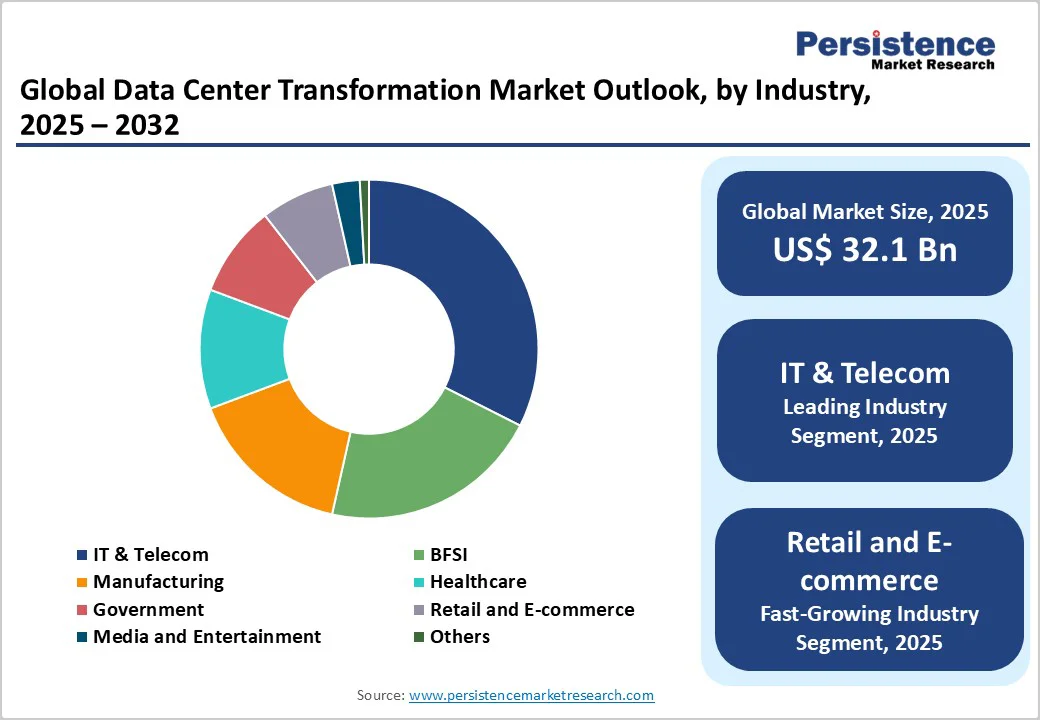

IT & Telecom are expected to account for over 35% share in 2025, due to their massive demand for scalable, high-performance computing and storage infrastructure. The deployment of 5G networks necessitates mobile edge computing (MEC) architectures distributing processing closer to users, fundamentally transforming telecom data center requirements. Telecom operators require robust interconnectivity and automation to manage surging data traffic and real-time service delivery. IT providers are upgrading legacy systems to support AI-driven analytics, cybersecurity resilience, and hybrid cloud models. These needs drive continuous investments in network fabrics, virtualization, and green data center modernization.

Retail and e-commerce are poised for rapid growth due to the surge in omni-channel retailing, digital payment adoption, and real-time customer analytics. Rapid expansion of online shopping platforms demands a scalable, low-latency data infrastructure to handle massive transaction volumes and dynamic inventory management. AI-driven personalization, recommendation engines, and immersive experiences such as AR-based shopping further increase data processing needs. Edge computing and cloud-native applications are being deployed to enhance customer experience and operational efficiency, driving transformation investments in this sector.

