ID: PMRREP35421| 189 Pages | 19 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

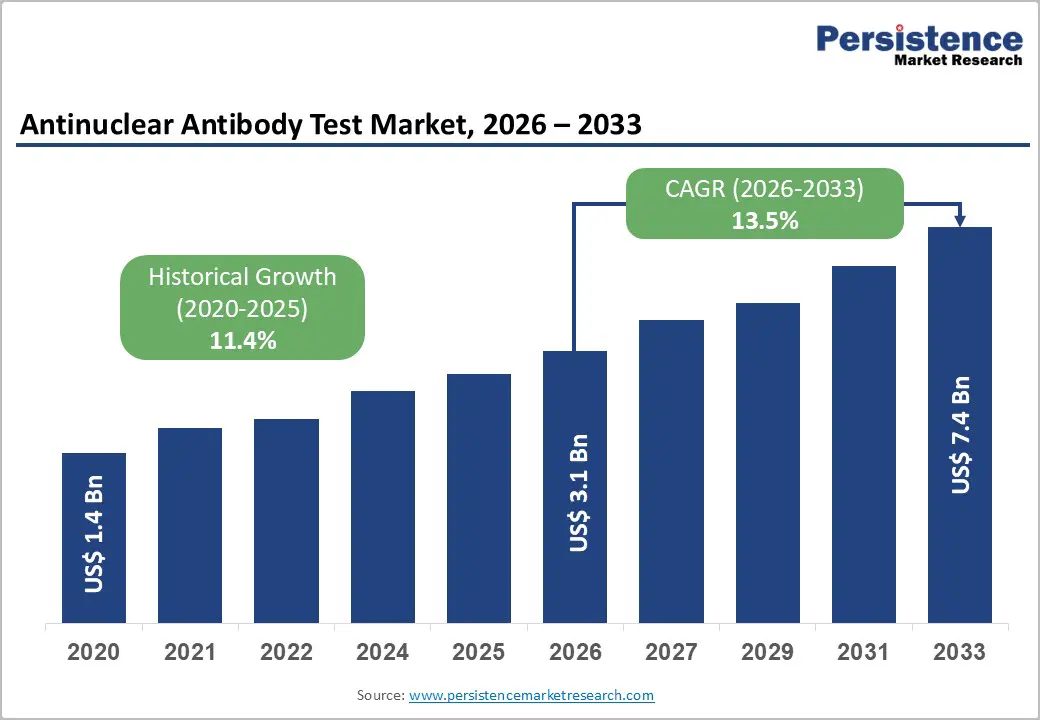

The global antinuclear antibody test market is estimated to grow from US$ 3.1 Bn in 2026 to US$ 7.4 Bn by 2033. The market is projected to record a CAGR of 13.5% during the forecast period from 2026 to 2033.

