ID: PMRREP11155| 195 Pages | 10 Jan 2025 | Format: PDF, Excel, PPT* | Healthcare

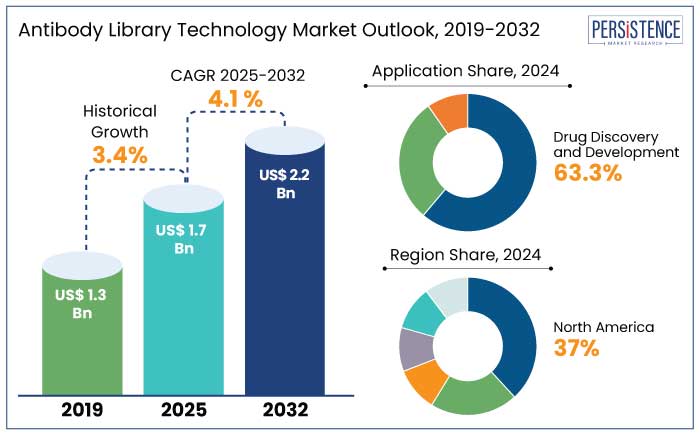

The global antibody library technology market is anticipated to reach a size of US$ 1.7 Bn by 2025. It is set to showcase a CAGR of 4.1% during the forecast period to attain a value of US$ 2.2 Bn by 2032. Rare and orphan diseases are estimated to witness exponential growth during the forecast period with over 20% of new therapeutic antibodies addressing orphan indications by 2030.

Oncology is projected to remain the dominant application, accounting for 40% of the market by 2032 owing to the rise of bispecific and checkpoint-modulating antibodies. AI-powered platforms are set to lead antibody library design industry, improving hit rates and decreasing discovery timelines by 40%. By 2030, over 30% of antibody libraries are likely to incorporate AI-based screening.

Key Highlights of the Industry

|

Market Attributes |

Key Insights |

|

Antibody Library Technology Market Size (2025E) |

US$ 1.7 Bn |

|

Projected Market Value (2032F) |

US$ 2.2 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

4.1% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

3.4% |

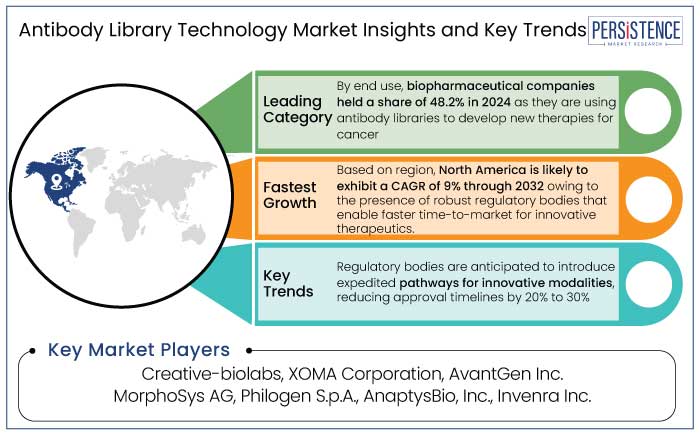

The antibody library technology market in North America accounted for a share of 37% in 2024. The U.S. is home to a vast network of leading biopharma companies, including Amgen, Genentech, Regeneron, and Eli Lilly, which significantly contribute to the demand for novel antibody discovery technologies.

The U.S. Food and Drug Administration (FDA) provides a streamlined and well-established approval process for biologics and antibodies. Regulatory bodies like the FDA and Health Canada have established clear guidelines for antibody library technologies, enabling faster time-to-market for innovative therapeutics.

The FDA's Breakthrough Therapy Designation and Accelerated Approval Pathways provide incentives for companies working with antibody libraries to expedite their drug development processes. It is particularly evident in oncology, autoimmune diseases, and rare disorders.

North America is at the forefront of integrating Artificial Intelligence (AI) and machine learning in antibody discovery processes. The region is a global leader in funding biotech start-ups, with venture capital investments reaching US$ 30 Bn in 2023 in the U.S. alone, much of which has been directed toward antibody discovery technologies.

Start-ups like AlivaMab and Nurix Therapeutics utilize antibody libraries to develop next-generation antibody therapies, particularly in oncology and immunology sectors. North America, specifically the U.S., benefits from world-class research institutions such as Harvard University, MIT, Stanford, and Johns Hopkins University, which are heavily involved in bolstering antibody discovery research. Presence of top-tier scientific talent in the region helps foster innovation in antibody library technologies, driving adoption of these technologies in drug discovery.

Drug discovery and development held a share of 63.3% in 2024. Monoclonal antibodies (mAbs) are the backbone of antibody-based therapeutics, making the development and discovery of mAbs through antibody libraries a key area of focus. mAbs currently account for about 40% to 45% of the global biologics market. It makes antibody library technologies vital in meeting the rising demand for new monoclonal antibodies.