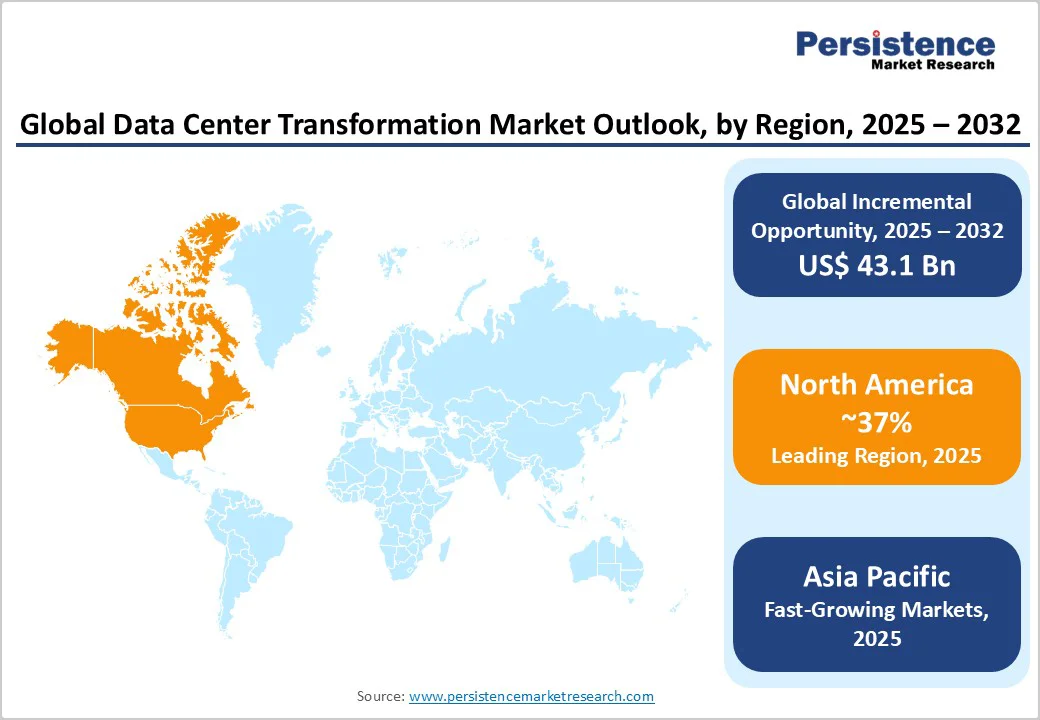

North America is expected to account for over 37% of the data center transformation market by 2025, driven by mature IT infrastructure, early cloud adoption, and hyperscale presence from AWS, Microsoft Azure, and Google Cloud. The U.S. data center transformation market, growing at a CAGR of 14.3%, is propelled by hybrid and multi-cloud expansion, AI-driven workloads, and regulatory compliance mandates such as HIPAA and PCI DSS. Organizations are deploying software-defined networking (SDN), software-defined storage (SDS), and virtualization technologies to enhance resource efficiency and agility. The Federal Data Center Consolidation Initiative accelerates the shift toward Tier-3 and Tier-4 facilities, while strong capital inflows of 80–90% from hyperscalers and private equity fuel expansion and energy optimization.

Asia Pacific has become the fastest-growing region with operational capacity reaching 12.2 GW in 2024 and another 14.4 GW under construction or planned, driven by explosive digitalization and manufacturing advantages. China leads with hyperscale expansions supporting the world’s largest internet population and digital economy, while Japan sustains advanced, high-reliability operations led by NTT’s 2,000 MW global IT load. India, backed by Digital India, 900 million mobile users, and data localization mandates, is set to add 850 MW more in two years. Despite Singapore’s power curbs, Malaysia and Thailand are absorbing excess demand, leveraging low costs, renewable energy growth, and favorable cooling conditions.

European data center transformation is driven by sustainability mandates and regulatory alignment under the EU Green Deal and Climate Neutral Data Centre Pact. Operators are investing in renewable energy (wind, solar, hydro), liquid and intelligent cooling systems, and PUE optimization targeting 1.3 in cool climates and 1.4 in warm climates for new data centers by 2025. Germany leads the region with major hubs in Frankfurt, Berlin, and Munich, leveraging strong connectivity and renewable access. The CNDCP aims for 75% renewable energy use by 2025 and 100% by 2030, with EU data centers already achieving an average Renewable Energy Factor (REF) of 0.87 across the EU.

The data center transformation market is fragmented, with competition driven by both global technology giants and regional infrastructure specialists. Leading players are competing through hyperscale capacity expansion, strategic partnerships, and AI-optimized infrastructure innovation. Leading manufacturers emphasize sustainability via renewable energy and advanced cooling, while adopting automation and AI-powered management platforms for predictive maintenance, energy efficiency, and operational excellence. These infrastructure-at-scale strategies enable comprehensive, efficient, and future-ready data center solutions.

The global data center transformation market is projected to be valued at US$32.1 Bn in 2025.

The growing need to modernize legacy infrastructure to support AI, cloud, and edge computing workloads is a key driver of the market.

The data center transformation market is poised to witness a CAGR of 12.9% from 2025 to 2032.

AI-driven automation and green infrastructure adoption, enabling enhanced efficiency, real-time processing, and compliance with global sustainability goals, are creating strong growth opportunities.

IBM, Cisco Systems, Inc., Microsoft, Google LLC, HPE, Dell Technologies, Vmware, AWS, Schneider Electric are among the leading key players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Component

By Tier

By Data Center Type

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author