ID: PMRREP8368| 201 Pages | 13 Jan 2026 | Format: PDF, Excel, PPT* | Semiconductor Electronics

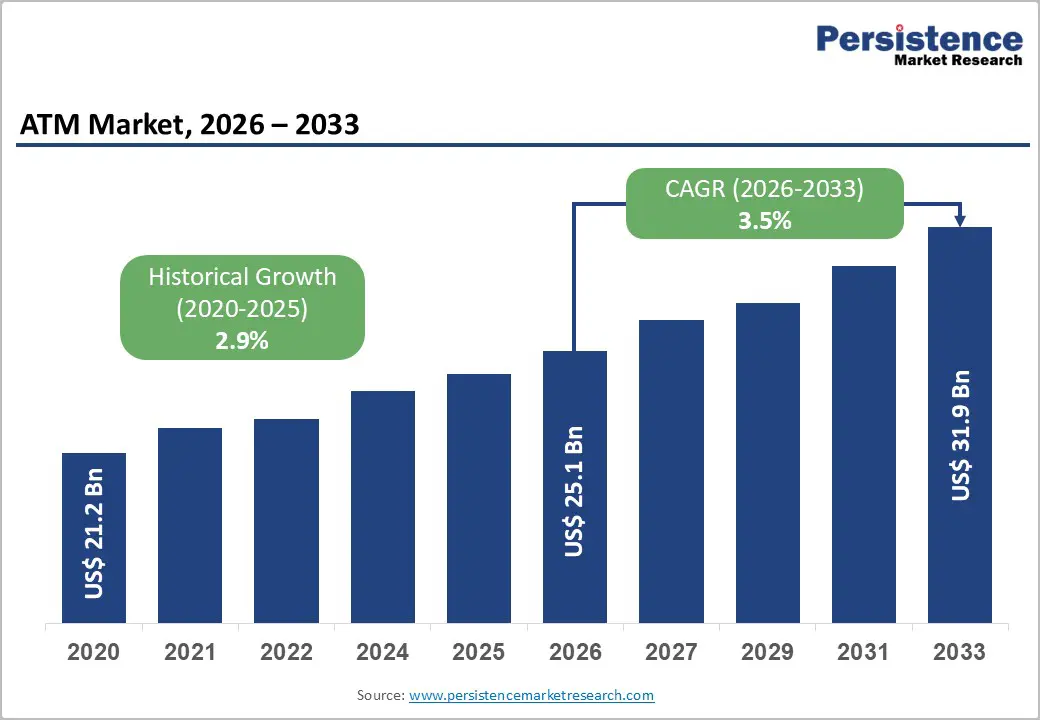

The global ATM Market size is projected at US$25.1 billion in 2026 and is projected to reach US$31.9 billion by 2033, growing at a CAGR of 3.5% between 2026 and 2033. Demand is underpinned by persistent cash usage in emerging markets, financial inclusion initiatives, and migration to smart, cardless and cash recycling ATMs. Regulatory support for interoperable ATM networks, coupled with branch rationalization and cost optimized self service banking, further sustains replacement and upgrade cycles.

| Key Insights | Details |

|---|---|

| ATM Market Size (2026E) | US$ 25.1billion |

| Market Value Forecast (2033F) | US$ 31.9 billion |

| Projected Growth CAGR (2026-2033) | 3.5% |

| Historical Market Growth (2020-2025) | 2.9% |

Growing cash usage persistence and financial inclusion programs

Despite rapid digitalization, cash remains a dominant payment instrument across many global economies. Estimates from the BIS and World Bank indicate cash still represents over 40–50% of point of sale transactions in several large emerging markets, with ATM withdrawals serving as a primary access channel. Central bank led financial inclusion programs in India, China, Indonesia, and multiple African countries continue prioritizing ATM deployment across semi urban and rural regions. These initiatives frequently combine white label and off site ATM models to broaden reach and improve accessibility. This ongoing structural dependence on cash circulation underpins stable baseline demand for fresh ATM installations, technology upgrades, and replacement units, supporting sustained market volumes throughout the forecast horizon despite accelerating digital payment adoption trends.

