ID: PMRREP27682| 201 Pages | 6 Feb 2026 | Format: PDF, Excel, PPT* | Food and Beverages

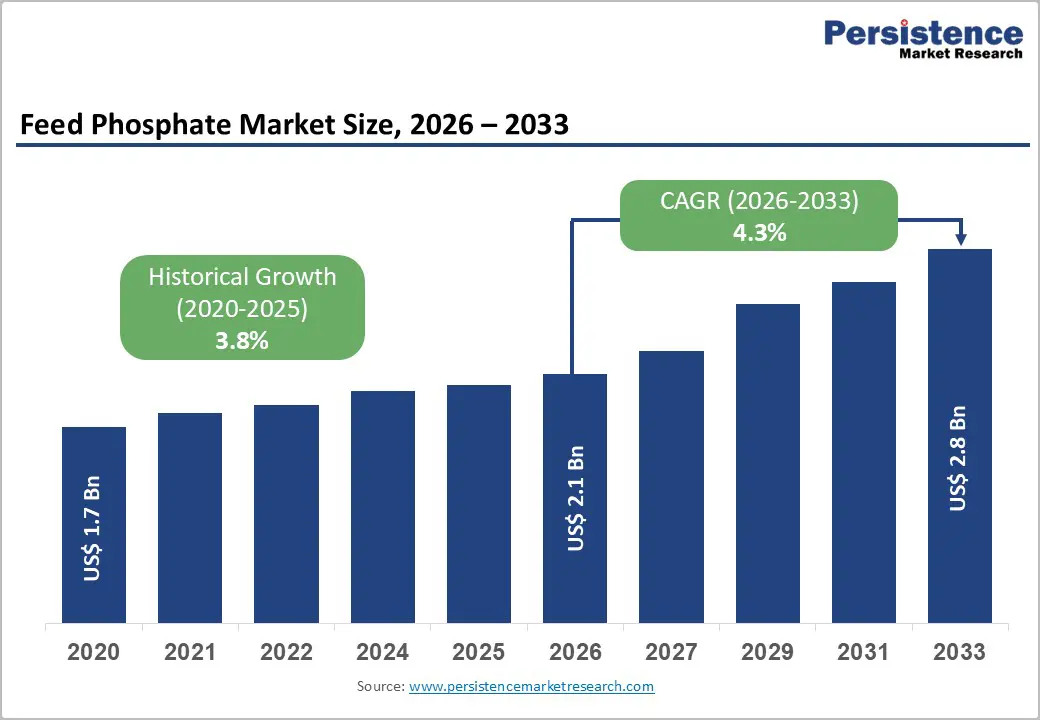

The global feed phosphate market size is expected to be valued at US$ 2.1 billion in 2026 and projected to reach US$ 2.8 billion by 2033, growing at a CAGR of 4.3% between 2026 and 2033. The market expansion is primarily underpinned by the global transition toward intensive livestock farming to meet the escalating demand for high-quality animal protein. As the global population surpasses 8 billion, the livestock industry is under immense pressure to improve feed conversion ratios and accelerate growth cycles, necessitating the use of high-purity mineral supplements.

Feed phosphates provide essential inorganic phosphorus, which is critical for skeletal development and metabolic efficiency in poultry and swine. Furthermore, rising awareness regarding the economic losses associated with phosphorus deficiency in livestock such as reduced fertility and growth stunting, is compelling farmers to adopt scientifically formulated diets, particularly in emerging economies within the Asia Pacific and Latin America.

| Key Insights | Details |

|---|---|

| Global Feed Phosphate Market Size (2026E) | US$ 2.1 Bn |

| Market Value Forecast (2033F) | US$ 2.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.8% |

Continuous innovation in animal nutrition is significantly boosting market growth by enhancing the bioavailability of phosphorus. Leading companies like Nutrien Ltd. and The Mosaic Company are investing in research to develop high-purity phosphate grades with lower heavy metal content, such as arsenic and cadmium. High-quality Monocalcium Phosphate is gaining traction because it offers superior phosphorus digestibility compared to traditional sources, allowing for lower inclusion rates in feed while maintaining optimal growth. This precision nutrition approach helps in reducing phosphorus excretion, which is a major environmental concern. Moreover, the integration of automation in feed manufacturing plants allows for the micro-dosing of minerals, ensuring uniform distribution in the feed matrix. This technological shift toward performance-oriented, high-purity phosphates is transforming the market into a value-driven sector.

A significant barrier to market stability is the fluctuation in the price of phosphate rock, which is the primary raw material for feed-grade phosphates. The extraction and processing of phosphate are concentrated in a few countries, notably Morocco, China, and Russia. Geopolitical tensions or export restrictions in these regions, as seen in recent years with OCP Group and PhosAgro PJSC operations, can lead to sharp supply-chain bottlenecks and price surges. Furthermore, the rising costs of energy and sulfuric acid used in the acidulation of phosphate rock add to the production overheads. These unpredictable costs make it difficult for feed manufacturers to maintain competitive pricing, often impacting the profit margins of small-scale livestock farmers who are highly price-sensitive to input costs.