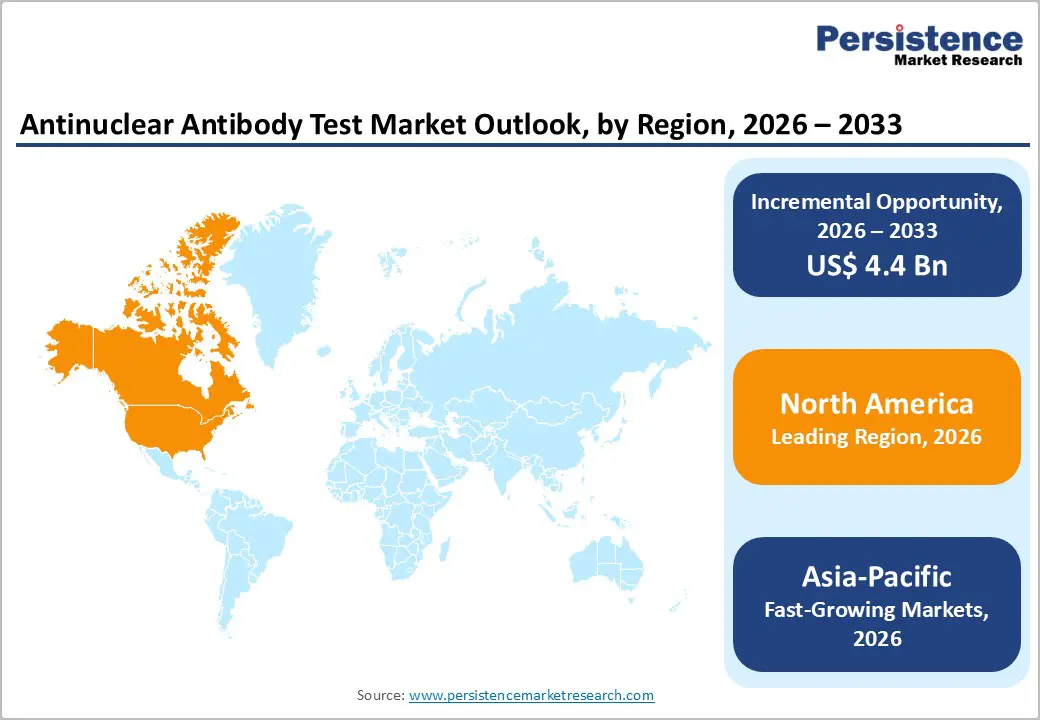

The global antinuclear antibody test market is expanding steadily, fueled by digital platforms, healthcare analytics, and data-driven research. North America dominates with advanced research infrastructure and strong regulations, while Asia-Pacific is the fastest-growing region, driven by healthcare expansion, government initiatives, rising clinical trials, and increasing investments in outsourced biomarker testing services

| Key Insights | Details |

|---|---|

| Antinuclear Antibody Test Market Size (2026E) | US$ 3.1 Bn |

| Market Value Forecast (2033F) | US$ 7,4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 13.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 11.4% |

The rising prevalence of autoimmune diseases worldwide is expected to drive the antinuclear antibody test market growth in the foreseeable future, finds Persistence Market Research. These tests are considered fundamental in diagnosing systemic autoimmune disorders, including scleroderma, Sjögren’s syndrome, and Systemic Lupus Erythematosus (SLE). As per a 2023 report by the Global Burden of Disease Study published in The Lancet, autoimmune diseases have surged in incidence by nearly 19% over the last decade. It is due to the improved diagnostic awareness and environmental triggers, including lifestyle changes and pollution.

The epidemiological trend has further resulted in a proportional surge in ANA testing volumes globally. Data from the U.S. Centers for Disease Control and Prevention (CDC) and other health organizations highlight that approximately five percent of the U.S. population is now affected by one or more autoimmune diseases. This growth directly correlates with high ANA test requisitions in both primary care and specialty clinics. Rheumatologists are relying on ANA screening as a frontline tool not only to confirm suspected autoimmune disorders but also to monitor disease progression.

The possibility of false positives and non-specific results significantly hinders the widespread adoption of ANA tests by creating diagnostic uncertainty. Recent studies, including a 2024 publication in Arthritis & Rheumatology, show that up to 20 to 30% of healthy individuals, primarily older adults, are likely to exhibit low-titer positive ANA results without any underlying autoimmune disease. This high background positivity reduces physician confidence in the test’s specificity and complicates clinical interpretation.

The Indirect Immunofluorescence Assay (IIFA), which is a gold standard for ANA testing, is subjective and operator-dependent, contributing to occasional misclassification. A 2023 comparative study from Clinical Chemistry demonstrated that inter-laboratory concordance rates for ANA IIFA patterns can be as low as 70%. This variability is specifically challenging in small-scale labs and community hospitals lacking specialized personnel, thereby hampering test adoption in resource-constrained settings.

The introduction of multiplex methods in ANA testing is changing autoimmune disease testing by enabling the simultaneous detection of multiple autoantibodies with high specificity and efficiency. Multiplex platforms use bead-based or microarray technologies to assess dozens of autoantibodies in one run, thereby lowering the time and sample volume required. A 2023 clinical validation study in the Journal of Clinical Immunology revealed that multiplex ANA assays increased diagnostic yield by detecting clinically relevant autoantibodies missed by conventional indirect immunofluorescence.