Technological shift toward smart, cash recycling and multifunction ATMs

The global ATM installed base is steadily transitioning toward multifunction and cash recycling platforms that enable deposits, bill payments, cardless withdrawals, and biometric authentication across banking networks. Industry assessments suggest smart and cash recycling units deliver a high single digit uplift to overall ATM hardware and software spending by increasing transaction volumes and fee based services. Banks increasingly deploy these advanced systems to consolidate teller operations, cut cash handling expenses by as much as 20-30%, and extend self service availability beyond branch hours. This structural shift accelerates replacement of legacy cash dispensers, raises average value per unit, and supports a larger, higher value hardware plus software revenue pool globally for banks, operators, and financial infrastructure providers worldwide

Rising digital payments adoption and mobile banking substitution

The rapid adoption of real time payments, mobile wallets, and contactless cards is structurally reducing cash usage in advanced markets. In North America and Europe, digital and card transactions now account for the majority of consumer payments, eroding routine ATM withdrawal volumes. Banks increasingly prioritize omnichannel digital journeys over physical infrastructure expansion, which caps net new ATM deployments. As transaction volumes consolidate on fewer high throughput terminals, operators focus on optimization rather than network expansion, moderating hardware demand and limiting upside in mature markets.

High capital intensity, compliance costs, and security risks

ATM networks demand significant upfront and recurring expenditure on hardware, software, secure cash logistics, and physical infrastructure. Additional layers of compliance with PCI standards, EMV migration, and data protection regulations elevate ownership costs, particularly for smaller banks and independent deployers. Simultaneously, rising cyber crime, skimming, and logical attacks force continual investments in encryption, monitoring, and secure operating systems. These structural cost burdens compress returns in low volume locations, slow roll outs in marginal geographies, and can prompt consolidation or network rationalization in saturated urban markets.

Migration to multifunction / smart ATMs and value added services

The shift from basic cash dispensers to multifunction and smart ATMs creates a strong value accretion opportunity across the global banking ecosystem. Smart ATMs enable real time deposits, bill payments, cardless and QR based withdrawals, and targeted on screen marketing. These capabilities expand non interest revenue streams while improving customer convenience and transaction efficiency. Industry research highlights that smart and cash recycling architectures increase ATM related fee and service revenues while reducing cash replenishment frequency and operational costs. As the global ATM market continues expanding toward the next decade, incremental smart upgrades represent a multi billion dollar opportunity across mature markets seeking optimization and emerging markets focused on modernization and financial inclusion driven by digital adoption and evolving banking strategies