The aquaculture sector represents a high-potential frontier for the Feed Phosphate Market. As wild-catch fisheries decline, the demand for farmed fish and shrimp is skyrocketing, especially in China, Vietnam, and Norway. Aquatic species have unique mineral requirements, and phosphorus is vital for preventing skeletal deformities and ensuring optimal metabolism in clear-water systems. According to The World Bank, aquaculture is one of the fastest-growing food production sectors globally. This growth is creating a massive demand for specialized, highly soluble phosphate variants like Monocalcium Phosphate, which is preferred in aquafeed for its high absorption rate in fish. Producers who can supply tailored, high-solubility mineral blends for various stages of fish growth will find significant revenue opportunities in the Asia-Pacific region, which dominates global aquaculture output.

Dicalcium Phosphate (DCP) is the leading segment in the global market, accounting for approximately 38% in 2025. Its dominance is attributed to its balanced calcium-to-phosphorus ratio and cost-effectiveness for mass-market livestock production. It is widely used in poultry and swine diets due to its established efficacy in skeletal development. However, Monocalcium Phosphate (MCP) is emerging as the fastest-growing segment. The shift toward MCP is driven by its higher phosphorus content and superior biological value, which allows for better nutrient absorption. For intensive farming operations, the higher bioavailability of MCP justifies its premium price by improving the overall feed conversion ratio and reducing mineral waste in manure, aligning with global sustainability goals.

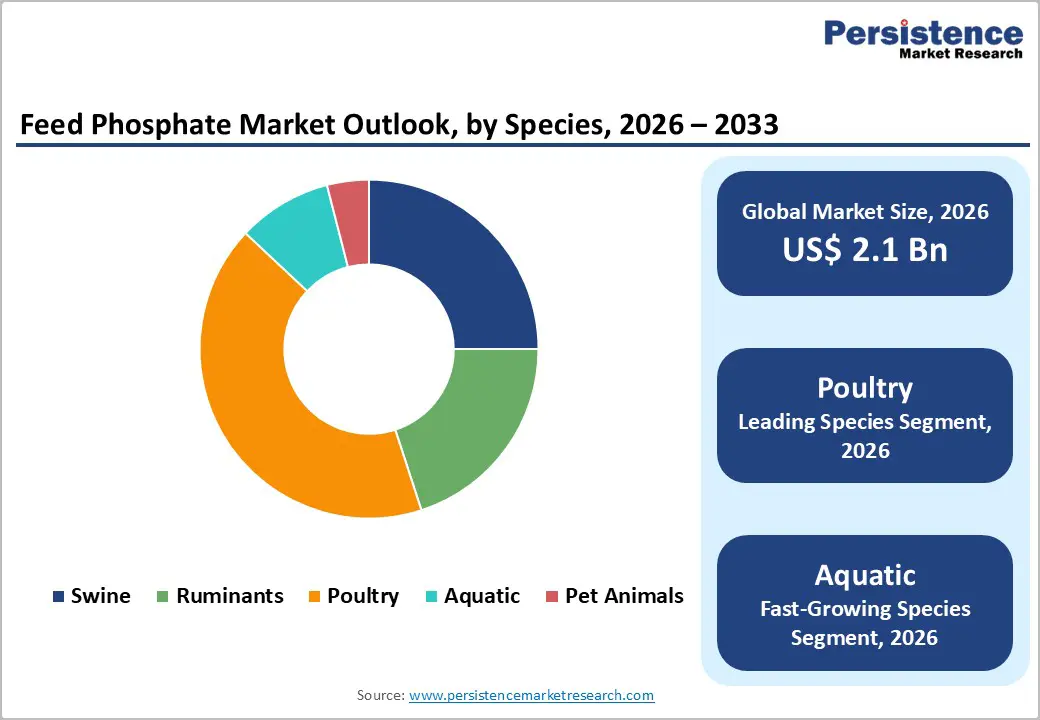

The Poultry segment is the dominant end-user category, holding a significant 42% market share in 2025. This leadership is sustained by the short production cycles of broilers and the high phosphorus requirements of layers for eggshell formation. The rapid industrialization of poultry farming in the Asia Pacific and Latin America has made poultry the primary consumer of feed phosphates. Conversely, the Aquatic animals segment is the fastest-growing species category. The expansion of commercial aquaculture and the need for high-solubility phosphates to maintain water quality and fish health are driving this growth. As aquaculture continues to outpace traditional livestock in growth rate, the demand for specialized aqua-grade phosphates is expected to surge throughout the forecast period.