Key companies such as Thermo Fisher Scientific and Bio-Rad Laboratories have innovated these multiplex platforms with extended autoantibody panels made for systemic lupus erythematosus and other connective tissue diseases. This targeted profiling enables clinicians to differentiate disease subtypes more accurately, resulting in personalized treatment strategies. For example, Bio-Rad’s BioPlex 2200 system, extensively used in North America, reported a 25% improvement in diagnostic confidence in 2024 compared to standalone ANA testing.

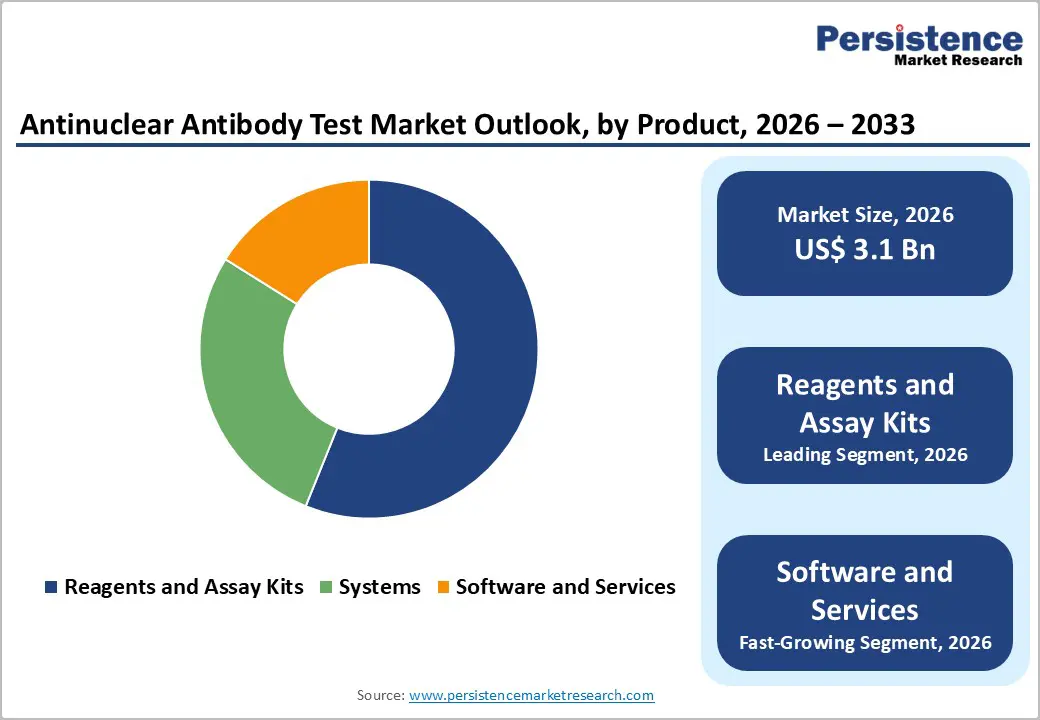

Based on product, the market is divided into reagents and assay kits, systems, and software and services. Out of these, the reagents and assay kits segment will likely account for a share of around 56.1% in 2025 due to their key role in ensuring standardized, reproducible, and accurate diagnostics, essential for managing complex autoimmune diseases. High-quality reagents, including fluorescent-labeled antibodies and cell substrates, directly impact the sensitivity and specificity of ANA tests. EUROIMMUN’s HEp-2 cell substrates, for instance, have demonstrated improved detection rates in a 2023 study published in Clinical Rheumatology.

Software and services have also emerged as essential product categories due to the rising complexity and volume of test data generated by modern diagnostic platforms. Automated IIFA, combined with multiplex technologies, produces vast amounts of imaging and serological data that require innovative interpretation tools. Novel software solutions, often powered by machine learning and AI, are important in standardizing ANA pattern recognition. It helps in lowering subjective variability and improving diagnostic accuracy.