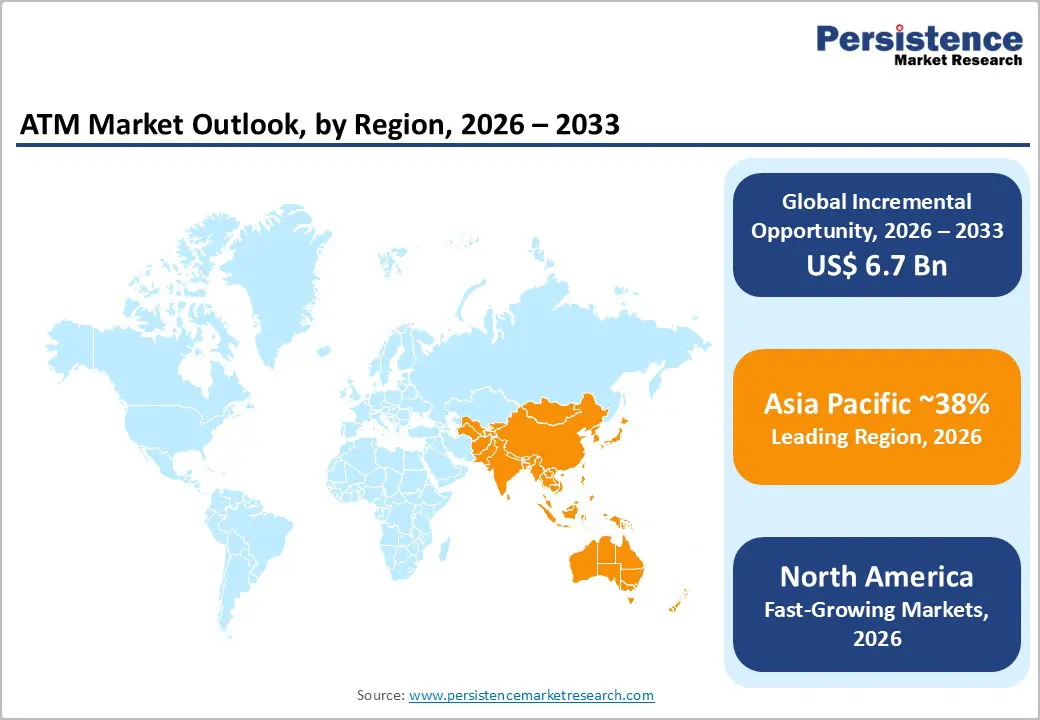

Off site, mobile and white label deployments in under served areas

Emerging markets across Asia Pacific, Latin America, and parts of Africa continue to show low ATM density relative to population size and economic output, creating significant headroom for off site, mobile, and white label ATM deployment. In Asia Pacific, off site ATMs already account for close to half of regional installations and are expected to remain a high growth configuration over the forecast period. With Asia Pacific representing roughly 38% of global ATM value, incremental rollout of flexible deployment models can unlock a sizeable multi billion dollar revenue pool through 2033. This opportunity strengthens further when deployments are bundled with managed services, outsourcing contracts, cash management, and network monitoring, improving profitability for operators and financial institutions across diverse banking environments.

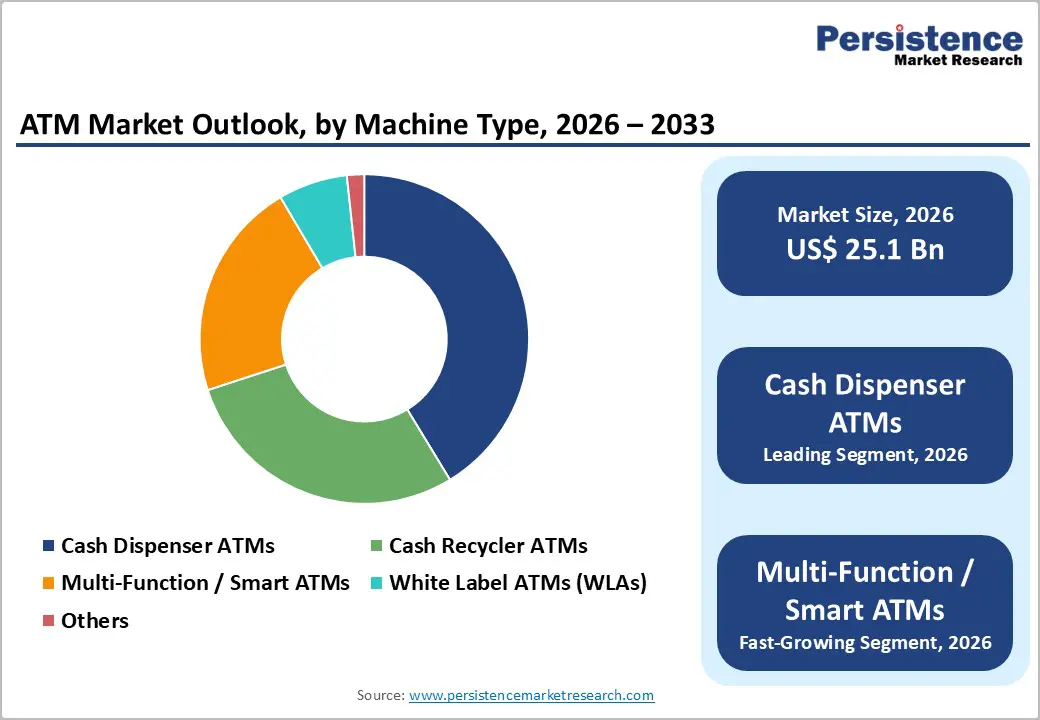

The leading machine type segment is Cash Dispenser ATMs, with approximately 41% share of global revenue in 2026, reflecting their ubiquity in both bank owned and independent networks. These terminals remain the main interface for routine cash withdrawals in urban and semi urban locations across developed and developing economies. While growth is modest due to digital substitution in mature markets, unit volumes remain large, and replacement cycles continue as operators upgrade to EMV compliant, secure and energy efficient models.

The fastest growing segment is Multi Function / Smart ATMs, expanding at about 6.9% CAGR between 2026 and 2033. Growth is driven by banks’ need to migrate high volume teller transactions deposits, transfers, bill payments to self service channels, and by customer demand for 24/7 advanced functionality. Integration of biometrics, cash recycling, cardless access, and marketing content further improves economics, encouraging accelerated replacement of legacy devices.

The Up to 15″ Screen segment leads the global ATM market, accounting for roughly 63% share. This configuration dominates traditional lobby, on site, and off site installations where standard size displays are sufficient for core cash and basic transaction flows. Its installed base benefits from lower hardware cost, mature supply chains and compatibility with existing enclosures, driving continued replacement demand. Although the segment’s share is expected to edge down as premium formats grow, its absolute revenue remains substantial through 2033.