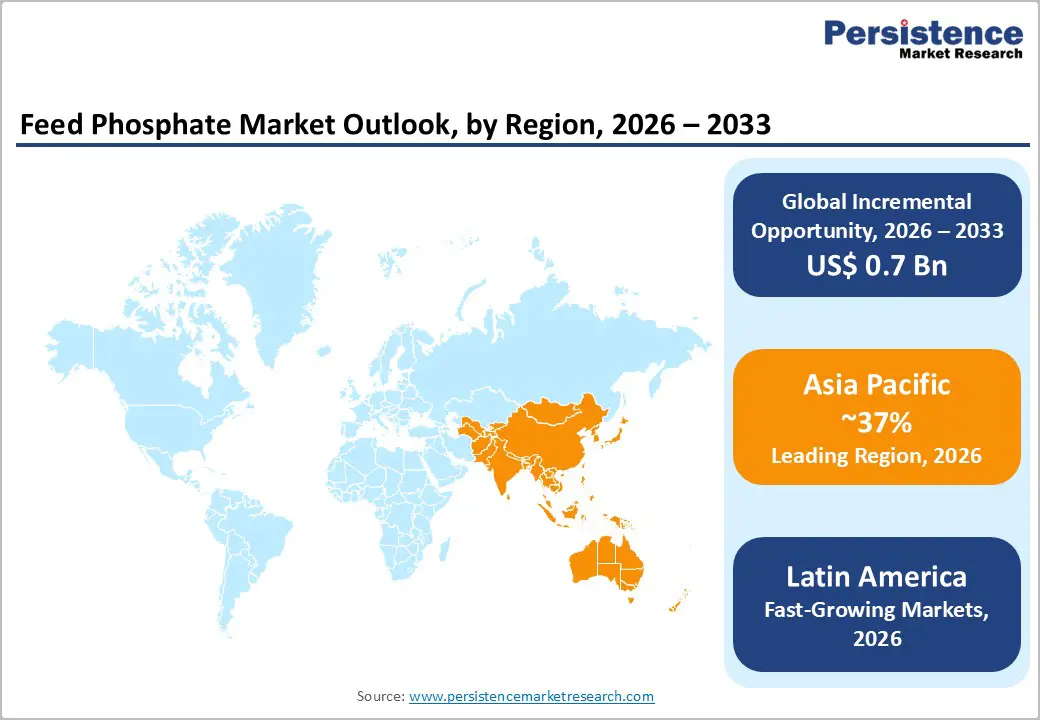

The Asia Pacific region is the leading market for feed phosphates, commanding a 37% market share in 2025. This leadership is fueled by the massive livestock sectors in China, India, and Thailand. China is both a major producer and consumer, possessing some of the world's largest phosphate reserves and manufacturing hubs, such as Yunnan Phosphate Group and Guizhou Chanhen Chemical.

The region's growth is driven by the rapid commercialization of farming and the rising consumption of meat and dairy products. India is witnessing a surge in broiler production, while the ASEAN countries are expanding their Aquatic farming capacity. The manufacturing advantage of low production costs in this region allows local players to export significant volumes. However, the market is also seeing a shift toward quality, as governments implement stricter feed safety regulations to boost export potential. The rapid expansion of the organized retail sector and a growing middle class are ensuring a long-term demand for high-quality animal proteins.

North America holds a significant position in the global market, driven by the U.S. market leadership in commercial livestock production and advanced animal nutrition. The region benefits from a highly sophisticated innovation ecosystem, with key players like The Mosaic Company and J.R. Simplot Company driving advancements in phosphate purity. The regulatory framework in the region, governed by the FDA and AAFCO, ensures high safety standards for mineral additives.

A key trend in this region is the shift toward "precision feeding" to optimize phosphorus levels and reduce environmental impact. The demand for high-bioavailability phosphates is rising as farmers seek to minimize costs while maintaining high livestock productivity. Additionally, the presence of a robust pet food industry further bolsters market demand, with a growing preference for premium, nutrient-fortified pet diets. The region's stable supply chain and extensive logistics network for mineral distribution also support a steady growth trajectory.

The global feed phosphate market is moderately consolidated, with the top five players controlling a significant portion of the global production capacity. Industry giants like The Mosaic Company, Nutrien Ltd., and OCP Group leverage their vertically integrated operations from phosphate rock mining to final chemical processing to maintain a competitive edge. These leaders focus on strategies such as geographic expansion into high-growth regions such as Latin America and Southeast Asia. Emerging business models emphasize the development of "value-added" phosphate blends that include other essential minerals like magnesium or trace elements. Research and development trends are centered on improving the solubility and biological efficiency of phosphates. Differentiation is increasingly based on sustainability certifications and the ability to provide low-impurity products that comply with stringent international safety standards.

The global feed phosphate market is expected to be valued at approximately US$ 2.1 billion in 2026, following a historical growth rate of 3.8% from 2020 to 2025.

The demand is primarily driven by the rising global consumption of meat and dairy products, which necessitates the use of phosphorus supplements to improve livestock productivity and ensure animal health in commercial farming.

Asia Pacific currently leads the market, holding a 37% market share in 2025, underpinned by the massive agricultural and livestock production capacities of China and India.

The rapid growth of the aquaculture industry in the Asia Pacific and Norway represents a significant opportunity, as producers shift toward high-solubility phosphate variants, such as monocalcium phosphate, for aquatic feed.

Key industry participants include The Mosaic Company, Nutrien Ltd., OCP Group, PhosAgro PJSC, ICL Group Ltd., and Yara International ASA.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Species

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author