Oncology remains one of the leading therapeutic areas for drug discovery using antibody libraries. Cancer therapeutics based on monoclonal antibodies have been highly successful, driving the continued use of antibody libraries in oncology. For example,

Personalized medicine heavily relies on antibody-based treatments and antibody libraries are central to the discovery of patient-specific antibodies tailored to individual genetic profiles. Increasing incidence of autoimmune diseases and infectious diseases is driving demand for new antibody-based drugs. Autoimmune diseases are increasingly being treated with monoclonal antibodies developed from antibody libraries.

Infectious diseases like COVID-19, HIV, and hepatitis also benefit from antibody-based therapeutics.

Biopharmaceutical companies held a share of 48.2% in 2024. These companies are actively leveraging antibody libraries for the development of monoclonal antibodies (mAbs) and other novel biologics, which have become essential for treating a variety of diseases. Biopharmaceutical companies are leveraging antibody libraries to screen several antibody candidates quickly and efficiently, enabling them to identify the most promising leads.

The use of antibody libraries is estimated to cut discovery timelines by 30% to 40%, significantly speeding up the development process for new antibody-based drugs. The shift from traditional small-molecule drugs to biologics is a key trend in the pharmaceutical industry. Biopharmaceutical companies are increasingly focusing on biologics, including monoclonal antibodies, therapeutic proteins, and other biologic drugs.

Biopharmaceutical companies are driving this trend by investing heavily in biologics and antibody libraries to discover new treatments for unmet medical needs. Biopharmaceutical companies are using antibody libraries to develop novel therapies for cancer, especially immuno-oncology treatments, where monoclonal antibodies are critical in enhancing the immune system’s ability to target and destroy cancer cells.

Biopharmaceutical companies are prominent investors in research and development, particularly in biologics. They allocate significant resources to discover and develop innovative antibody-based therapies, thereby fueling demand for antibody libraries.

Potential growth in the global antibody library technology industry is predicted to be driven by the integration of AI for antibody design and high-throughput screening. By 2026, over 20% of new antibody libraries are estimated to be AI-assisted. Manufacturers are likely to have an increased focus on fully human libraries and bispecific antibody libraries to enhance therapeutic outcomes.

Prominent companies like Regeneron and Genmab are heavily investing in these technologies. Antibody libraries are anticipated to witness adoption in agriculture for crop protection and veterinary medicines. The assessment period is estimated to witness a rising demand for antibody-based diagnostics, particularly for infectious diseases and cancer biomarkers.

The antibody library technology market growth was decent at a CAGR of 3.4% during the historical period from 2019 to 2023. Growth during this period was driven by increased adoption of phage display and yeast display technologies for therapeutic antibody development. Therapeutic applications dominated the market with 75% of antibody libraries being used to develop treatments for oncology, autoimmune diseases, and infectious diseases during the period.

Blockbuster antibody therapies like Keytruda and Opdivo further exemplified the impact of unique library technologies. Partnerships and licensing agreements witnessed a surge, with companies like AbCellera and Adimab leading the way. For instance,

The forecast period is estimated to witness substantial growth owing to rising demand for precision medicine. Expansion of applications in rare diseases and emerging markets is set to be crucial for growth.

Trend for Precision Medicine and Personalized Therapies to Bolster Demand

The trend for precision medicine and personalized therapies is highly driven by increasing demand for targeted treatments that cater to individual patient needs, decreasing side effects and improving therapeutic efficacy.

Biomarker-driven therapies enable the identification of patient-specific molecular targets, which antibodies can precisely address. Monoclonal antibodies, often discovered or optimized through antibody libraries, accounted for 21 out of the top 100 best-selling drugs in 2023.

Several of these therapies are designed for personalized applications, such as HER2-targeted therapies for breast cancer. Precision medicine addresses diseases with limited treatment options, particularly rare genetic disorders.

Technologies like phage display and yeast display enable the rapid generation of antibodies tailored to unique patient biomarkers. Companion diagnostics often rely on antibodies to identify patient subpopulations likely to benefit from specific treatments. Antibodies discovered via libraries are increasingly used in CAR-T cell therapies and CRISPR applications, allowing for personalized cancer and genetic disease treatments.

Innovations in Antibody Discovery Technologies to Foster Growth

Innovations in antibody discovery technologies are revolutionizing the development of therapeutic antibodies, enabling quick, precise, and cost-effective solutions for a wide range of diseases. High-Throughput Screening (HTS) technologies accelerate the identification of promising antibodies from vast libraries. Automation and robotics in HTS have decreased lead discovery times by up to 40%, enabling quicker drug development cycles.

Antibodies like Pembrolizumab (Keytruda) were optimized using phage display and high-throughput techniques, generating US$ 23 Bn in revenue in 2023. Novel technologies are enabling the discovery of new immune checkpoint inhibitors and bispecific antibodies. AI optimizes antibody discovery by predicting binding affinities, stability, and immunogenicity.