Immunofluorescence Assay (IFA) dominates the antinuclear antibody test market because it remains the clinical gold standard for ANA detection, offering broadly recognized and clinically validated performance metrics that support its continued preference in diagnostic workflows. IFA using HEp2 cell substrates can detect a wide range of autoantibodies and visualize detailed nuclear staining patterns, which provide clinicians with both qualitative pattern information and quantitative titers, a capability many solid phase methods lack. For example, studies report 100% ANA positivity by IFA in childhood systemic lupus erythematosus (SLE) cases versus only 55% by enzyme immunoassay in the same cohort, demonstrating clearly higher detection sensitivity in certain diseases. IFA’s high sensitivity (often >90% in systemic rheumatic diseases) and ability to support nuanced interpretation of autoimmune profiles underpins its sustained utilization in clinical laboratories worldwide.

North America dominates the antinuclear antibody test market with 42.1% share in 2025, because the region has a high prevalence of autoimmune diseases and world class diagnostic infrastructure that enables widespread screening and specialized laboratory services. In the United States, about 8% of the population (over 50 million people) are affected by autoimmune disorders, driving demand for tests such as ANA panels for early detection and disease monitoring.Government supported research funding and robust insurance reimbursement systems further facilitate adoption of advanced diagnostics.Additionally, Canada’s surveillance of conditions like rheumatoid arthritis, affecting roughly 1.2% of adults, underscores regional disease burden and testing needs. These epidemiological and healthcare system advantages collectively sustain North America’s market leadership.

Europe is an important region in the antinuclear antibody test market because it has a high burden of autoimmune and related conditions, strong public healthcare systems, and widespread adoption of advanced diagnostic protocols. According to the European Centre for Disease Prevention and Control, autoimmune diseases affect tens of millions of Europeans, creating substantial demand for ANA and related diagnostics. The European Union has dedicated significant research funding, such as through the Horizon Europe program with €95.5 billion for research and innovation (including healthcare and diagnostics), which supports development and deployment of improved immunologic assays. Additionally, countries like Germany, France, and the United Kingdom maintain well established laboratory networks and national screening initiatives, which help integrate ANA testing into routine clinical practice and strengthen regional market relevance.

Asia Pacific is the fastest growing region in the antinuclear antibody test market due to a rising burden of autoimmune conditions, expanding healthcare infrastructure, and increased access to diagnostic services. For instance, approximately 50 million autoimmune cases were reported across Asia Pacific in 2023, with notable growth in China and India, boosting demand for ANA and related immunologic tests. Immunologic testing facilities in Japan grew by 15% from 2021–2024, enhancing diagnostic access. Government initiatives and rising healthcare investment, such as programs in India that increased autoimmune testing volumes by about 30% have further accelerated uptake of complex diagnostics. These demographic and system level trends underpin rapid regional expansion for ANA testing.

Leading antinuclear antibody test market companies focus on advanced analytics, AI-driven diagnostic platforms, and integrated service offerings. Key priorities include ensuring data interoperability, regulatory compliance, and optimizing laboratory workflow efficiency. Investments in genomics, proteomics, and multi-omics technologies improve autoantibody detection accuracy, while collaborations with biopharmaceutical firms, CROs, and academic institutions accelerate clinical translation, expand diagnostic capabilities, and drive global adoption of ANA testing across research and clinical laboratories.

The global antinuclear antibody test market is projected to be valued at US$ 3.1 Bn in 2026.

Rising autoimmune disease prevalence, precision medicine adoption, advanced diagnostics, R&D spending, and complex clinical trials drive growth.

The global antinuclear antibody test market is poised to witness a CAGR of 13.5% between 2026 and 2033..

Opportunities include AI-driven analysis, predictive biomarker discovery, multi-omics integration, autoimmune research, CRO collaborations, and emerging markets.

Trinity Biotech Plc., ERBA Diagnostics Mannheim GmbH, Antibodies Incorporated, Inova Diagnostics, Inc., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Technique

By Application

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author