The Above 15″ Screen segment is the fastest growing, projected to expand at about 6.4% CAGR over 2026–2033. Larger, high resolution touch displays support more intuitive user interfaces, accessibility features, and richer promotion or cross selling content. This format is especially attractive for smart ATMs placed in high traffic retail and transport hubs, where differentiated user experience and advertising potential justify higher unit costs.

The Off site ATMs segment is the leading location category, representing around 42% of global market revenue. Offsite terminals deployed in retail outlets, transportation centers, and high footfall public spaces provide convenient access beyond branch premises and generate substantial interchange and surcharge income. Their strategic role in financial inclusion and in supporting cash heavy micro retail ecosystems enables strong utilization, making them priority assets for both banks and independent ATM deployers.

The Mobile ATMs segment is the fastest growing location type, recording an estimated 7.6% CAGR during 2026–2033. Growth stems from deployments at events, rural outreach programs, disaster relief operations, and temporary high demand locations. Banks and service providers increasingly use mobile ATMs to test new markets, support branding, and maintain continuity of service when branches close or are renovated, creating a niche but rapidly scaling sub segment.

North America is a mature yet innovation driven ATM market, characterized by high ATM density and strong participation from independent deployers and retail alliances. The region is forecast to grow at a CAGR of about 4.2% from 2026 to 2033, supported by upgrades to smart, cash recycling and cryptocurrency enabled kiosks, and expansion of surcharge free networks. The United States remains the dominant national market, backed by robust card usage, a large base of underbanked consumers reliant on cash access, and active retail partnerships.

The fastest growth in North America is expected in advanced multifunction and software rich ATMs, as banks focus on experience and security. Adoption of contactless, cardless withdrawals, biometrics and advanced monitoring is accelerating, driven by both competitive differentiation and evolving regulatory and cybersecurity standards.

Europe represents a sizeable and relatively mature ATM market, with the region estimated to hold around 24% of global revenue in 2026. Overall growth is moderate, with a CAGR of about 2.1% between 2026 and 2033, as rising digital payment penetration dampens cash withdrawal volumes in several Western European economies. Germany and Spain retain comparatively higher cash usage and ATM density, while the U.K. and France focus on optimizing networks and ensuring rural access through regulatory oversight. Harmonized EU payment regulations and security standards shape technology roadmaps.

The fastest growing pockets in Europe are in value added and smart ATM deployments, including deposit enabled and recycling units, particularly in Central and Eastern European markets where cash usage remains resilient. Banks prioritize cost efficiency, regulatory compliance, and cross border interoperability, supporting steady though not explosive upgrades.

Asia Pacific is the largest regional market, accounting for roughly 38% of global ATM value, and is expected to retain this leadership through 2033. The region combines high absolute transaction volumes with strong penetration gains in semi urban and rural areas. China, Japan, India, and major ASEAN economies deploy large ATM fleets to serve cash reliant populations, even as digital payments grow. Off site and worksite ATMs are particularly prominent, addressing geographic dispersion and branch access gaps. Governments support financial inclusion and digital cash coexistence, sustaining new installations and replacement demand.

Within Asia Pacific, growth is strongest in off site, mobile and smart ATMs, reflecting the need for convenient access in transport hubs, retail corridors, and remote regions. India and parts of ASEAN show robust momentum in white label, outsourced and managed service models, while China and Japan prioritize multifunction and cardless capabilities. Overall, Asia Pacific delivers above global average expansion and anchors long term volume demand.

Leading ATM vendors pursue innovation led differentiation, expanding smart and cash recycling portfolios while embedding biometrics, AI based security, and digital channel integration. Strategies emphasize cost efficient deployments, outsourcing and managed services, regional customization, and ecosystem partnerships with banks, retailers, and fintechs, alongside lifecycle support that bundles hardware, software, and services into outcome based value propositions.

The global ATM Market is expected to be about US$25.1 billion in 2026, reaching nearly US$31.9 billion by 2033.

The ATM Market is driven by persistent cash usage, financial inclusion programs, and migration toward smart, multifunction and cash‑recycling ATMs.

The ATM Market is projected to grow at a CAGR of approximately 3.5% between 2026 and 2033.

Key opportunities include expansion of smart and cash‑recycling ATMs, off‑site and mobile deployments in under‑served regions, and integration with biometrics and digital wallets.

Major players include Diebold Nixdorf, NCR Atleos, Hyosung TNS, GRG Banking, Hitachi‑Omron, OKI, Fujitsu, Euronet Worldwide, Brink’s, HESS Cash Systems, Cardtronics/Allpoint, and Triton Systems.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Machine Type

By Screen Size

By Location

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author