AI has decreased the time required for lead optimization by up to 30%, significantly lowering research and development costs. Phage display technology won the Nobel Prize in Chemistry (2018) and remains instrumental in developing blockbuster drugs like Adalimumab (Humira).

Increasing Regulatory Challenges to Create Hindrances

Regulatory landscape for antibody library technology and related therapies is complex, stringent, and often acts as a significant barrier to market entry. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) require extensive documentation, which increases time-to-market.

Antibodies are large, complex molecules with intricate manufacturing processes, making consistent production a challenge. Around 40% of biologics submissions face delays or rejections due to manufacturing inconsistencies or quality issues. FDA’s rejection of a monoclonal antibody in 2021 owing to insufficient stability data highlighted the importance of meeting stringent quality benchmarks.

Companies are required to navigate multiple regulatory frameworks, increasing time and cost for global market entry. Immunogenicity-related delays account for 15% of biologics’ regulatory review challenges. As of 2023, over 60% of novel antibody modalities faced extended review periods compared to conventional monoclonal antibodies.

Ambiguities in regulatory pathways create uncertainty and also discourage investment in innovative platforms. Regulatory delays and additional studies can increase development costs by up to 30% to 50%. Companies are hence likely to prioritize conventional therapies over novel modalities due to uncertainties in approval pathways.

Rising Focus on Novel Modalities to Augment New Opportunities

Exploration of novel modalities in the antibody library technology market is driving innovation in therapeutic design and extending the range of diseases that can be effectively treated. Over 100 bispecific antibodies are currently in clinical development, focusing primarily on oncology and immunology.

Novel modalities enable high specificity for disease-associated targets as these minimize off-target effects. Multispecific antibodies allow simultaneous modulation of complex disease pathways. ADCs deliver cytotoxic drugs directly to cancer cells, sparing healthy tissues and decreasing side effects.

Novel modalities open new avenues for treating diseases that were previously considered untreatable, like neurodegenerative and rare genetic disorders. Over 2,000 clinical trials are currently investigating novel antibody modalities, reflecting rising interest and investment. Trastuzumab Deruxtecan (Enhertu), an ADC for HER2-positive cancers, showcased significant survival benefits and generated US$ 2 Bn in 2023.

Diversification of Intellectual Property to Forge New Prospects

Growth and diversification of Intellectual Property (IP) in the antibody library technology market are vital for innovation and competitive advantage. Patents covering novel antibody libraries, screening methods, and therapeutic candidates are at the core of the market's IP landscape. As of 2023, there were over 7,000 active patents worldwide related to antibody library technologies.

Patents on phage display libraries, such as those held by MorphoSys and Dyax, have shaped the antibody discovery process. Licensing deals for proprietary antibody libraries and discovery technologies are a significant revenue source. AbCellera's licensing deals with multiple biopharma companies generated over US$ 450 Mn in milestone payments in 2022.

Companies are filing patents in emerging markets like China, India, and Brazil to tap into growing healthcare markets. For example,

IP is extending into cutting-edge areas such as bispecific antibodies, Antibody-Drug Conjugates (ADCs), and nanobodies. Over 60% of antibody-related patents filed in 2023 were associated with novel modalities like bispecifics and ADCs.

Companies in the antibody library technology market are working on employing high-throughput screening and next-generation sequencing to identify and optimize antibodies efficiently. They are leveraging AI to predict antibody structures, binding affinities, and therapeutic potential.

Businesses are also creating diverse and sophisticated libraries, including synthetic, naïve, and immune-based libraries. They are progressively collaborating with universities and research labs to stay at the forefront of scientific developments. They are further partnering with biotech and pharma companies for co-development and commercialization of antibody-based therapies.

Brands are also licensing proprietary technologies to other companies to extend market reach and revenue streams. They are strengthening their IP by filing patents for novel antibody libraries and associated technologies.

Recent Industry Developments

The market is anticipated to reach a value of US$ 2.2 Bn by 2032.

They are collections of antibodies generated in vitro or extracted from several sources that represent a diverse range of antibody sequences.

Immune antibody libraries are constructed using V genes from immunized donors or previously infected individuals.

Prominent players in the market include Creative-biolabs, XOMA Corporation, and AvantGen Inc.

The market is predicted to witness a CAGR of 4.1% during the forecast period.

|

Attributes |

Detail |

|

|

Forecast Period |

2025 to 2032 |

|

|

Historical Data Available for |

2019 to 2023 |

|

|

Market Analysis |

US$ Billion for Value |

|

|

Key Regions Covered |

|

|

|

Key Market Segments Covered |

|

|

|

Key Companies Profiled in the Report |

|

|

|

Report Coverage |

|

|

|

Customization and Pricing |

Available upon request |

By Technology

By Application

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author